The half-year results from Kenyan banks confirm a period of significant growth and market consolidation. Equity Group and KCB Group are at the forefront, not only reporting substantial profit increases but also demonstrating the financial strength of their diversified portfolios. The data indicates that their core Kenyan operations and regional subsidiaries are key drivers of this performance, solidifying their positions as the market’s leading financial institutions.

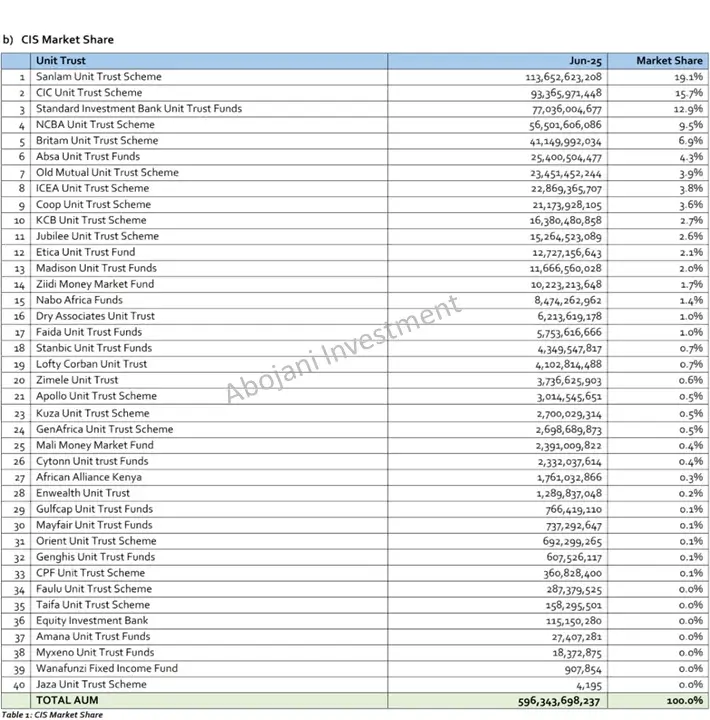

Sanlam Surpasses KSh 100 Billion AUM as CIS Market Nears KSh 600 Billion

Collective Investment Schemes’ assets under management reached KSh 596.4 billion in H1 2025. Sanlam Unit Trust Scheme now manages KSh 113 billion, widening its lead over long-time leader CIC Unit Trust Scheme.

Equity Group Reclaims Profit Leadership in East Africa

Equity Group’s H1 2025 profit after tax climbed 17% to KSh 34.6 billion, driven by strong regional performance, with subsidiaries contributing 43% of the total. The Kenyan unit posted 40% growth.

KCB Group Hits KSh 300 Billion Shareholders’ Funds, Declares Record Dividend

KCB reported an 8% rise in H1 2025 net profit to KSh 32.3 billion, becoming the first in East & Central Africa to surpass KSh 300 billion in shareholders’ funds.

Absa Breaks New Ground in Bancassurance and Custody Services

Absa posted a 9% profit after tax increase to KSh 11.7 billion. Its Bancassurance unit earned KSh 1 billion pretax in just six months, a market first, while its custody business crossed KSh 40 billion in assets.

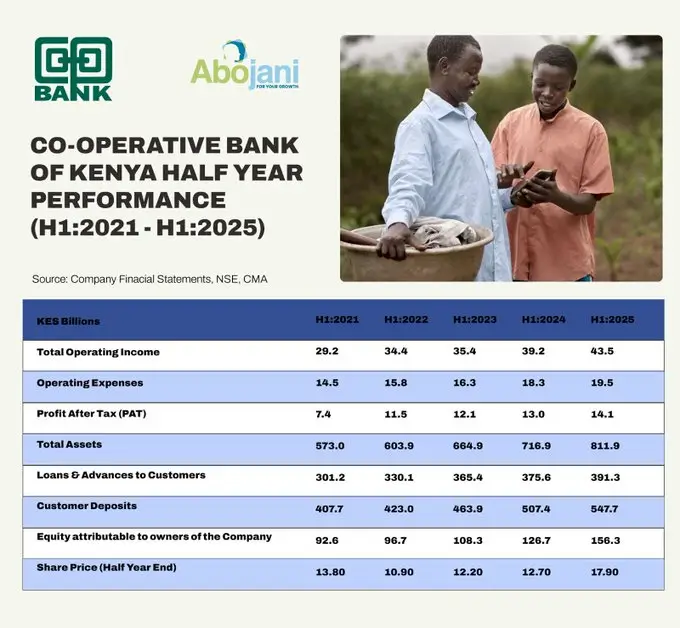

Co-op Bank Growth

Co-op Bank’s H1 profit after tax rose 8.4% to KSh 14.11 billion, with bancassurance earnings of KSh 790.8 million.

