This week’s financial and business updates covered several key developments with Co-op Bank’s nine-month profit of KSh 21.56 billion and the declaration of its first-ever interim dividend. Other highlights included KCB’s interim and special dividend payments, leadership changes at I&M Bank Kenya, a new entrepreneurship partnership between Equity Group Foundation and UNDP, updates on Kenyan banks operating in Tanzania, MSCI index additions for Kenyan-listed companies, activity in the treasury markets, corporate recognitions, corporate ations, and the long awaited 5th Abojani Economic Empowerment Conference.

KCB Shares Dividend Joy with Shareholders

KCB shareholders received their interim and special dividend payments this week, for those who were in the books as of 3rd September 2025.

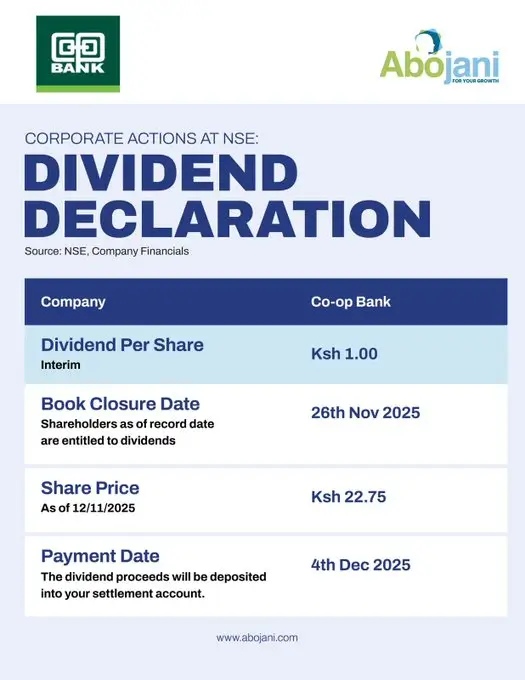

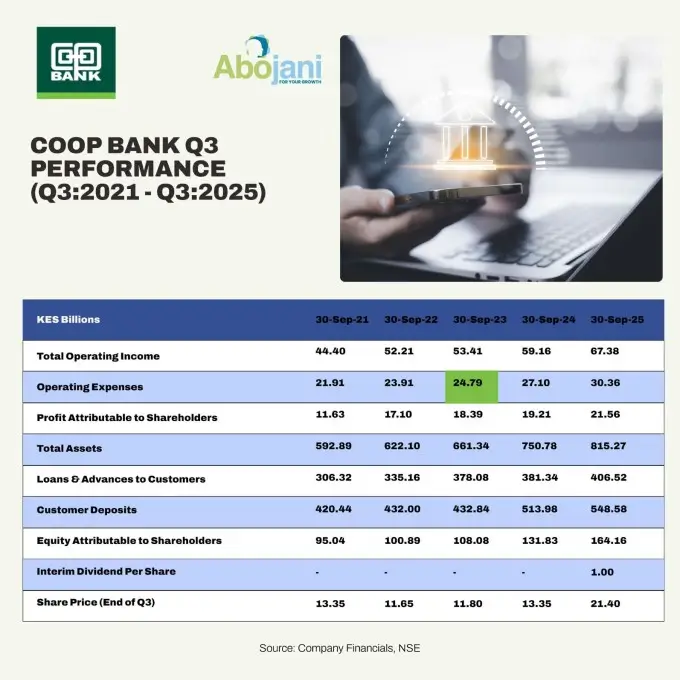

Co-op Bank Posts Strong Nine-Month Profits and Declares First Interim Dividend

Co-op Bank reported KSh 21.56 billion in nine-month profits, driven by stronger interest earnings. Riding this momentum, the bank declared its first-ever interim dividend of KSh 1 per share, payable in early December 2025.

Leadership Change at I&M Bank Kenya

Change is underway at I&M Bank Kenya as the Board announced the exit of Gul Khan, who served as Chief Executive Officer. Kihara Maina, the current Regional CEO at I&M Group, has been appointed as the Interim CEO of I&M Bank Kenya, pending regulatory approval.

Equity Group Foundation Partners with UNDP to Empower African Entrepreneurs

The partnership will establish Timbuktoo innovation hubs to train, mentor, and finance African entrepreneurs. The initiative aims to drive inclusive growth by supporting youth, strengthening value chains, and backing climate-neutral, high-potential businesses across the continent.

