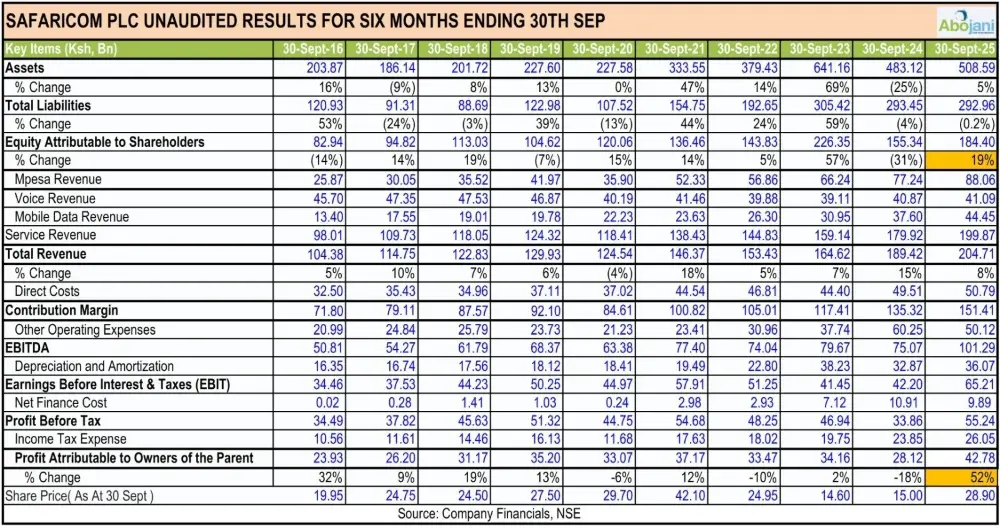

Safaricom has once again demonstrated its market leadership with impressive half-year results, underscoring strong growth across Kenya and Ethiopia. The company’s robust financial performance, driven by rising service revenue and expanding regional operations, highlights Safaricom’s strategic focus on innovation, connectivity, and customer value. As one of Africa’s leading telecom operators, Safaricom continues to set the pace in driving digital transformation and economic empowerment across the region.

The Week In Markets

Safaricom’s Half-Year Results Show Strong Growth Across Markets

Safaricom PLC released its highly anticipated HY results, revealing strong performance in both Kenya and Ethiopia. The Kenyan business reported a 22.6% rise in net profit to KSh 58.2 billion, supported by a 9.3% increase in service revenue to KSh 194.0 billion. The results affirm Safaricom’s continued dominance and successful regional expansion.

Also read: Safaricom HY 26: A Strong Core, a Bold Frontier, and the Power of M-PESA

