Kenyan Banks in Tanzania: FY2025 Results Set the Tone

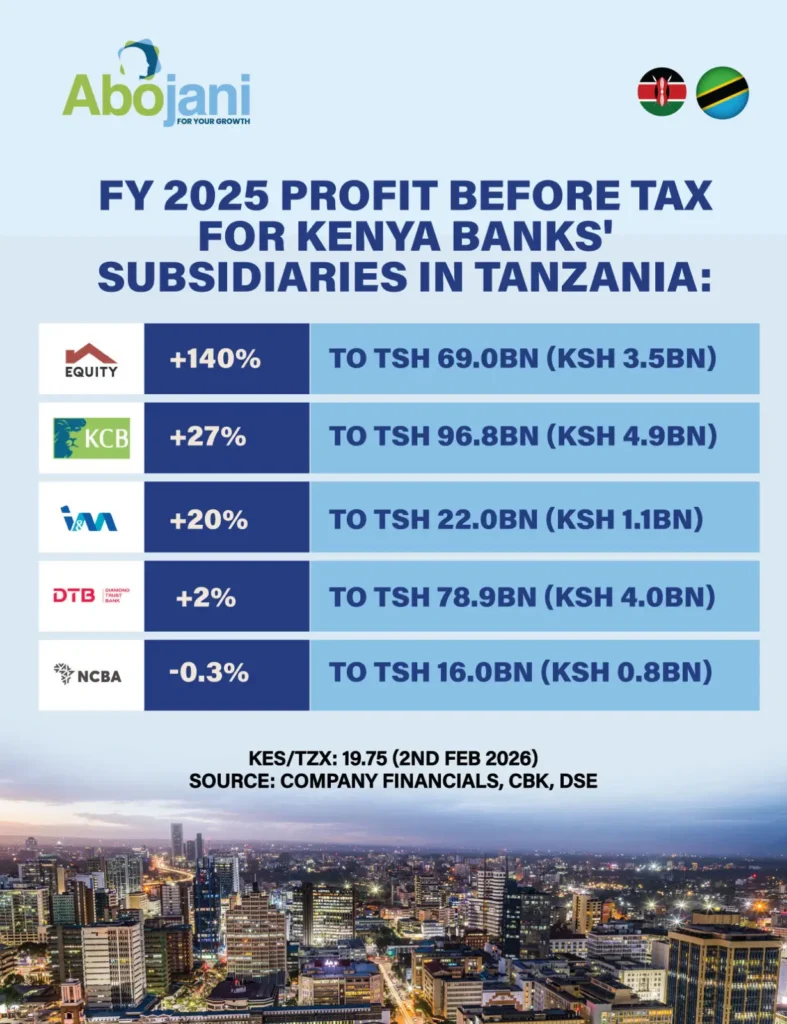

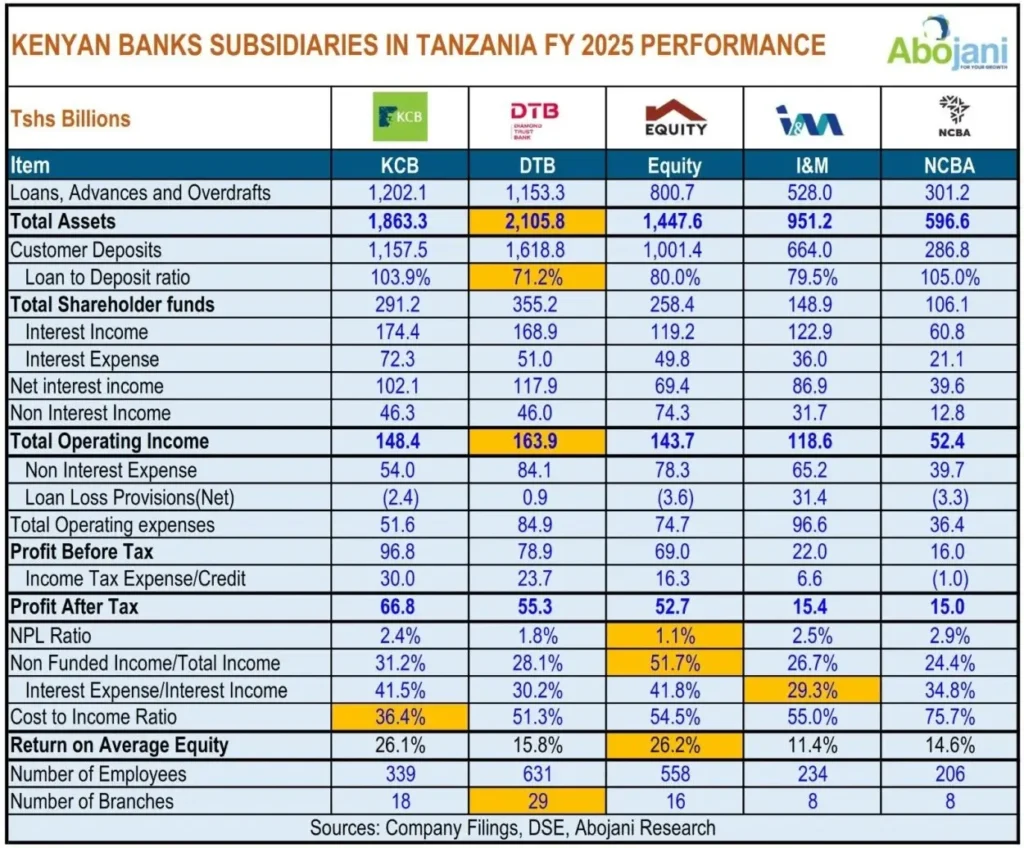

The week opened with Kenyan banks’ subsidiaries in Tanzania releasing their FY2025 results, offering a clear snapshot of regional performance. KCB Group maintained its position as the most profitable Kenyan banking operation in Tanzania, while Equity Bank Tanzania emerged as the fastest-growing in terms of profitability. In aggregate, Kenyan bank subsidiaries operating in Tanzania posted a combined profit after tax of Tsh 205.1 billion, equivalent to approximately Ksh 10.4 billion, underscoring the strategic importance of the Tanzanian market to Kenyan lenders.

Beyond headline profits, differences in business models were evident. DTB continues to dominate in terms of asset size among Kenyan banks in Tanzania. KCB stood out as the most efficient operator, while Equity Bank Tanzania led on asset quality and delivered the highest return on average equity, highlighting the varied strengths across institutions.

