Here’s a roundup of the biggest developments shaping Kenya’s financial and business landscape this week:

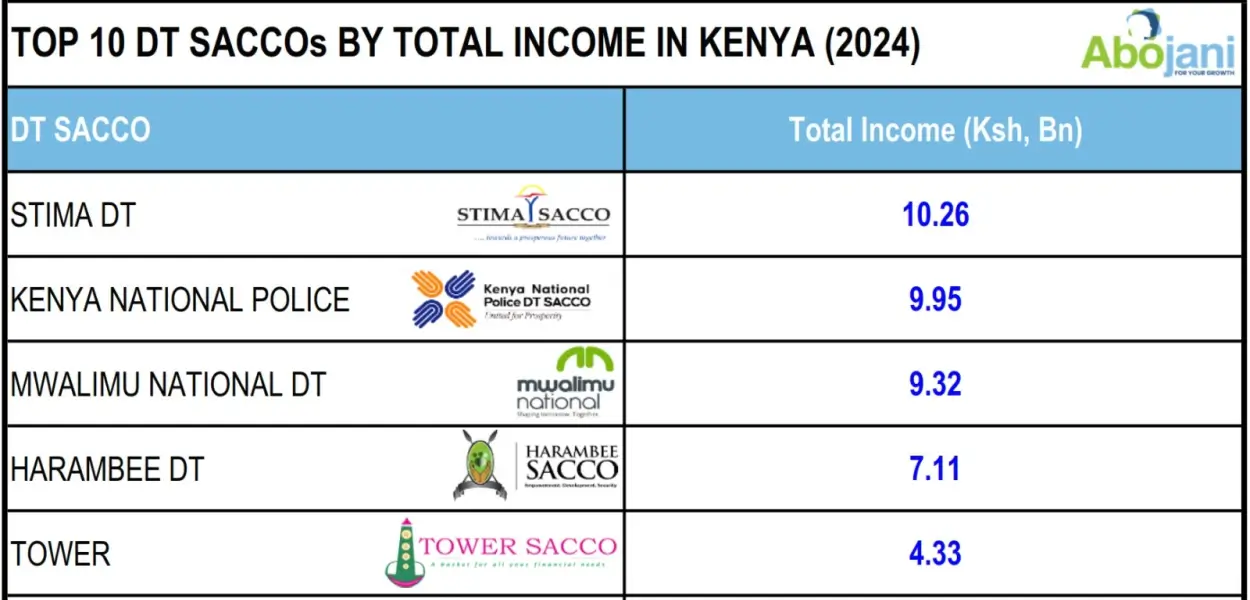

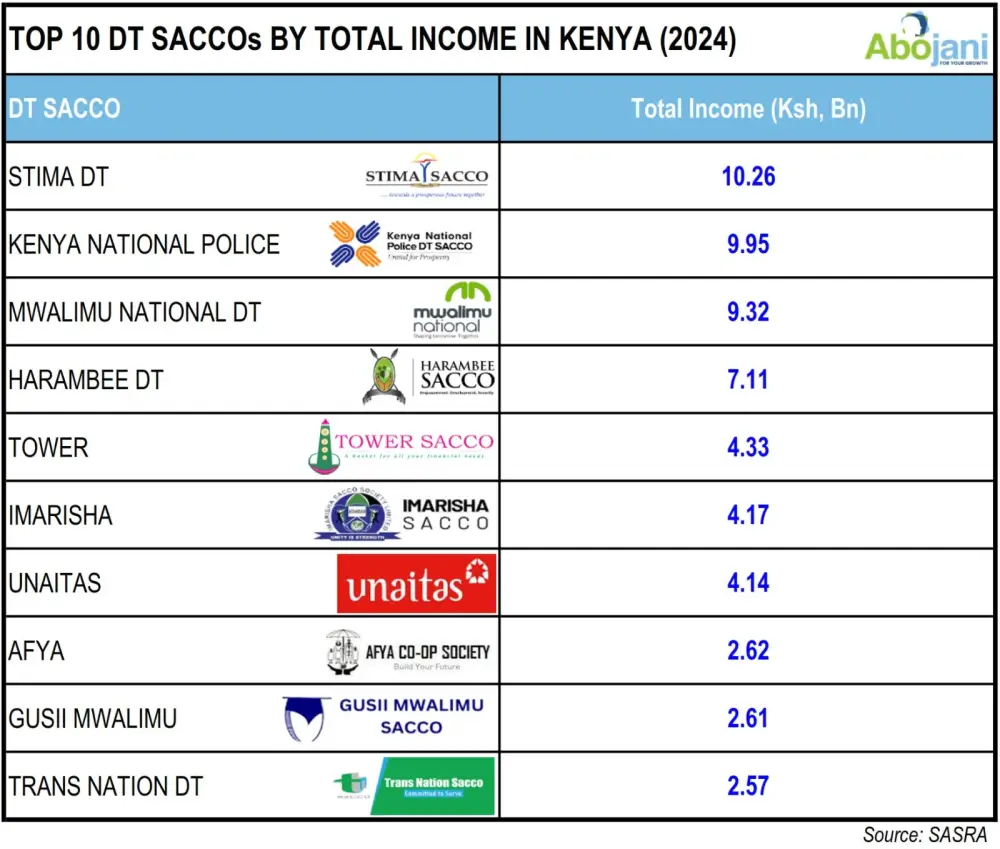

Stima Sacco Tops the Charts Again

Stima Sacco retained its position as the leading Deposit-Taking Sacco by total income in 2024. This reinforces its dominance in Kenya’s cooperative sector, which continues to play a crucial role in deepening financial inclusion, particularly for salaried workers and professionals.

