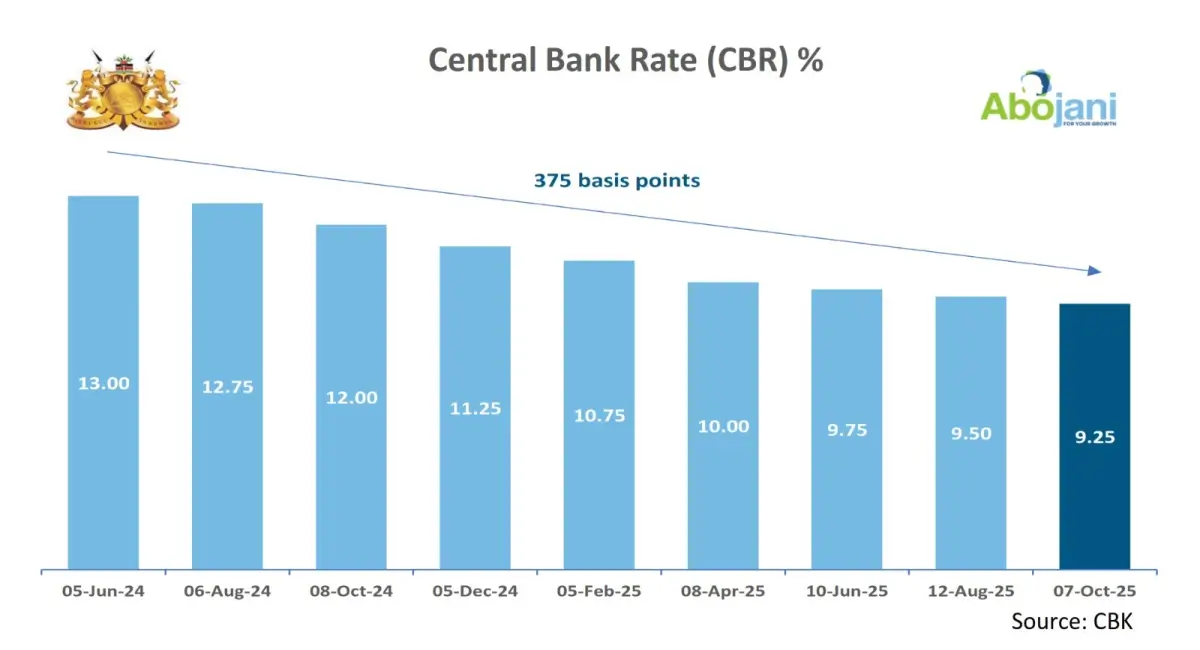

1. The Monetary Policy Committee (MPC) has lowered the Central Bank Rate (CBR) by 25 basis points, from 9.5% to 9.25%.

2. NCBA Insurance held a Cyber Conference this week, themed “Cybersecurity: A Global and Urgent Priority.” During the event, NCBA Insurance launched CyberGuard, a comprehensive cyber insurance solution designed to protect businesses across Kenya from evolving digital risks.

#NCBATwendeMbele #Goforit

Also read: Kenya’s Inflation Edges Up to 4.6% in September 2025

3. CIC has launched the Global Balanced Special Fund, a USD-denominated fund designed to provide Kenyan investors with access to offshore global investments.

4. Sanlam Kenya also launched the Sanlam Akiba Plus, a tech-powered pension platform designed to assist Kenyans in saving more effectively and retiring with dignity.

5. Safaricom launched its 14th Sustainable Business Report, reaffirming its commitment to ESG principles. In FY2025, the telco’s total economic, social, and environmental impact reached Ksh 1.1 trillion, 16 times its financial profit, and it contributed Ksh 809 billion to Kenya’s GDP.