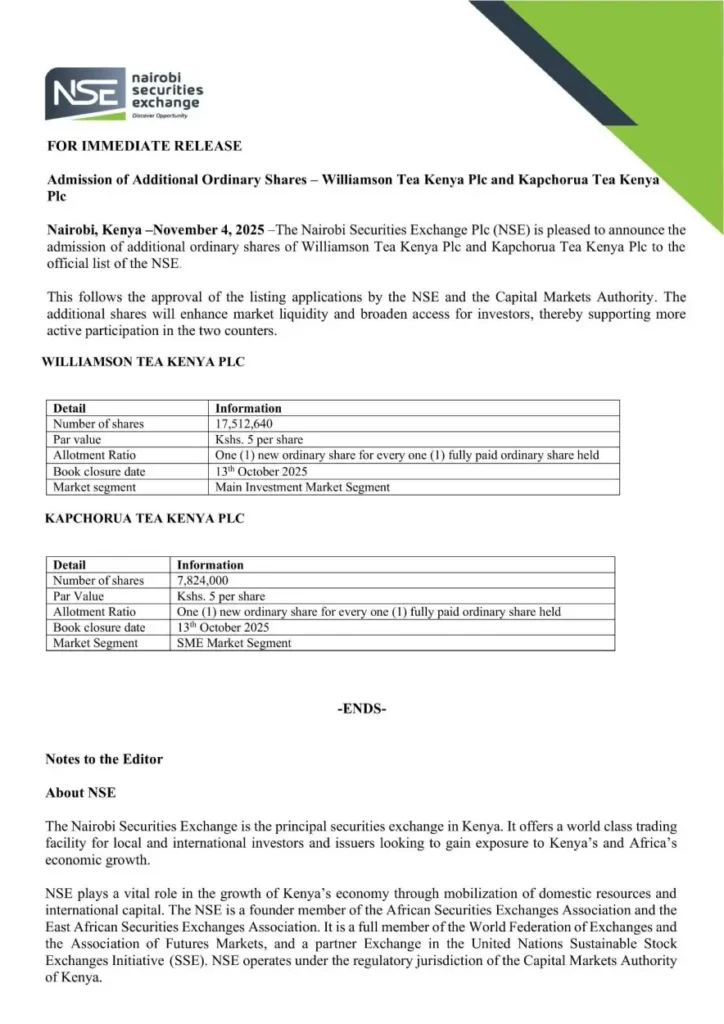

Tea Firms List Additional Shares on the NSE

Williamson Tea Kenya Plc and Kapchorua Tea Kenya Plc listed additional ordinary shares on the Nairobi Securities Exchange after receiving approvals from the Capital Markets Authority.

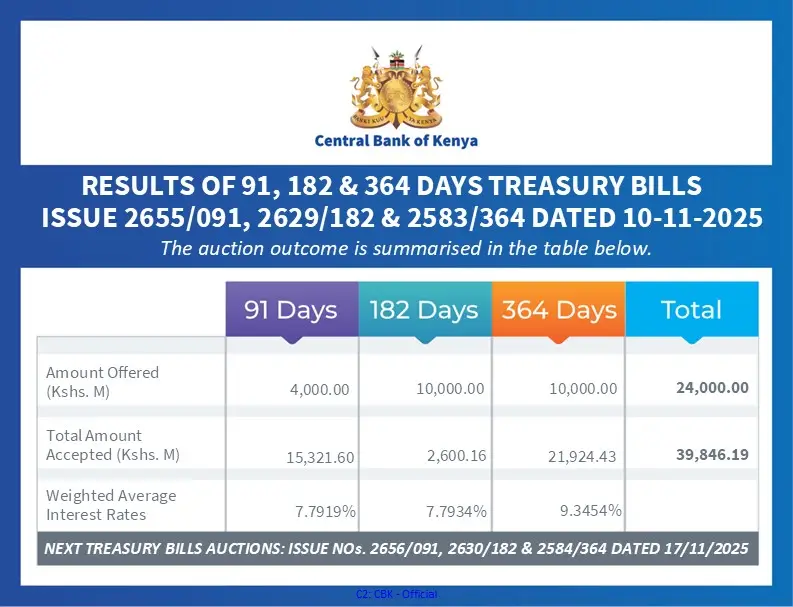

Treasury Bill Auction Oversubscribed

The Treasury bill auction recorded strong investor appetite, with CBK offering KSh 24 billion and receiving KSh 39.85 billion in bids, nearly double the target. The 91-day T-Bill rate stood at 7.7919%.

