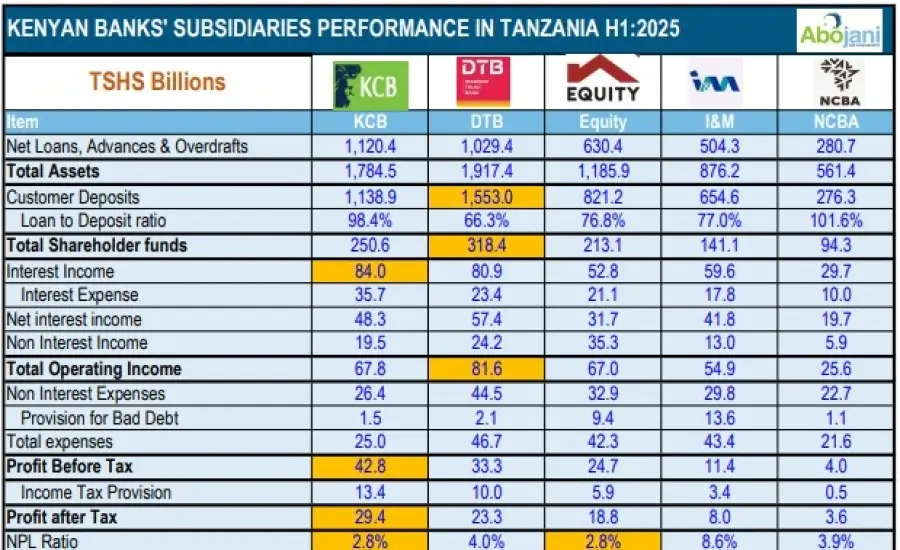

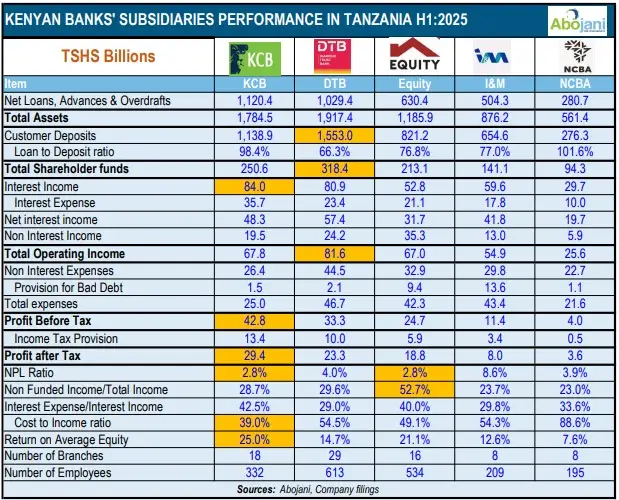

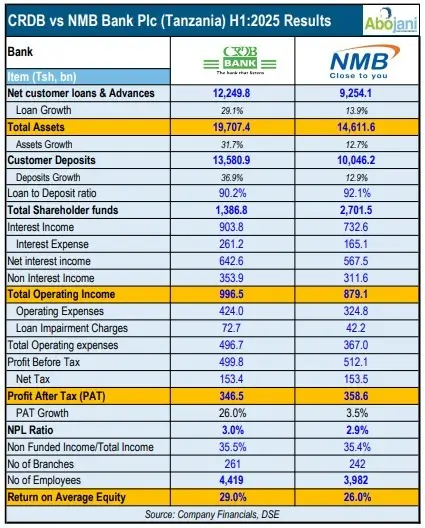

Kenyan Banks with subsidiaries in Tanzania have reported KSh 5.5 Bn pre-tax profits in H1 2025 alone. KCB and DTB stole the spotlight as the ultimate profits and assets kingpins while Equity reported the fastest growth in pre-tax profits.

