HF Group Reports Exceptional Growth

HF Group posted a profit before tax of Ksh 1.14 billion in Q3 2025, marking a remarkable 265% increase compared to the same period in 2024. The growth was powered by a combination of reduced cost of funds, higher interest and non-funded income, and a successful diversification strategy, with all subsidiaries reporting profitability gains.

Standard Chartered Faces One-Off Hit

Standard Chartered Bank Kenya saw profit before tax fall 41% to Ksh 13.2 billion, influenced by a one-off Ksh 2.7 billion pension-related cost and a 17% drop in operating income due to lower interest margins and reduced transactional activity. The bank remains highly liquid, well-capitalised, and strengthened its asset quality, with NPL ratio improving to 5.9%.

Safaricom Launches Domestic MTN Programme

Safaricom initiated the first tranche of its Ksh 40 billion Domestic MTN Programme, targeting Ksh 15 billion with a Ksh 5 billion greenshoe. Fixed Rate Green Notes priced at 10.40% over a 5-year tenor will fund projects under its Sustainable Finance Framework. The offer runs from 25th November to 5th December 2025, with allotment on 8th December and NSE listing on 16th December.

Kenya Airways Issues Profit Warning

Kenya Airways projected at least a 25% drop in full-year earnings for 2025 due to reduced passenger numbers following the grounding of a third of its wide-bodied aircraft. The national carrier recorded a Ksh 12.15 billion net loss in H1 2025 and expects full-year profits to fall below the Ksh 5.4 billion posted in 2024.

