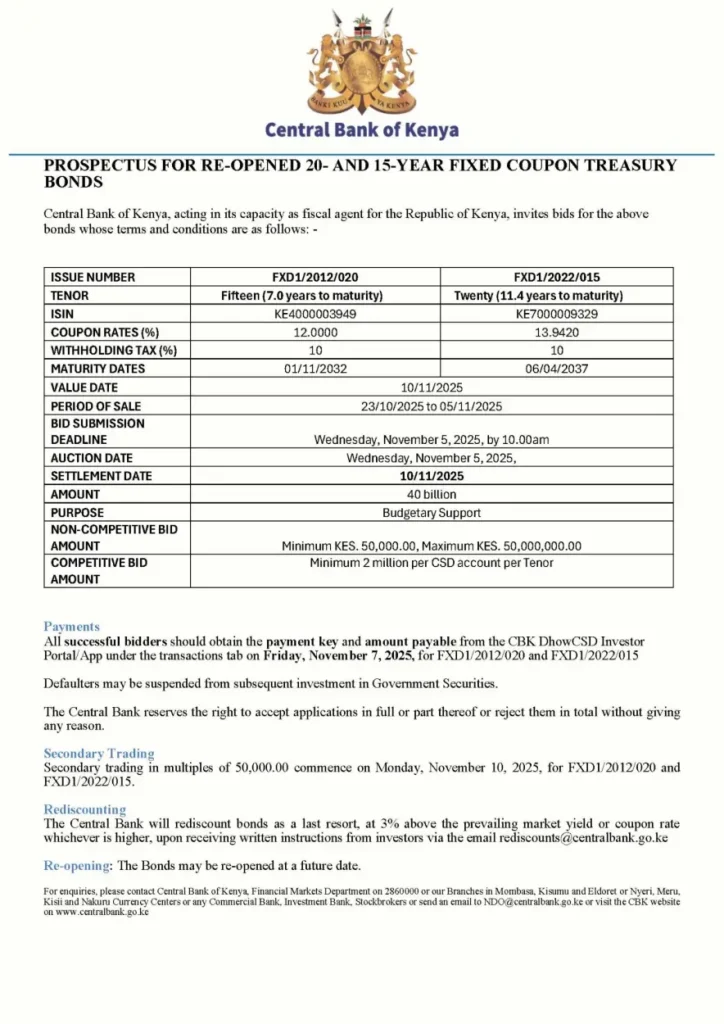

The Central Bank of Kenya has reopened the 20-year (FXD1/2012/020) and 15-year (FXD1/2022/015) Treasury bonds, seeking to raise Ksh 40 billion. The coupon rates are set at 12% and 13.942%, respectively.

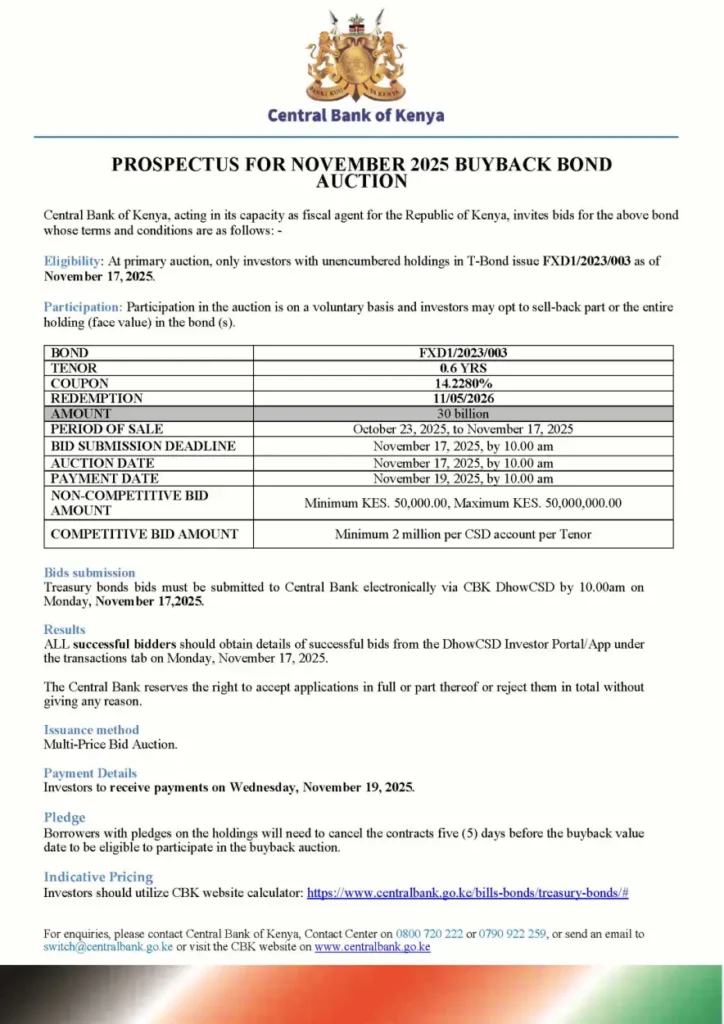

The Central Bank of Kenya has also announced a buyback auction for bond FXD1/2023/003, with a 0.6-year tenor and a 14.228% coupon rate, targeting Ksh 30 billion. The auction will take place on November 17, 2025, and successful bidders will receive payments on November 19, 2025.