#SustainableSafaricom

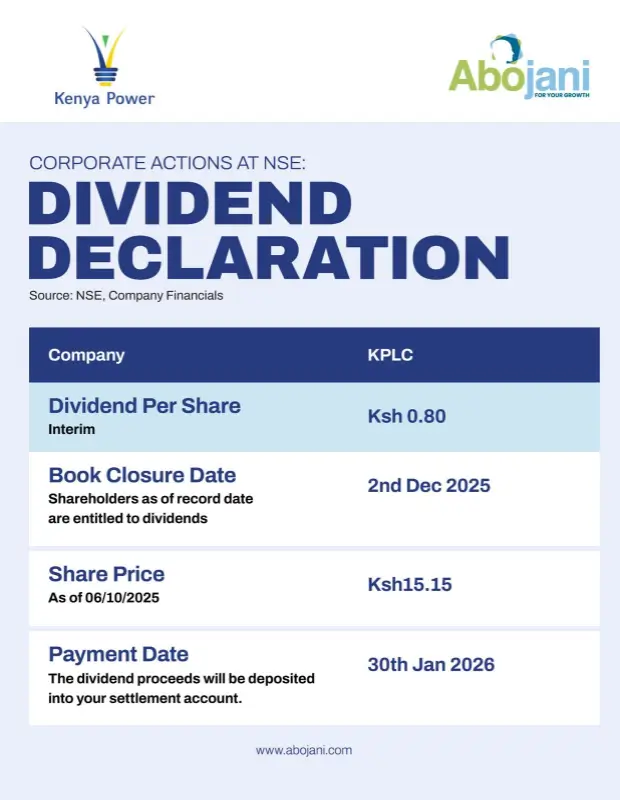

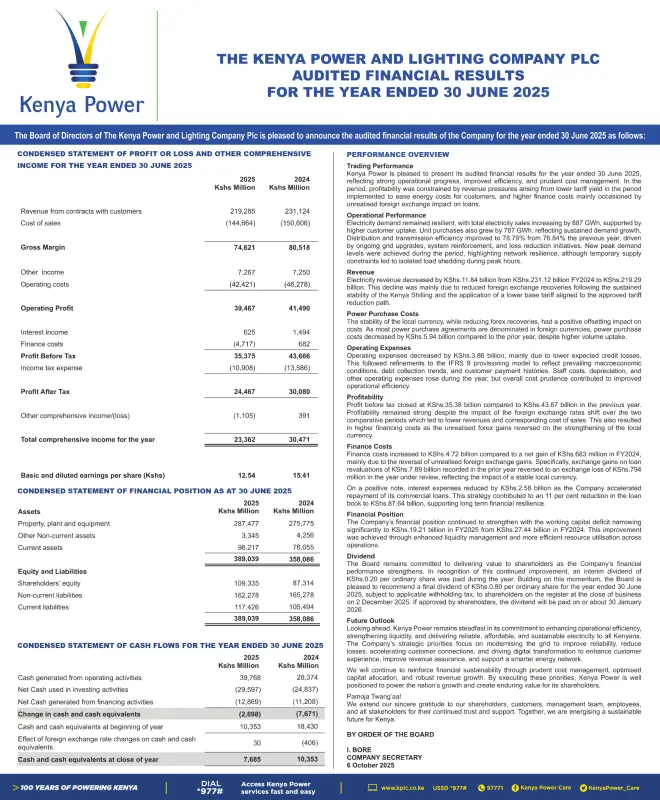

6. KPLC declares a final dividend of Ksh 0.80 despite a 19% drop in profit to Ksh 24.5 billion, from Ksh 30.8 billion last year.

7. The Kenya Bankers Association kicked off its October – November 2025 #CEOChat edition this week with an informative discussion featuring Jubril Adeniji, MD, GTBank Kenya, on Loan Repayment History: Why It Matters and How It Can Save You Money.

8. The Nairobi Securities Exchange has appointed Ms. Nancy Angano Noreh as Non-Executive Director. She currently serves as Acting Chief Executive of Sterling REIT Asset Management and as General Manager of Sterling Capital.

9. Upcoming Events

Investors can look forward to BOC Kenya’s interim dividend payment on October 14, 2025, and Absa Bank Kenya’s on October 15, 2025.

Later in the week, KBA will host #CEOChat with Mary Mulili, MD & CEO of UBA Kenya, on Friday, October 17, 2025 (10:00 a.m –11:00 a.m. EAT) to discuss “Cross-Border Trade and Payment Solutions: Opportunities for MSMEs in Kenya.”

10. Africa’s next phase of growth depends on ownership, not dependency.

This year’s Abojani Economic Empowerment Conference focuses on how African households and businesses can build assets and wealth that create lasting impact.

Nov 22, 2025 | Radisson Blu, Upper Hill