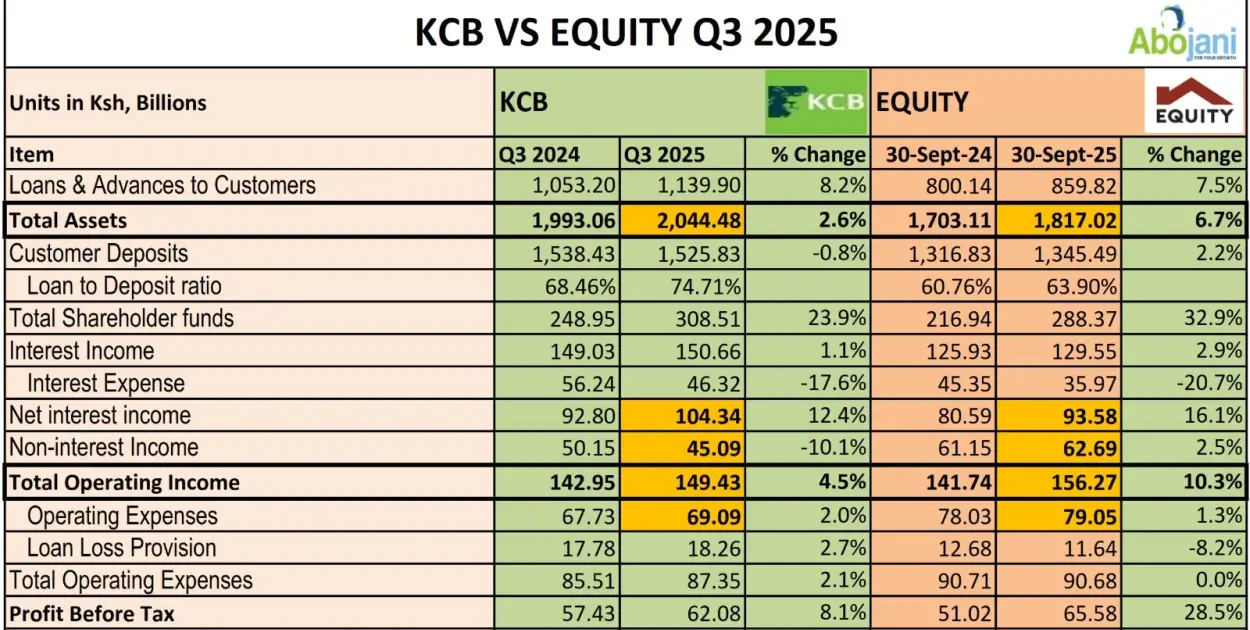

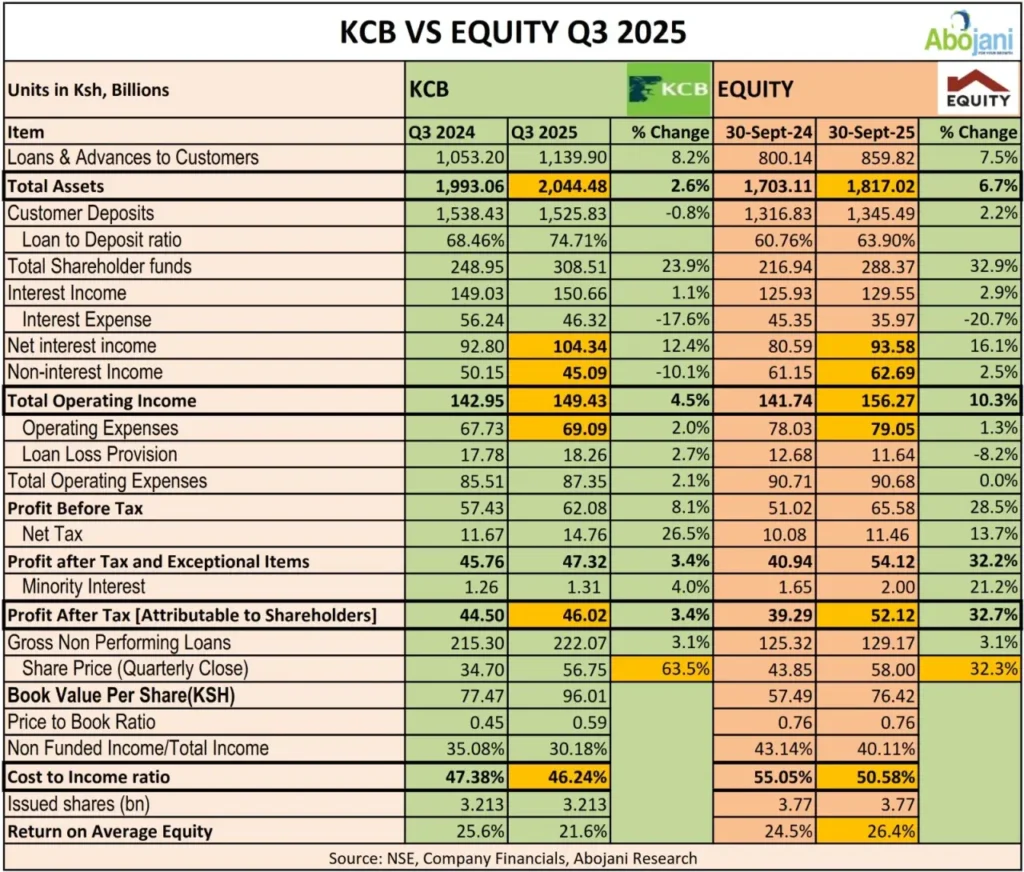

Equity Group Maintains Regional Profit Leadership

Equity Group has retained its position as the most profitable bank in East and Central Africa. The Group continues to demonstrate strong operational efficiency, strategic regional diversification, and market leadership, cementing its place at the top of the profitability rankings for yet another reporting cycle.

