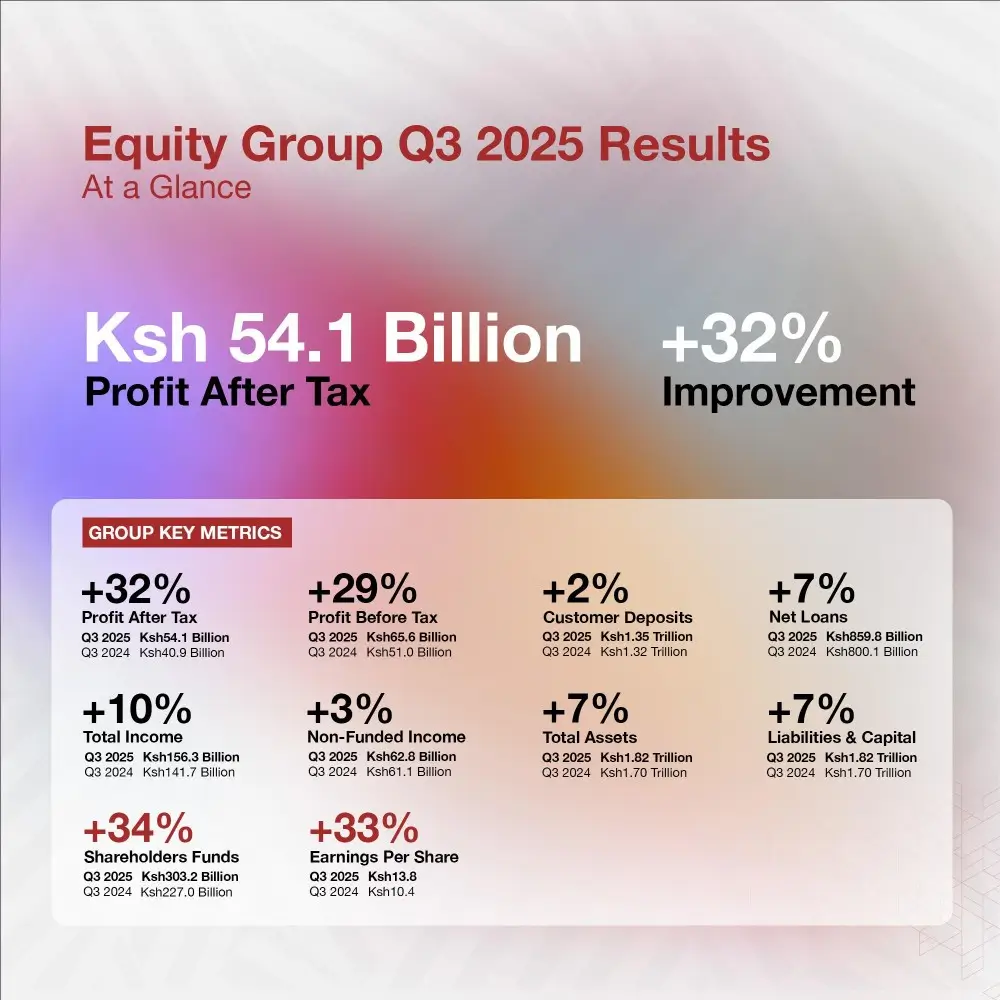

Equity Group Opens Q3 Earnings Season Strong

Equity Group kicked off the Q3 2025 earnings season in style, posting a 32% jump in profit after tax to Ksh 54.1Bn. The growth reflects its strategic transformation, diversified income streams, improved efficiency, and a strong rebound in the Kenyan business. Regional subsidiaries also contributed significantly, reinforcing Equity’s position as one of East Africa’s most resilient financial institutions.

KenGen Reports 54% Surge in Profit

KenGen recorded a 54% rise in profit after tax to Ksh 10.48Bn for the year ended June 2025, buoyed by operational efficiency, cost management, and growth in new revenue streams. The company reaffirmed its clean energy commitment with major projects like the 63MW Olkaria I and 42.5MW Seven Forks Solar Project currently underway.

Airtel Africa Revenue Rises 25.8%

Airtel Africa PLC announced a 25.8% increase in half-year revenue to $2.98Bn, with data revenue up 37% and mobile money up 33.9%. Data has now overtaken voice as the Group’s largest contributor, signalling the growing dominance of digital and financial services across Africa.