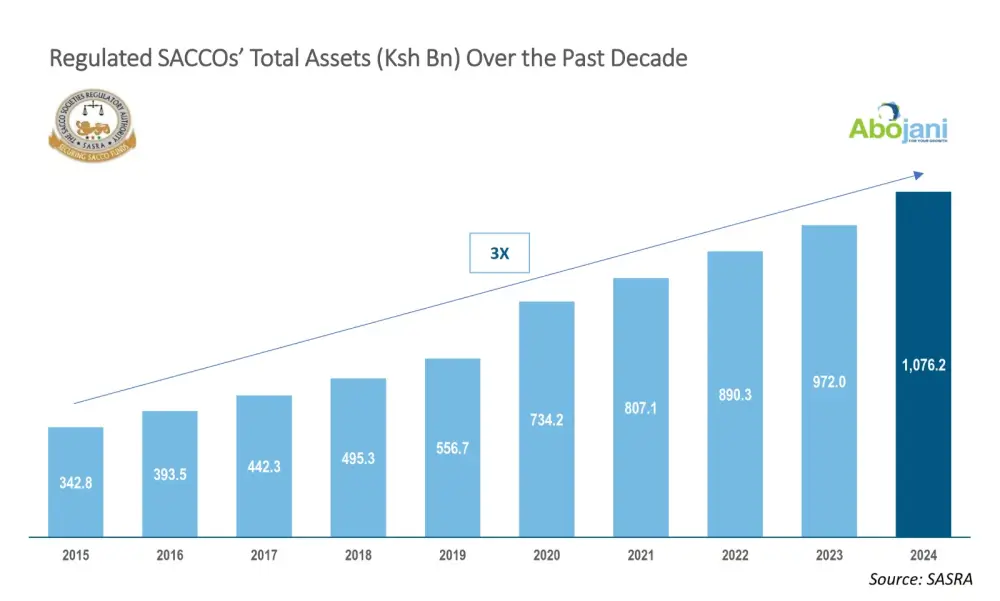

Regulated SACCOs Cross the Trillion Mark

The Sacco sector has now surpassed KSh 1 trillion in assets, a historic milestone. This growth reflects rising confidence in cooperatives as vehicles for saving, lending, and wealth creation. With this momentum, Saccos are increasingly rivaling mainstream banks in mobilizing deposits and credit.

