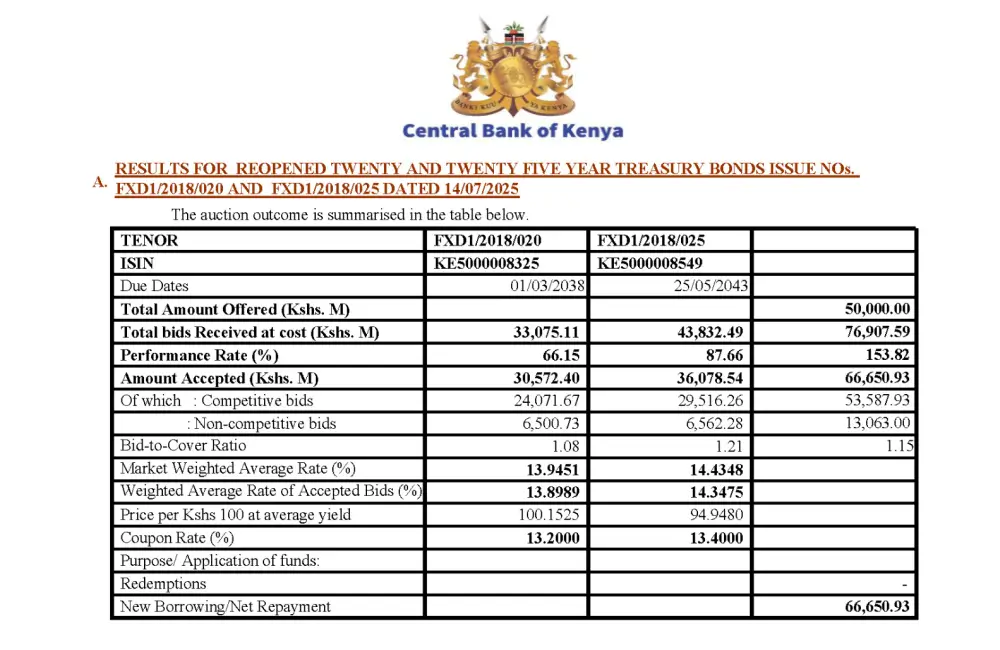

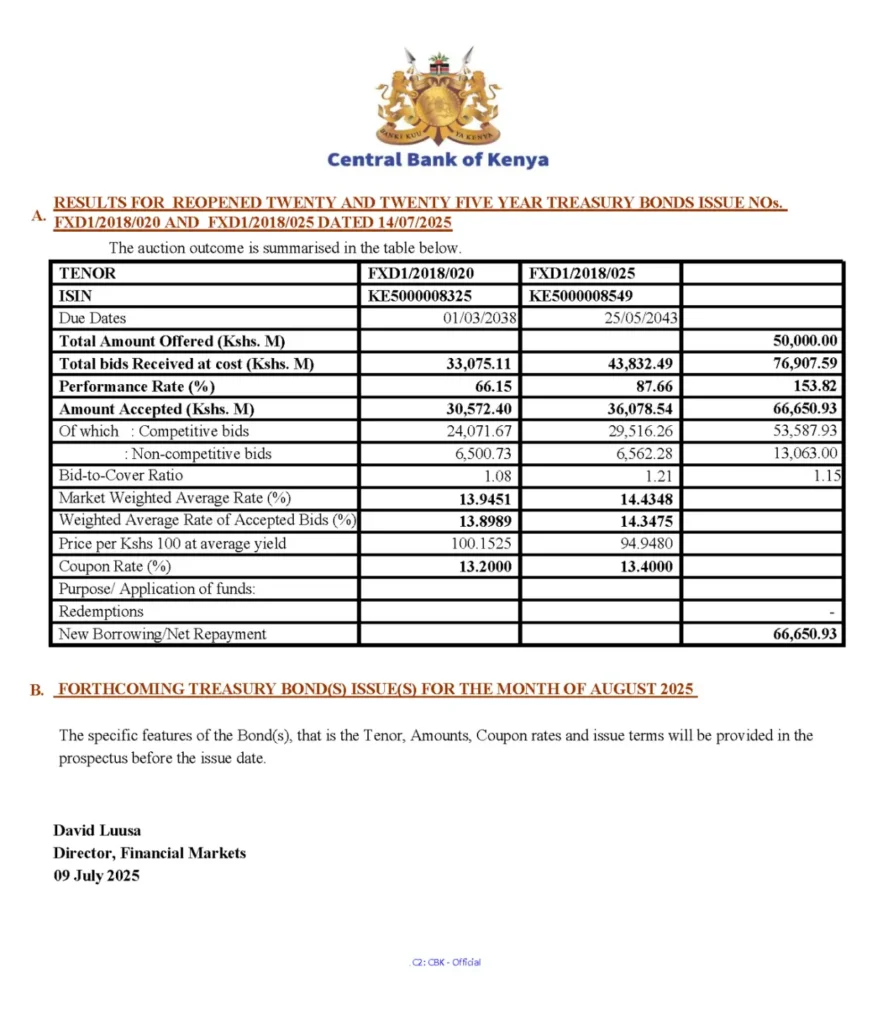

1. Investors showed strong interest in the reopened 20- and 25- year leading to Treasury bonds being oversubscribed by 153.82%.

CBK aimed to raise Ksh 50 billion but received bids worth Ksh 76.91 billion and accepted Ksh 66.65 billion.

