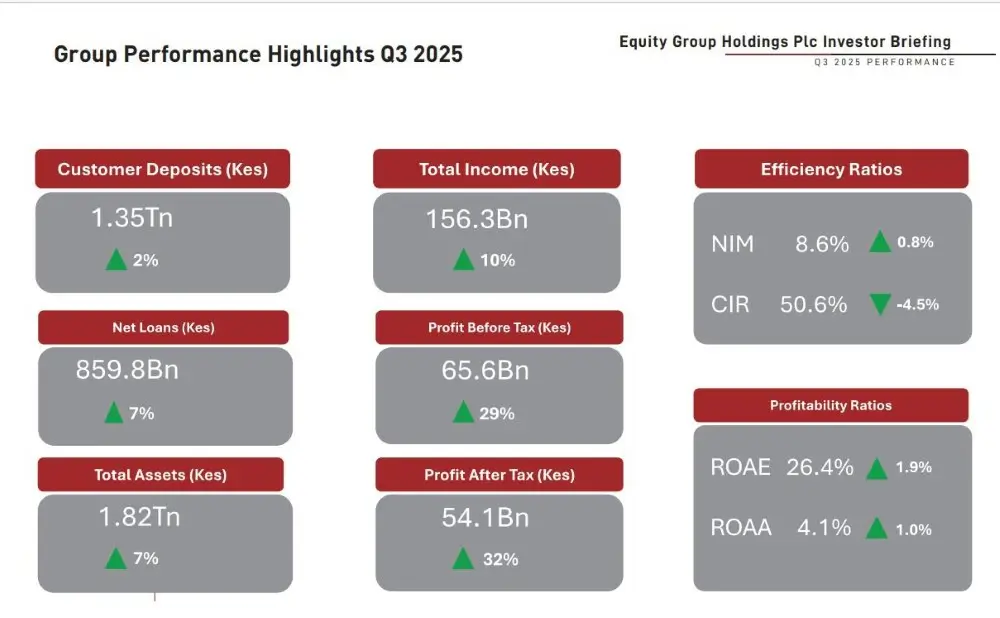

Equity Group Holdings Plc’s Q3 2025 results tell a story that extends beyond banking. While its banking operations remain core, the Group’s diversification across regions, insurance, technology, and sustainability reflects a financial services group reimagining Africa’s economic future.

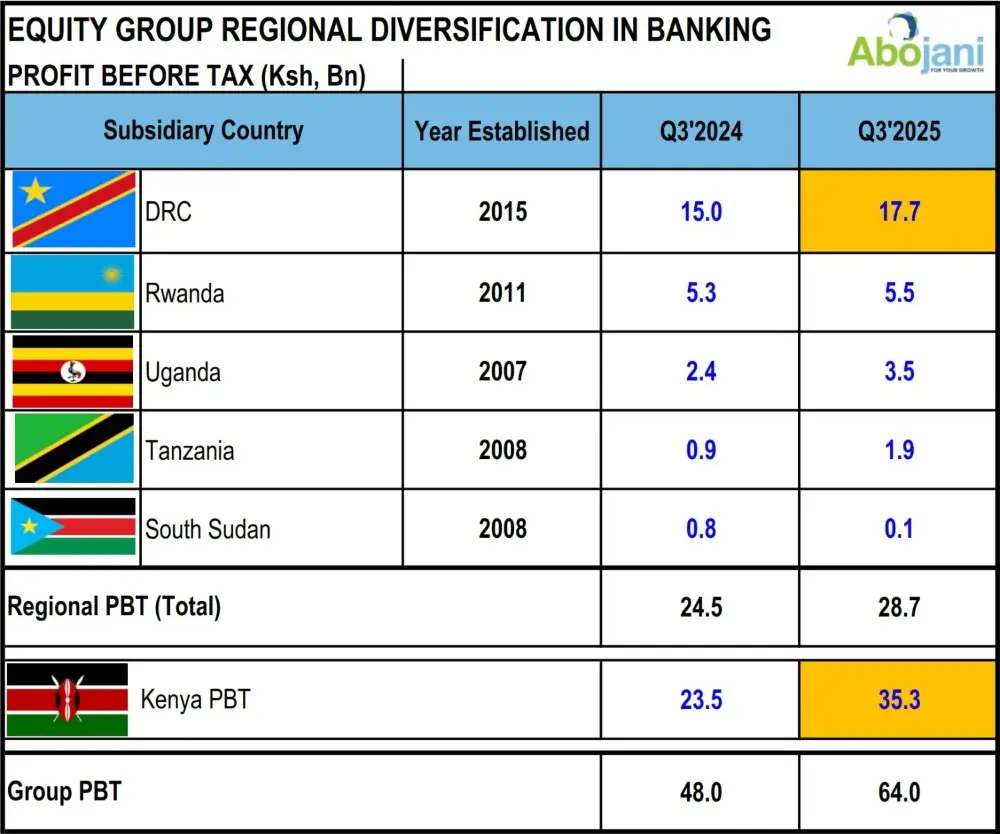

Regional Diversification: Strength in Geographic Spread

Equity’s footprint across six African countries has evolved from a growth strategy into a competitive moat. Q3 2025 results show how this diversification cushions against local shocks while capturing growth across economic cycles.

Also read: Kenyan Banks in Tanzania Report Strong H1 Performance

- The DRC Emerges as a Growth Engine

Equity Bank Congo (EBCDC) posted impressive Q3 performance with assets growing 7% year-on-year in constant currency to KES 634.3 billion. More remarkably, the subsidiary achieved 19% loan growth and maintained strong profitability with a Return on Average Assets (ROAA) of 2.6% and Return on Average Equity (ROAE) of 22.3%.