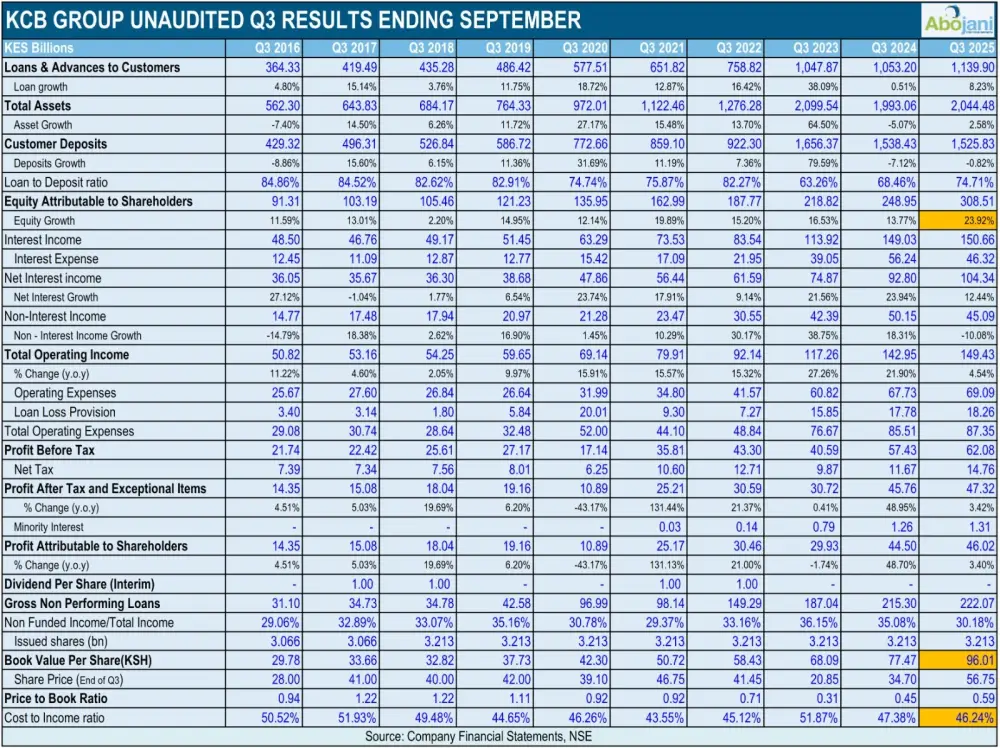

KCB Group Reports Steady Earnings Growth

KCB Group recorded a 3.4% increase in profit attributable to shareholders, reaching KES 46.02 billion for the nine months ending September 2025. The performance was driven by a 12.4% rise in net interest income, which climbed to KES 104.3 billion. Subsidiaries contributed a notable 35% of overall Group earnings.