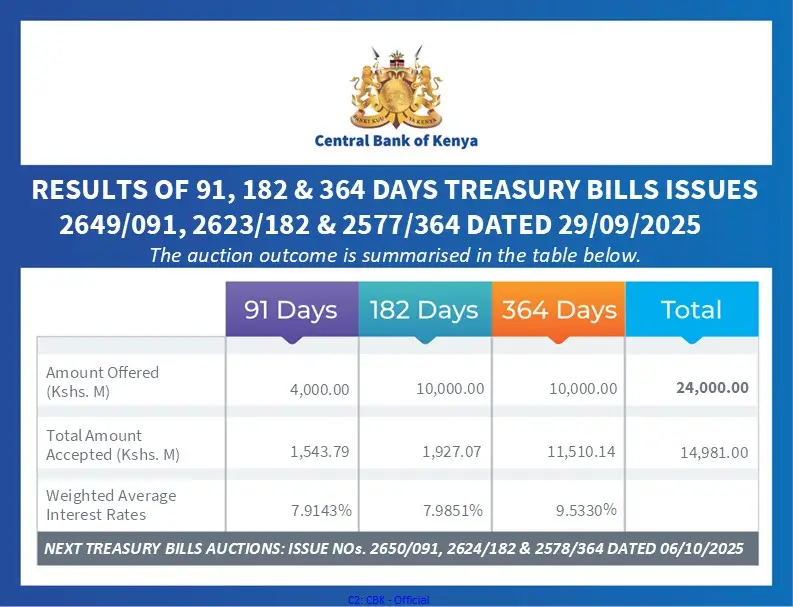

Treasury Bill Auction Undersubscribed

The Central Bank of Kenya (CBK) raised KSh 14.98 billion out of a targeted KSh 24 billion in this week’s Treasury bill auction. Despite undersubscription, yields continue to trend downwards, with the 91-day T-Bill at 7.91%, the 182-day at 8.00%, and the 364-day at 9.53%. Investors appear cautious, balancing between lower yields and alternative opportunities.

New Market Entrants Licensed by CMA

The Capital Markets Authority (CMA) expanded its list of licensed players this week, bringing the number of fund managers to 47. New approvals include Kenya Climate Ventures and EDC Asset Management (Kenya) as fund managers, Jalia Advisers & Intermediaries as an investment adviser, and Co-operative Bank as a corporate trustee. This move is expected to inject fresh capital and advisory expertise into the market, especially in climate-focused investments.

