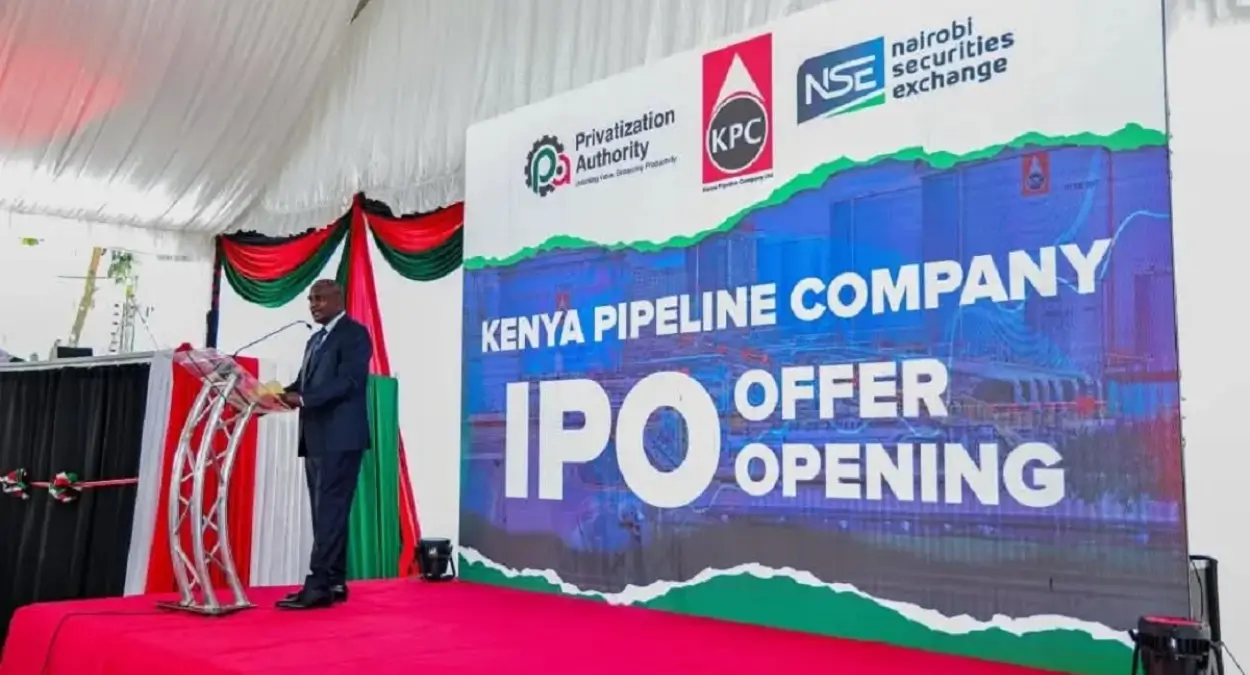

The government has launched the Initial Public Offering (IPO) of Kenya Pipeline Company Limited (KPC), offering 11.81 billion shares, representing a 65% stake, at Sh9 per share in a deal expected to raise Sh106.3 billion ($825 million). The offer will close on 19 February, with trading set to begin on 9 March 2026 on the Nairobi Securities Exchange’s Main Investment Market Segment (MIMS).

Nedbank Group Limited, the 5th largest bank in South Africa by assets, intends to acquire 66% of NCBA Group PLC for about ZAR 13.9 billion (Sh109.5 billion), with completion targeted by Q3 2026.

NCBA Group has been certified as a Top Employer for 2026 by the Top Employers Institute.

