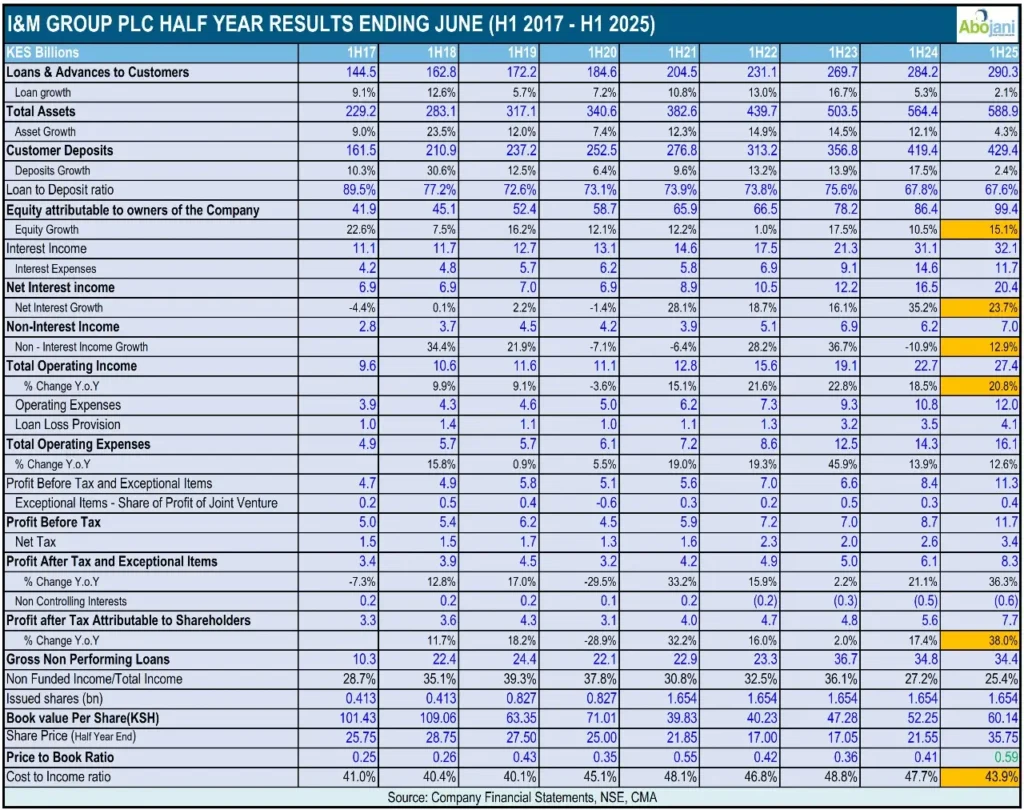

I&M Group Plc has reported strong results for the first half of 2025, delivering a 36% year-on-year increase in profit after tax to KShs 8.3 billion. Profit before tax rose 34% to KShs 11.7 billion, supported by double-digit income growth, improved cost efficiency, and enhanced contribution from subsidiaries. The Group’s return on equity improved to 16%, while return on assets rose to 2.9%, signaling strengthened profitability across its footprint.