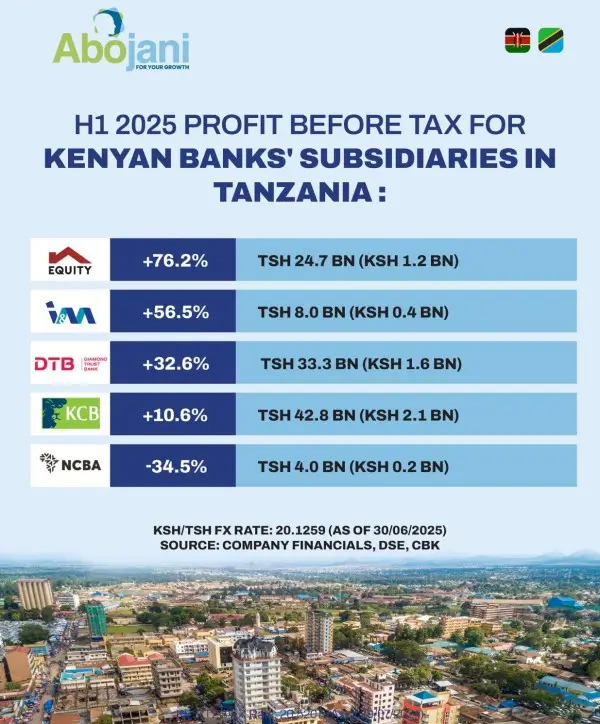

Banking Giants CRDB and NMB continue to break records in Tanzania.

NMB Bank led with a net profit of TSh 358.6 billion (KSh 17.2 billion), followed closely by CRDB at TSh 346.5 billion (KSh 16.5 billion). Both institutions reported double-digit growth in assets and customer deposits. CRDB also regained the lead in revenue generation, a signal of shifting competitive dynamics in Tanzania’s fast-evolving banking sector.

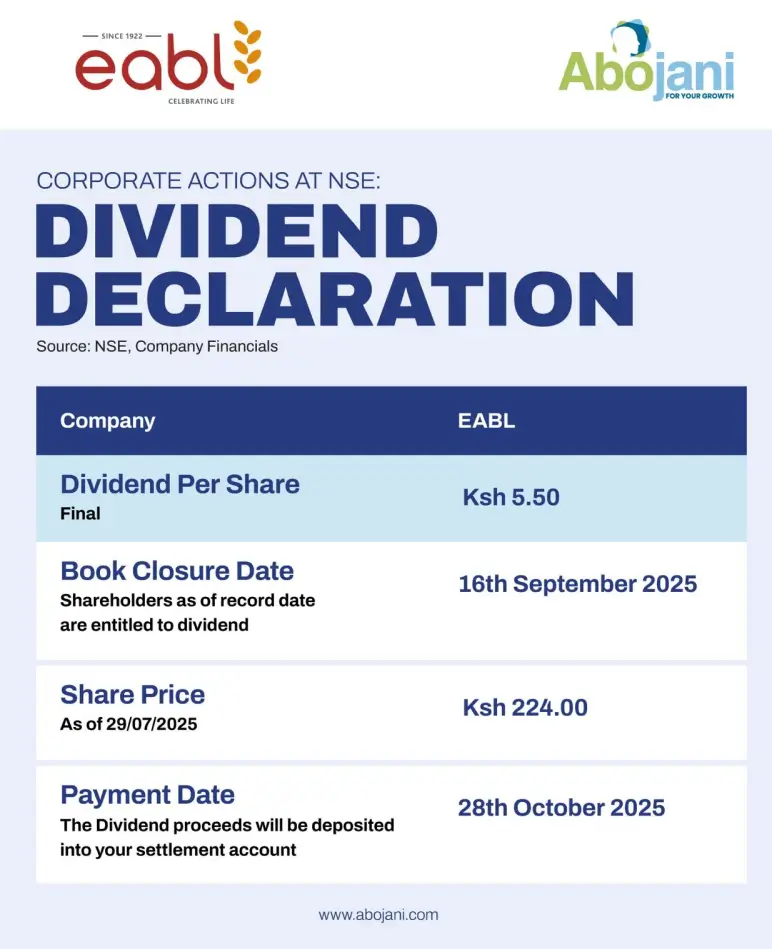

Listed brewer, EABL, has announced a 4% year-on-year increase in revenue to Ksh 128.8 billion for the financial year ended 30th June 2025, reflecting sustained demand and resilient consumer spending across its markets. The brewer posted a 12% growth in net profit after tax, closing the year at KSh 12.2 billion.