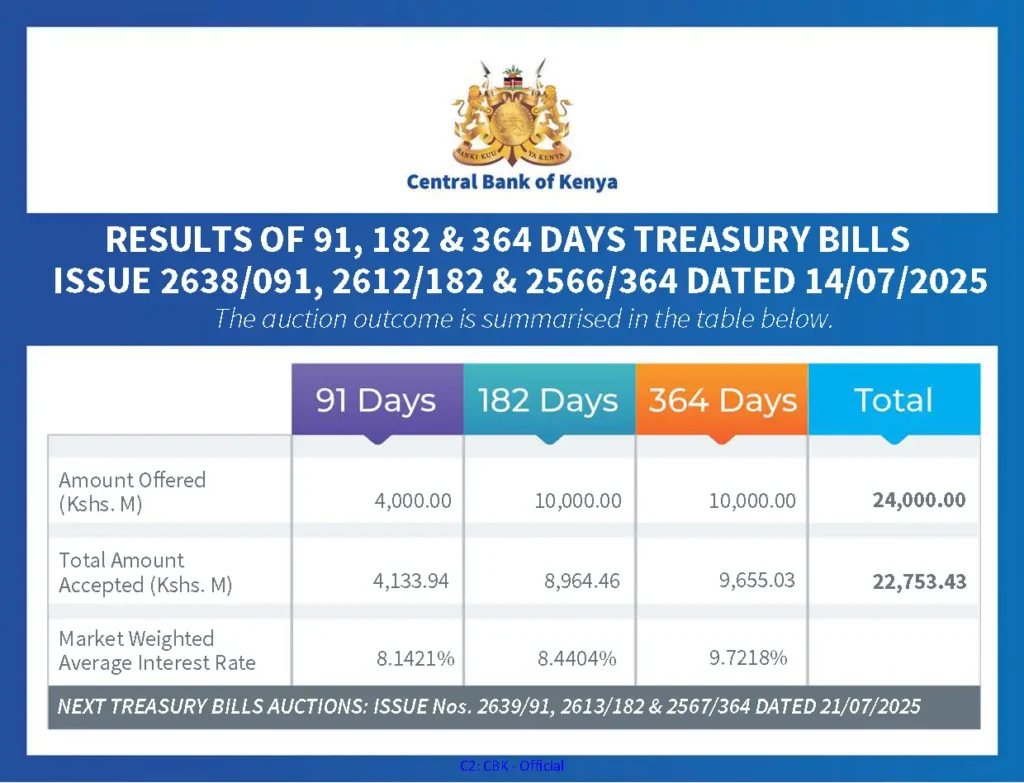

2. Treasury bills saw subdued demand for 3 consecutive weeks.

The Central Bank of Kenya received bids worth Ksh22.78 billion against an advertised amount of Ksh24.0 billion, representing a performance rate of 94.91%. CBK accepted Ksh22.75 billion worth of Treasury Bills.

The 91-day T-bill interest rate stood at 8.14%.

3.The Satrix MSCI World Feeder ETF is set to list on the Nairobi Securities Exchange on Wednesday next week.

The ETF, which will be dual listed and KES-denominated, aims to track the performance of the MSCI World Index, offering Kenyan investors exposure to large- and mid-cap equities across 23 developed markets.

4. Unilever and Equity Bank have partnered to roll out a KES 2.4 billion Distributor Financing Solution aimed at strengthening supply chains and supporting SMEs in Kenya’s fast-moving consumer goods (FMCG) sector.

5 Absa Bank Kenya has unveiled an enhanced La Riba proposition, introducing La Riba Timiza, the country’s first fully Shariah-compliant mobile banking platform.

The launch also featured the La Riba Card, a Riba-free payment solution, and Sultana, a tailored women’s offering promoting ethical financial empowerment.

6. FINTRUST SECURITIES LTD, a subsidiary of FINCORP CREDIT, has officially been licensed by the Capital Markets Authority (CMA) and admitted by the Nairobi Securities Exchange (NSE) to operate as an Authorized Securities Dealer.

7. Old Mutual Life Assurance Kenya has appointed Martin Karenju as the new Managing Director and Principal Officer.

8.Nation Media Group (NMG) has appointed Sekou Owino as its new General Counsel.

With over 25 years of experience in legal affairs and corporate governance, Owino will be responsible for leading the Group’s legal and regulatory strategy across the region.

9. Sanlam Allianz and Hubris Holdings have secured CMA approval for an exemption from Kenya’s mandatory takeover rules.

The exemption allows them to acquire up to 66.7% of Sanlam Kenya Plc without making a mandatory offer, and up to 71.47% subject to further approvals under the Insurance Act.

Upcoming Events

10.The 5th Abojani Economic Empowerment Conference is coming this November!

We’re bringing together investors, entrepreneurs, leading economists, industry innovators, policymakers, and African households for real conversations on building ownership and self-sustenance.

Get ready. This year will be bigger and better.

#EconomicEmpowermentKE #OwnershipEconomyKE

11. And finally, we’re celebrating a major milestone – our 70th online session on Personal Finance and Investment.

Since 2018, our masterclass has empowered over 20,000 people across East Africa to take control of their money – from budgeting, debt management, retirement planning to investing. We’re proud to equip individuals with the knowledge and confidence to make smarter financial decisions.

Be part of a growing community transforming their financial lives.

Register for The 70th Masterclass