Many people approach wealth the way they approach a deadline – as a sprint not a marathon: with urgency, pressure, and the hope that if they just push hard enough, fast enough, they’ll get ahead. And for a while, maybe they do.

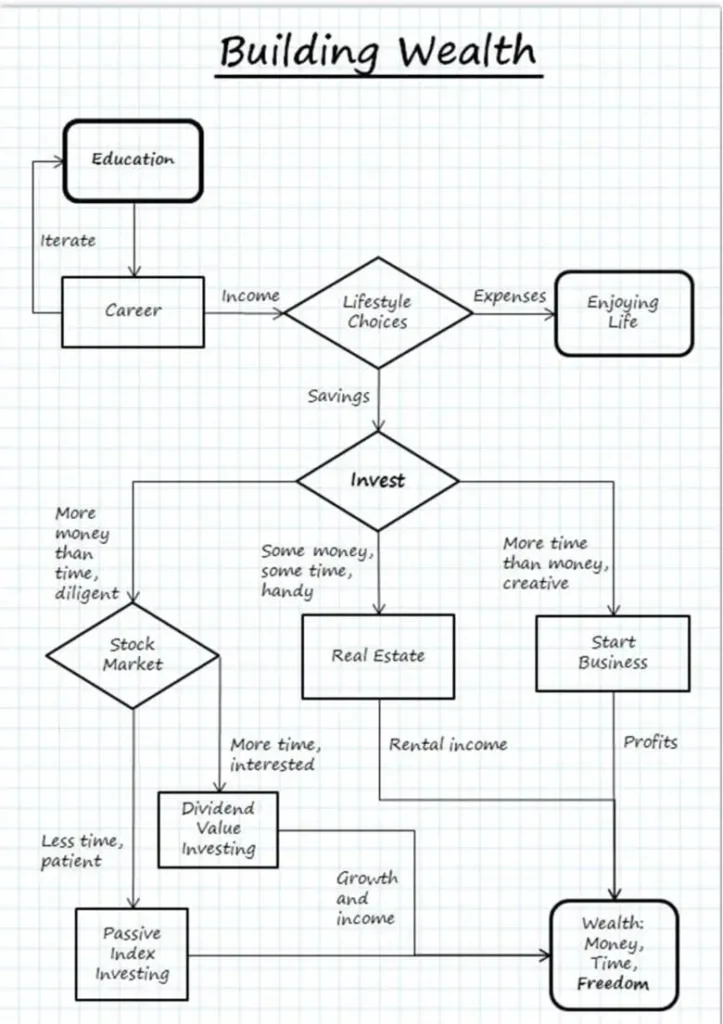

A side hustle here, a gig there, a smart flip, a lucky investment. But the wealth that stays, holds you through a storm, supports your family, and outlives your energy; it never comes from speed. It comes from structure.

Also read: Compound Interest: The Engine Behind Wealth Building

The structure of income that doesn’t demand your presence. The structure of savings that cushions you during change. The structure of investments that outpace inflation. The structure of a life where your money has direction, not just motion.

Remember that you can’t build structure if you’re always chasing emergencies. You can’t build wealth while constantly patching holes. There must come a point where your energy shifts, from making money to keeping and growing it. That point usually requires a mindset change.

It requires understanding that every coin you earn is a seed. You can spend it, or you can plant it, nurture it, and let it compound into something that serves you later. And wealth, in that sense, becomes less about effort and more about patience, discipline, and clear decisions.

Not everyone who makes money keeps it. And not everyone who keeps it grows it. But everyone who grows it builds a structure around it. They plan. They prioritize. They say no to shortcuts that cost more later. They make room not just for profits, but for rest, resilience, and regeneration.

That’s the kind of wealth that doesn’t disappear when the economy shifts or when your energy dips. It’s the kind that protects your future, powers your dreams, and gives your family stability.

So the question isn’t how fast you can hustle. It’s whether your money has somewhere meaningful to go when it arrives. The race is how well you build your structure.