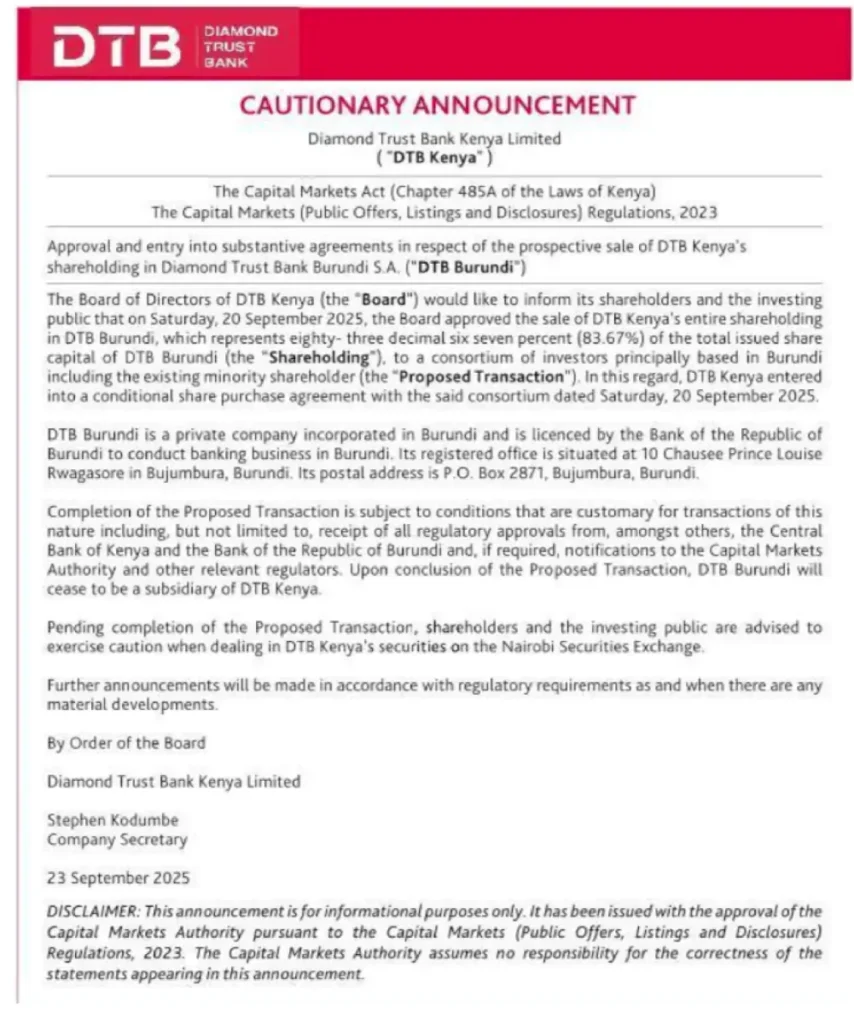

DTB Kenya to Exit Burundi Subsidiary

Diamond Trust Bank Kenya has approved the sale of its 83.67% stake in DTB Burundi. Subject to regulatory approvals, DTB Burundi will cease being a subsidiary of DTB Kenya. The exit is part of a strategic reallocation of resources as banks streamline cross-border operations.

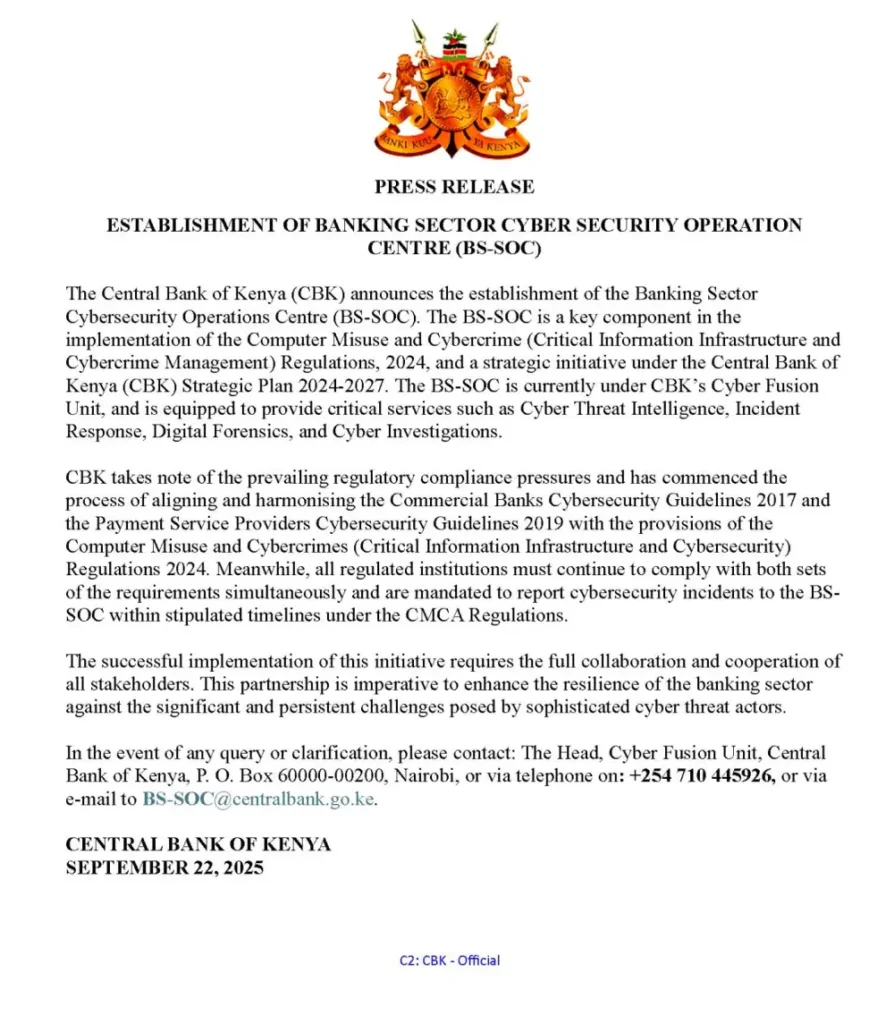

CBK Strengthens Cybersecurity with New SOC

The Central Bank of Kenya has set up the Banking Sector Cybersecurity Operations Centre (BS-SOC). This facility aims to enhance resilience against increasing cyber threats targeting the banking industry. With digital transactions on the rise, the SOC is a timely intervention to safeguard customer trust and system integrity.

Pesalink & TendePay Partner for SMEs

In a boost to small businesses, Pesalink has partnered with TendePay to deliver a seamless, real-time payments solution. SMEs will now be able to make instant single or bulk payments of up to KSh 999,999 across all banks, improving cashflow management and operational efficiency.