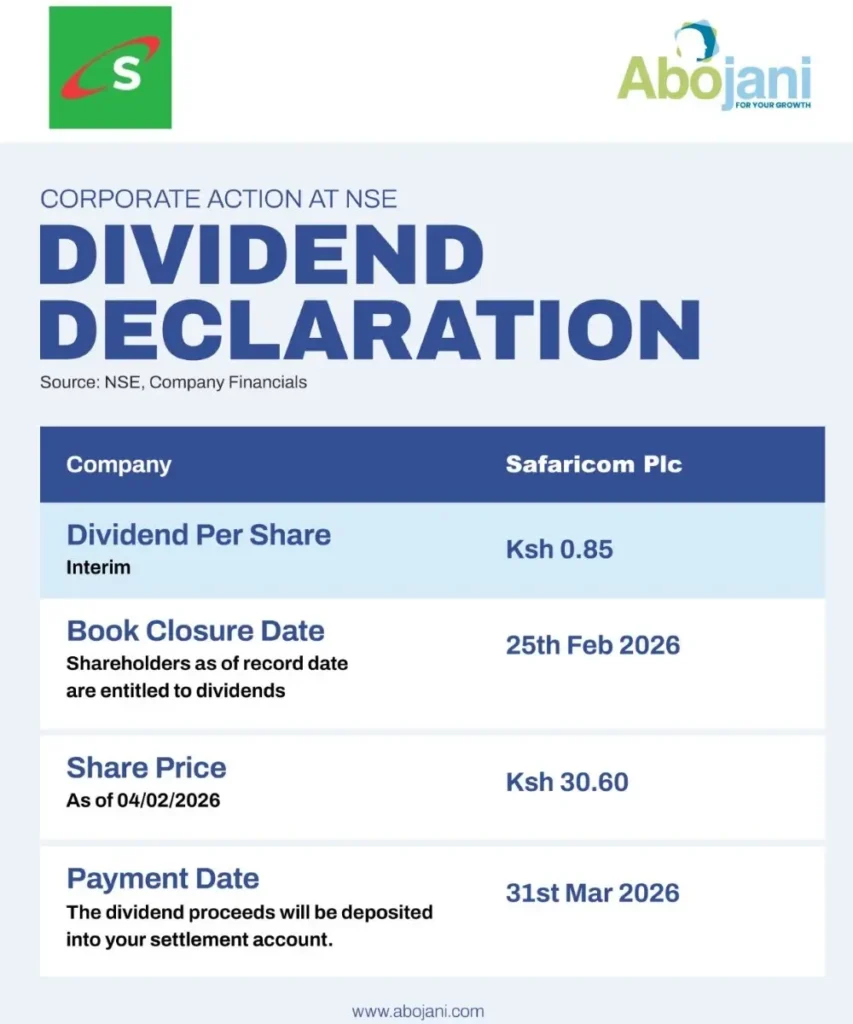

Safaricom Raises Interim Dividend

Safaricom announced a 55% increase in its interim dividend to Sh0.85 per share. The dividend book closure date is set for 25th February 2026, with payment scheduled for 31st March 2026, reinforcing the telco’s strong cash generation and shareholder return profile.