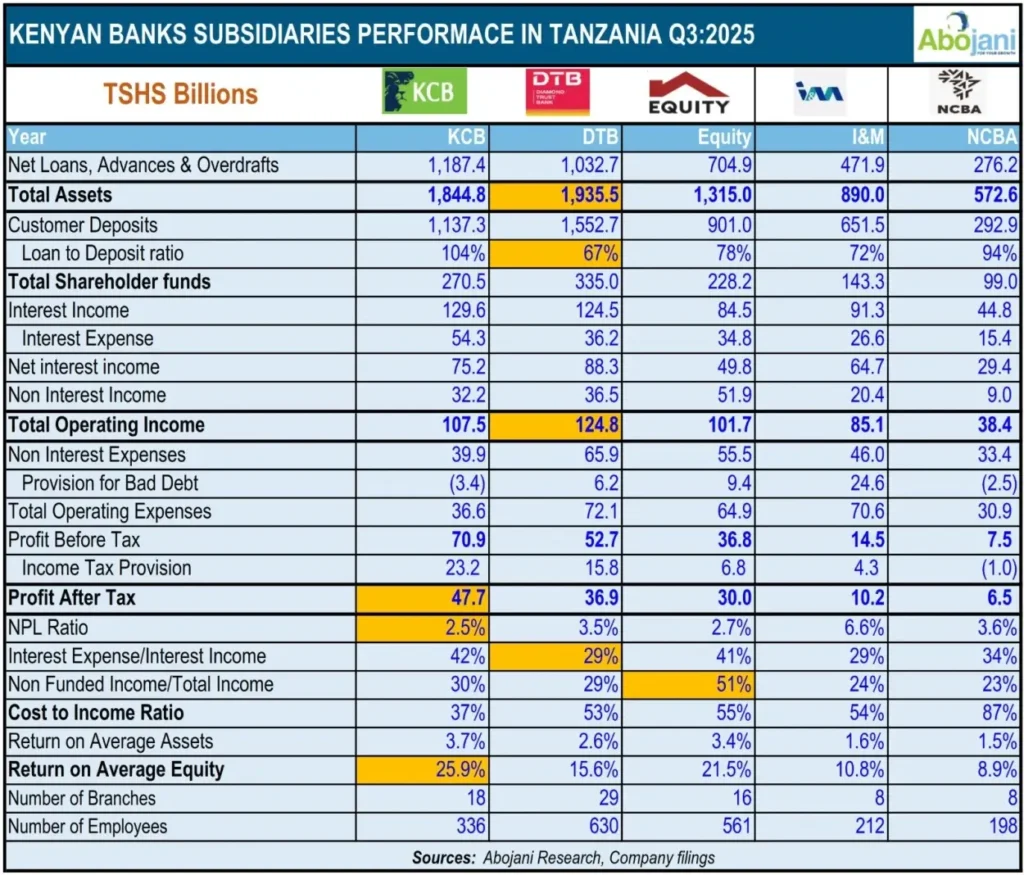

Kenyan Banks in Tanzania

During the week, we compiled our final analysis for the Kenyan banks operating in Tanzania. The analysis highlighted KCB Tanzania’s profitability and operational efficiency, Equity Bank’s rapid growth and diversification, and DTB’s continued leadership in asset size.

