Week’s highlight: KCB Bank, Kenya’s most profitable listed lender, has been named 2025 African Bank of the Year at the 15th Africa Business Leadership Awards in London.

The Week in Markets

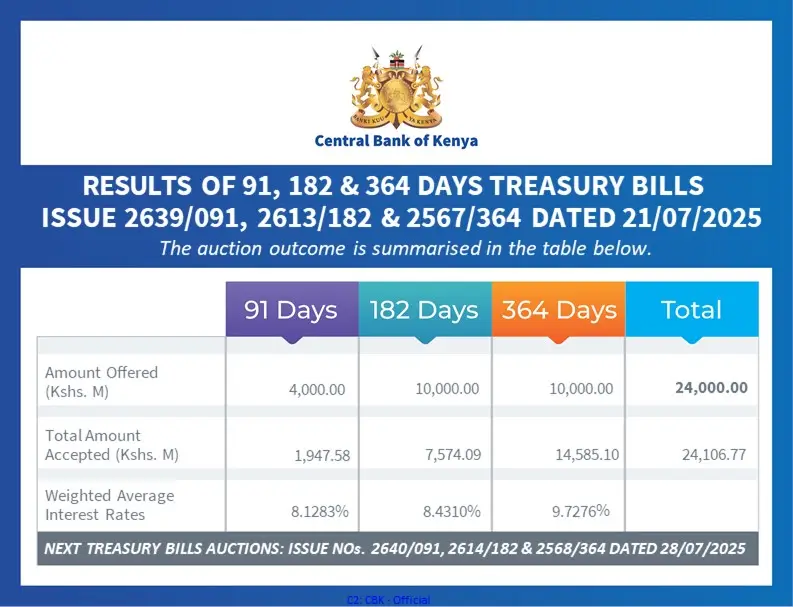

Interest rates on Treasury Bills continued their downward trajectory, now firmly in single digits. The sustained decline points to an improving liquidity environment and reduced government borrowing pressure. While this eases costs for borrowers, income-focused investors may need to adjust their return expectations or explore alternative yield strategies.

South African fund manager Satrix has officially dual-listed its MSCI World Feeder ETF on the Nairobi Securities Exchange. This opens up access to over 1,300 developed market stocks across 23 countries through one listed product, offering Kenyan investors a low-cost and diversified exposure to global equity markets.

CORPORATE UPDATES

KCB Bank, Kenya’s most profitable listed lender, has been named 2025 African Bank of the Year at the 15th Africa Business Leadership Awards in London. The award highlights KCB’s leadership, innovation, and continental footprint, marking a milestone not only for the bank but also for Kenya’s positioning in Africa’s financial sector.

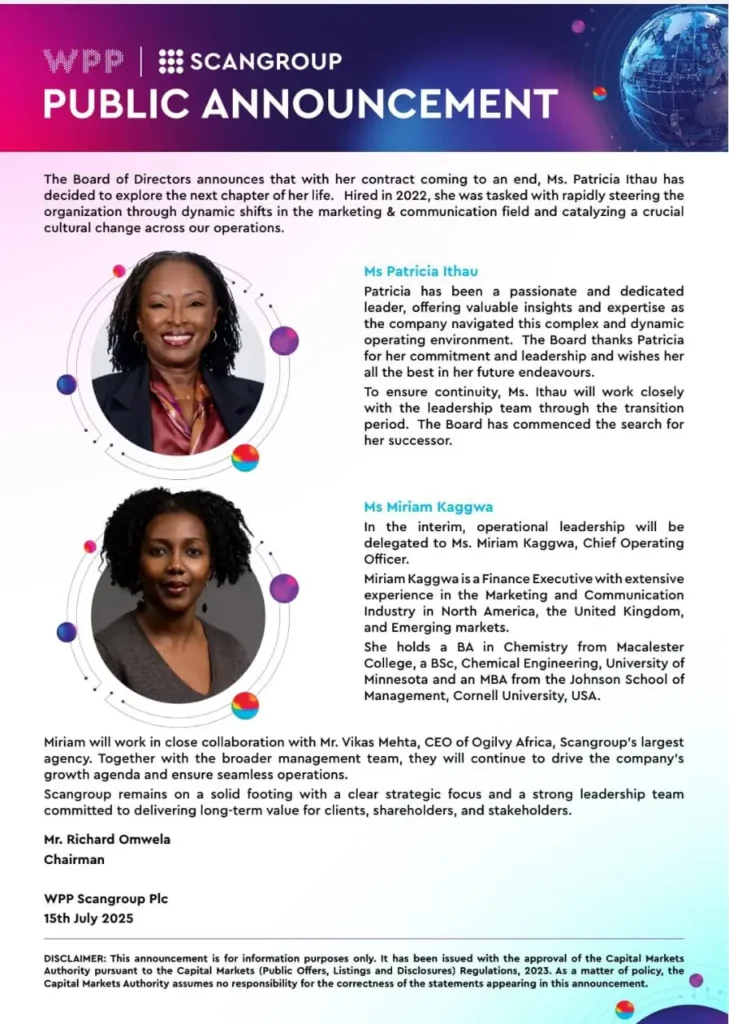

WPP Scangroup CEO Patricia Ithau has officially exited the firm upon completing her three-year contract, which focused on operational restructuring. Miriam Kaggwa, the current COO with over two decades of global marketing experience, steps in as the interim CEO.

