EABL Delivers Strong Half-Year Results

East African Breweries Plc has posted a strong half-year performance to December 2025, with net sales rising 11% to Ksh 75.5 billion and profit after tax surging 38% to Ksh 11.2 billion, supported by an 8% volume growth and improved operational efficiencies.

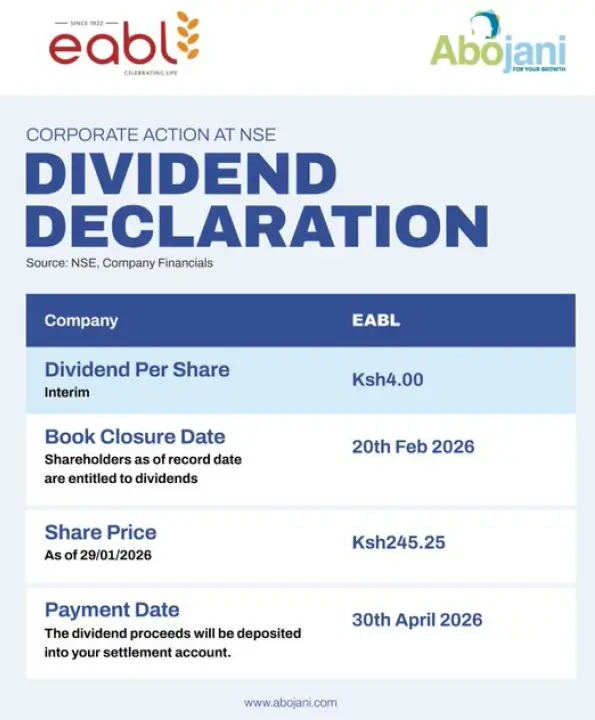

It’s an upcoming party for EABL shareholders after the listed brewer announced a record Ksh 4.00 interim dividend per share, following the post tax profits surging 38% to Ksh 11.2 billion, supported by volume growth and improved operational efficiencies.

Safaricom Ethiopia: Momentum Builds Across Core Services

Safaricom Ethiopia financial update is out. The Telco posted strong operational momentum in Q3 FY26, growing its three-month active customers to 12.2 million (+71.7% YoY) as 4G coverage expanded to 57.1% of the population, while service revenue rose 54.2% year-on-year to Ksh 9.68 billion. M-PESA was a standout, with three-month active users surging 258.5% YoY following full interoperability with Ethiopia’s national payments system.