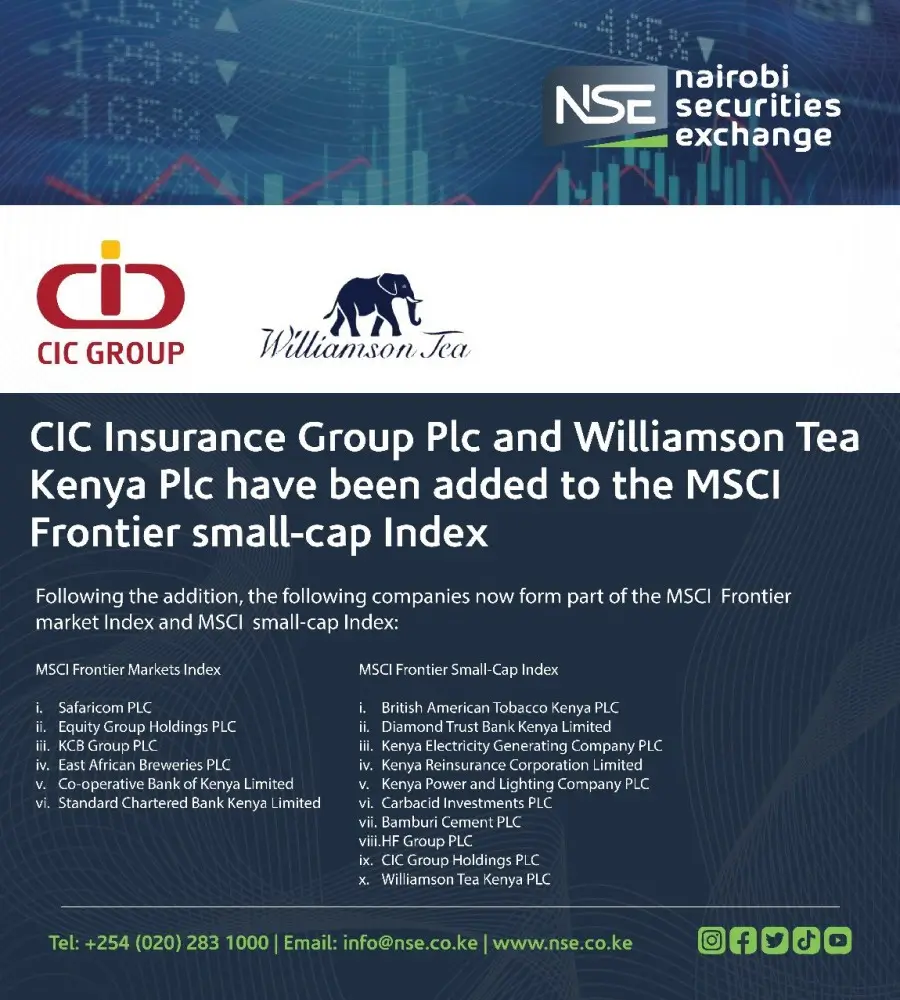

Kenya Gains Global Exposure with MSCI Frontier Small Cap Index

Morgan Stanley’s MSCI added CIC Insurance Group Plc and Williamson Tea Kenya Plc to its Frontier Small Cap Index, widening Kenya’s international market visibility and attracting foreign investment to the NSE.

