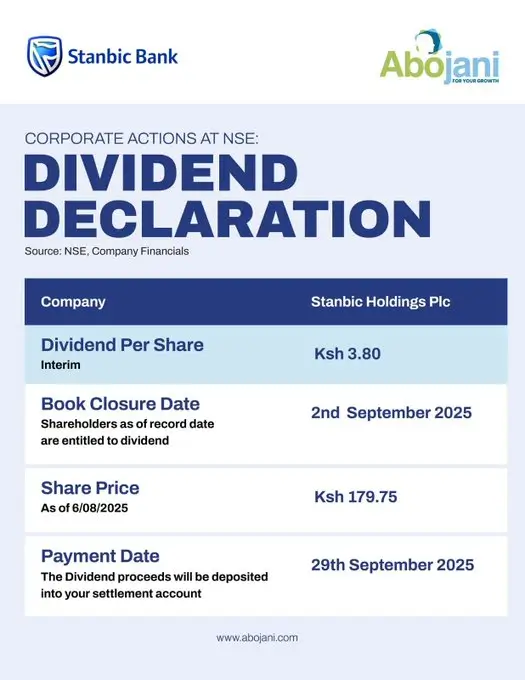

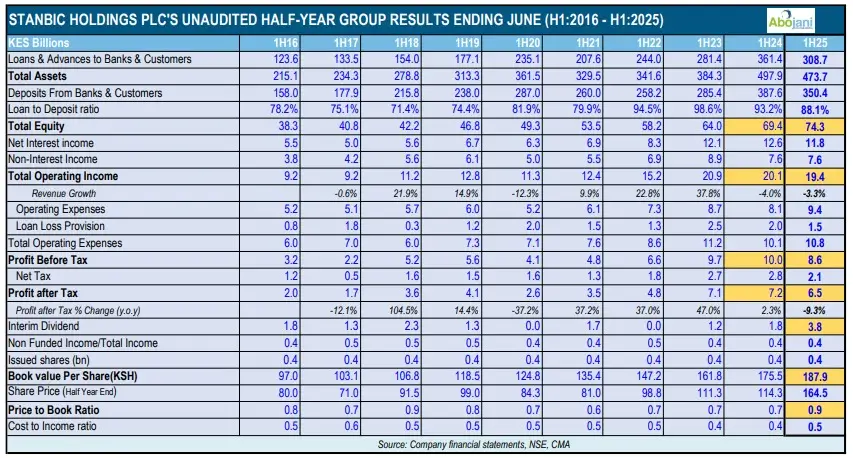

The Week in Markets: Stanbic Holdings has opened earnings season with a net profit of KSh 6.5 billion for H1 2025, reflecting a 9.3% decline from KSh 7.2 billion in H1 2024. However, in a strong show of shareholder support, the board has more than doubled the interim dividend to KSh 3.80 per share from KSh 1.84. The payout is expected on or around 29th September 2025.

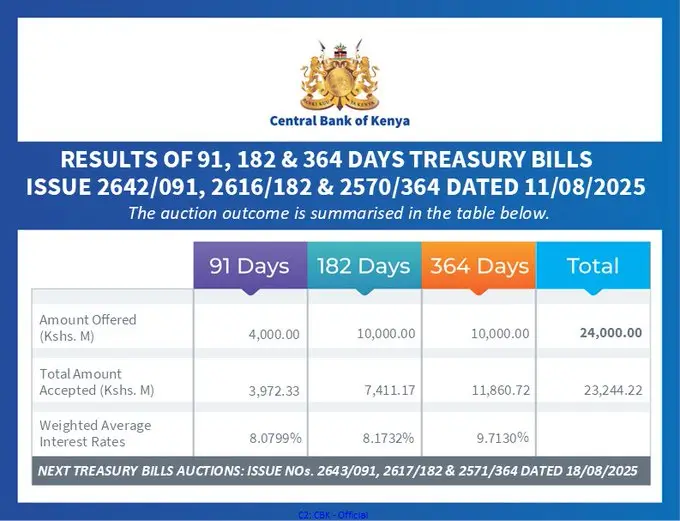

Treasury Bill Uptake Strong, Interest Rates Hold

The government raised KSh 23.2 billion through T-Bills this week, just shy of the KSh 24 billion target. Current interest rates are 8.08% for the 91-day paper, 8.17% for the 182-day, and 9.71% for the 364-day.

