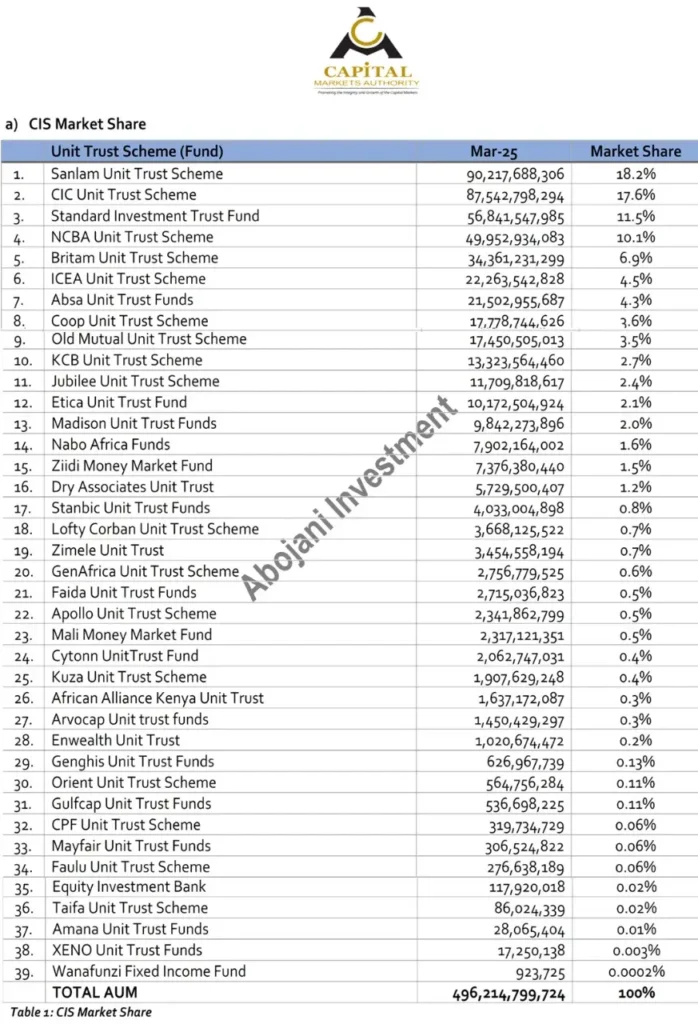

Sanlam Unit Trust has overtaken CIC to become Kenya’s largest unit trust manager.

Assets under management (AUM) rose 44% in Q1 2025, from Ksh 62.7B to Ksh 90.2B, pushing its market share to 18.2%.

CIC now ranks second with Ksh 87.5B in AUM and a 17.7% market share.

