There’s a phase many people go through that gets easily overlooked, and only identified once the damage has been done.

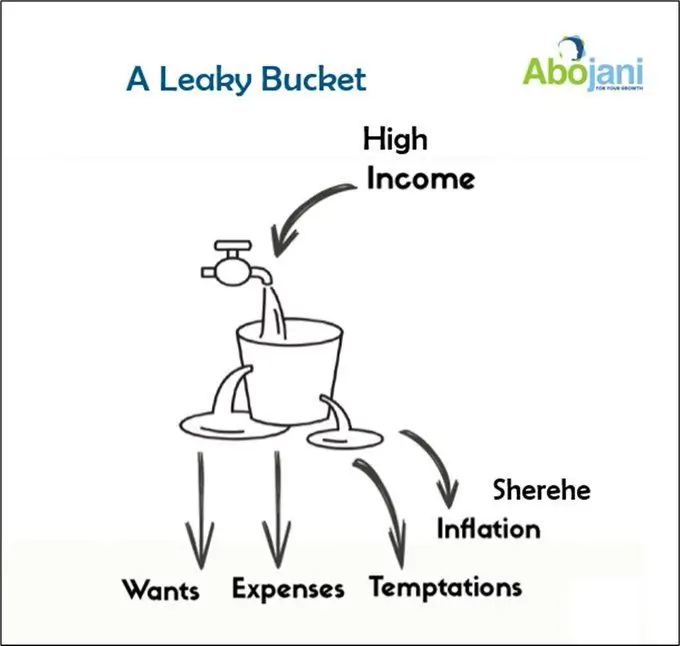

It starts when the income finally improves. Maybe it’s a promotion. A new job. A successful side hustle. Suddenly, there’s room for nicer things, better clothes, upgraded gadgets, spontaneous trips, a better apartment.

You feel like you’re finally “catching up.” You can breathe. You can afford things you used to delay or deny.

And for a while, it feels like progress because on the outside, everything looks good.

But the reality is that nothing is being built.

Also read: The Essence of Delayed Gratification in Wealth Creation

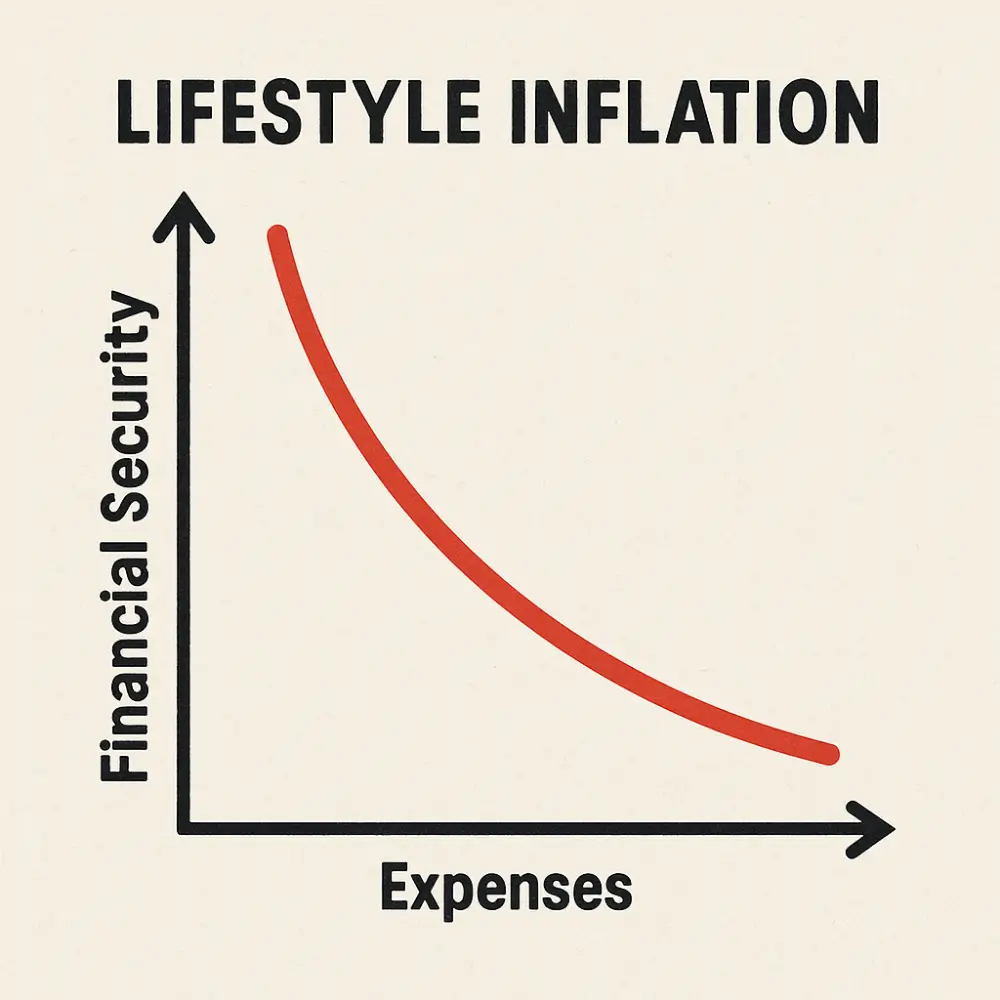

You’re spending more, but you’re not saving more. Your standard of living is improving, but your actual financial position isn’t. There’s no emergency fund. No investments. No debt reduction. No long-term plan.

It’s a trap that disguises itself as success.

Because society teaches us to measure growth by upgrades, we always get caught up in the mess. But your financial health is like an ocean, and how your life looks is just the ripples on the surface. Financial health is what would happen if your income stopped for three months. It’s about whether your future is secure, or only your present is comfortable.

And if all the money you make is consumed by the life you’re trying to maintain, it’s not growth, it’s just motion in the water.

There’s nothing wrong with enjoying your money. You worked for it. You deserve rest, pleasure, and experiences. But balance is everything. If your lifestyle inflates with your income, you’re simply not building.

Real financial progress is quiet.

It looks like delayed gratification. Like a smaller apartment, even when you can afford more. Like investing before upgrading your phone. Like driving the same car even though people assume you’d have changed it by now.

That’s how freedom is built; with firm foundations.

So if you’ve started earning more, good. Now the question is: will this new income grow your life, or just dress it up?

Sometimes, it’s best to seem behind while moving wisely.