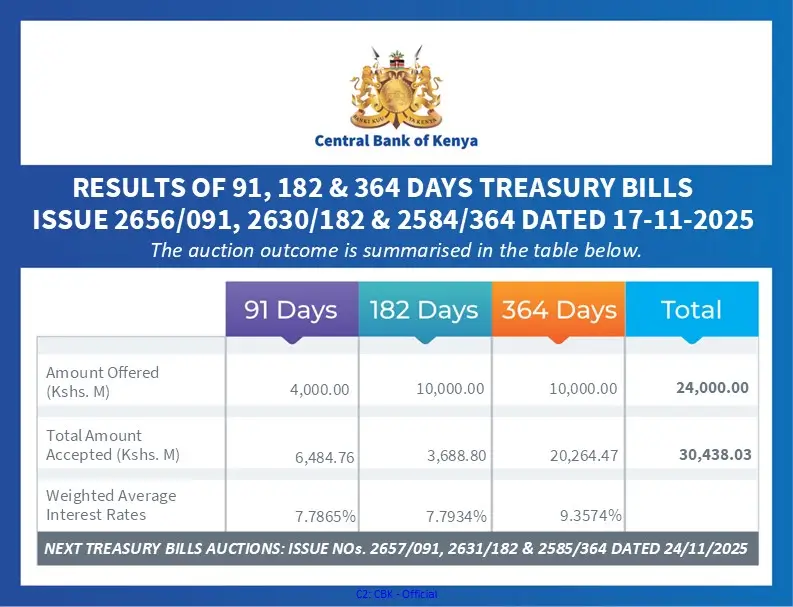

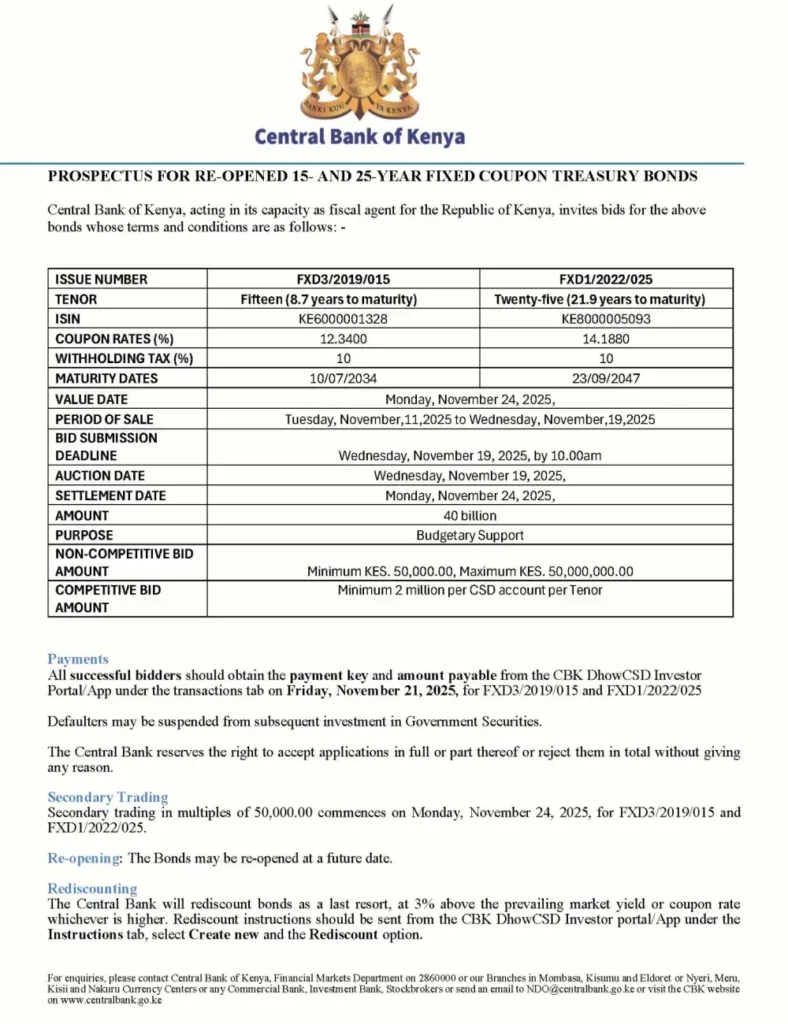

Treasury Bills and Bonds This Week

The government raised KSh 30.4 billion through treasury bills this week, exceeding the KSh 24.0 billion on offer. CBK also opened bids for two reopened bonds, targeting KSh 40 billion, to manage interest rates and support fixed-return securities.

Old Mutual Kenya Recognized for Responsible Business Conduct

Old Mutual Kenya was named First Runners-Up in the Responsible Business Conduct category at the 2025 Employers of the Year Awards, highlighting its commitment to integrity, people-centered leadership, and sustainable business practices.

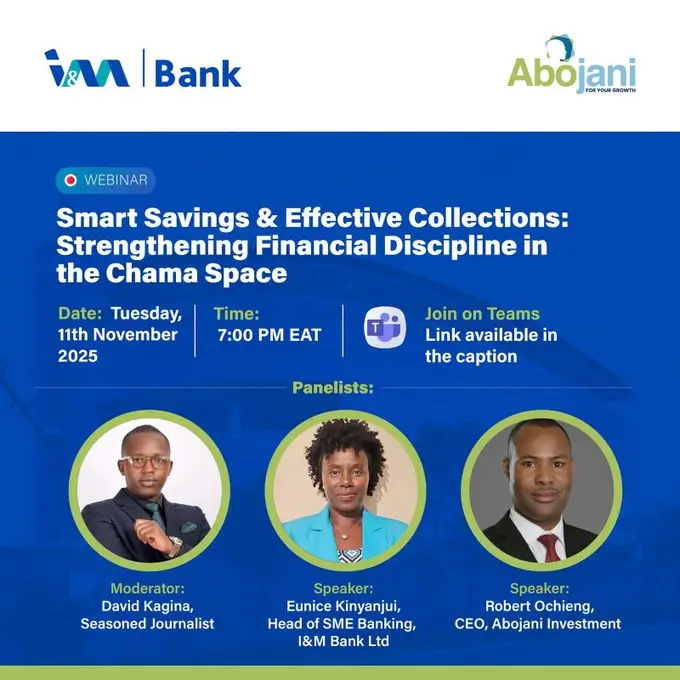

Chama Webinar: Smart Saving & Effective Collections

In partnership with I&M Bank, we hosted a webinar for the chama sector focusing on financial discipline, smart saving, and effective collection strategies.

Click here to Catch the Recording

Countdown to the 5th Abojani Economic Empowerment Conference

The conference takes place this Saturday, focusing on Ownership Economy & Self-Sustenance for African Households and Businesses. Don’t miss out on expert panels and insightful discussions.