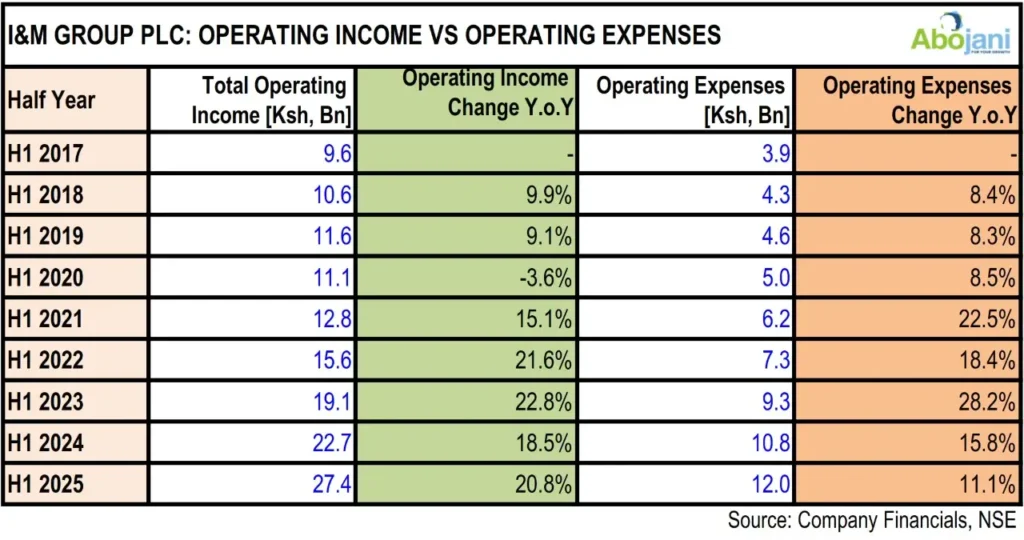

Operating income increased 21% to KShs 27.4 billion, benefiting from a 19% rise in net interest income as funding costs moderated. Non-interest income also grew steadily, supported by trade finance, fees, and ecosystem partnerships. The cost-to-income ratio improved to 43% from 48% in H1 2024, underscoring disciplined expense management even as the Group invested in technology, branch expansion, and people initiatives.

Also read: Stanbic Kicks Off Earnings Season with Steady Numbers, Big Dividend Surprise

Asset quality showed progress, with the gross non-performing loan ratio easing to 11.8% from 12.3% in the same period last year. Net NPA ratio declined further to 4.1%, reflecting stronger recoveries and more prudent credit reviews across the Group. The cost of risk rose modestly to 2.8%, indicating continued caution in a mixed macroeconomic environment.

The Group’s balance sheet remained resilient, with customer deposits increasing 2% to KShs 429 billion, while net loans and advances rose slightly to KShs 290 billion. Total assets stood at KShs 589 billion, a 4% increase year-on-year. Capital and liquidity buffers remain robust, with the total capital adequacy ratio at 20% and liquidity ratio at 54%, well above regulatory thresholds across all subsidiaries.

Subsidiaries made meaningful contributions to growth, accounting for 24% of Group profit before tax. Rwanda led with a 15% share, supported by double-digit income growth and a rebound in key sectors such as manufacturing and oil & gas. Tanzania contributed 5% of Group PBT, buoyed by strong digital lending momentum, while Uganda’s profitability improved on the back of recoveries and agency banking expansion. Mauritius, though facing higher funding costs, continued to benefit from recoveries and balance sheet growth.

In Kenya, which still accounts for 75% of Group profit before tax, performance was anchored on stronger core earnings, with operating income up 21% and PBT rising 31%. Growth in Corporate and Institutional Banking was driven by higher margins, diversification initiatives, and an expanding trade finance book, while Retail and Business Banking continued to broaden its customer base, with MSMEs comprising over 30% of new acquisitions.

The Group also registered significant momentum in its wealth management and bancassurance businesses. Assets under management rose sharply to KShs 70 billion, from KShs 20.7 billion a year earlier, highlighting growing client trust in I&M’s investment solutions. Wealth management customers almost tripled over the same period to 9,400.

Bancassurance also expanded its footprint, with the customer base reaching 13,900 and revenue growing 15% to KShs 352.7 million. These businesses are becoming increasingly central to the Group’s diversification strategy, adding resilience to income streams beyond traditional lending.

Ecosystem partnerships disbursed over KShs 14 billion in the half-year, spanning payments, agri-tech, and green SME financing. Subsidiaries are increasingly integrated into this growth story, demonstrating the benefits of a regionalized, technology-driven approach.

Beyond financials, I&M continued advancing its sustainability agenda through the I&M Foundation. Initiatives included planting over 600,000 trees, expanding scholarships in secondary and tertiary education, and equipping women and youth with skills for sustainable income generation. These efforts underline the Group’s commitment to embedding environmental and social impact into its business model.

I&M aims to build on its strengthened fundamentals by accelerating digital innovation, deepening ecosystem partnerships, and leveraging subsidiary growth. With profitability momentum intact and asset quality stabilizing, the Group remains on course toward its 2026 ambition of achieving a return on equity above 20% and impacting over 10 million lives across Eastern Africa.