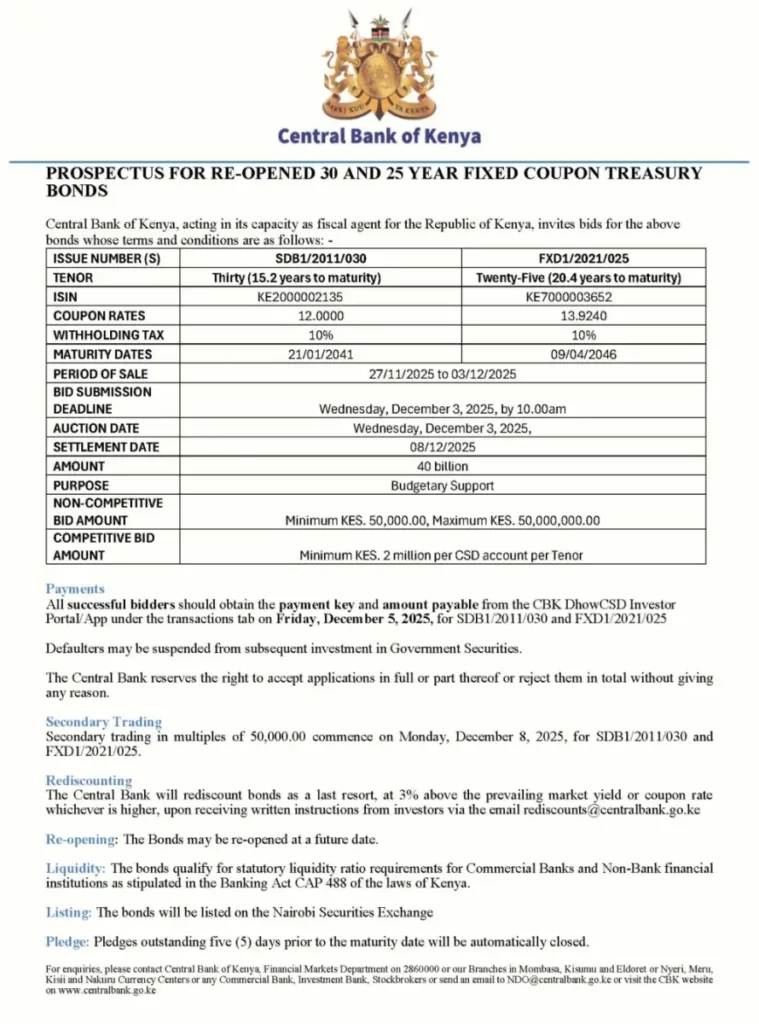

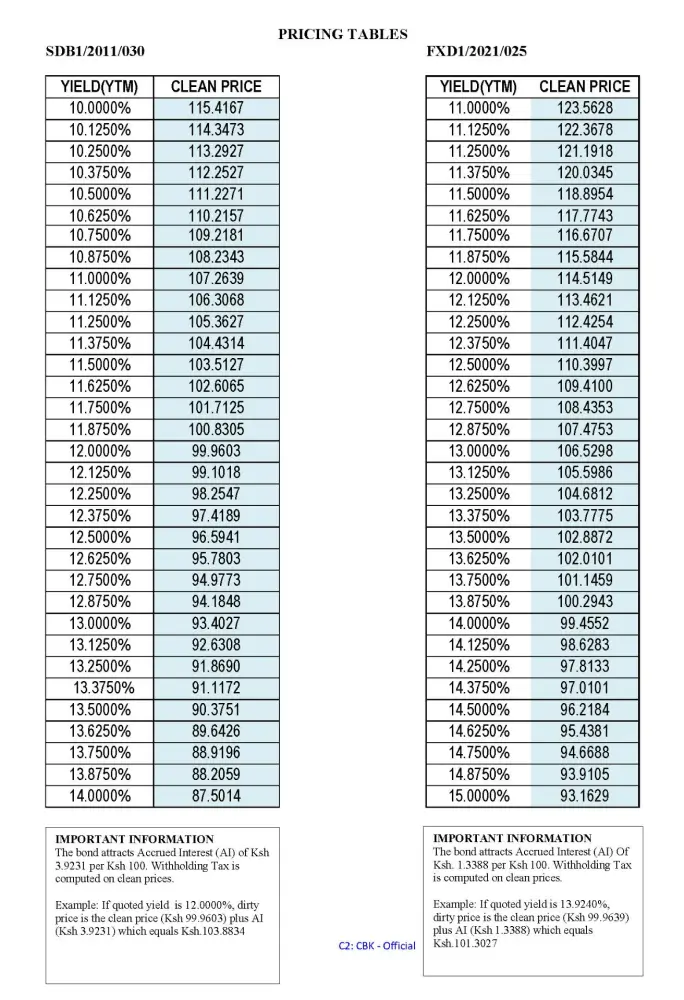

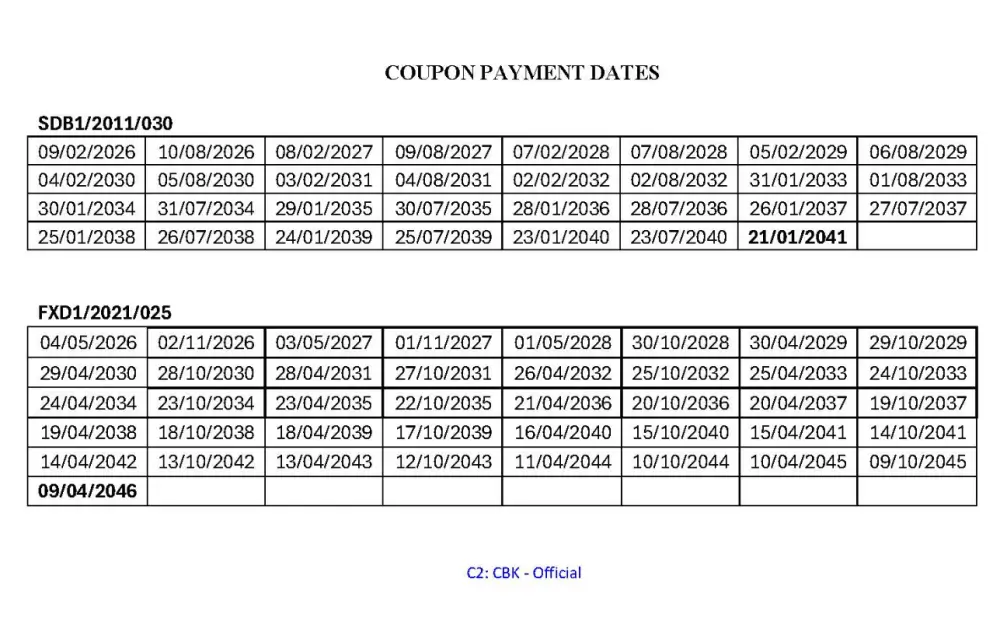

CBK Reopens Long-Term Bonds

The Central Bank of Kenya is gauging investor interest with a Sh40 billion reopening of long-term government bonds, offering 15- and 20-year maturities. The auction, running from 27 November to 3 December, revisits a 25-year bond from May 2021 and a 30-year bond from February 2011.