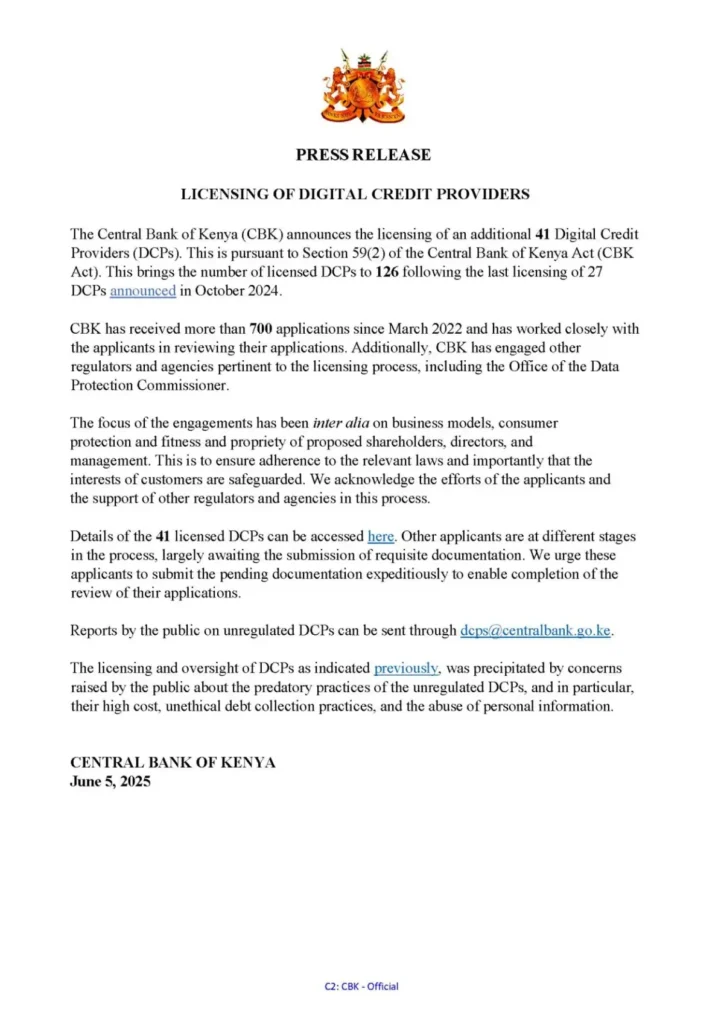

CBK Expands DCP Licensing

The Central Bank of Kenya licensed 41 additional Digital Credit Providers (DCPs) this week, raising the total number of licensed players to 126. This follows the previous batch of 27 in October 2024, marking continued efforts to formalize Kenya’s digital lending space.

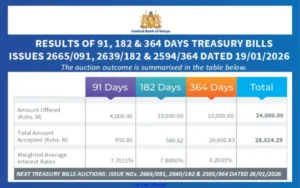

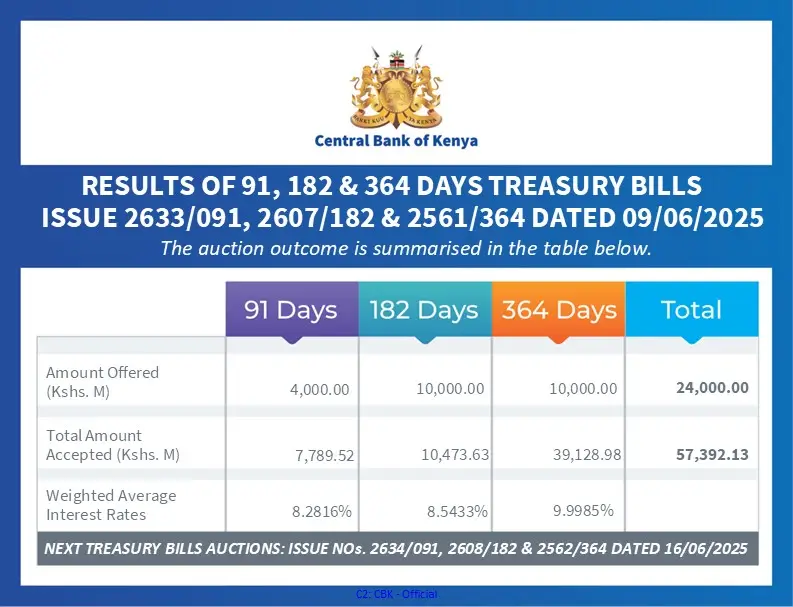

364-Day T-Bill Drops Below 10%

For the first time in recent months, the 364-day Treasury bill yield fell below double digits, closing at 9.9985%.

NCBA Marks World Environment Day

NCBA Group, in partnership with Boreka Group, Kenya Forest Service, Kwale County Government, NEMA, and local communities, planted 3,000 mangroves and organized a coastal clean-up in Diani.

This initiative is part of NCBA’s broader environmental agenda to plant 10 million trees by 2030.

Safaricom Launches M-PESA Sokoni Festival

Safaricom kicked off the M-PESA Sokoni Festival at Mombasa Sports Club Grounds to celebrate its 25th anniversary and 18 years of M-PESA.

The two-month nationwide festival will highlight M-PESA’s journey and connect more Kenyans to digital finance.

Abojani Q1 2025 Banking Sector Analysis

We hosted the X-Space session on Kenya’s banking sector, which highlighted these four trends:

- East Africa is projected to be the fastest-growing economic bloc globally in 2025.