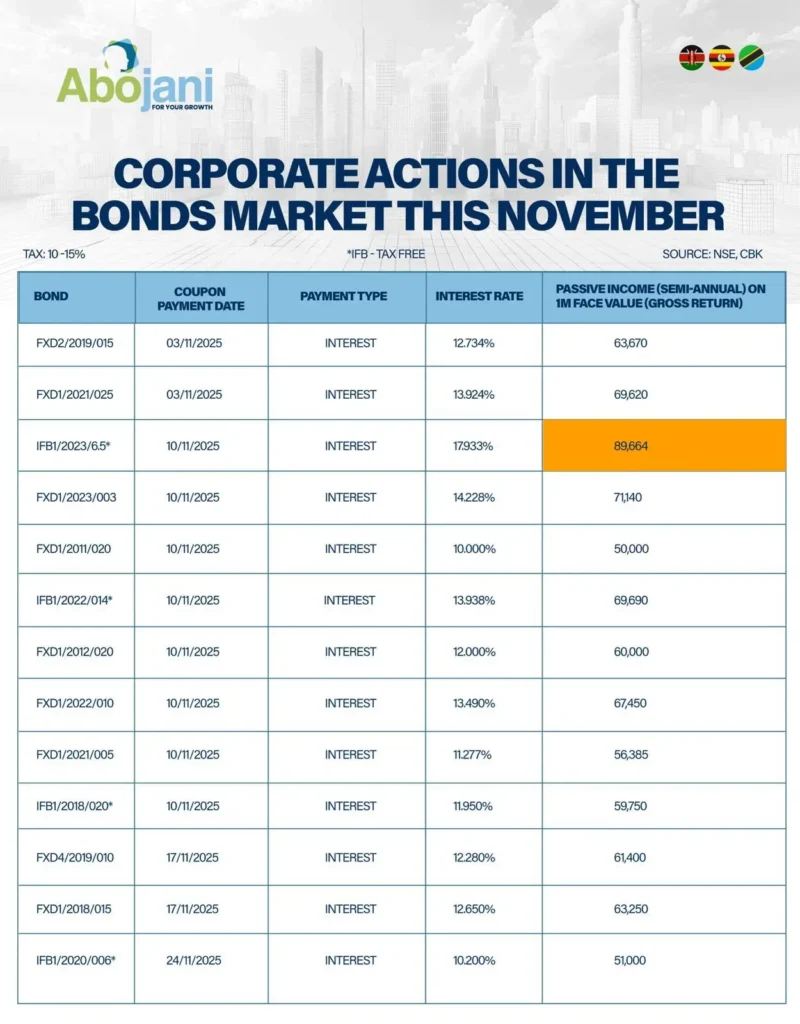

Dividend & Bond Payments Due

KCB will pay an interim and special dividend of KSh 4.00 per share on 11th November 2025.

Investors holding the following government bonds will receive semi-annual interest payments this week: IFB1/2023/6.5, FXD1/2023/003, FXD1/2011/020, IFB1/2022/014, FXD1/2012/020, FXD1/2022/010, FXD1/2021/005, and IFB1/2018/020.

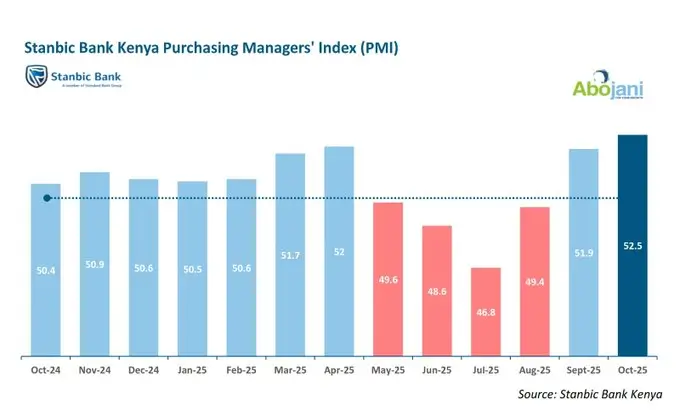

Private Sector Activity Strengthens

Stanbic Bank Kenya’s Purchasing Managers’ Index (PMI) rose to 52.5 in October, its highest level since February 2022, signalling solid improvement in business activity and private sector confidence.

NCBA Champions SME Growth and Industrialization

NCBA joined the 2025 Changamka Festival in partnership with the Kenya Association of Manufacturers, reaffirming its commitment to empowering SMEs and driving Kenya’s industrialization agenda.

The bank also launched a national Business Development Programme (BDP) with Kabarak University, designed to equip SMEs with strategic skills in finance, innovation, sustainability, and business growth.

