As the year 2026 rolls on the demand for Treasury bills remains remarkably resilient, continuing a streak of high investor appetite that defined much of 2024 and 2025

Leadership Shifts

Among the key developments, NCBA Group’s Director of Corporate and Investment Banking, Tirus Mwithiga, is set to take over as CEO of CIB Kenya, subject to approval by the Central Bank of Kenya and the Central Bank of Egypt. Tirus has over 30 years of experience and has previously worked with the likes of Standard Chartered Bank and the then Barclays Bank.

East African Breweries PLC has also announced that Group Chief Financial Officer and Executive Director, Risper Genga Ohaga, will resign effective 30 June 2026, bringing to a close her six-year tenure at the regional brewer. Ohaga joined EABL in February of 2020 and has overseen the company’s financial strategy through the Covid-19 pandemic and post-pandemic operating environment; the board said she will pursue other interests outside the group, with successor details to be announced in due course.

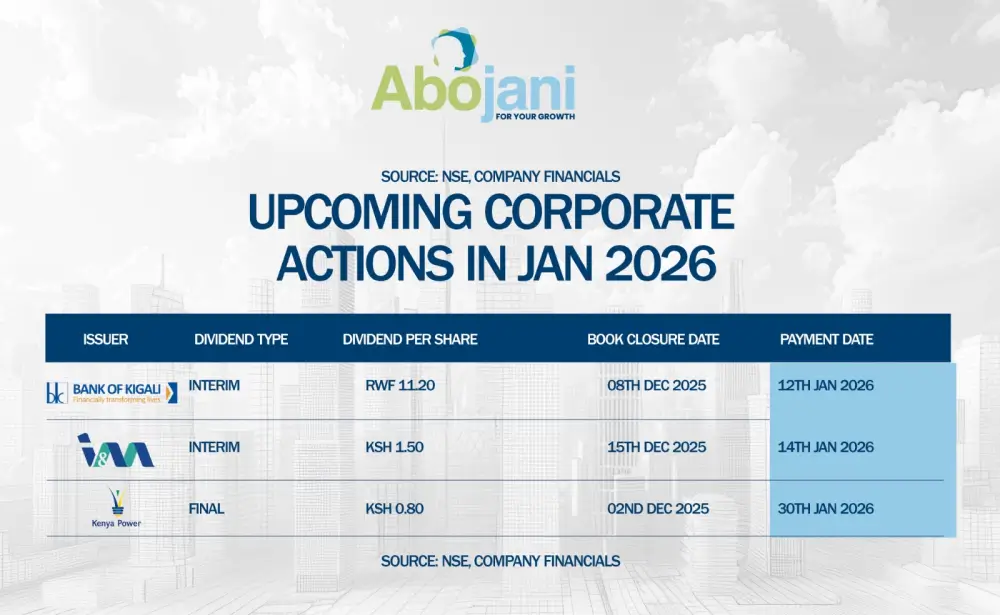

Corporate Actions

It was a celebratory week for shareholders, especially those who bought I&M based on our advice as Stock of the year 2024, as they received their interim dividends this week.

Up next: KPLC with a KShs 0.80 dividend on 30th January.

I&M Boosts Tanzania Ownership

In an interesting development, I&M Group has boosted its ownership of I&M Bank Tanzania to 95.5% after acquiring additional shares from Proparco and Microfinance East Africa, marking a notable consolidation of its regional presence.

Absa Receives Top Employer Certification

Absa Bank Kenya has received Top Employer certification for 2026 from the Top Employers Institute, marking its fifth consecutive year of recognition after an independent review of its people and talent practices.

NCBA Partners with Inchcape

NCBA Group has partnered with Inchcape to roll out a high-leverage tractor financing programme offering farmers up to 95% funding, seasonal repayment plans, and working capital support, targeting increased mechanisation in a sector that contributes over a fifth of Kenya’s GDP.

