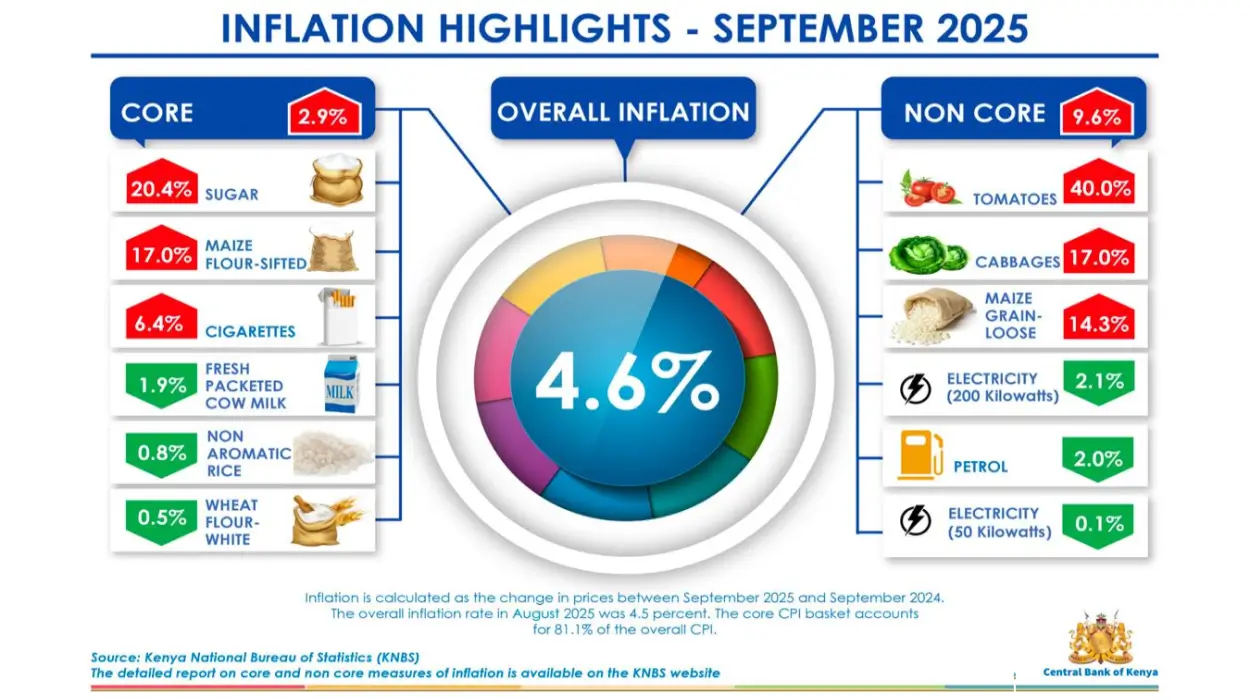

Kenya’s inflation edged up to 4.6% in September 2025, driven mainly by higher food, transport, and housing costs, according to KNBS. Households found some relief as prices of some staples recorded slight declines during the month.

The boardrooms of corporate Kenya held the spotlight this week, with leadership moves and strategic shifts. Absa Bank Kenya announced the appointment of one Ms. Caroline Armstrong as an Independent Non-Executive Director to its Board.

Ms. Armstrong, a seasoned professional in the financial services sector, brings extensive experience that is expected to play a critical role in strengthening Absa’s governance and shaping its long-term strategy.