CMA Approves 8 New Collective Investment Schemes

Capital Markets Authority approved eight new CIS on 26 November 2025, expanding Kenya’s regulated investment options to a total of 57 schemes.

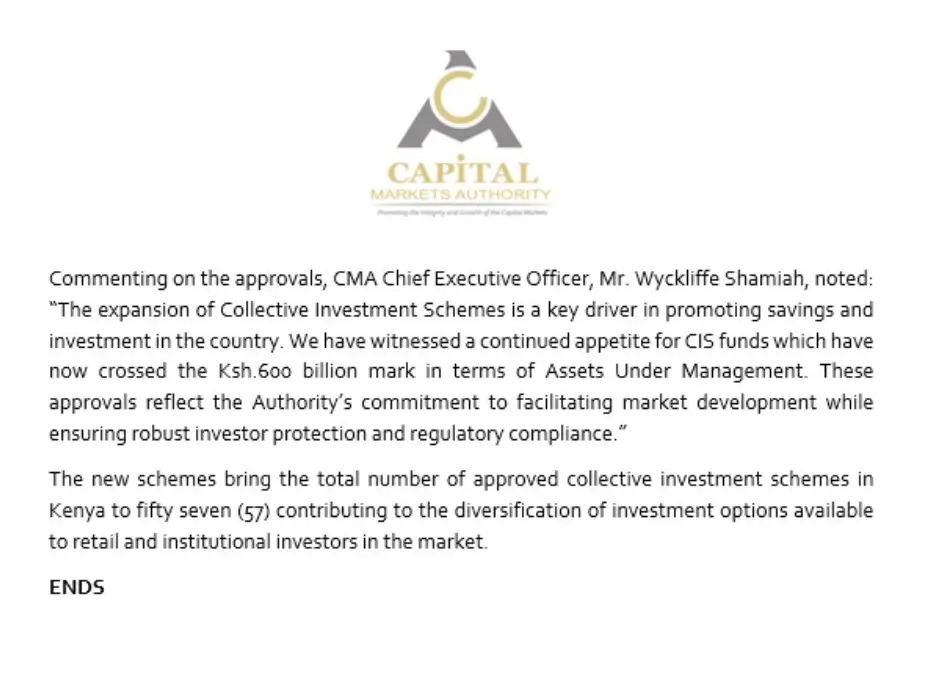

Treasury Bills Oversubscribed

The government raised Ksh 44.8 billion through treasury bills, overshooting the Ksh 24.0 billion on offer.

NCBA Welcomes Muhoho Kenyatta to Board

Muhoho Kenyatta has been appointed as a Non-Executive Director at NCBA Group, effective 1 December 2025, marking the Kenyatta family’s renewed influence in the bank.

NCBA Launches Offshore Investment Solutions

At the 5th Abojani Economic Empowerment Conference, NCBA Bank introduced Offshore Investment Solutions, led by MD Muathi Kilonzo. The initiative provides professionally-managed global investments and currency diversification opportunities for clients.

#NCBATwendeMbele #EconomicEmpowermentKE #OwnershipEconomyKE

From Abojani

We thank everyone who supported #EconomicEmpowermentKE and helped deliver a successful 5th Abojani Economic Empowerment Conference.