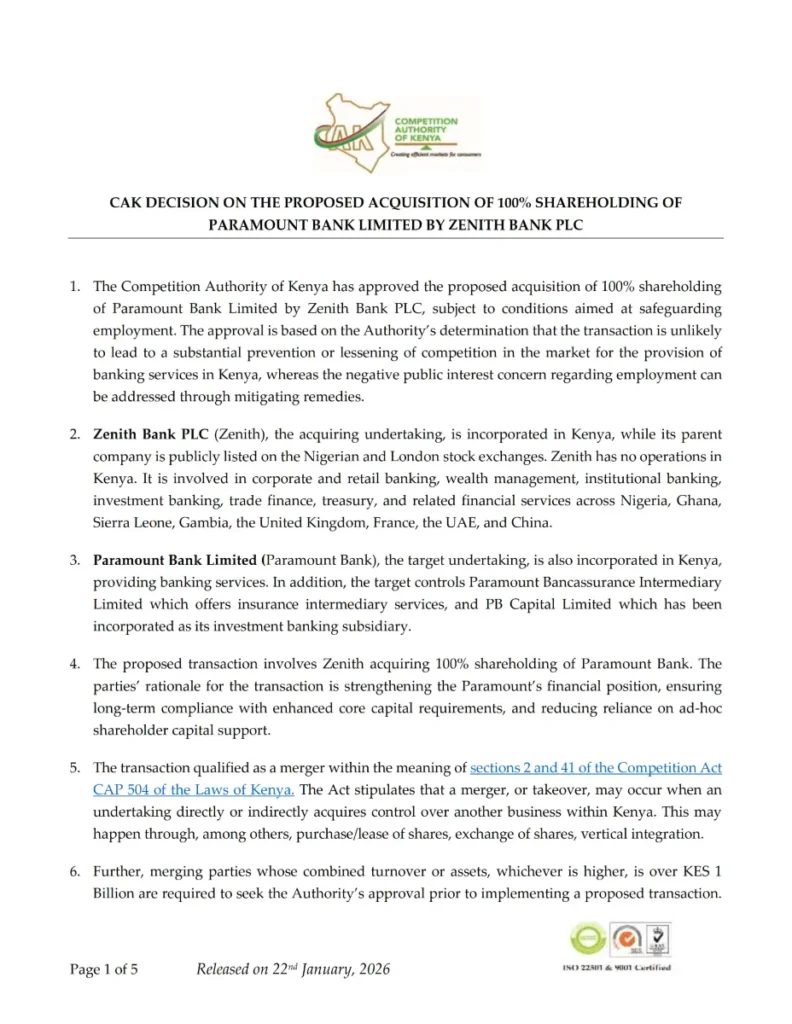

Zenith Bank, Nigeria’s second biggest lender by market cap, gets green light to acquire Paramount Bank

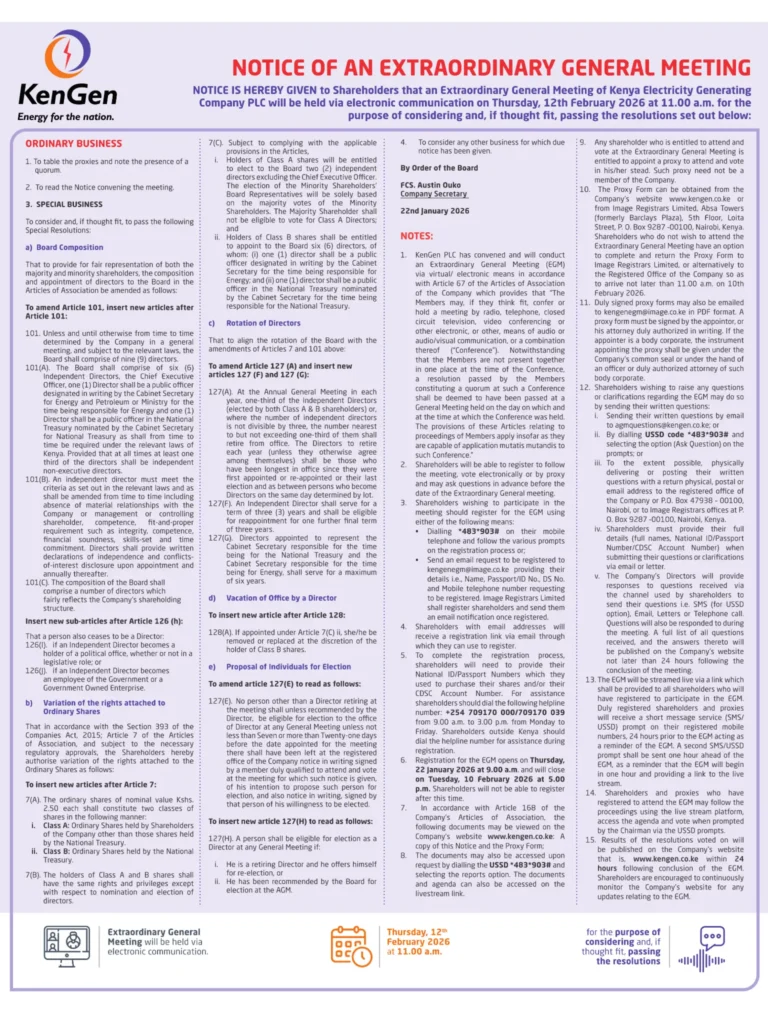

KenGen will hold an Extraordinary General Meeting to seek shareholder approval for governance changes, including restructuring the board and granting the National Treasury greater control over director appointments through a new share class and revised voting rights.

Liberty Kenya has issued a profit warning for the financial year ended December 31, 2025. The company expects its 2025 PAT to drop 25% from Sh1.40 billion in 2024, due to lower investment returns, adverse claims, and a one-off accounting loss.

StanChart appoints Birju Sanghrajka as the new Managing Director and CEO of Standard Chartered Bank Kenya. He will succeed Kariuki Ngari, who is set to retire from his role on 16 April 2026.

Dalu Ajene has been appointed as the new Chief Executive Officer of the Bank’s operations in Africa, taking on dual responsibilities as Head of Coverage for Africa. He succeeds Kariuki Ngari, who previously served as CEO, Africa, and oversaw Sarmad Lone’s Africa Coverage portfolio.