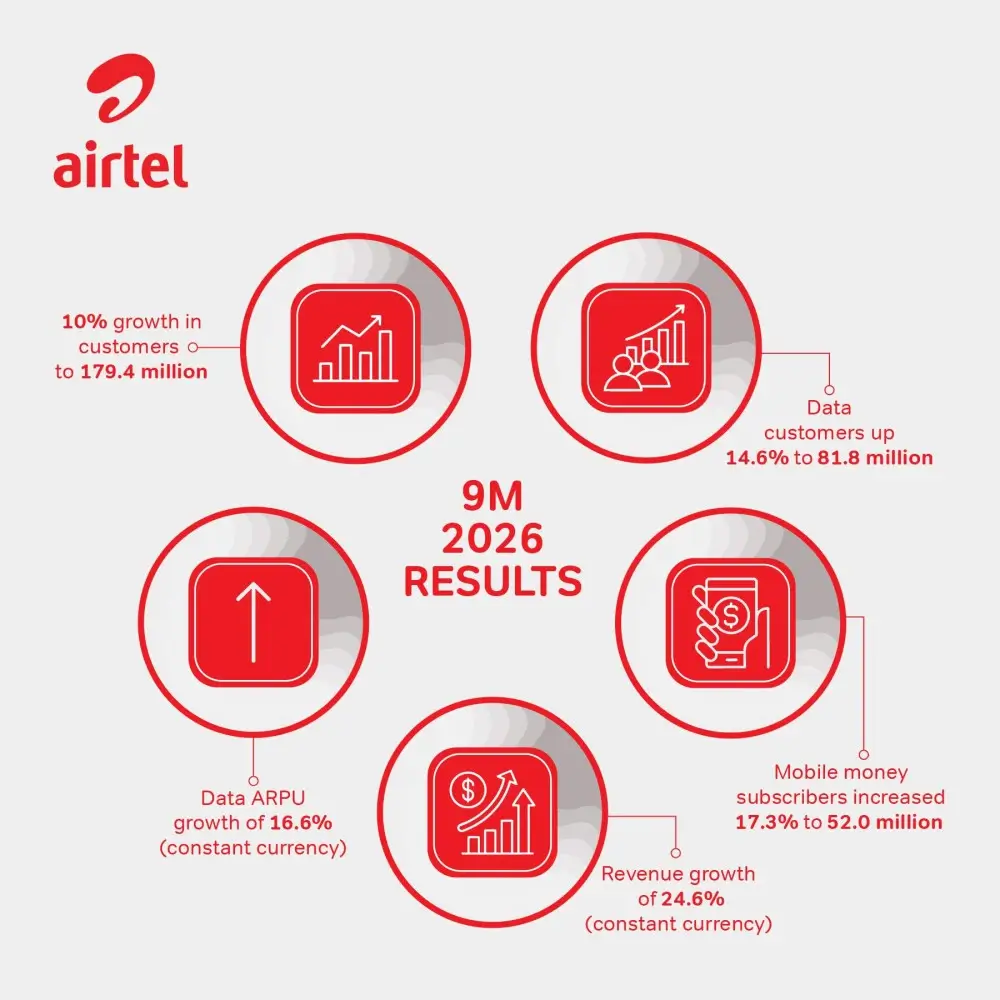

Airtel Africa Posts Robust Nine-Month Performance

Airtel Africa delivered a strong nine-month performance to December 2025, with revenues rising 28.3% to $4.67 billion, EBITDA up 35.9%, and profit after tax more than doubling to $586 million, driven by robust data and mobile money growth. The customer base grew 10% to 179.4 million, while Airtel Money crossed 52 million users and annualised transaction value exceeded $210 billion, underscoring accelerating digital and financial inclusion across its markets.

Dividend Payouts at KPLC

It was harvest day for KPLC Investors on Friday, as the company paid out a dividend of Ksh 0.80. As usual, we recommend you re-invest your dividends.

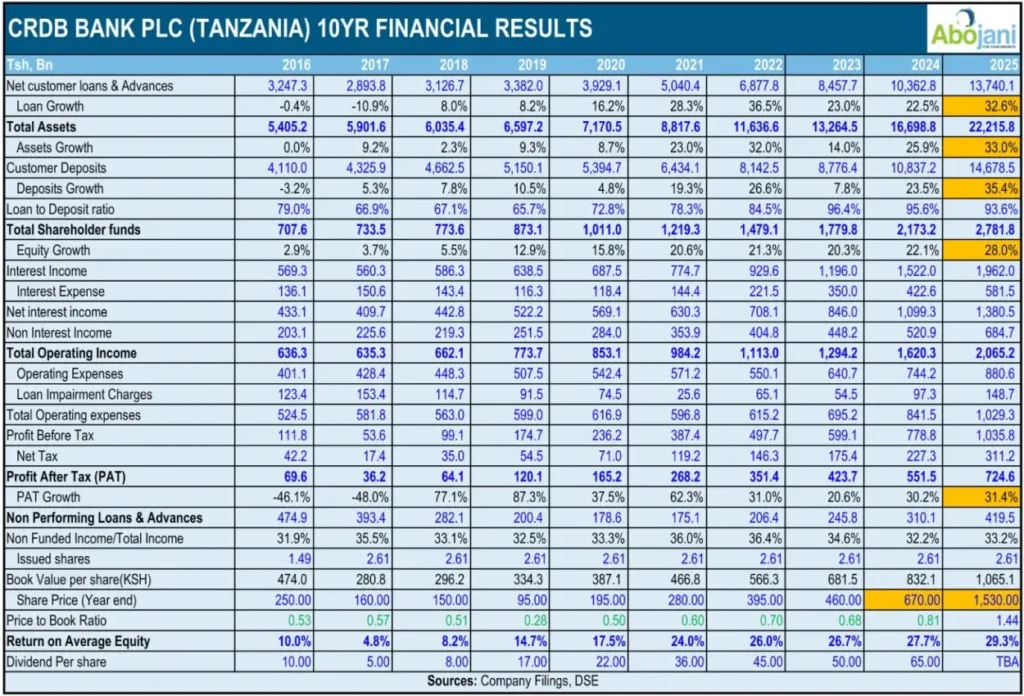

CRDB Sets the Pace in Tanzania’s Banking Sector

Tanzanian banks have begun releasing their FY’ 2025 results, and CRDB Bank has set the tone with a stellar performance. Loans, deposits, assets and profits all growing above 30%, and the share price up 128%, the bank has reported a strong bottomline of Ksh 36.5 billion.