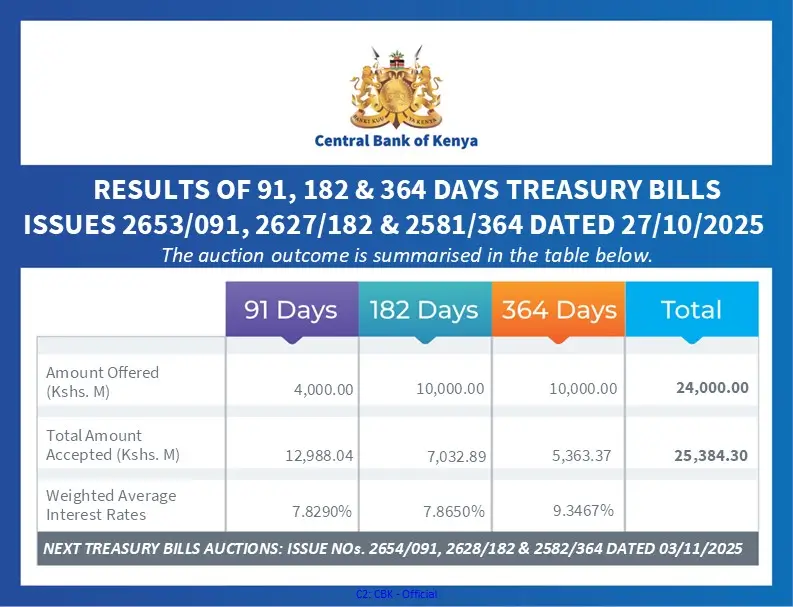

Additionally, this week the Central Bank of Kenya offered Ksh 24 billion worth of Treasury bills, received bids totaling Ksh 25.404 billion, and accepted Ksh 25.384 billion. The 91-day T-bill yield, a key benchmark rate for money market funds, stood at 7.8290%.

NCBA Bank’s Commercial and SME Division has successfully concluded its 2025 China Business Immersion, a 12-day trade mission across Shanghai, Yiwu, and Guangzhou. The initiative aimed to connect African entrepreneurs with global markets and sourcing opportunities.

5) Tanzania has launched its first Exchange-Traded Fund (ETF), the Vertex International Securities ETF (VIS-ETF), on the Dar es Salaam Stock Exchange (DSE).

The Kenya Bankers Association hosted another insightful #CEOChat edition this week featuring Raphael Lekolool, Postbank Kenya’s MD, who shared practical insights on how MSMEs and entrepreneurs can access cheaper credit and grow their businesses.

Watch the discussion here:

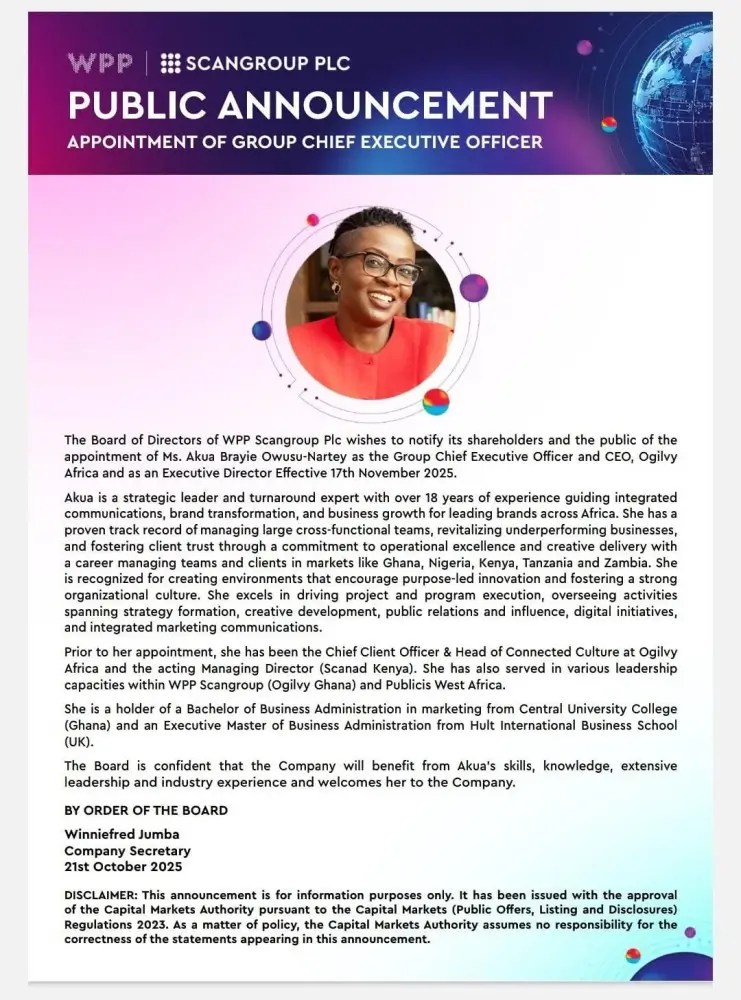

WPP Scangroup Plc has appointed Ms. Akua Brayie Owusu-Nartey as the new Group Chief Executive Officer and CEO, Ogilvy Africa, effective 17th November 2025.

Upcoming Events

The Kenya Bankers Association will host Osman Dualle, CEO of Premier Bank, in next week’s #CEOChat to discuss Islamic Banking. Join the conversation: http://chat.kba.co.ke

East African Breweries Plc (EABL) shareholders are set to receive a final dividend of KES 5.50 per share next week, on October 28, 2025.

To wrap up the week, we invite you to the 5th Abojani Economic Empowerment Conference, where thought leaders, entrepreneurs, and professionals will share insights on how African households and businesses can achieve lasting financial independence.