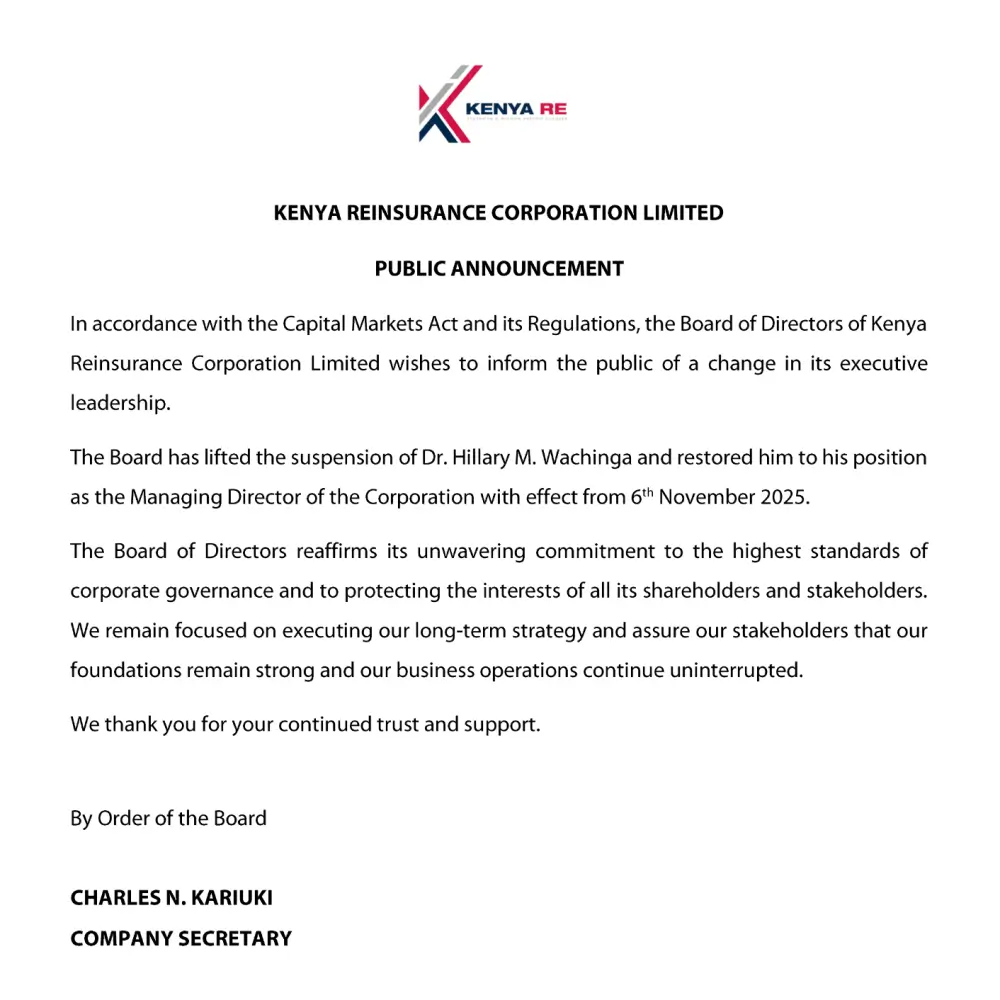

Kenya Re Reinstates Managing Director

Kenya Reinsurance Corporation reinstated Dr. Hillary M. Wachinga as Managing Director, effective 6th November 2025, following the lifting of his suspension.

KBA #CEOChat on Digital Banking and MSME Support

The fourth session of KBA’s #CEOChat featured Ralph Opara, Country Managing Director at Access Bank Kenya. The discussion focused on driving financial inclusion through digital banking, highlighting key insights:

- Banks must invest in tools to mitigate risks such as cyber threats.

- Data can now be leveraged to design credit programs tailored to customer profiles.

- Despite digital advances, maintaining the human touch remains crucial.

Abojani X Space with Tatu City Explores Future Growth

This week’s X Space discussion, held in partnership with Tatu City, explored where Kenya’s next wave of business growth will come from.

Key takeaways included:

- The future belongs to those who see beyond the short term.

- Agricultural aggregation presents untapped opportunities.

- Expanding internet coverage is creating new digital business frontiers.

Coming Up

We are pleased to announce that HF Group and CIC Asset Management have joined the list of sponsors for the upcoming 5th Abojani Economic Empowerment Conference, strengthening support for financial inclusion and ownership-driven growth.

The much-anticipated conference, happening on 22nd November 2025 at Radisson Blu, Upper Hill, promises invaluable insights for professionals, entrepreneurs, and households eager to build lasting wealth and independence through the Ownership Economy.