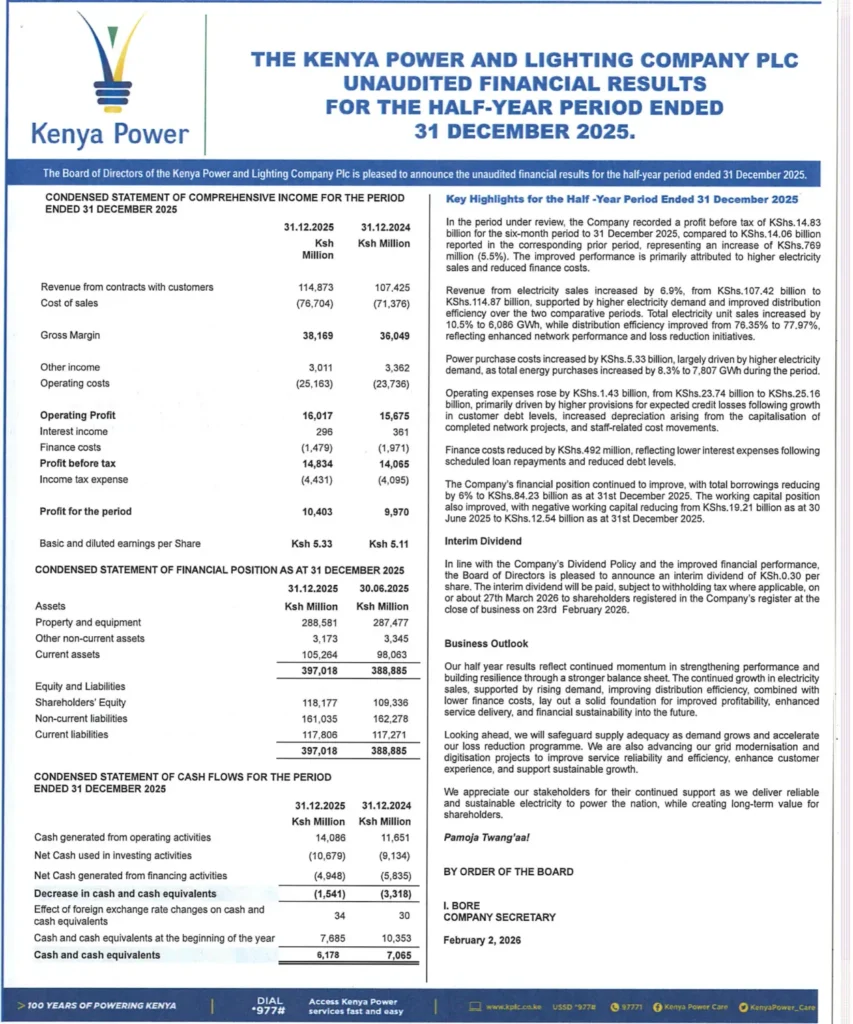

KPLC Delivers Profit Growth and Higher Interim Dividend

Kenya Power and Lighting Company reported a 4.3% increase in net profit to Sh10.40 billion for the half-year ended 31st December 2025. The growth was driven by a 6.95% rise in electricity sales revenue to Sh114.87 billion. The board declared an interim dividend of Sh0.30 per share, a 50% increase from the Sh0.20 paid in the comparable period last year.

CBK Warns Against Misuse of Banknotes

The Central Bank of Kenya issued a public warning against the misuse of banknotes, including the creation of cash flower bouquets and ornamental displays. Such practices often involve folding, stapling, gluing or pinning notes, actions that damage currency and undermine its integrity.