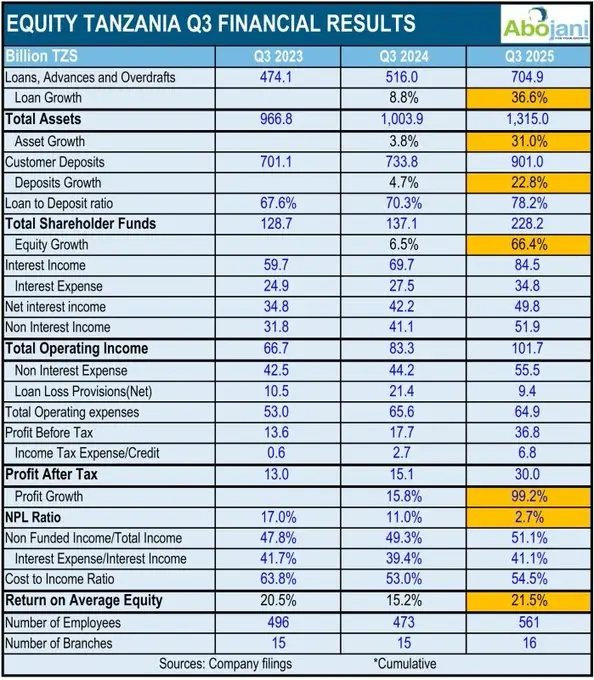

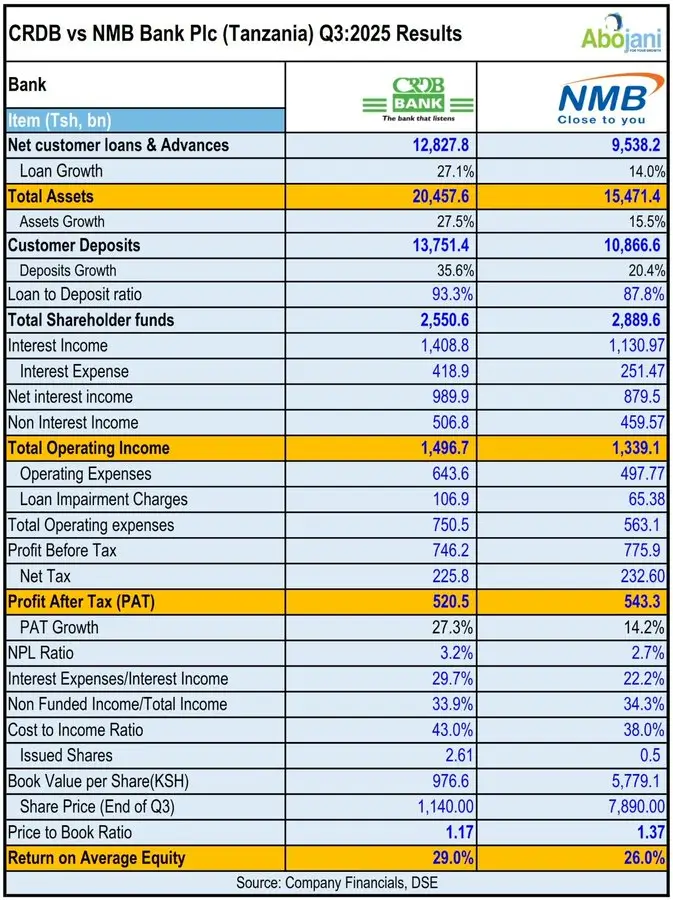

Equity Bank Tanzania Nearly Doubles Profit

Equity Bank Tanzania’s profit after tax nearly doubled (+99.2%) to Tsh 30.0Bn (Ksh 1.6Bn), driven by 31% asset growth to Tsh 1.32 trillion and a healthy NPL ratio of 2.7%. Meanwhile, the Tanzanian banking sector continues to showcase efficiency battles, with CRDB leading in revenue but NMB maintaining higher profitability.

Equity Raises FX Limit to Enhance Convenience

Back home, Equity Bank raised its walk-in foreign exchange limit from USD 1,000 to USD 5,000 (or equivalent), making transactions faster for travellers, freelancers, and SMEs. The move simplifies branch-level FX services while offering competitive rates.

Absa Kenya Partners with Dr. John Maxwell

Absa Bank Kenya partnered with global leadership icon Dr. John C. Maxwell to host the first-ever Africa Highroad Leadership Conference at the Sarit Expo Centre. The bank contributed Ksh 3 million to the event, aimed at nurturing transformational leadership and purpose-driven influence across the continent.

NCBA’s Economic Outlook Highlights Growth

Economists at the 2025 NCBA Economic Forum projected Kenya’s GDP growth at around 5.1%, supported by easing inflation, stable exchange rates, and renewed private sector confidence. NCBA Investment Bank’s MD, Muathi Kilonzo, echoed the optimism during this week’s CNBC Africa PowerLunch session, noting broad recovery and portfolio opportunities across Africa.

ICEA LION Releases Q4 Investor Pulse

ICEA LION Asset Management’s latest Investor Pulse highlighted that Kenya’s stable macroeconomic outlook offers a rare opportunity for early value capture across fixed income, equities, and alternatives. The report also noted a 9% rise in consumer spending, driven by improved retail sales and disciplined savings.