Tatu City Celebrates Culture

Kikuyu elders from the Gikuyu Cultural Association unveiled a Mugumo tree sculpture at Tatu City SEZ. Beyond its cultural symbolism, the installation underscores the integration of ecological preservation into modern urban development, highlighting Tatu City’s role as a model for sustainable growth.

Key Takeaways from Equity & Balanced Funds X-Space

The Old Mutual X-Space session on Equity and Balanced Funds drew strong engagement. Key lessons included:

- Avoid chasing returns without understanding the risks.

- Balanced Funds diversify risk across equities and government securities.

- Equity Funds require a long-term horizon of at least five years.

- The 30s and 40s are prime years to take calculated investment risks and build wealth.

NCBA Strengthens Presence in Central Kenya

As part of its customer-obsession agenda, NCBA Bank Kenya, led by MD James Gossip, embarked on an engagement tour across Kerugoya, Karatina, Nyeri, and Nanyuki. The bank used the tour to connect with customers in key sectors like agriculture, healthcare, manufacturing, and trade, demonstrating its regional growth strategy.

Coming Up

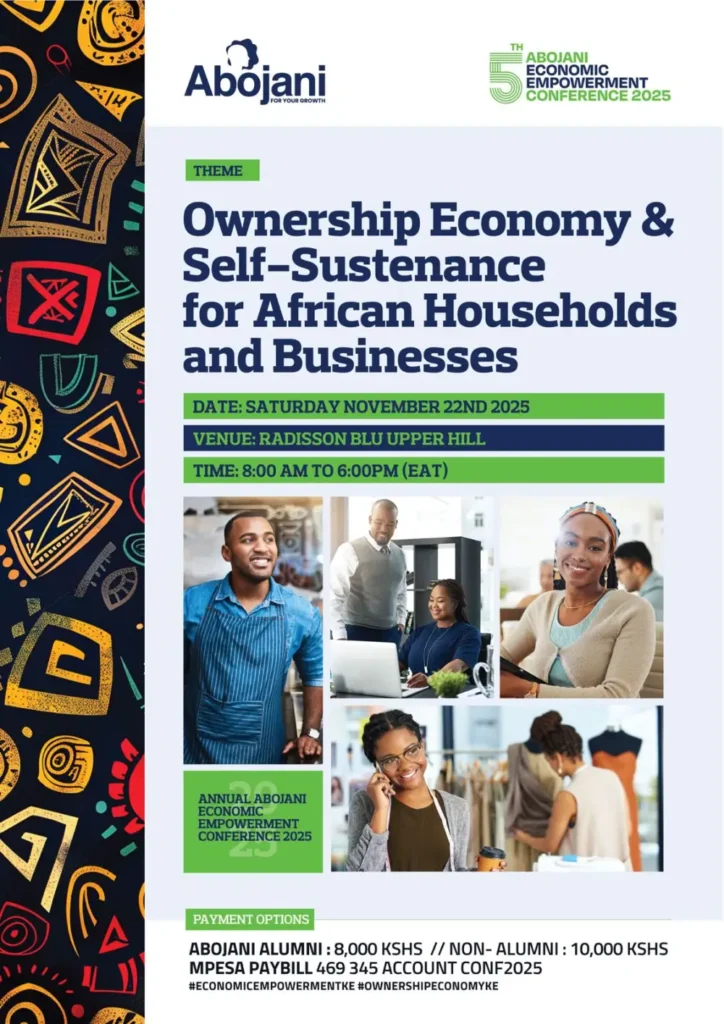

Countdown to the Abojani Economic Empowerment Conference

We are only weeks away from the 5th Abojani Economic Empowerment Conference on November 22, 2025, at Radisson Blu, Upper Hill. Expect a full day of powerful conversations on ownership, self-sustenance, and building resilient African households and businesses. Secure your spot to network with industry leaders, investors, and entrepreneurs.

Final Masterclass of the Year

Registration is now open for the 72nd Masterclass on Personal Finance & Investing, running this October. As our final cohort of the year, this program will cover money management, financial goal-setting, and practical investing in unit trusts, stocks, bonds, and treasury bills; plus a guest speaker to share real-world insights. Don’t miss your chance to close the year with stronger financial knowledge.