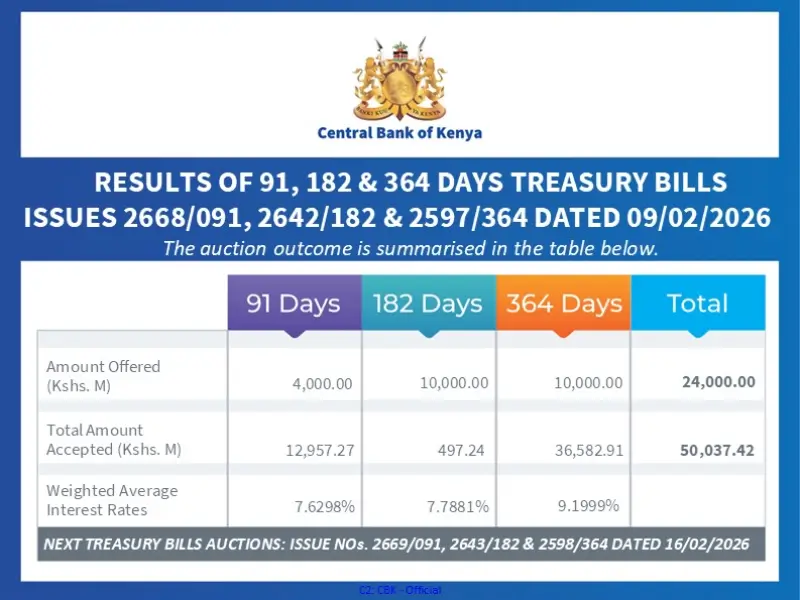

Treasury Bills Signal Strong Liquidity Appetite

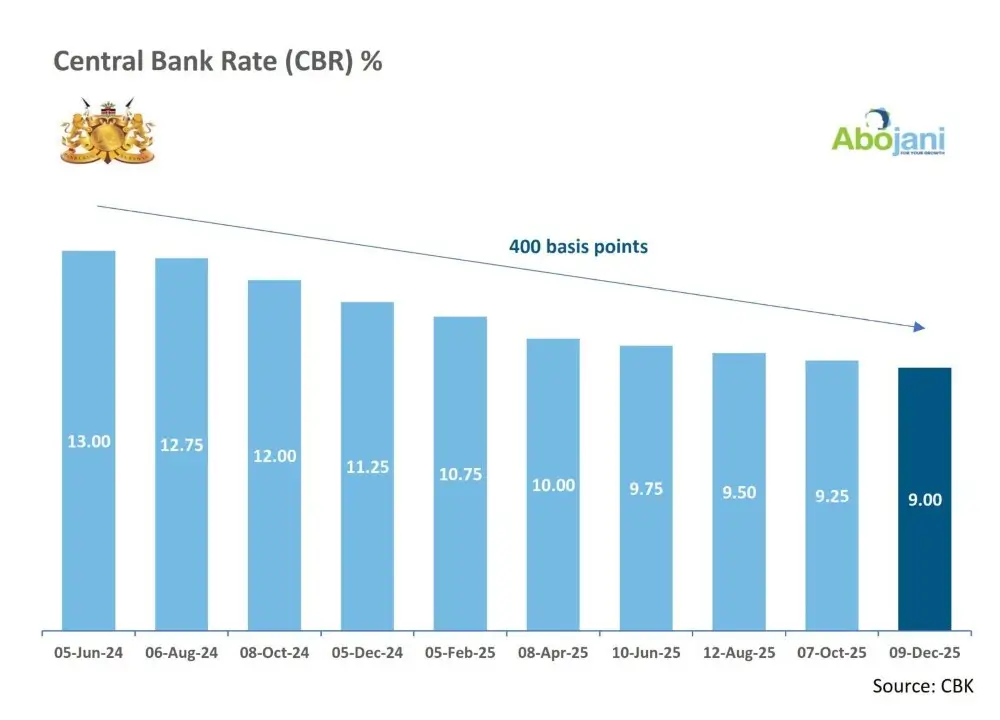

Treasury bills were heavily oversubscribed during the week, with the government accepting more than double the amount on offer. The 364-day paper was the most oversubscribed, recording a performance rate of 508.29%. Yields settled at 7.6298% for the 91-day, 7.7881% for the 182-day, and 9.1999% for the 364-day bills, reflecting sustained demand for short-term government securities.

Boardroom ShakeUps

Jubilee Holdings appointed Barbara S. Mulwana as a Non-Executive Director, bringing with her prior experience as Chairman of Jubilee Health Insurance Uganda.