The board declared a final dividend of KSh 5.50 per share, bringing total FY2025 dividends to KSh 8.00, a 14.3% increase from the prior year.

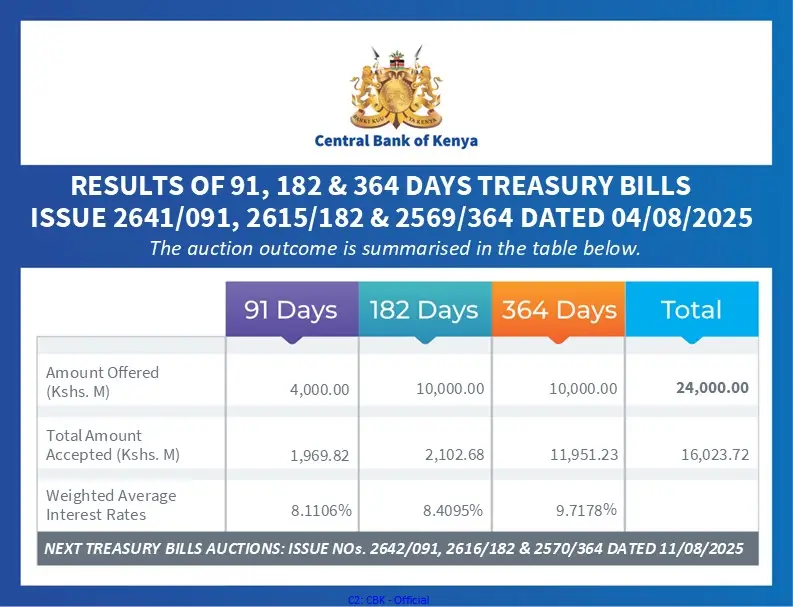

Treasury Bills were undersubscribed once again, seeing the government raise only KSh 16.0 Bn out of the KSh 24.0 Bn that was on offer.

Corporate Updates

NCBA announced a new distributor partnership with Zetu Innovations, the creators of Nyumba Zetu platform.

The deal will see the NCBA real estate customers utilize the next generation property management platform designed to simplify the complexities of managing residential, commercial and mixed use and affordable housing properties.

Equity Bank Kenya and CFAO have launched a 105% vehicle financing solution, starting with school buses and vans. This new offer includes not just full vehicle funding but also insurance and related costs, easing the financial burden for learning institutions.

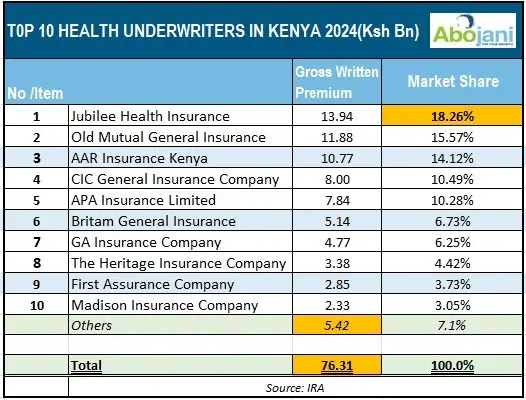

Kenya’s health insurance scene is heating up as Jubilee Health and Old Mutual go head-to-head in premiums and market share. The top 10 players now dominate over 90% of the market, showing just how consolidated and competitive this space has become.

Coming Up

X-Space: Taking Control of Your Finances for the Rest of the Year

As we enter the final stretch of 2025, it’s a good time to reflect on the goals we set at the start of the year; especially financial ones.

Some have been achieved, others adjusted, and a few may still feel distant. But there’s still time to pause, refocus, and finish strong.

Join us for the upcoming X-Space conversation.

The 5th Abojani Economic Empowerment Conference

This year, we will go all out, partnering with reputable organizations to bring you the best line up of speakers and experts on matters #OwnershipEconomy and #EconomicEmpowerment

See details on the flier below.

The 70th Abojani Personal Finance, Saving & Investing Masterclass

To mark this milestone, we’re going deeper into real strategies for real people. Whether you’re just starting your journey or looking to fine-tune your strategy, this session is designed to meet you right where you are.

We will add you to our WhatsApp Group once you register.