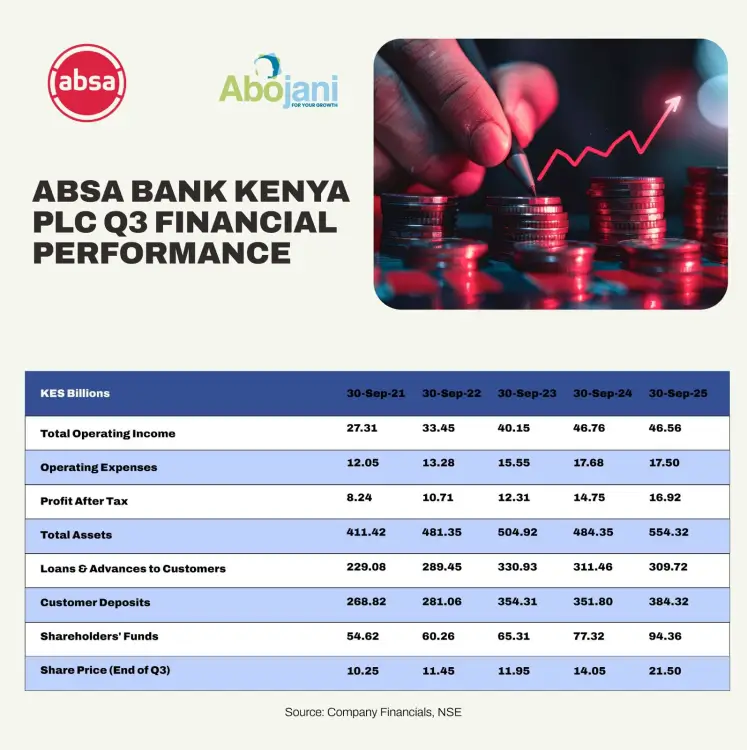

Absa Bank Kenya Delivers Strong Q3 Numbers

Absa Bank Kenya posted a 14.7% increase in profit after tax to KES 16.9 billion in Q3 2025. The results were supported by an 11.2% uplift in non-interest income and a 40% drop in loan provision expenses.