- Kenya faces a Ksh 900B fiscal gap: Expenditure is Ksh 4.2T, while revenue is Ksh 3.3T.

- All listed banks remain undervalued; only two trade above book value.

- DTB shows strong growth potential with improved balance sheet metrics.

Listen here: https://x.com/i/spaces/1LyxBWrqOYoKN

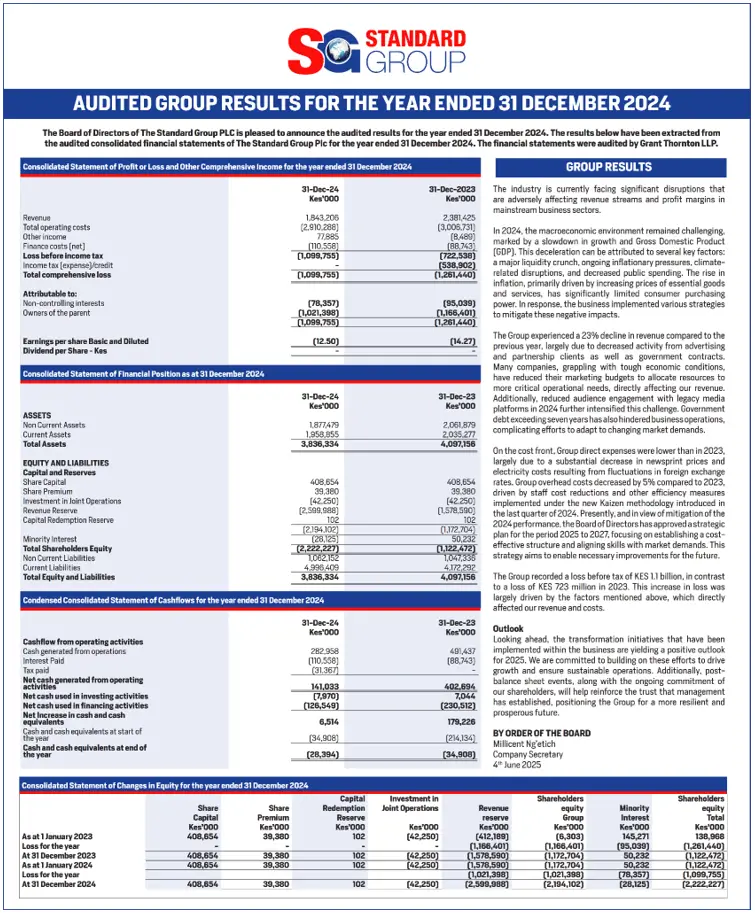

Standard Group Records Pre-Tax Loss

Standard Group reported a Ksh 1.1 billion pre-tax loss and a 23% revenue decline in 2024.

The performance was hit by rising inflation, lower government advertising, and shrinking media budgets across the private sector.

Upcoming Corporate Actions

Co-op Bank will pay a final dividend of Ksh 1.50 per share on Tuesday, 10th June 2025.

Liberty will close books for both final and special dividends on 14th June 2025. BK Group will also close books on 14th June 2025.

Upcoming Events

This Wednesday, we will be hosting a webinar, “Taking Control of Your Finances for the Rest of 2025 & Beyond”, at 7:00 pm EAT, featuring Dennis Gitahi, Manager, Business Development at Jubilee Asset Management Limited, and Robert Ochieng, CEO of Abojani Investment.

The session will be moderated by Claire Munde.

Save the Date: Abojani Economic Conference 2025

Saturday, 22nd November 2025

Radisson Blu, Nairobi | 8 AM – 6 PM EAT

This year’s theme is “Ownership Economy & Self-Sustenance,” offering practical strategies to help African households and businesses build financial independence and lasting resilience.

Abojani Masterclass Starts Today

The 68th edition of our Masterclass kicks off today, Monday, 9th June 2025.

Enroll now to boost your financial skills and mindset, learning everything about personal finance and investing to help you make the most of your money.

Don’t miss out: Secure Your Spot Here!