NCBA Bank has partnered with Car & General, offering customers access to up to 90% asset financing with flexible repayment terms of up to 60 months. Customers also benefit from a 60-day grace period post-delivery, easing upfront cost burdens.

In recognition of its commitment to service, NCBA was named among Kenya’s Top 20 Most Customer-Centric Brands and also ranked in the Top 10 High-Performing Public Listed Companies for 2025. Its insurance arm, NCBA Insurance, was also highlighted for delivering valuable, trusted insurance solutions.

Equity Bank was awarded Best Regional Bank in East Africa at the 2025 African Banker Awards. The recognition affirms the lender’s continued focus on financial inclusion, SME support, and cross-border growth through its purpose-led model and the #AfricaRecoveryandResiliencePlan.

Standard Chartered Bank Kenya launched its 2024 Sustainability Progress Report, revealing a 132% growth in sustainable finance income to KSh 2.99 billion, and a tenfold increase in sustainable finance assets to KSh 31.3 billion; demonstrating a growing institutional commitment to ESG.

I&M Bank expanded its branch network with a new opening in Mwea, built using its innovative sustainable container model. The branch is designed to serve the area’s farmers, traders, and entrepreneurs; an effort to deepen financial inclusion in Kenya’s agricultural zones.

Visa and the Nairobi Securities Exchange have launched a new report titled “Reimagining Retail Investors in Kenya.” The study proposes tech-enabled, low-cost solutions to expand capital markets access, including mobile-based investing and diaspora-focused platforms.

Absa Bank Kenya opened a new branch in Kawangware, Nairobi, furthering its mission to bring formal financial services closer to underbanked, high-growth neighborhoods.

REGULATORY NOTICES

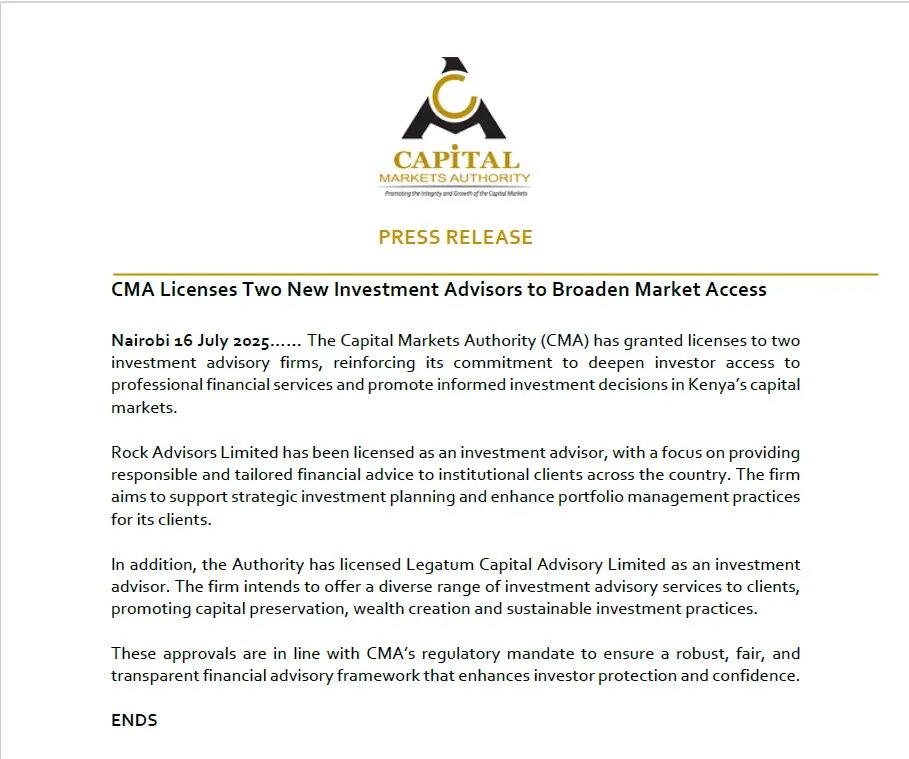

The Capital Markets Authority (CMA) has licensed two new investment advisors, Rock Advisors Limited, which will focus on institutional clientele, and Legatum Capital Advisory, which will offer services in wealth creation, capital preservation, and sustainable investing.

