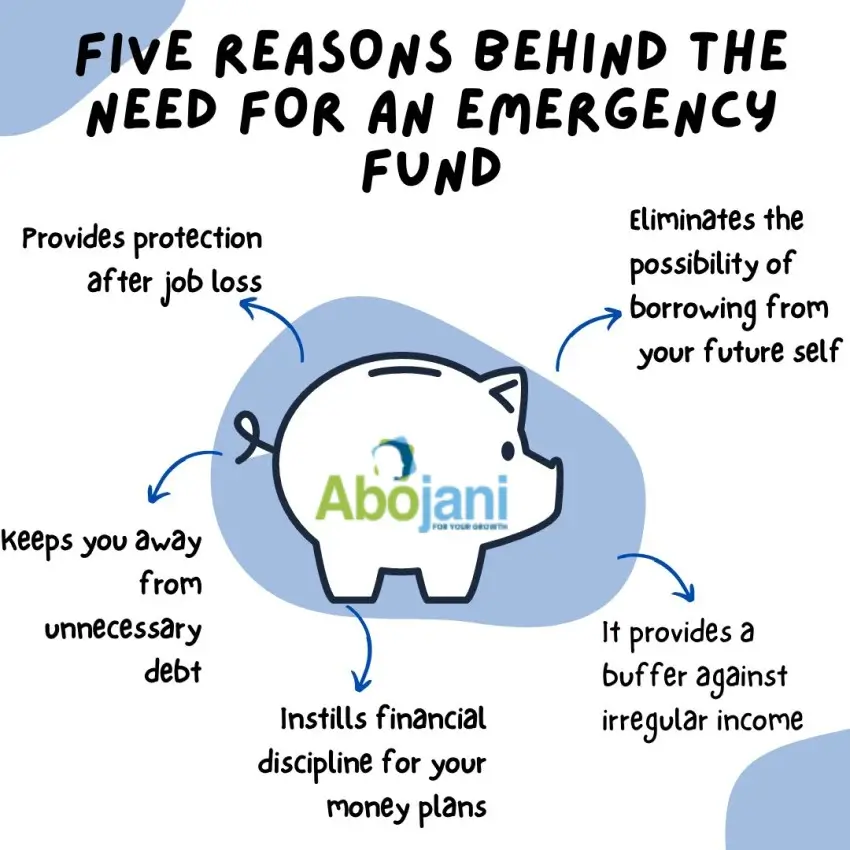

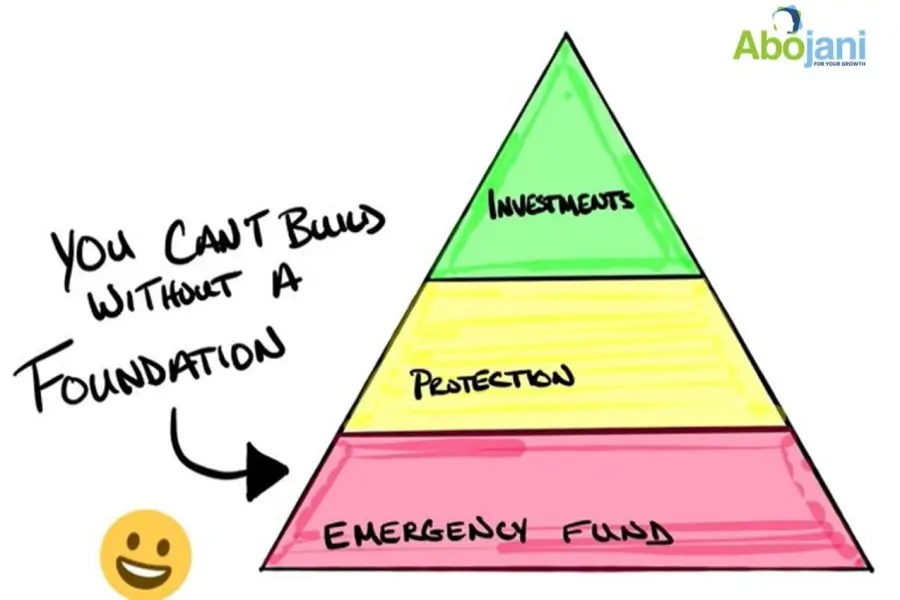

An emergency fund acts as a financial safety net, providing peace of mind during unexpected situations such as medical emergencies, job loss, or urgent repairs. Establishing this fund is crucial for financial stability. If you’re looking to build one, here are some effective, practical strategies to help you begin and stay consistent:

1. Start Small, Stay Consistent

Many people delay building an emergency fund because they feel they can’t set aside a large sum. But consistency matters more than size at the beginning. Even setting aside KES 500 to KES 1,000 a week or month builds the habit. Over time, this consistency compounds into a reliable cushion.

Also read: What Qualifies as a Financial Emergency?

2. Treat It Like a Non-Negotiable Expense

Think of your emergency fund like rent or utilities, something you must “pay” every month. Automate a standing order or mobile transfer to a separate savings account, so you don’t forget or get tempted to spend it. Out of sight, out of reach, out of mind.

3. Choose the Right Account

Your emergency fund should be accessible but not too convenient. A money market fund or high-yield savings account strikes a good balance: your funds grow modestly, but you can still access them when needed without penalties or delays.

4. Use Windfalls Wisely

Bonuses, refunds, or gifts can be tempting to spend impulsively, but these one-off inflows are a great way to accelerate your emergency fund goals. Even allocating half of such windfalls to your fund can dramatically shorten the time it takes to hit your target.

5. Set a Clear Goal

A vague “I’ll save something” approach doesn’t provide clarity or motivation. A good rule of thumb is to save 3–6 months’ worth of essential living expenses. If your monthly expenses are KES 50,000, aim for KES 150,000 to KES 300,000. Adjust based on your job stability, number of dependents, or other risks you face.

6. Review and Adjust Regularly

Your income, expenses, and risks evolve over time. Review your emergency fund target at least annually, especially after major life events like moving out, getting married, having a child, or changing jobs. Your emergency needs won’t be the same forever.

7. Avoid Using It for Non-Emergencies

The most disciplined savers still get tempted to dip into their emergency fund for travel deals or flash sales. But remember: the purpose of this fund is to protect your financial stability, not to fund impulse purchases. Label the account “Emergency Only” if that helps.

8. Supplement with Insurance

An emergency fund is part of your safety net, not the whole net. Health, car, or even personal accident insurance can reduce the financial shock when emergencies strike. That way, your fund lasts longer and works hand-in-hand with your other protections.

An emergency fund isn’t just about saving money, it’s about buying peace of mind. Life is unpredictable, and while you can’t plan for everything, you can prepare. Whether you’re starting with KES 200 or have the capacity to stash away more, the key is to begin and stay the course. Financial resilience doesn’t come from wealth alone, it comes from being prepared for the unknown.