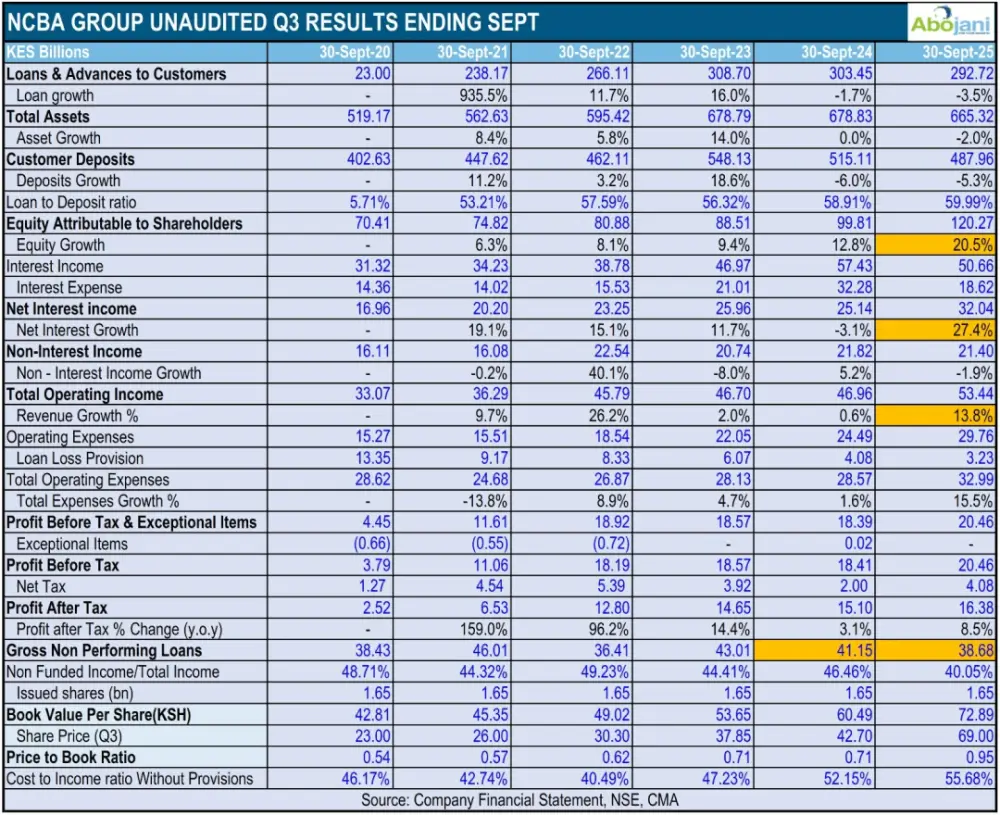

NCBA Group Registers Steady Growth

NCBA Group PLC reported a profit after tax of KES 16.4 billion in Q3 2025, representing an 8.5% growth compared to the same period in 2024. The continued momentum reflects the Group’s strong retail footprint, improved cost efficiency, and diversified revenue base.

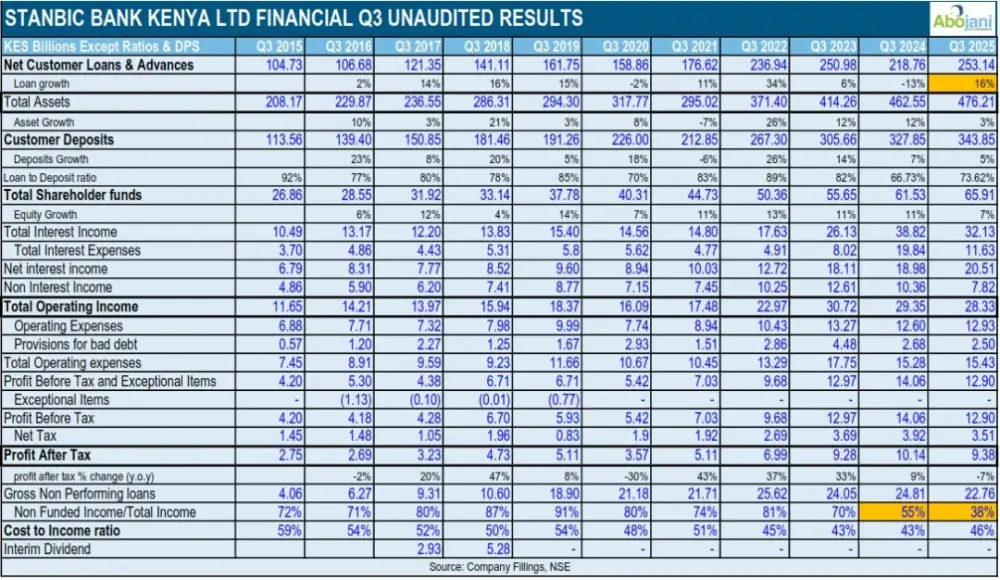

Stanbic Bank Kenya Reports Decline in Profit

Stanbic Bank Kenya recorded a 7% drop in profit after tax to KES 9.4 billion for the nine months ended September 2025. The decline was primarily driven by a 24.5% reduction in non-funded income.

I&M Group Raises Interim Dividend as Profit Climbs

I&M Group increased its interim dividend to KES 1.50 per share, up from KES 1.30 last year, following a 28.7% rise in profit attributable to shareholders to KES 11.8 billion.