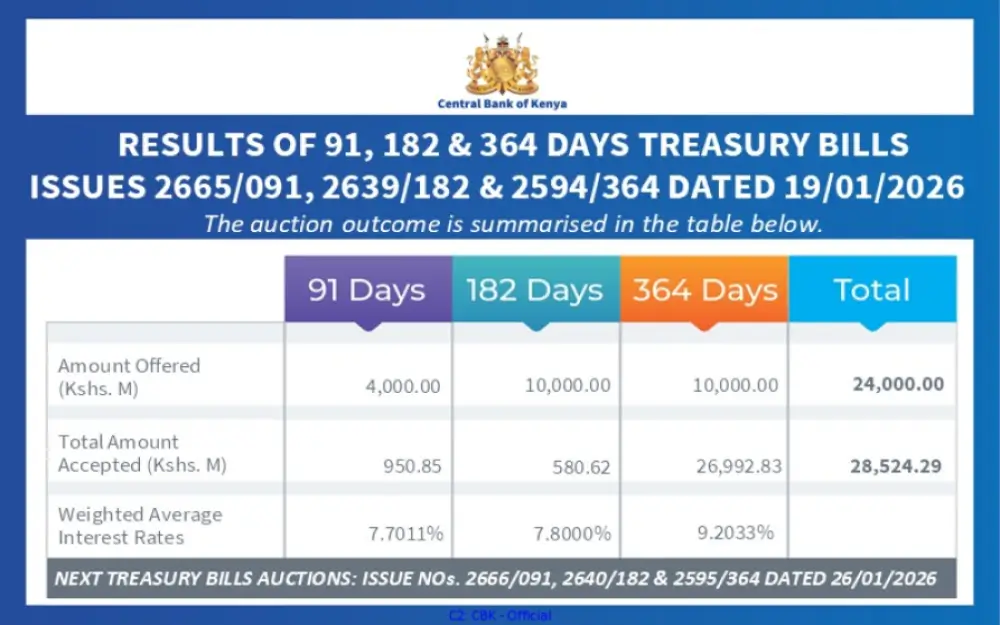

T-Bills Oversubscribed

Strong demand for short-term safety continues to define investor behaviour, with this week’s 128.44% T-bill oversubscription signalling excess liquidity chasing low-risk returns rather than aggressive yield. The slight dip in yields, especially on the 91-day and 364-day papers suggests investors are increasingly prioritising capital preservation and flexibility as rate expectations stabilise and market price in a softer interest-rate environment.

Uber Halts Visa Payments

Ride-hailing firm Uber, has stopped accepting Visa card payments on its Kenyan platform, citing rising global payment processing costs. The company said alternative payment options including M-Pesa, cash, Mastercard and American Express remain available to users.

From Abojani

Upcoming Webinar

In our calendar of events, we have partnered with leading Microfinance Bank, Branch, to bring you an exclusive webinar on “Smart Saving & Goal Planning for 2026.”

Be sure to join this conversation coming up this Wednesday.

Time: 7PM EAT

Zoom Joining Link: https://bit.ly/SmartSaving2026

Passcode: Smart2026

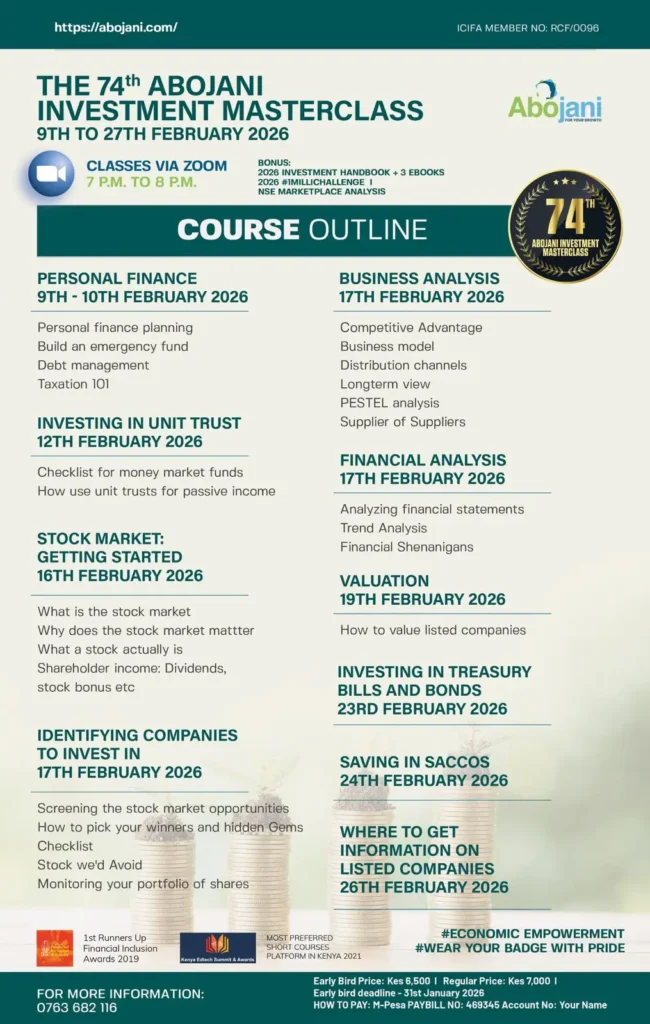

74th Masterclass

Coming up in February, the 74th Abojani Personal Finance, Saving & Investing Masterclass which will empower you with the right skillset, toolset and mindset to build generational wealth. We will cover topics such as Unit Trusts, Stocks, SACCOs, Bonds and even Treasury Bills.

Book your seat here: AbojaniFeb2026Masterclass