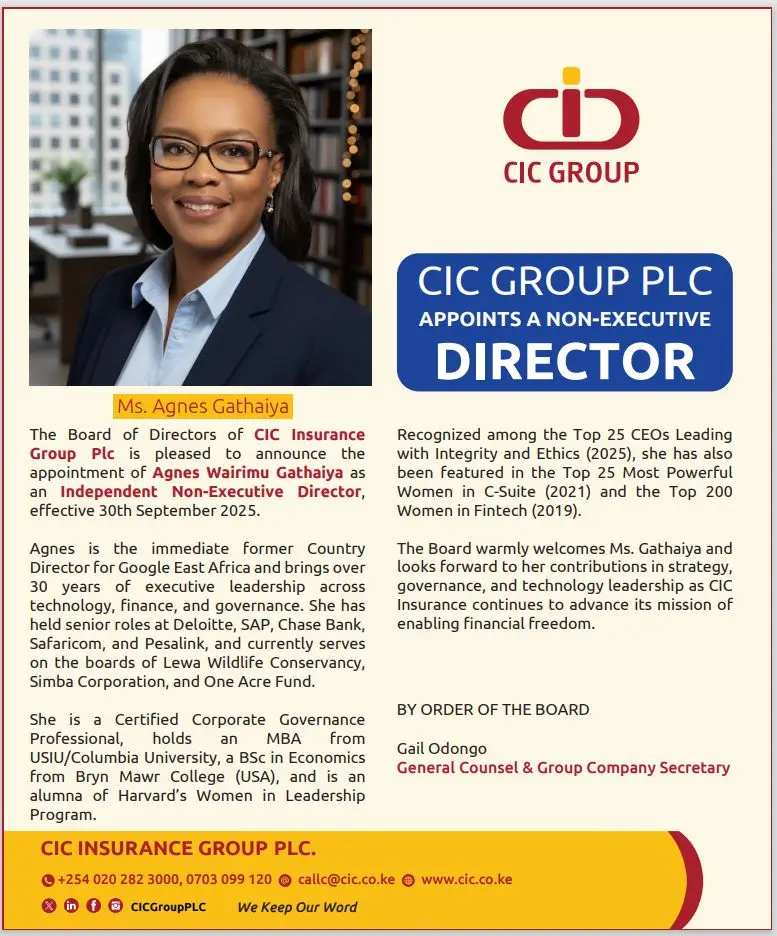

Leading insurance and financial services provider, CIC Group, also strengthened its Board with the appointment of Agnes Gathaiya as an Independent Non-Executive Director, effective 30th September 2025. Renowned for her leadership in technology and governance, Ms. Gathaiya is expected to bring valuable insights as CIC advances its mission of enabling financial freedom.

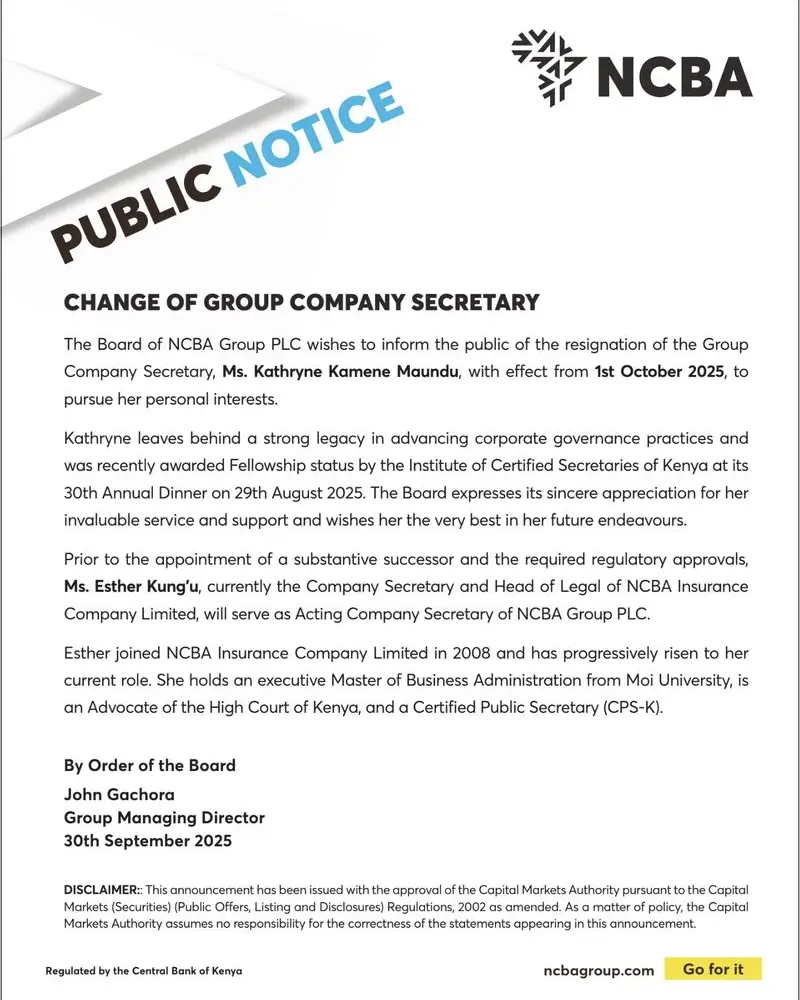

At NCBA Group, the week marked a change in the company secretariat. Kathryne Maundu stepped down from her role as Group Company Secretary, with effect from 1st October 2025. In the interim, Esther Kung’u, who currently oversees legal affairs at NCBA Insurance, has been tapped to hold the fort as Acting Company Secretary until a substantive replacement is announced.

In an interesting development, The Nairobi Securities Exchange (NSE) introduced the Banking Sector Index, a transparent benchmark designed to enhance visibility for listed banks and guide investor decision-making. NSE CEO Frank Mwiti said the Index not only highlights banking as a key driver of economic growth but also paves the way for product innovation such as ETFs and other index-linked instruments.

Old Mutual launched Thrive, Kenya’s first holistic wellness app, bringing financial, physical, mental, and nutritional health into one platform to help Kenyans live fuller, balanced lives. The app was officially unveiled at the Wellness Festival this Saturday, 4th October at Mass House (off Ngong Rd), inviting the public to begin their journey to better living.

Family Bank has set the stage for a long-awaited NSE debut, calling an extraordinary general meeting to seek shareholder approval for a listing by introduction. The move, which will shift trading of its shares from the OTC market to the bourse, aims to boost liquidity without issuing new stock, with shares currently priced at Sh16.

Additionally, Standard Chartered CEO Bill Winters concluded a visit to South Africa, reaffirming the Bank’s commitment to Africa as a key growth market. He highlighted digital innovation, cross-border partnerships, and the rising fintech sector as drivers of opportunity across the continent.