HFC Limited named Samuel Mwangi Makome as an Independent Non-Executive Director.

In the tea sector, Williamson Tea Kenya and Kapchorua Tea Kenya appointed Angus Omete as Executive Director. Mr. Omete, currently the Group Chief Financial Officer, succeeds Samuel Ndungu Thumbi following his resignation effective 31st January 2026.

Standard Group Suspends Rights Issue

Standard Group PLC has suspended its planned Sh1.5 billion rights issue.

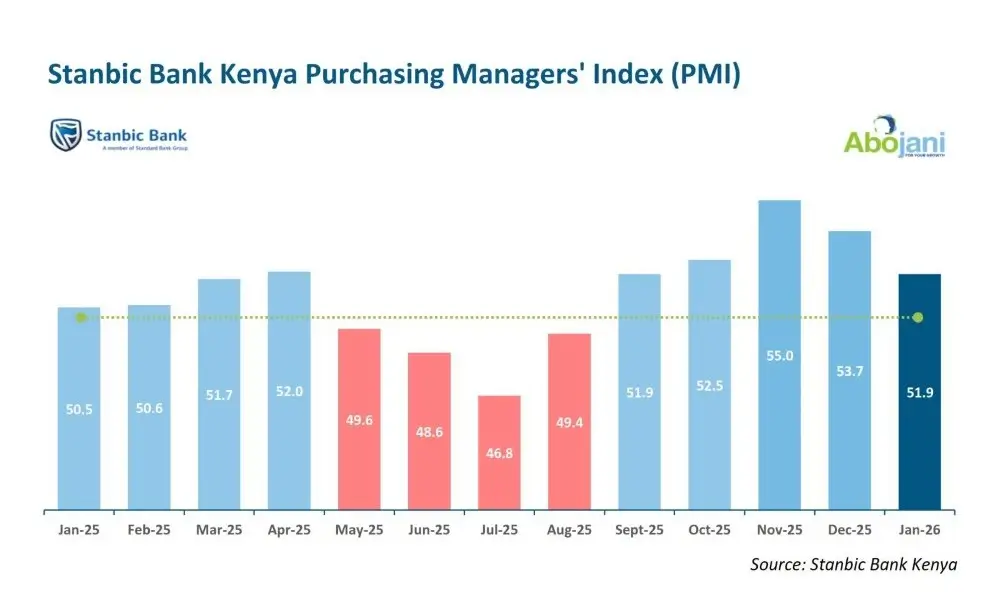

Stanbic’s PMI Points to Continued Private Sector Expansion

Stanbic Bank Kenya’s Purchasing Managers’ Index stood at 51.9 in January 2026, indicating continued expansion in private sector activity and suggesting steady business conditions at the start of the year.