Additionally, CMA approved:

- ALA Capital Ltd’s registration of a Collective Investment Scheme (CIS)

- New offshore funds by VCG Asset Management

- A GBP Fixed Income Fund by Sanlam Investments

- Fintrust Securities as an Authorized Securities Dealer

- Stanbic Bank Kenya as a corporate trustee

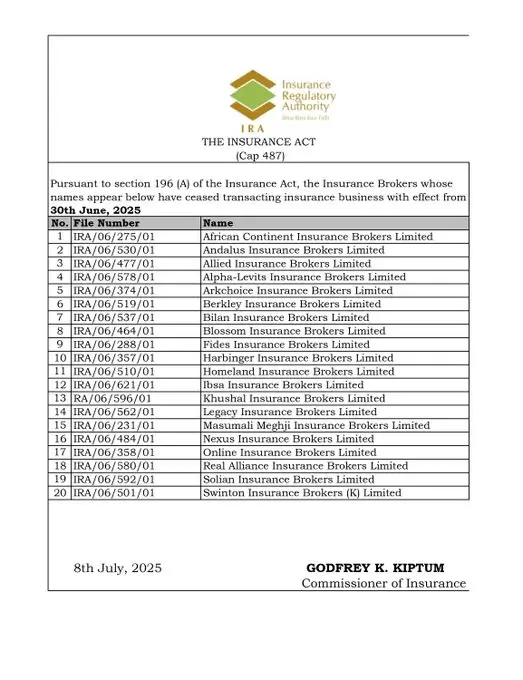

In the insurance sector, the Insurance Regulatory Authority (IRA) cancelled licenses for 20 brokers due to non-compliance with Section 196(A) of the Insurance Act. The move is part of its ongoing effort to enhance integrity and accountability in the insurance space.

COMING UP

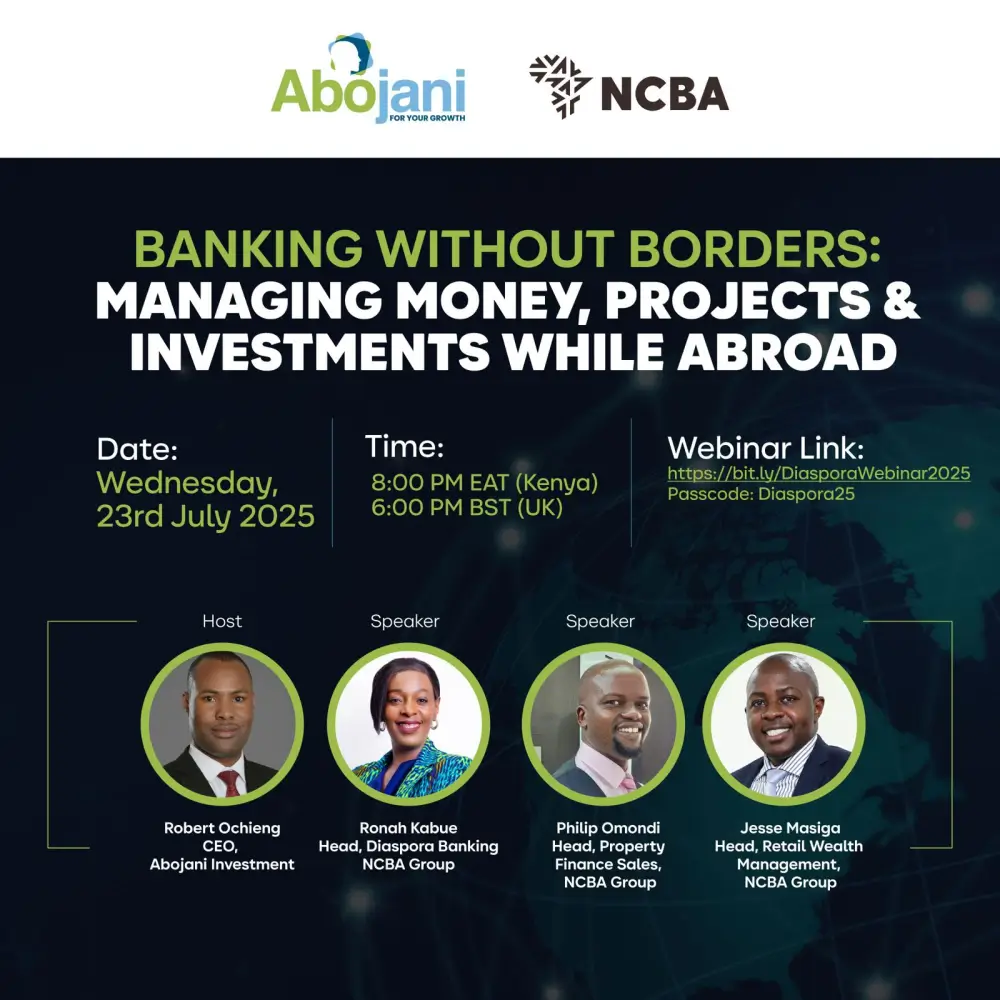

Webinar: Banking Without Borders: Managing Money, Projects & Investments While Abroad

Wednesday, 23rd July 2025

8:00 PM EAT | 6:00 PM BST

Join us for a conversation tailored for the diaspora on making smarter financial decisions from anywhere in the world.

Abojani Personal Finance, Saving & Investing Masterclass – 70th Edition

A results-driven, globally attended masterclass that helps participants realign their money with their long-term life goals. Register now to begin your transformation.

5th Abojani Economic Empowerment Conference

Scheduled for later this year, the conference will bring together business leaders, diaspora professionals, and financial experts to explore the theme of Ownership Economy & Self-Sustenance for African households and enterprises.