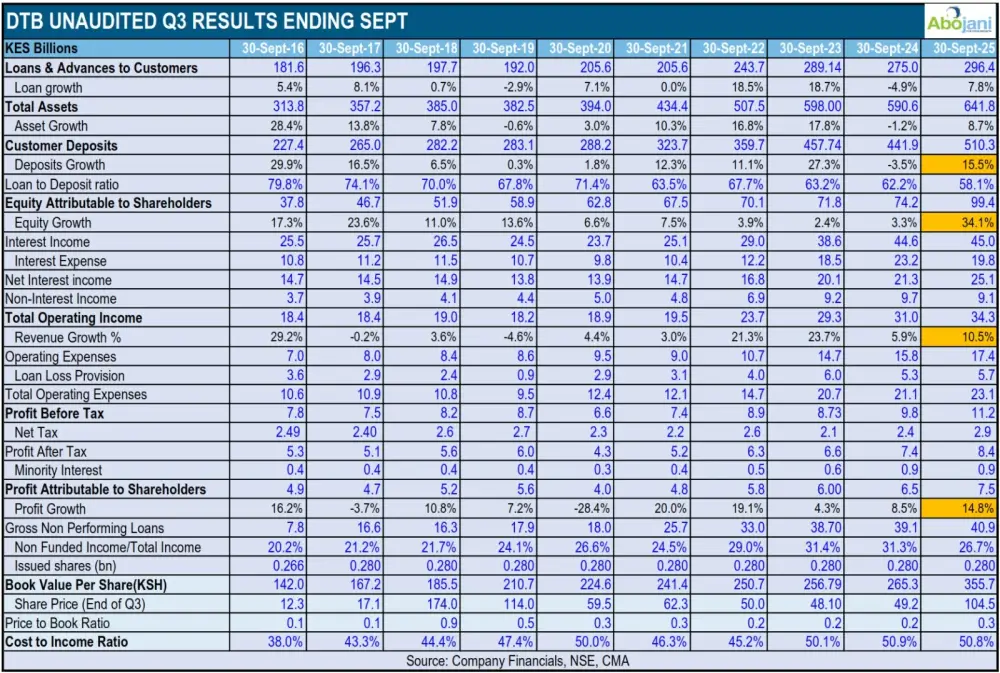

DTB Crosses the KES 100 Billion Shareholders’ Funds Mark

DTB reported a 14.8% increase in profit attributable to shareholders, reaching KES 7.5 billion. Net interest income grew by 17.9% to KES 25.1 billion, and the bank surpassed KES 100 billion in shareholders’ funds for the first time.

Key Insights from the #CEOChat with NBK’s George Odhiambo

The #CEOChat session hosted by the Kenya Bankers Association featured National Bank of Kenya MD George Odhiambo, focusing on innovative financing solutions for MSMEs.

Highlighted insights included:

- Ease of access to digital credit should not encourage borrowing beyond capacity.

- Lending is anchored in trust, technology now enhances the ability to assess borrower character and repayment history.

- A business’s diversification strategy determines its long-term sustainability.

Standard Chartered Strengthens Its Board

Standard Chartered Bank Kenya has appointed Kinya Kimotho as an Independent Non-Executive Director, adding seasoned leadership experience to its governance structure.

Safaricom Secures Approval for KES 40 Billion Bond Programme

Safaricom received regulatory approval from the Capital Markets Authority to issue bonds worth up to KES 40 billion, positioning the telco to mobilize significant long-term capital for strategic expansion.