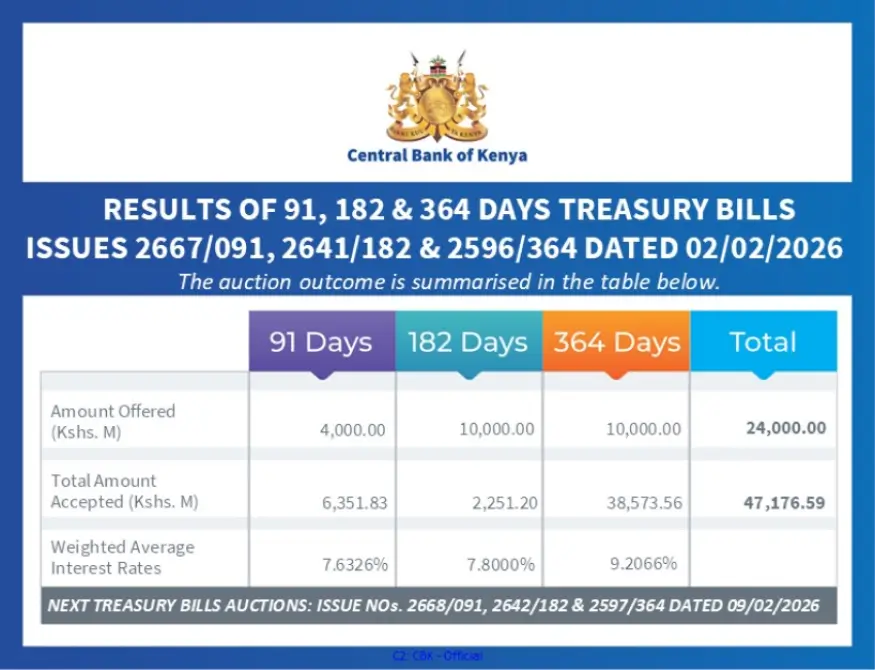

Treasury Bills Continue to Attract Heavy Demand

This week, the government raised Ksh 47.2 billion out of the Ksh 24.0 billion that was on offer through treasury bills. Interest rates are well settled below 10%

Leadership Update at Kenya Airways

Kenya Airways has appointed former Treasury Investment Secretary and veteran Safaricom director Ms. Esther Koimett, CBS, as a Non-Executive Director representing its lenders, effective January 26, 2026, strengthening creditor oversight at the airline. The move comes as KQ continues its post-restructuring recovery, with lenders now a key stakeholder alongside the Government of Kenya and KLM.

Investor Education and Community Engagement

During the week, we partnered with Sterling Capital and the Nairobi Securities Exchange to host a free webinar on stock investing.

Catch the recording here: Webinar Recording

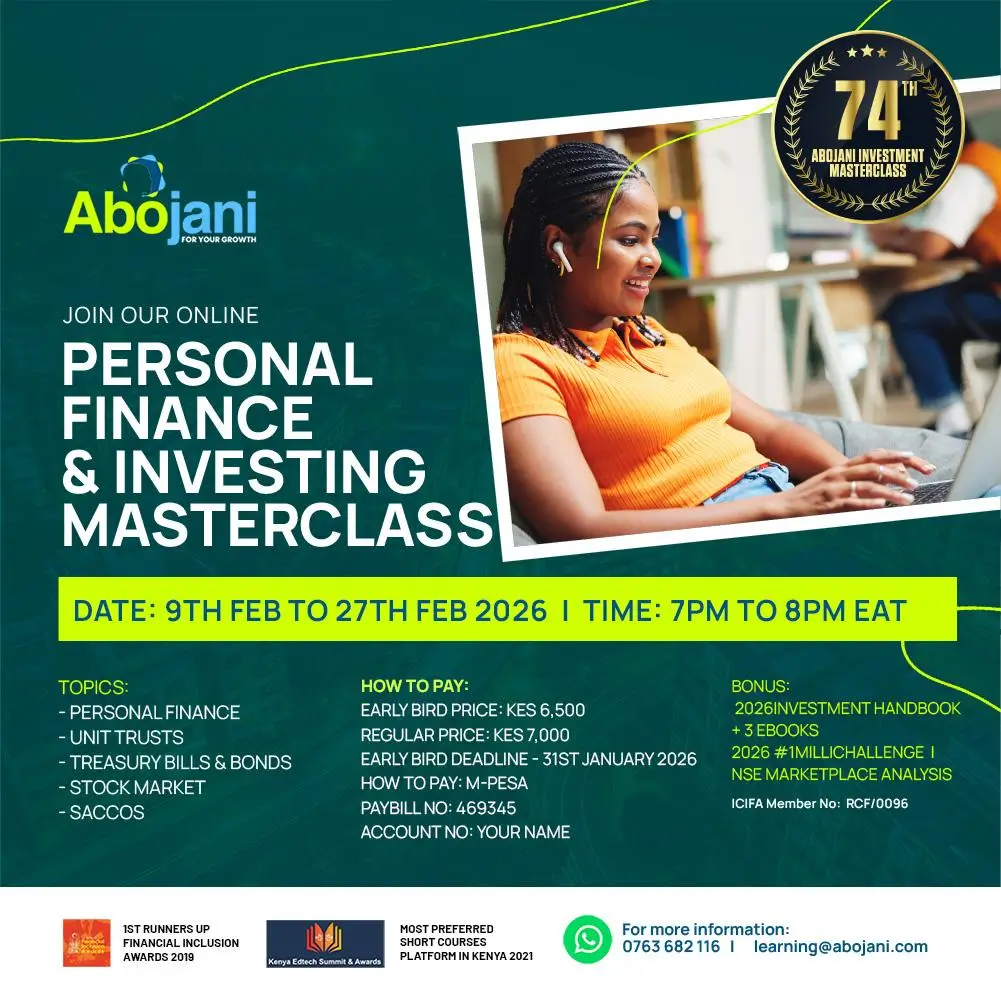

74th Abojani Investment Masterclass

We invite you to register for the 74th Personal Finance, Saving & Investing Masterclass, scheduled to run online via Zoom from 9th to 27th February 2026. Participants will be added to our WhatsApp group upon registration.