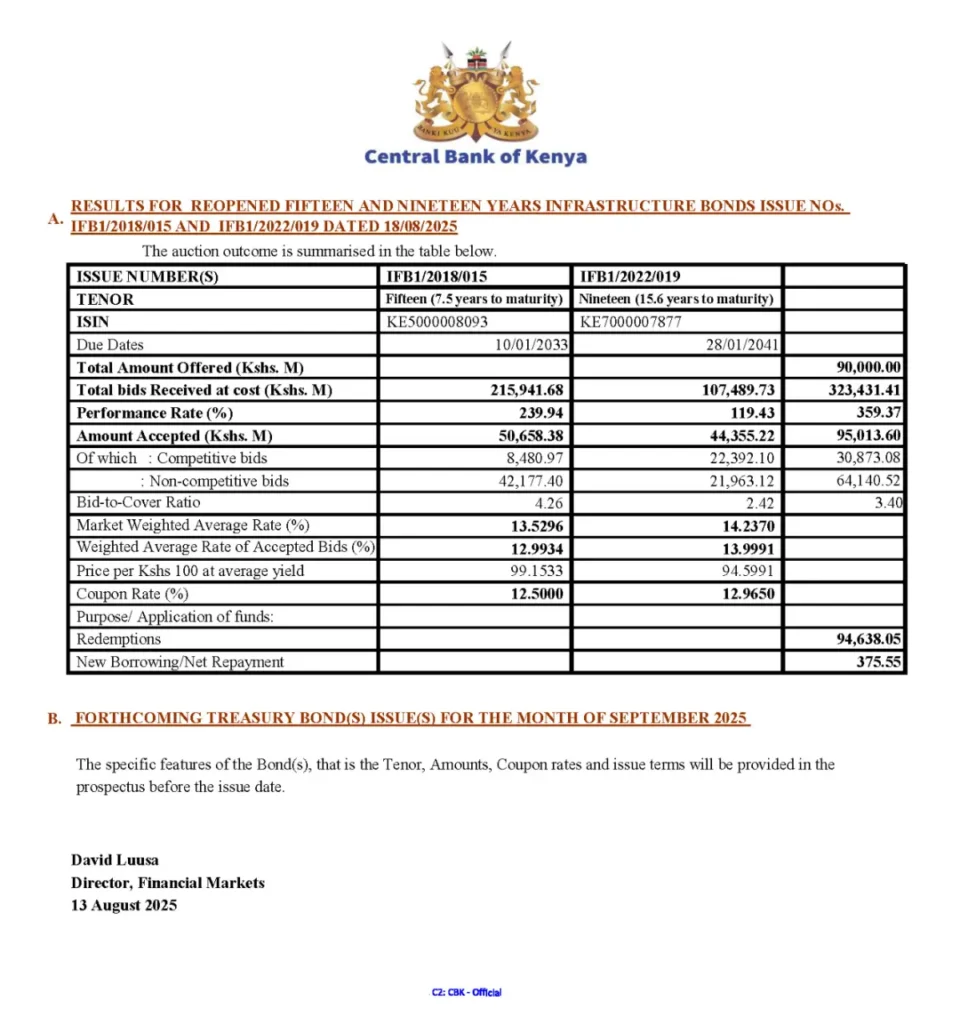

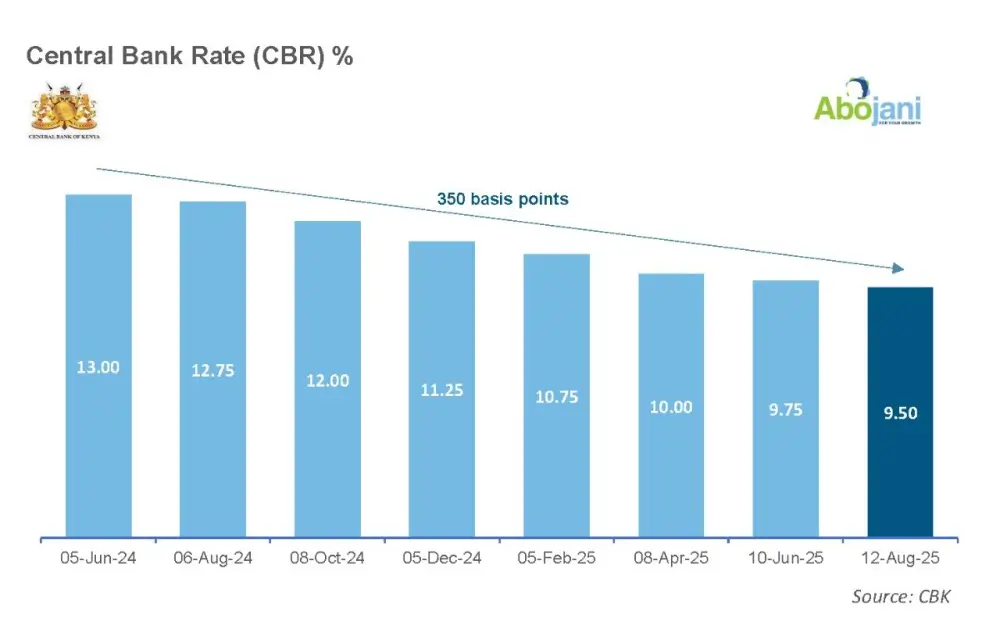

CBK Cuts CBR Again as Bonds Break Records

The CBK reduced the Central Bank Rate to 9.50%, the seventh consecutive cut.

Still on CBK, the reopened 15- and 19-year infrastructure bonds attracted bids worth KSh 323.4 billion against KSh 90 billion offered, with performance at 359.4%.

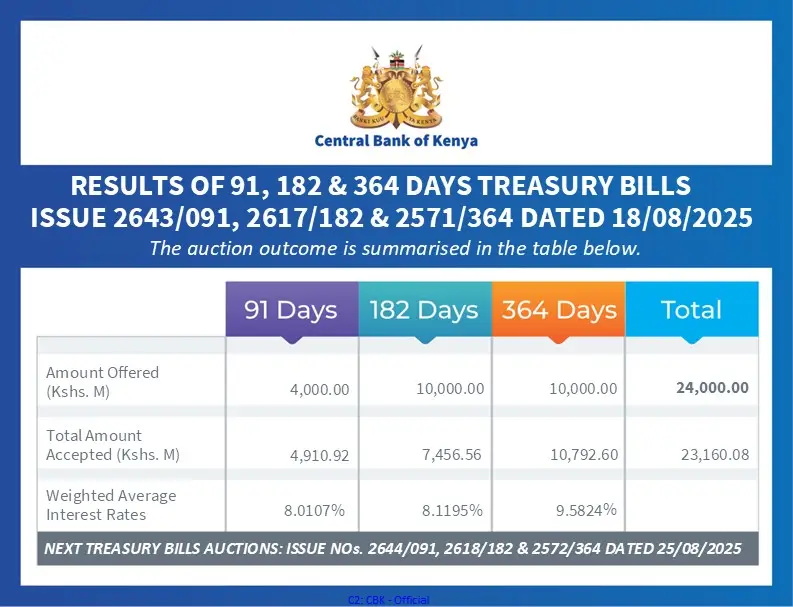

T-Bill Uptake Slightly Lower

Treasury bills were 96.58% subscribed, raising KSh 23.2 billion, with the 91-day rate averaging 8.0107%.

Equity Leaders Program Expands Global Reach

The Equity Group Foundation is sending 128 scholars from Kenya, Rwanda, Uganda, and DRC to top global universities under the Equity Leaders Program. The KSh 2.79 billion scholarships bring the total number of beneficiaries to 1,098 since inception.

NCBA Launches New Digital Personal Loan

NCBA has rolled out an unsecured Digital Personal Loan product, accessible through the NCBA NOW App, aimed at offering customers quick and convenient access to funds without the need for collateral. #NCBATwendeMbele

Upcoming Events

#WisdomSeries X Space with Samuel Kariuki, CEO, Mi Vida Homes (Aug 18)

On Thursday, August 28, 2025, from 7:00 PM to 8:00 PM EAT, we will host a “Passive Income Playbook for Investors in Kenya” session featuring Samuel Kariuki, CEO of Mi Vida Homes.

In this Wisdom Series X-Space, we will explore strategies that go beyond the hype focusing on what works, what to avoid, and how to start building returns that don’t require your constant presence.

Set your reminder: https://x.com/i/spaces/1OdKrOEZREPGX

Abojani Masterclass #71 (Sept 8) – Click the Badge Below to Register

Early bird offer of KSh 6,000 valid until Aug 31.

Our 71st Abojani Personal Finance Masterclass is scheduled for September 2025 from the 8th. Enroll now to learn all things personal finance and investing to help you get the best out of your money. #LevelUp2025

Abojani Economic Empowerment Conference (Nov 22)

The 5th Abojani Economic Empowerment Conference 2025 is set to happen on the 22nd of November 2025 at the Radisson Blu Hotel. This event will bring together investors, entrepreneurs, and champions of financial growth. Save the date for this momentous event!