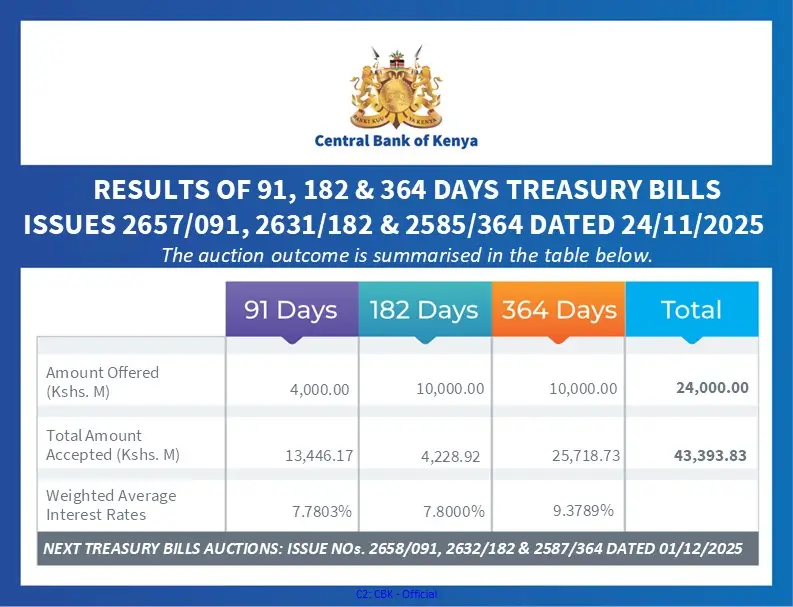

T-Bills Oversubscribed as Yields Hold Steady

This week’s treasury bill auction was heavily oversubscribed, with CBK receiving bids totalling KES 43.42 billion against an offer of KES 24 billion. The 91-day yield stood at 7.78%.

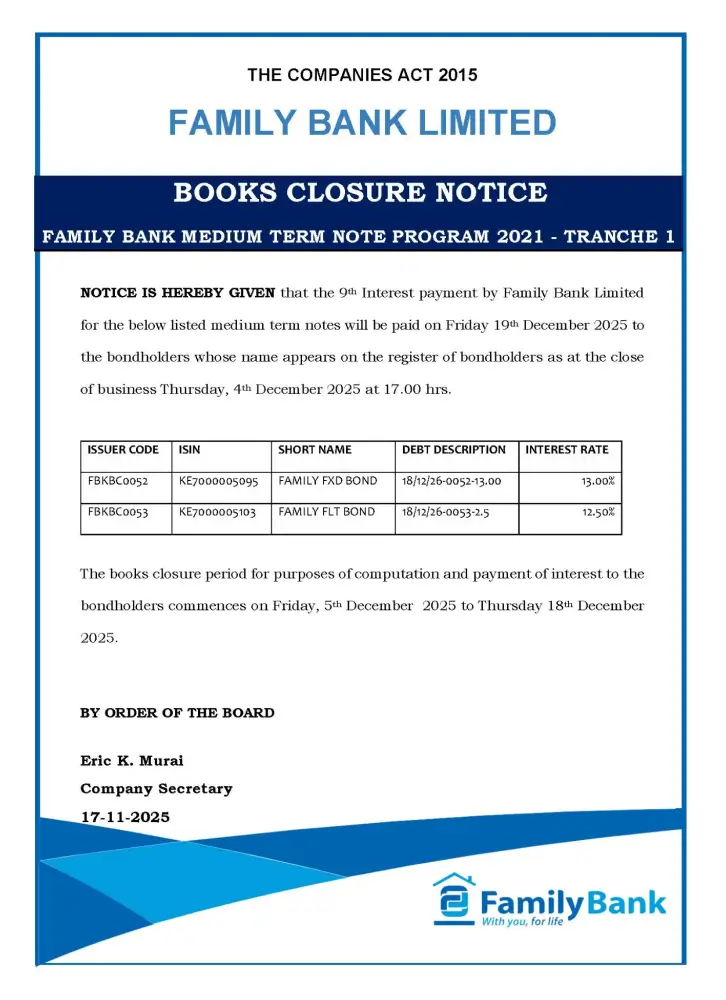

Family Bank Set to Pay Bond Interest

Family Bank will pay the 9th interest installment on Friday, 19th December 2025.

January 2026 Abojani Personal Finance & Investing Masterclass

We are excited to invite you to join the 73rd edition of the Abojani Masterclass which will run from 12th to 30th January 2026, offering comprehensive learning on personal finance, stocks, unit trusts, treasury bills, bonds, and SACCOs.

Book your seat today – HERE

Call: 0763 682 116 | Email: learning@abojani.com

#LevelUp2026