Happy holidays!

When people think of December, it is almost instinctive to associate it with laughter, joy, shared moments, travel, food, and togetherness. There is something about the final month of the year that feels lighter, warmer, and more forgiving. Even for those who do not explicitly celebrate Christmas, the season carries a certain magic. Offices slow down, cities soften, and for a brief moment, life seems less demanding.

For many, this is the time when families reunite after long stretches apart. You meet relatives you have not seen or spoken to in a year. There are new faces at the table, stories to catch up on, gossip exchanged freely, and old disagreements temporarily set aside. It is a season that invites rest, reflection, and enjoyment. For once, you are allowed to simply be present.

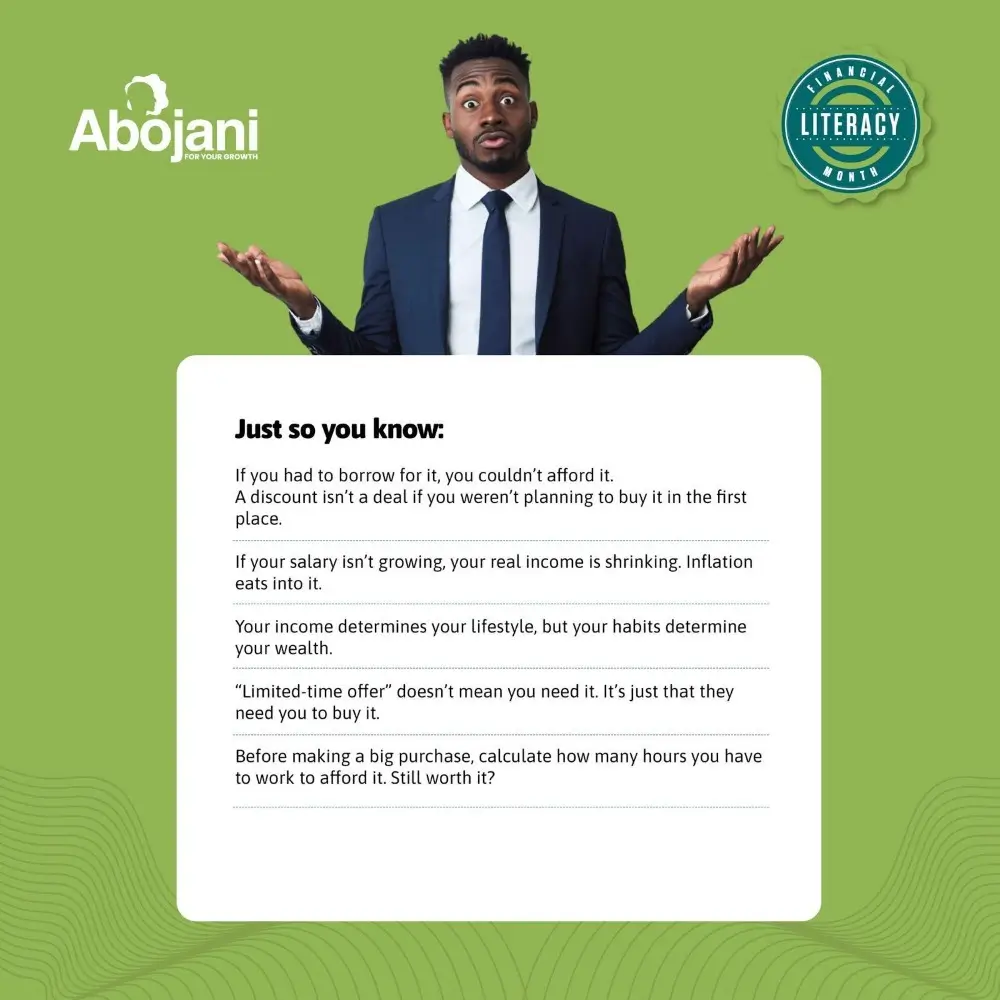

But as comforting and necessary as this period is, it also comes at a cost, however small it may seem at the time. December has a way of loosening financial discipline. You begin to reason with yourself. You remind yourself how hard the year was. You remember the days you cried, the moments you almost gave up, the obstacles you pushed through. You tell yourself that you deserve a break, that you deserve happiness, that you deserve to enjoy good things while you can.

And you are not wrong.

But there is also a future version of you waiting in January, looking back at December you whispering caution. It is asking whether that trip was necessary, whether every party needed attendance, whether the newest phone was truly necessary, whether every gift had to be expensive.

But let’s not borrow grief from the future. Instead, let us find a balance that allows you to enjoy the present while protecting your financial wellbeing.

Managing your finances during the holidays needs to be intentional. It is about maximizing joy without creating unnecessary strain, and ensuring that when the celebrations end, you are not left scrambling to recover.

- Drawing Up a December Budget, Even Mid-Month

Even if December is already underway, a simple, honest look at what you have left and what you are likely to spend can make a significant difference.

Knowing how much you can reasonably afford to spend on travel, social plans, gifts, and personal treats helps you enjoy them more fully, because you are not constantly worried about overstepping your limits.

- Detach the Sentimental Value from the Price Tag

One of the biggest pressures during the holidays comes from how we attach meaning to money. Gifts and experiences don’t have to be expensive; their value is not directly tied to the price. Whether buying for yourself or others, thoughtfulness will always outweigh the price. And when spending becomes performative, driven by appearances rather than genuine desire, it quickly loses its joy.

If you didn’t save for it and you don’t have the money for it, don’t break your back trying to make it happen. Otherwise you’ll be choosing to start your 2026 in a very tough way.

- Comparison Is the Thief of Joy

This is especially true in an age of constant comparison. Social media turns December into a highlight reel of destinations, outfits, tablescapes, and gift exchanges. It is easy to feel as though you are falling behind or not doing enough. Even at home, you may start comparing yourself to other family members who seem to have it better than you.

But comparison distorts reality. You rarely see the stress that sometimes sits behind those polished images. Measuring your holiday against someone else’s presentation only robs you of contentment.

- Save, Even When It Feels Counterintuitive

Saving during the holidays can feel counterintuitive. After all, you have worked hard all year, it feels unfair to deny yourself now. Yet discipline is often tested most when it is hardest to stay faithful to your plan.

Choosing to set aside even a small amount during December is a declaration that your future matters too. Putting money away early, before the spending momentum fully takes over, creates a sense of security that actually makes enjoyment easier. Don’t say you’re waiting for January to start saving. Start now and continue in January and the rest of the year.

- Plan for 2026

Planning ahead also transforms how you experience the season. Thinking about the year ahead does not dampen the holiday spirit; it anchors it.

Take time to reflect on what you want your money to do for you in the coming year. Start thinking about what you want to build, grow, or protect. What financial milestone are you aiming for? Which investments are you starting or strengthening? Dream big, and set that plan in motion.

A well-thought-out plan needs to be comprehensive, flexible, and honest. It should reflect your reality, your priorities, and your values. When you know where you are headed, the choices you make in December feel less conflicted. And when you plan well, the next holiday will find you with better lined pockets.

Ultimately, managing your finances during the holiday season is about kindness, both to yourself now and to yourself later. It is allowing joy without excess, generosity without strain, and rest without regret. The holidays are meant to be enjoyed, not endured, and they are even sweeter when you know that once they pass, you will still be standing on solid ground.

When January arrives, it should not feel like punishment for December. With intention, balance, and a little foresight, the end of the year can be a celebration that strengthens rather than weakens your financial future.

Don’f forget the Upcoming 73rd Abojani Masterclass in January 2026. BOOK YOUR SEAT