#KnowledgeSeries: Stock Market 101 X-Space

Our X-Space on Investing in the Stock Market 101, held in partnership with Equity Bank, recorded strong participation. The conversation emphasized the value of patience in investing, the importance of independent research, understanding management quality, and knowing when professional advisory input becomes necessary as portfolios grow.

Recording Link: https://x.com/i/spaces/1rmxPvowponGN?s=20

Upcoming Events: 9/2/2026

- The Monetary Policy Committee (MPC) is scheduled to meet.

- DTB will hold a virtual briefing to share insights on the Kenya Economic Outlook 2026.

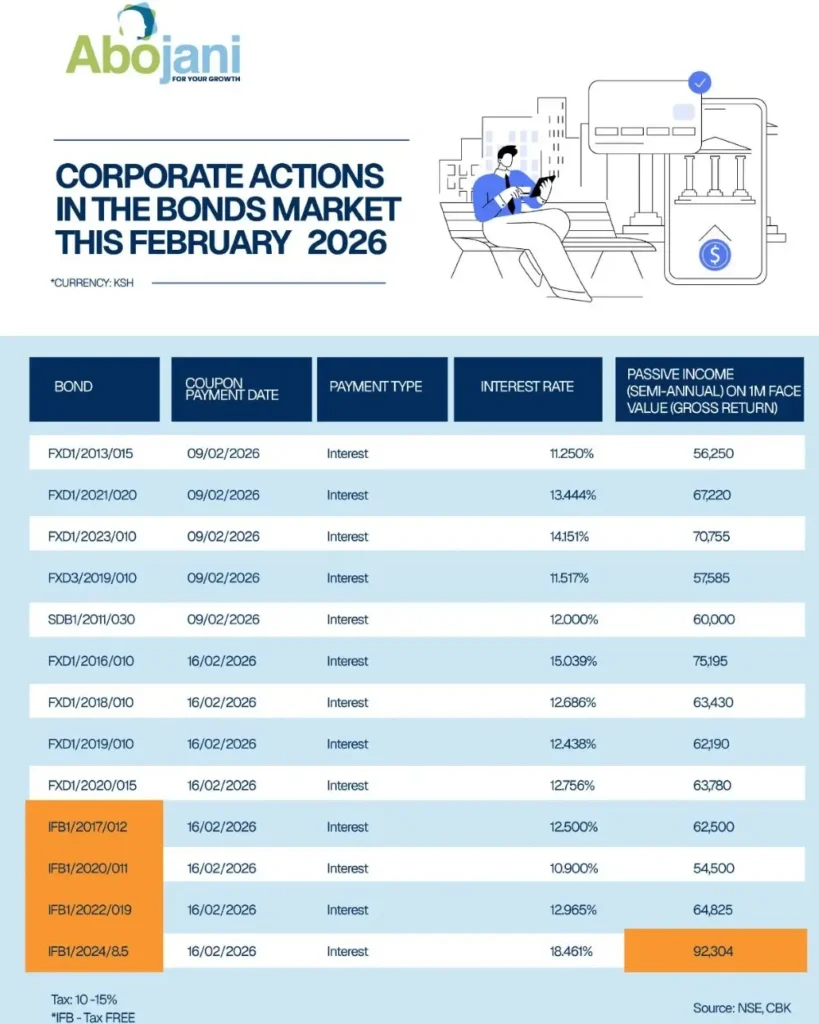

- Holders of bonds FXD1/2013/015, FXD1/2021/020, FXD1/2023/010, FXD3/2019/010, and SDB1/2011/030 will receive their coupon payments.