NSE Moves to Lower Entry Barriers for Investors

The Nairobi Securities Exchange has updated its Equity Trading Rules to allow shares to be bought and sold in single units. This move enables Kenyans to start investing in listed companies with as little as the cost of one share, a major step toward financial inclusion.

Corporate Updates

Absa Launches 110% Eco-Home Loan, Releases 2024 Sustainability Report

Absa Bank Kenya has introduced a market-first 110% Eco-Home Loan to finance climate-friendly home upgrades from solar installations to water-saving systems. In its latest Sustainability and Climate Report, Absa also disclosed that it channeled KSh 47 billion into sustainable finance in 2024, planted over 1.5 million trees, and reduced its electricity-related emissions by 38% since 2019.

Green Housing Gets a Boost from Europe

Kenya’s push for affordable, sustainable housing has received a KSh 3.2 billion injection from the European Investment Bank. The funds, channeled through EIB Global into the IHS Kenya Green Housing Fund, will support climate-conscious housing developments.

Chama Power: Rongai Operators Buy Minibus Through Group Savings

In Rongai, 50 tuktuk and boda boda operators under the Nyoroma Self-Help Group have pooled resources and, through Equity Bank’s asset finance programme, purchased a brand-new 33-seater minibus. This shows how disciplined saving and group banking can unlock access to larger business assets.

KCB Foundation Opens Applications for Vocational Scholarships

The KCB Foundation is accepting applications for vocational training scholarships under the 2Jiajiri Programme. The initiative targets Grade 3 level skills training and is available in Nairobi, Nakuru, Nyandarua, and Trans-Nzoia Counties.