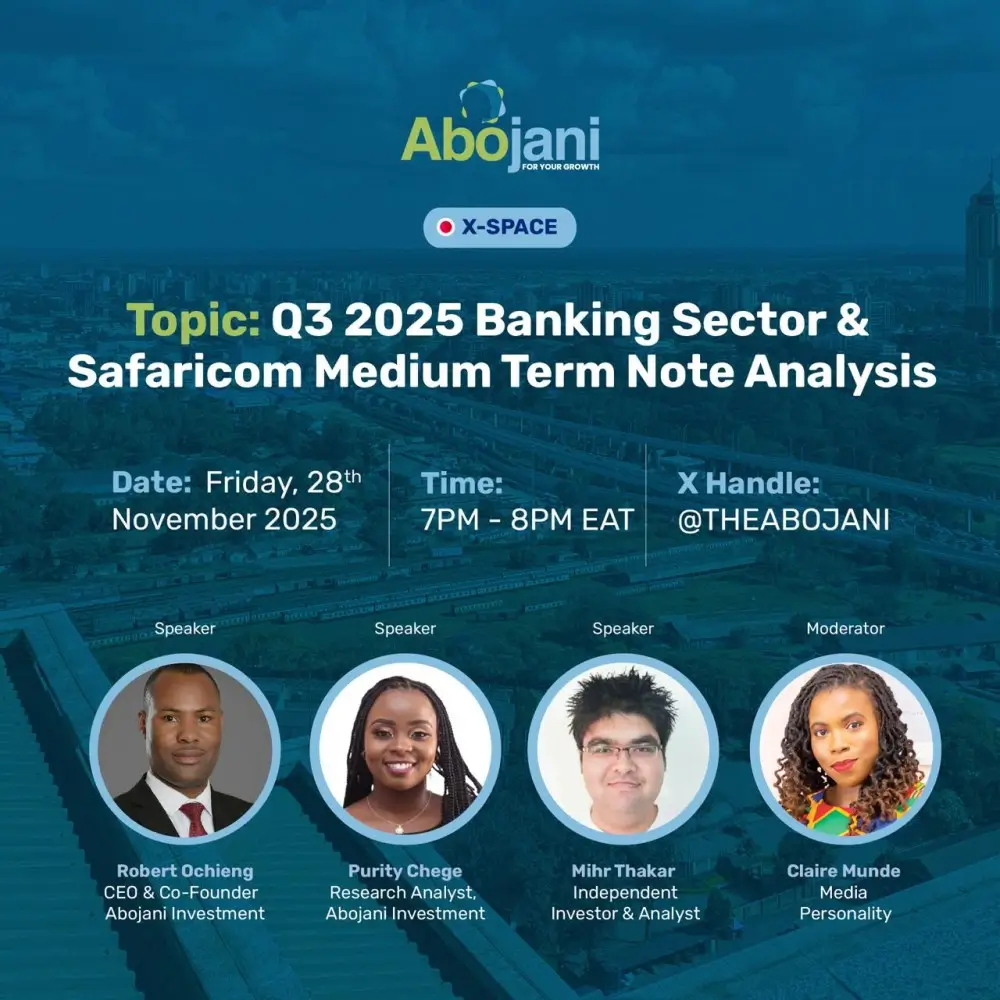

Banking Sector and Safaricom MTN X-Space

We ended the week on a high note at our highly anticipated Banking Sector Analysis and Safaricom Medium Term Note X-Space. Catch the recording here: https://x.com/i/spaces/1LyGBXROMQYxN?s=20