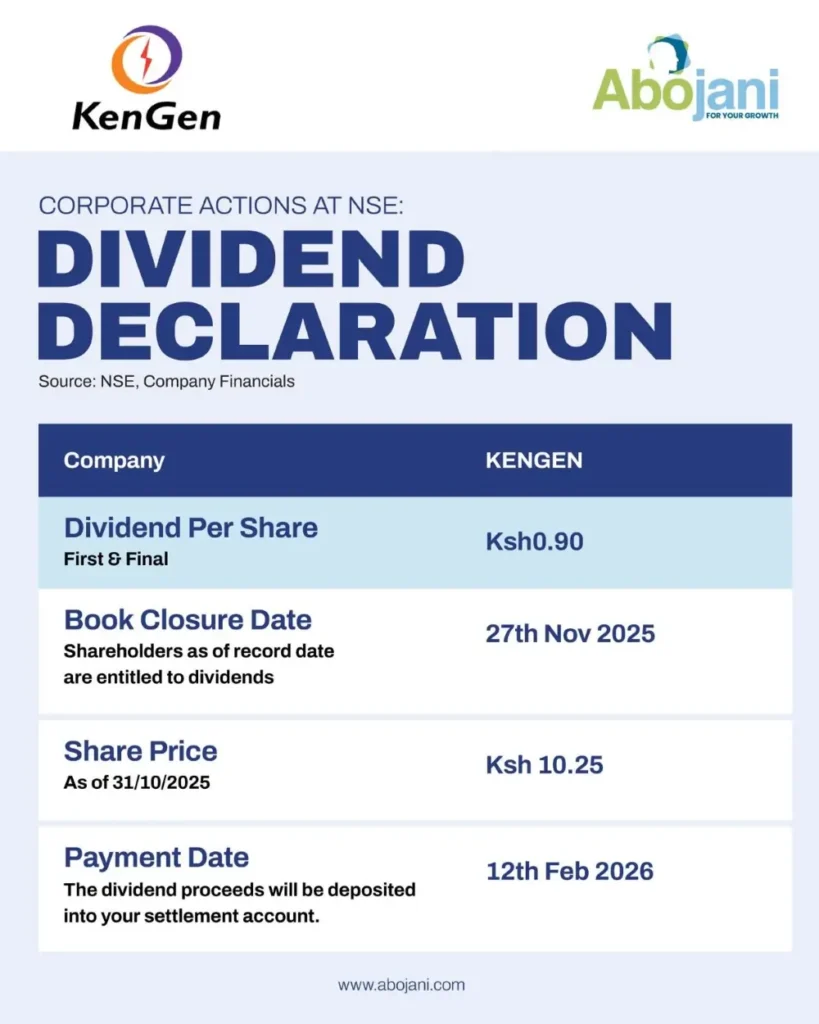

Additionally, KenGen shareholders are set to receive their dividend on Thursday, 12th February 2026.