UBA Kenya Emphasises Character in Lending

During the recent KBA #CEOChat, UBA Kenya’s CEO Mary Mulili stressed that “in lending, character is very important; MSMEs must build good character by repaying loans.” The conversation explored how youth and women-led businesses can leverage AfCFTA and digital platforms to expand regionally.

Catch the conversation below

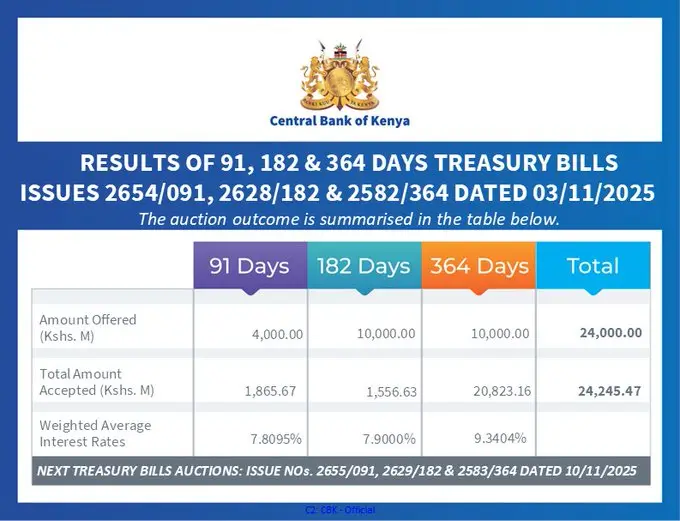

Interest Rates Continue to Ease

Interest rates continued their downward trend this week, with Treasury Bill rates now at 7.8095%, 7.9000%, and 9.3404% for the 91-day, 182-day, and 364-day papers respectively.

Coming Up…

Tatu City X-Space

Join us this Wednesday at 7 PM EAT for an X-Space with Tatu City, where we’ll explore “Where Kenya’s Next Wave of Business Growth Will Come From.” Expect insights on infrastructure, investment incentives, and emerging integrated ecosystems.

Set a reminder here: https://x.com/i/spaces/1OwxWerPkPMGQ

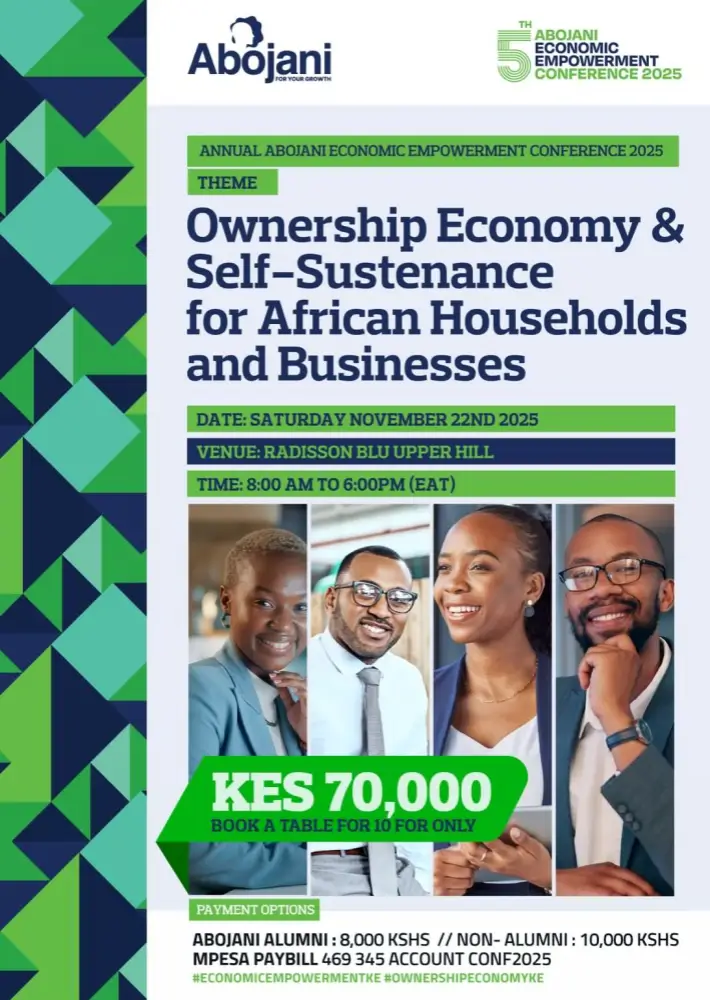

Abojani’s 5th Economic Empowerment Conference

Mark your calendar for Saturday, 22nd November 2025 at Radisson Blu, Upper Hill.

The 5th Abojani Economic Empowerment Conference will focus on Ownership Economy & Self-Sustenance for African Households and Businesses. This is more than an event, it’s a call to move from survival to ownership, and to build systems that safeguard your future.

#EconomicEmpowermentKE #OwnershipEconomyKE