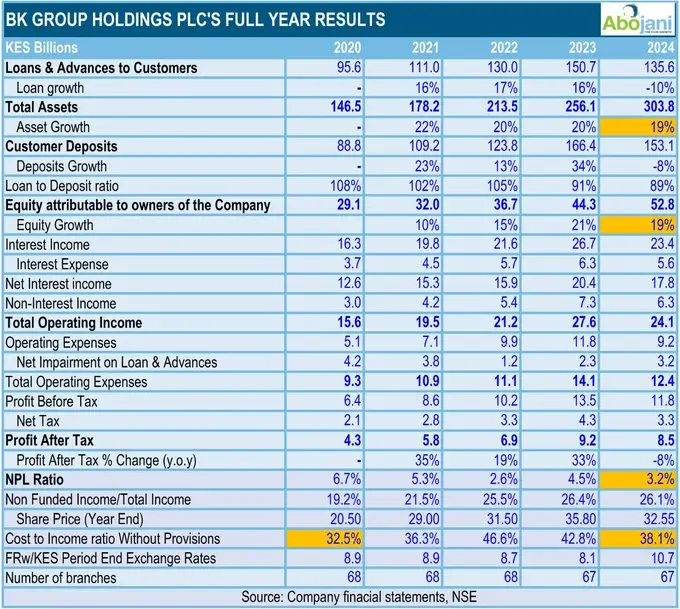

The BK Group closed 2024 with strong financial results, underpinned by strategic growth across its subsidiaries and a disciplined focus on efficiency. The Group delivered a 21.7% year-on-year increase in profit after tax to RWF 91 billion; one of its strongest earnings performances in recent years.

BK Group’s performance was supported by solid fundamentals in its core banking operations. Total interest income grew 16% YoY, off the organic loan portfolio growth.

This performance came on the back of strong loan book growth, particularly in corporate and SME segments, which contributed about 50% of the expansion. The retail segment added 39%, while agri-business contributed 11%, highlighting a well-diversified lending strategy.

Also read: Strong Growth in Safaricom’s H1 2025 Results – Mpesa Impact

Non-funded income rose, especially from FX-related income, supported by higher volumes and better management of valuation losses. Loan-related fees, particularly on short-term facilities, also improved.

On cost efficiency, BK Group stood out. Operating expenses grew by only 2.6% at the group level. Impressively, expenses at the banking level dropped by 1%, showcasing a tightly managed cost base during a year of expansion.

BK Group’s results reflect the strength of its five distinct but complementary subsidiaries operating in high-potential areas of financial services: Bank of Kigali (Commercial Banking), BK Insurance, BK Capital, BK TecHouse, and BK Foundation.

BK TecHouse serves as a digital enabler within the Group, collaborating directly with the Bank to develop inclusive and scalable fintech products. Several digital solutions have been rolled out, many of them aimed at closing the financial access gap for the unbanked populations. Through this, the Group is reinforcing its ambition to remain relevant in a rapidly digitising economy while maintaining leadership in innovation.

BK Insurance continued to lead Rwanda’s insurance sector with consistent profitability. In 2024, the subsidiary generated RWF 4.4 billion in net profit and maintained a market share of 51% in the non-life category. This performance is largely attributed to innovation, a disciplined approach to underwriting that has kept claims ratios low, and strong cost management.

The wealth management business also saw accelerated growth in 2024. AUM under BK Capital rose by 46% year-on-year, reflecting rising interest in unit trusts and institutional investment products. Though penetration of unit trusts in Rwanda remains low, the upward trajectory is promising, especially with BK Capital’s leadership and visibility.

The Group continues to view Rwanda’s high financial inclusion rate, now at 96% up from 48% in 2008, as both a national achievement and a business opportunity. While inclusion across all financial channels is high, only 22% of the population is formally banked, indicating significant headroom for continued expansion in formal financial services.

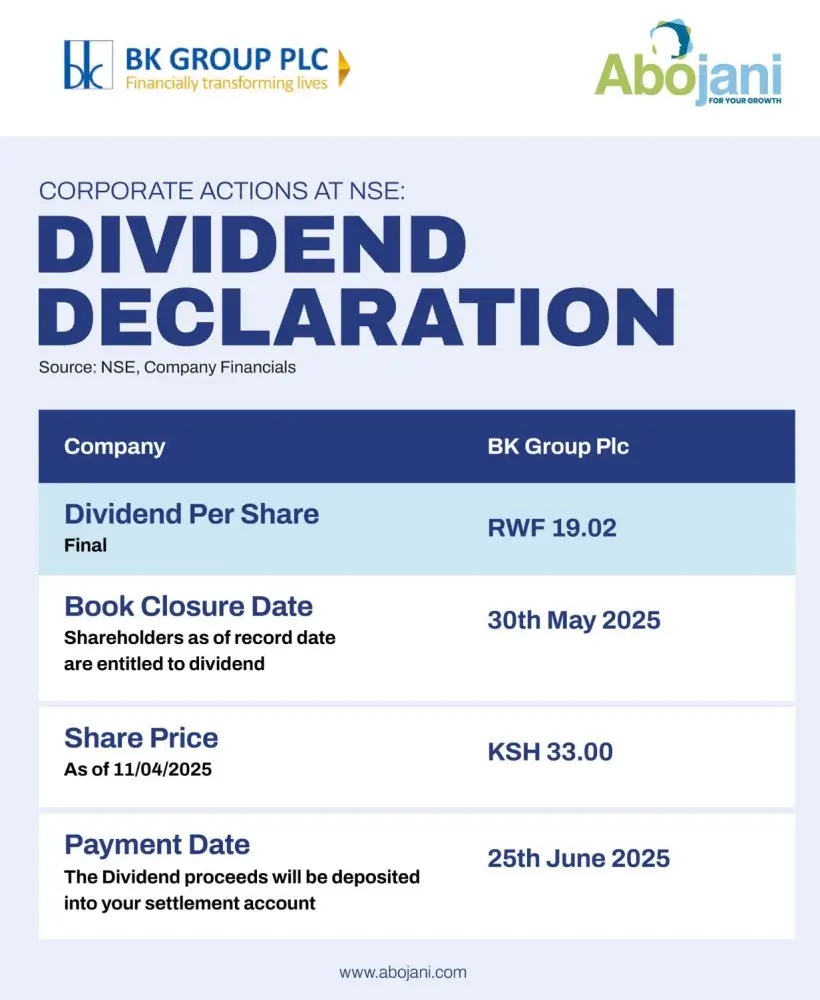

Investors will be pleased with the final proposed dividend of RWF 29.34 per share, with a book closure date of 30th May 2025 and payment set for 25th June 2025. BK Group remains the only foreign bank cross-listed on the Nairobi Securities Exchange (NSE). For Kenyan investors, it offers exposure to a promising budding economy through a solid and profitable financial institution. Indeed, over the last three years, including dividends, Rwandan stocks have appreciated 27%; a compelling figure in today’s market.

BK Group is clear on its future: more operational efficiency, regional expansion, and product diversification. As FY2025 begins, all eyes will be on how BK Group executes its next phase but with this performance, the Group has reaffirmed its commitment to sustainable growth and long-term value creation.