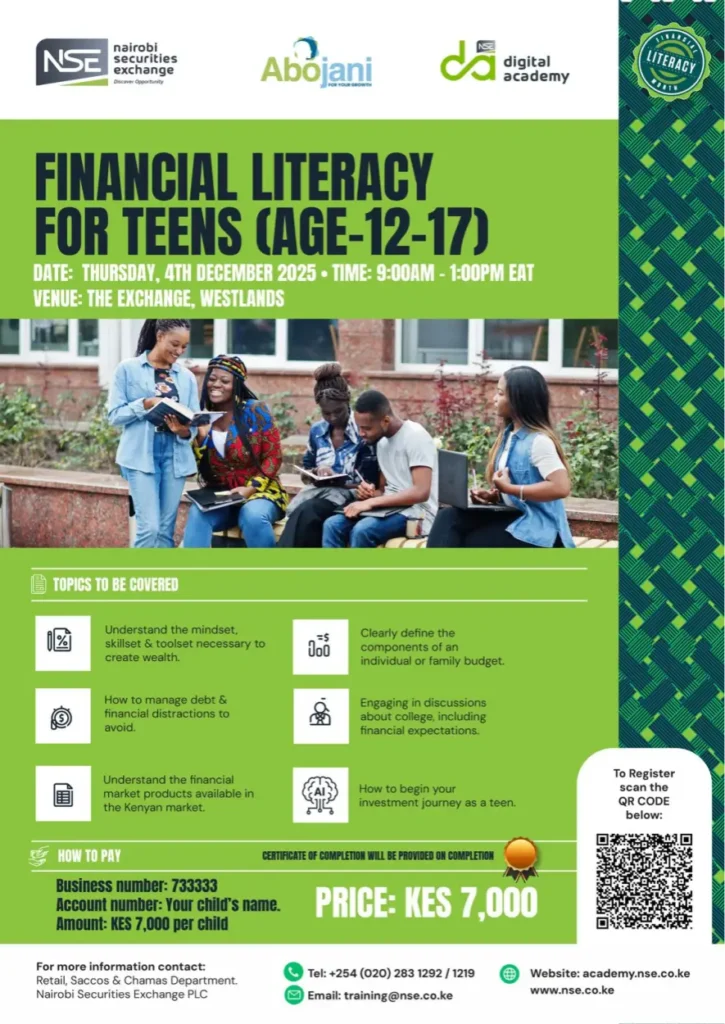

Coming Up: Finance for Teens Workshop

In partnership with NSE, we are doing this workshop designed to equip the next generation of investors with skills for wealth creation.

- Date: 4th December 2025

- Time: 9:00am – 1:00pm

- Venue: The Exchange, Westlands

- Fee: KSh 7,000 per child

- Paybill: 733333 | Account: Child’s Name

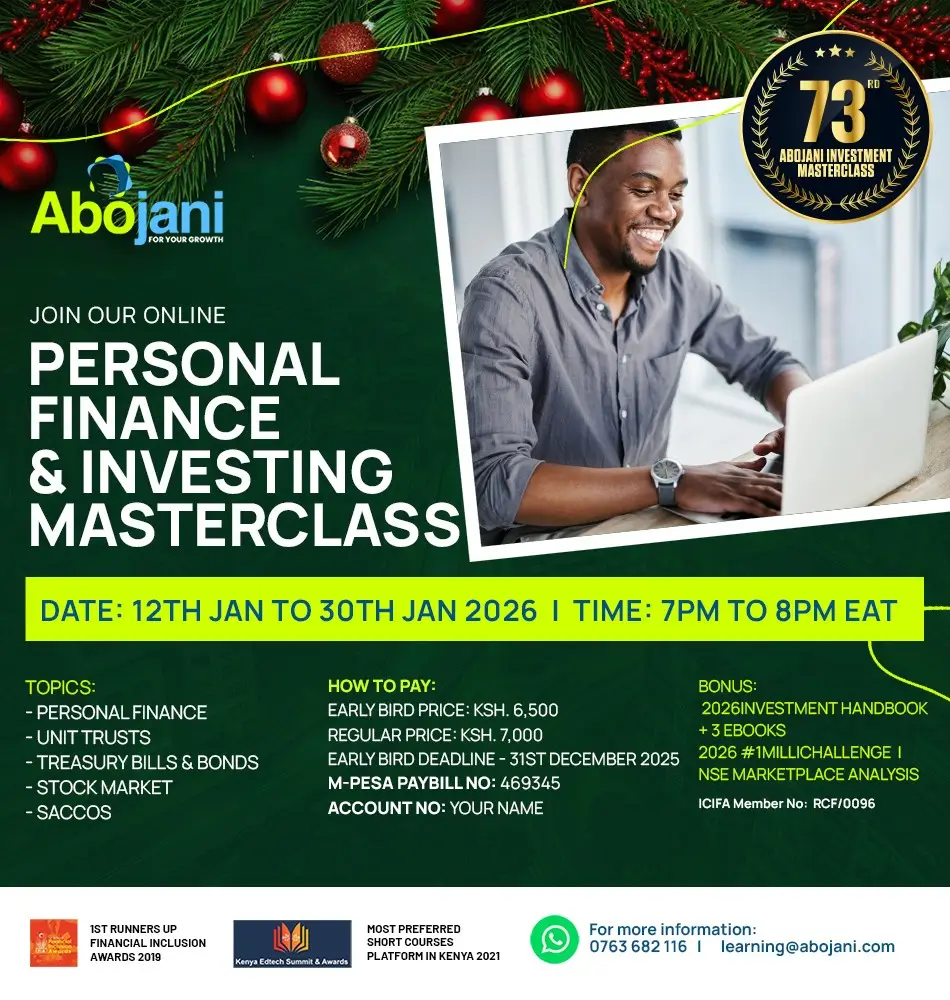

Abojani 73rd Masterclass

The Abojani monthly masterclasses are back! Book You Seat

The 73rd edition officially starts on 12th January and will be online via zoom. We welcome you to start the year on a high note and take full charge of your financial life!