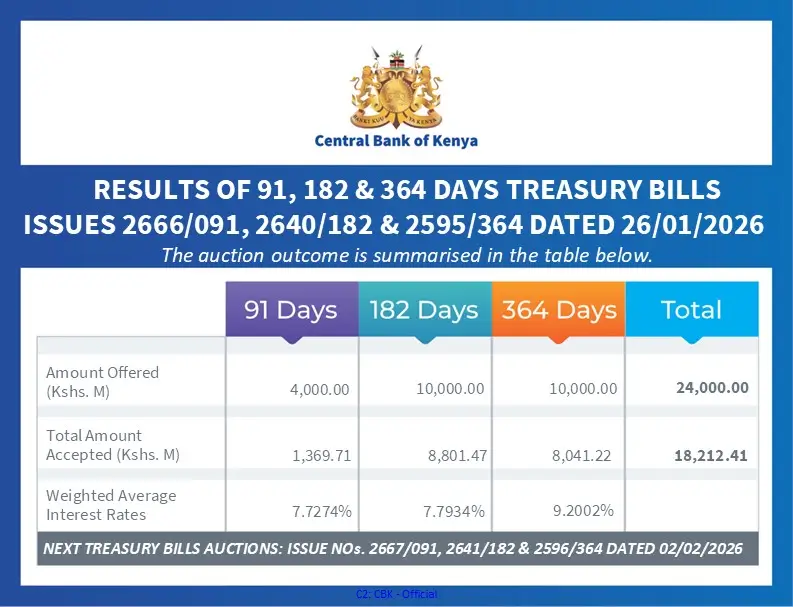

Treasury Bills were undersubscribed this week at 76.46%, with the government raising Sh18.21 billion out of the offered Sh24 billion. The 91-day weighted average interest rate stood at 7.7274%.

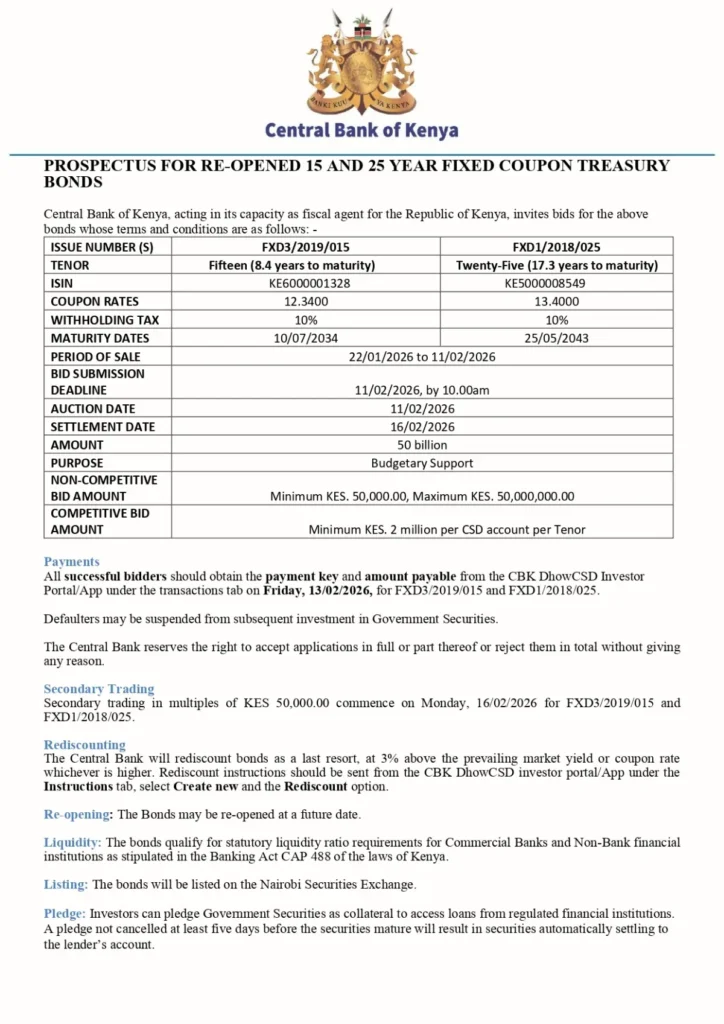

The government is raising Sh50 billion through re-opened 15-year (FXD3/2019/015) and 25-year (FXD1/2018/025) fixed-coupon treasury bonds. The bonds offer coupon rates of 12.34% and 13.4%, respectively. Bids must be submitted by 11 February 2026.

This week, in collaboration with Branch, we held a webinar on Smart Saving and Goal Planning for 2026.

Here are the key takeaways:

- “Living paycheck to paycheck is not ideal. You need to be more responsible with your finances.”

- “If you’re making revenues daily, for example running a business, you should save your money daily.”

- “Your Emergency Fund will help you pursue your other goals with intensity and focus.”

- “Define your WHY first as you plan your finances.”

Upcoming Events

In collaboration with NSE & Sterling Capital, we’ll host a “Stock Market Made Simple” webinar on January 28, 2026, from 9:00 to 11:15 a.m. Join us to learn how to invest in NSE equities and bonds.

Scan the QR code on the poster to register.

KPLC will pay dividends on Friday, 30 January 2026, to shareholders on the register as of 2 December 2025.

We cordially invite you to the Abojani Valentine’s Edition Masterclass, which will take place from February 9 to 27, 2026.

- You’ll get to learn simple, practical tools for budgeting, saving, investing, and planning for your shared financial goals.

- It’s a great gift for couples looking to improve their money management skills.