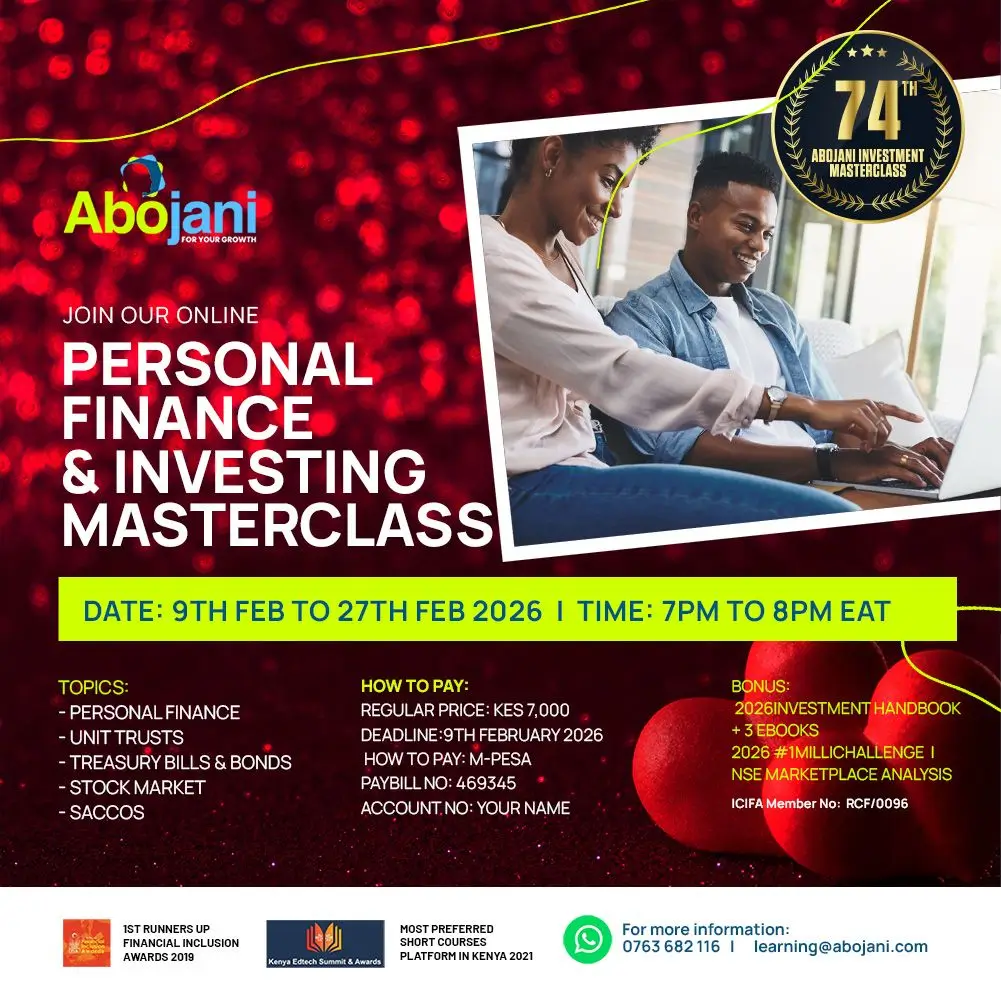

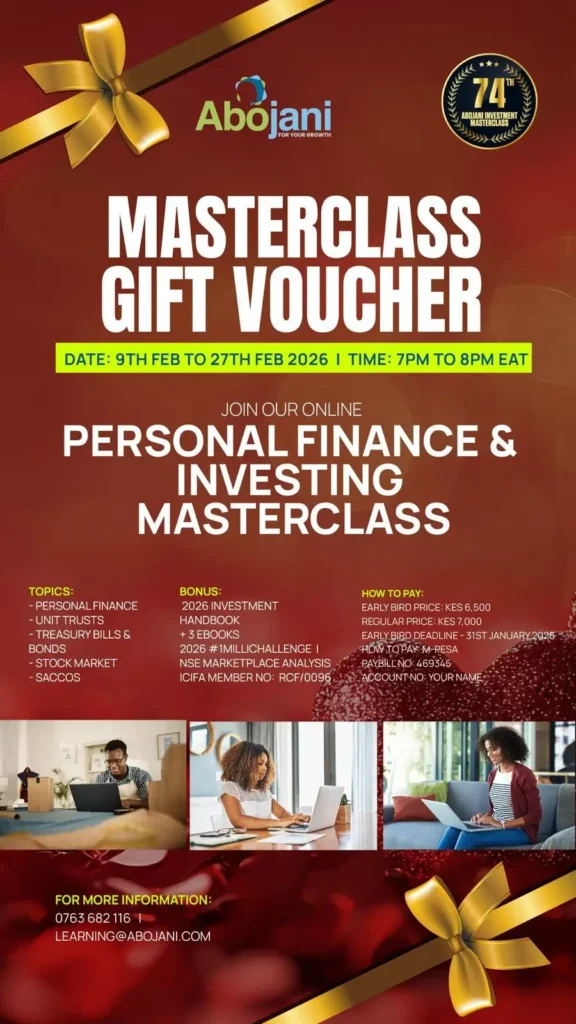

74th Masterclass Begins

Today marks the start of our February Masterclass!

If you’d like to take charge of your money, learn how to manage your money better, invest wisely, and grow your wealth, this is your chance to equip yourself with practical tools to secure a financially free future.

You can even gift this Masterclass to someone special this Valentine’s! ❤️

Spots are limited. Reserve yours now: https://bit.ly/AbojaniFeb2026Masterclass