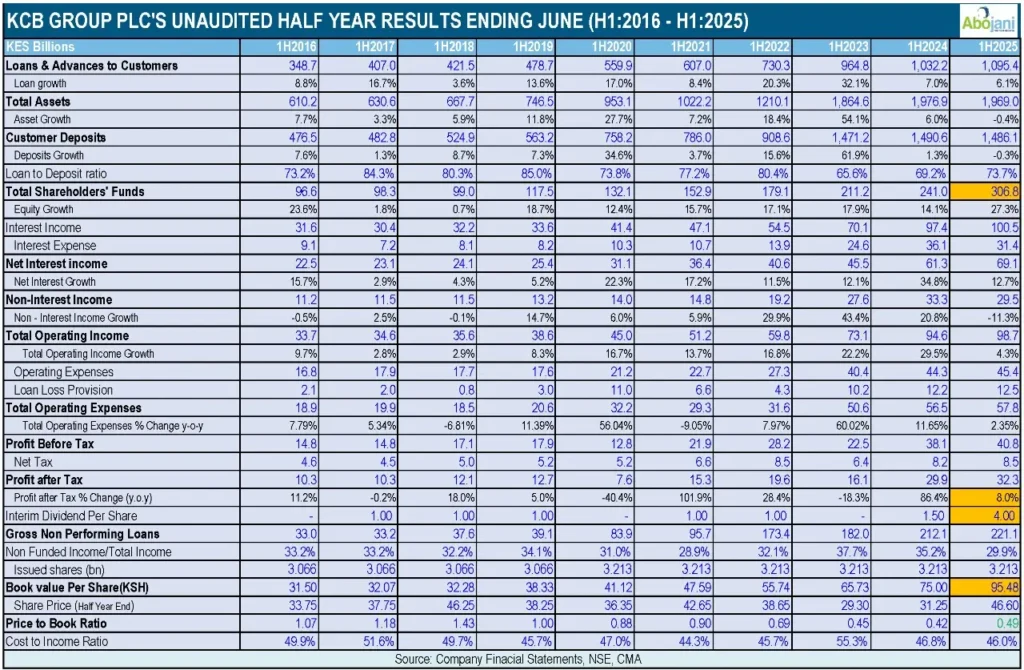

KCB Group PLC has announced robust half-year results for the period ending June 2025, posting an 8% growth in net profit to KES 32.3 billion. In a landmark move, the Board has approved a KES 13 billion shareholder payout; comprising an interim dividend of KES 2.00 per share and a special dividend of KES 2.00 per share linked to the sale of the National Bank of Kenya (NBK), bringing the total dividend to KES 4.00 per share. This marks the largest interim dividend and the first special dividend in the Group’s history, set for payment on or about 11 November 2025.

Also read: Stanbic Kicks Off Earnings Season with Steady Numbers, Big Dividend Surprise

KCB’s strong performance was underpinned by strategic growth in earning assets and a sharpened focus on customer-centric initiatives across its network. Subsidiaries outside Kenya continued to play a critical role, contributing 33.4% of profit before tax and 31.4% of the balance sheet. Non-banking entities; including KCB Investment Bank, KCB Asset Management, and KCB Bancassurance, also saw improved contributions to Group earnings.

Despite the sale of NBK in Q2 2025, total assets remained stable at KES 1.97 trillion, demonstrating resilience and capacity to serve customers across its seven operating countries. The loan portfolio grew 2.8% (or 12% excluding NBK’s impact) to KES 1.18 trillion, while customer deposits stood at KES 1.48 trillion, reflecting stable liquidity and strong brand confidence.

Total revenue rose 4.3% to KES 98.6 billion, driven by a net interest income increase to KES 69.1 billion, supported by higher yields and loan volumes. Non-funded income remained strong at KES 29.5 billion, accounting for 29.9% of total revenue, despite a softer foreign exchange environment.

The Group maintained its focus on operational efficiency, with costs up only 2.4% and the cost-to-income ratio steady at 46.0%.

Digitally, KCB is moving with purpose. 99% of transactions now happen outside the branch, and the new unified mobile app launched this August takes convenience a step further with AI, instant self-onboarding, and a mini-app ecosystem.

The Group’s non-performing loan (NPL) ratio improved to 18.7% from 19.2%, supported by proactive credit risk management. Capital and liquidity buffers remained well above regulatory requirements, with a core capital ratio of 17.0% and liquidity ratio of 47.2%.

Aligned with its People and Planet strategy, KCB issued KES 26.9 billion in green loans during H1 2025 and screened KES 133.2 billion in facilities for environmental and social due diligence. The Group also made significant contributions to sports, education, and community development, and continued to receive global recognition for corporate responsibility and ESG leadership.

Outlook

KCB Group Chairman, Dr. Joseph Kinyua, noted that the strong H1 performance, combined with the Group’s strategic positioning, provides the capacity to reward shareholders while investing for future growth. Group CEO, Paul Russo, reaffirmed the focus on customer needs, operational resilience, and leveraging regional scale to deliver sustainable value.

“The strong half-year performance and the projected trajectory of the business has allowed us a great bandwidth to propose a historic special and interim dividend to shareholders,” said Dr. Kinyua.

As KCB continues its growth journey, the Group remains committed to driving economic transformation across the region while delivering superior returns for shareholders.