Despite ongoing challenges in eastern regions, EBCDC’s loan portfolio reached KES 302.7 billion, with an improved non-performing loan ratio of 7.1%, a testament to prudent risk management in a complex environment.

- Rwanda and Tanzania: The Fast-Growth Markets

Equity Bank Rwanda (EBRL) demonstrated exceptional momentum with 44% loan growth in constant currency, pushing its loan book to KES 62.3 billion. The Rwandan subsidiary improved its ROAA to 4.3% and ROAE to 29.7%, benefiting from Rwanda’s 7.8% GDP growth, the fastest in the Equity Group region.

Tanzania, which the Group describes as having “the best top-down macro in the EGH region,” saw Equity Bank Tanzania (EBTL) achieve 37% loan growth in constant currency. Assets reached KES 69.7 billion profit before tax jumped 114% year-on-year to KES 1.9 billion. Tanzania exemplifies the Group’s ability to capture opportunities in stable, high-growth economies.

- Kenya: The Anchor Market Facing Headwinds

Equity Bank Kenya (EBKL), representing 43% of Group assets, faced a more challenging environment with loans declining 4% year-on-year in constant currency to KES 406.9 billion. However, the subsidiary demonstrated resilience through improved efficiency, with a cost-to-income ratio of 47% and a significantly improved ROAE of 28.3%, up from 23.7% in Q3 2024.

Kenya’s subdued credit growth reflects broader market dynamics, including fiscal consolidation and cautious lending sentiment. Yet EBKL’s continued dominance in MSME lending, disbursing 45% of all MSME loans between January and July 2025, underscores its strategic alignment with the Africa Recovery and Resilience Plan (ARRP) target of 65% MSME loan mix by 2030.

- Uganda: Navigating Mature Market Dynamics

Equity Bank Uganda (EBUL) posted a 9% decline in loans in constant currency, reflecting deliberate portfolio optimization. However, asset quality improved markedly, with NPLs falling to 8.8% from 20.9% year-on-year, while IFRS coverage strengthened to 91%. The bank’s ROAA improved to 3.4% and ROAE to 24.1%, demonstrating that strategic retreat from risky segments can enhance overall returns.

Insurance: Building Africa’s Protection Infrastructure

Perhaps no initiative better illustrates Equity’s vision for holistic financial services than its rapid insurance expansion. Since launching Equity Life Assurance Kenya (ELAK) in March 2022, the Group has built what it calls “Africa’s protection infrastructure.”

By September 2025, ELAK had 17.8 million policies covering 6.8 million customers through digital-first channels and the bank’s network. Key growth segments include deposit administration and pensions, life assurance, and group credit life, positioning Equity as a wealth management player.

In 2025, Equity operationalized two additional insurance subsidiaries: Equity General Insurance Kenya (EGIK) for general insurance and Equity Health Insurance Kenya (EHIK), which commenced operations in September 2025. This completes a comprehensive insurance ecosystem addressing life, property, and health risks.

Technology: The Digital Backbone

Equity’s technology investments form the invisible infrastructure enabling both banking and insurance expansion. AI is now deployed in fraud detection, transaction monitoring, and customer insights, delivering measurable value across 20 million customers.

Currently, 98% of transactions occur outside branches via self-service channels, boosting efficiency and reach while cutting infrastructure costs. This channel migration directly improves efficiency ratios while expanding geographic reach without proportional infrastructure costs, crucial for serving dispersed rural populations profitably. System uptime remains above 99.95%, supported by hybrid-cloud architecture and continuous monitoring.

Security investments aligned with ISO 27001 and PCI-DSS standards address both regulatory requirements and customer trust, increasingly important as digital transaction volumes scale.

Sustainability: Finance as Development

Equity’s sustainability agenda integrates finance with development. The Group has invested KES 98 billion in social programs, with Wings to Fly and Elimu initiatives accounting for 46%.

The Wings to Fly program has placed 1,115 scholars in 245 universities across 39 countries, including 224 Ivy League admissions, while maintaining gender balance (65% male, 45% female). The Equity Leaders Program equips graduates with skills for fast-growing sectors like technology and finance.

In March 2025, Proparco granted €1 million to the Equity Group Foundation for the Climate Resilient Agri-Food Systems (CRAFS) project, supporting Kenyan smallholders’ shift to climate-smart agriculture, advancing the ARRP goal of 20% agricultural lending by 2030.

With agriculture employing 60% of Africa’s workforce, improving productivity and resilience is a critical development lever.

Equity Bank Kenya also launched Africa’s first voluntary Sustainable Development Impact Disclosure with J.P. Morgan, aligning financial results with measurable SDG outcomes and enhancing appeal to impact investors.

Looking Ahead

Equity Group’s Q3 2025 results reflect a financial institution evolving into a diversified African powerhouse. Regional diversification ensures resilience; insurance and technology drive inclusion; and sustainability links profitability with purpose.

The strategy carries execution risks: insurance requires different capabilities than banking, technology investments demand continuous capital, and regional expansion in fragile states involves geopolitical complexity. Yet the logic appears sound; Africa’s development requires financial services that go beyond deposits and loans to address holistic economic needs.

As Dr. James Mwangi, Group Managing Director and CEO, articulated in the Group’s vision: “To be the champion of the socio-economic prosperity of the people of Africa.” The Q3 2025 results suggest this vision is translating into operational reality, one diversified business line at a time.