9. NCBA hosted its commercial banking customers for a forum aimed at helping entrepreneurs navigate emerging risks in the operating business environment.

With over 100 attendees, business leaders discussed strategies on how to tackle cybercrime, climate change, fraud, and employee liability. #NCBATwendeMbele

10. Eastleigh traders have called for greener business practices and longer banking hours, with community leaders urging Equity Bank to extend operations beyond the current 4:30 p.m. close. In response, Equity Bank MD Moses Nyabanda assured traders of the bank’s readiness to co-create solutions, including sustainability initiatives and more convenient banking access.

Airtel Africa Foundation, unveiled a bold plan to directly impact 10 million lives across the continent by 2030 through its FEED pillars- Financial Empowerment, Education, Environmental Protection, and Digital Inclusion. The strategy builds on successes such as its UNICEF partnership, which has already connected over 1,800 schools and benefited more than one million students across 14 markets.

But the highlight of the week was the #Free Webinar that we organized for investors in partnership with NSE. The theme was: Decoding Stock Market Opportunities in Q4’2025. Here’s the link to the recording for your perusal:

Passcode: retailKE@2025

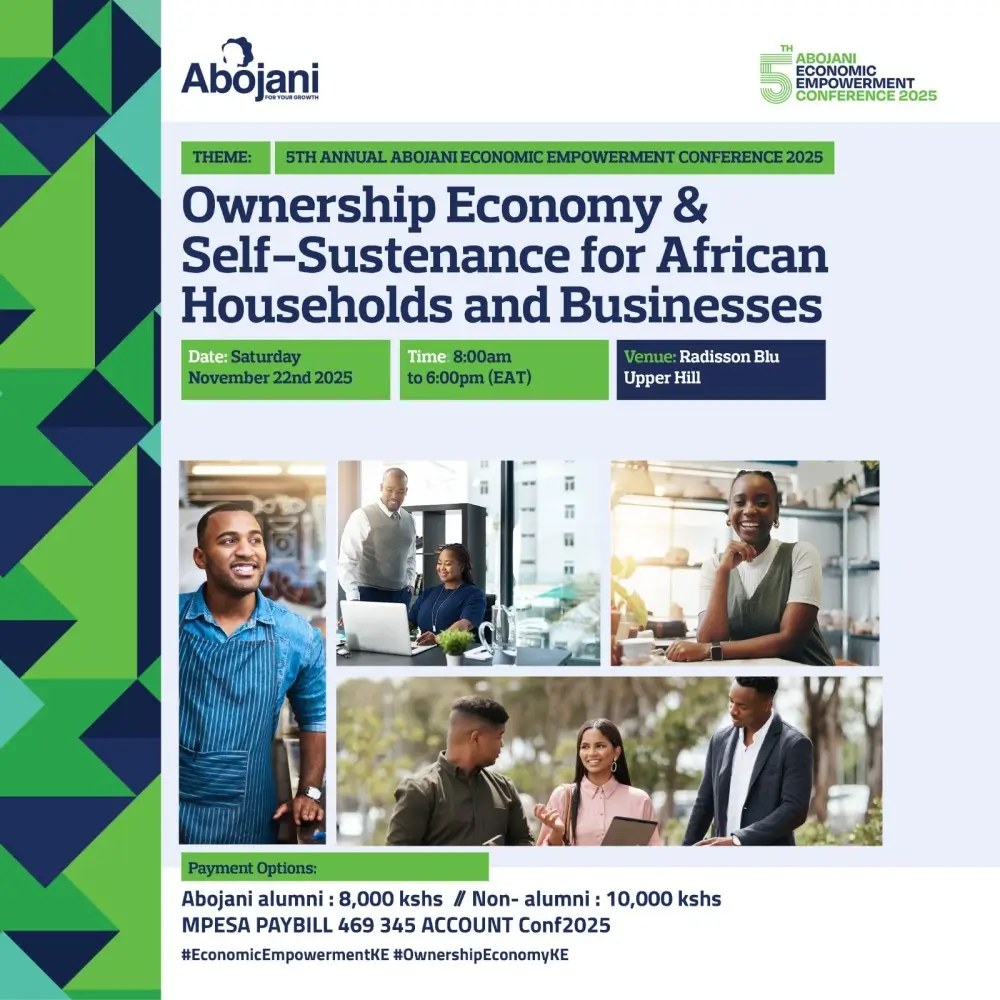

We are pumped to announce our long-awaited 5th Annual Economic Empowerment Conference on 22nd Nov 2025 from 9am, at Radisson Blu in Upperhill – Nairobi. Come and learn about:

- Moving from Earners to Owners

- Owning What We Build

- Ownership and Wealth-Building as a Team Sport

- Moving from Dependency to Design

- Beyond Growth: Building Wealth That Lasts

From salary to equity, this conference shows you how to secure the bag.

And finally, we are geared up and very ready for the last Personal Finance, Saving & Investing Masterclass of the year. We will walk the journey with you for an entire month, to help you understand all matters stocks, money market funds, Saccos, Bonds and even treasury bills. We look forward to having you onboard!