Earning rental income gives you something most salary earners wish they had, flexibility. But with that flexibility comes responsibility. When your income doesn’t land on the same day every month, and when you’re the one collecting instead of being paid, you must be even more deliberate with your financial management.

Unlike salaries, rental income can be irregular. A tenant might delay. A unit may be vacant for a while. Repairs might eat into what looked like a good month. That’s why treating your rental earnings like personal pocket money is the quickest way to destabilize your finances.

The Power of Passive Income Generation

You have to separate the income from the cash flow. Just because KES 100,000 came in this month doesn’t mean you “earned” it. What if two tenants were late last month and paid this month? What if you didn’t account for the roof repair due next quarter?

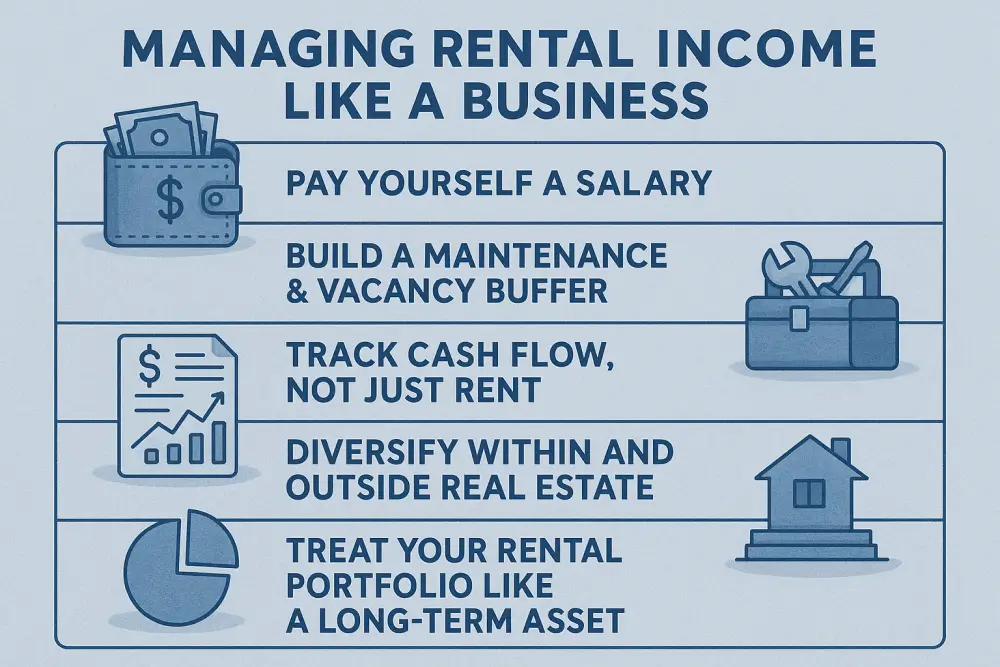

Here’s how to approach rental income with structure:

1. Pay Yourself a Salary

Even if your properties generate income, treat it like a business. Set aside a portion each month as your ‘salary’, a consistent amount that you can rely on. The rest should go into maintenance reserves, taxes, savings, or reinvestment.

This gives your personal income stability, which is crucial for planning, especially if rental income is your only source of money.

2. Build a Maintenance & Vacancy Buffer

You won’t always be at 100% occupancy. And even when you are, things break; pipes burst, walls crack, tenants leave without notice. Build a buffer of at least 3-6 months’ worth of expenses to protect yourself from periods of low or no income.

3. Track Cash Flow, Not Just Rent

Cash flow is not just “money in minus money out.” It includes irregular costs, uncollected rent, annual expenses like land rates, insurance, or renovations. Without a clear system to track these, it’s easy to overestimate your income and live beyond your means.

A simple spreadsheet or property management software can go a long way in giving you visibility.

4. Diversify Within and Outside Real Estate

If all your income is coming from a single source, you’re vulnerable. Consider reinvesting some rental income into other instruments: money market funds for liquidity, bonds for predictable income, or even stocks for growth.

5. Treat Your Rental Portfolio Like a Long-Term Asset

Rental income is not just for today’s needs. It can fund your retirement, your children’s education, or the next phase of your life. But only if you’re building with the long term in mind.

Ask yourself regularly:

✔ Are my properties appreciating in value?

✔ Is my income keeping up with inflation?

✔ Am I reinvesting or just consuming?

When your income isn’t a payslip, discipline must come from you, not your employer. Rental income can be a powerful foundation for financial independence, but only if you manage it like the opportunity it truly is.