Regulatory Updates

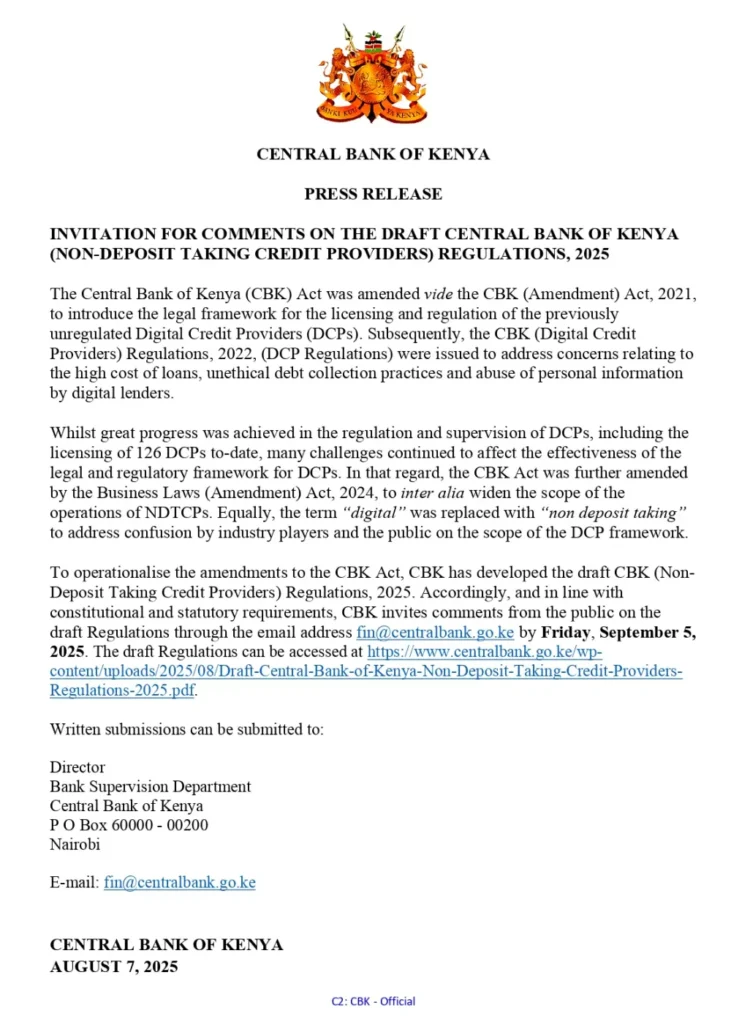

CBK Proposes New Rules for Non-Deposit Credit Providers

The Central Bank of Kenya has published draft regulations targeting non-deposit-taking credit providers. The proposed rules aim to improve borrower protection through clearer loan terms, ethical debt collection, and stricter data handling. Public feedback is open until early September.

Coming Up

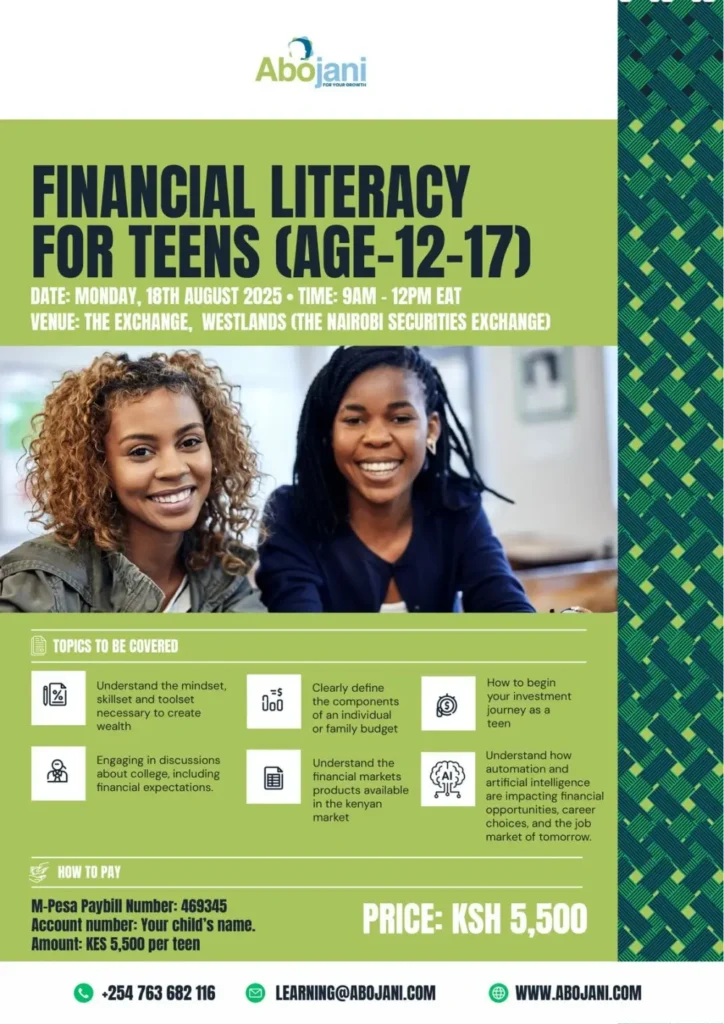

Finance4Teens Workshop: This week, we’re transforming the NSE Trading Floor into a hands-on learning space where teenagers will explore practical money skills like budgeting, investing, and wealth-building.

Abojani Masterclass #70: Our 70th Personal Finance, Saving & Investing Masterclass kicks off today at 7PM. There’s still time to Register HERE!

Abojani Economic Empowerment Conference 2025: Scheduled for 22nd November 2025 at Radisson Blu, Nairobi.

This year’s theme is “Ownership Economy & Self-Sustenance for African Households and Businesses.”