For many Kenyans living abroad, the idea of investing back home is filled with both promise and apprehension. There’s the deep desire to secure a home, grow a business, or support loved ones. But alongside that are legitimate concerns: Will my money be safe? Can I trust the people managing it? What if I plan to return home, how do I transition with my finances in order?

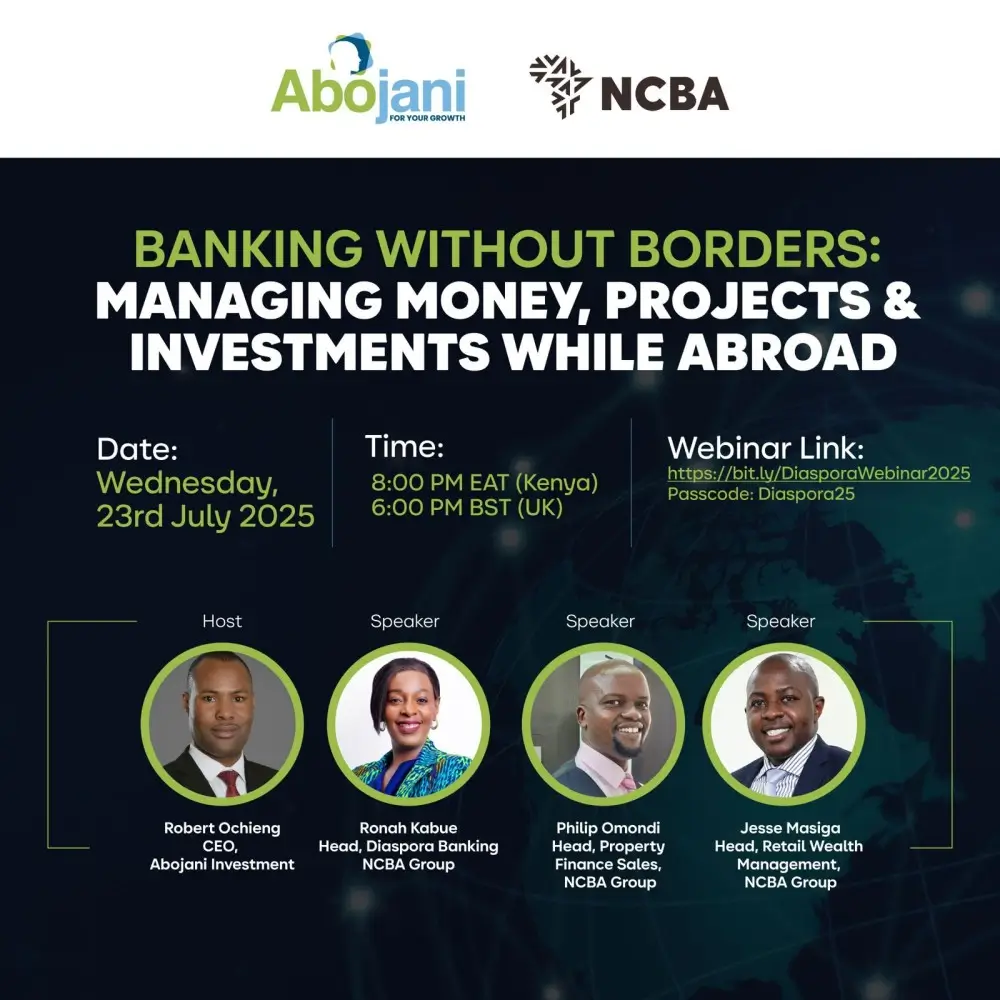

These were some of the core questions explored during Banking Without Borders: Managing Money, Projects & Investments While Abroad, a recent webinar hosted by Abojani in partnership with NCBA. The conversation brought together seasoned experts from NCBA to unpack the opportunities and pitfalls of diaspora investing, and more importantly, how to navigate them confidently.

The session featured Jesse Masiga (Head, Retail Wealth Management), Ronah Kabue (Head, Diaspora Banking), and Philip Omondi (Head, Property Finance Sales), who each brought unique perspectives on investing, real estate, financial structure, and long-term planning.

Property remains one of the top investment choices for Kenyans in the diaspora, but it’s also one of the most emotionally charged. Philip Omondi addressed a familiar concern: funds meant for land or construction often fall into the wrong hands or disappear altogether.

“It’s common to rely on family and friends, but when investing, complement personal trust with professional structures — even when dealing with family,” Philip advised. He emphasized the importance of working with professionals: engaging surveyors, conducting title searches, and involving lawyers to ensure legitimacy. These steps aren’t luxuries; they are safeguards.

Diaspora investors are encouraged to rethink how they define a “good” property. “When choosing a property investment, ask yourself; is it near a road, a school, or a hospital? Those are the things that drive long-term value.”

And for those overwhelmed by the idea of investing from a distance, Philip broke it down simply: “Start with regulated institutions that have a local footprint. Let professionals verify legitimacy and protect your interests.”

One of the most overlooked tools for diaspora investors is something surprisingly basic: a local bank account. But as Ronah Kabue pointed out, it’s far from simple in its impact.

“A bank account is not just for transactions,” she said. “It’s your gateway to investing and growing your wealth back home.” From facilitating monthly transfers to enabling access to property finance and investment products, the humble bank account is the starting point for every financial journey.

NCBA offers diaspora-friendly accounts with multi-currency options, zero ledger fees, and remote onboarding. “You can open a USD, GBP, or KES account, access it via internet or mobile banking, and even update your details through WhatsApp — no forms, no fuss,” Ronah explained.

But her advice went beyond logistics, it was about mindset. “Don’t just plan around your current income abroad. Plan around what your costs will be once you return.” In other words, it’s not just about investing for today, but preparing financially for a future back home that may come sooner than expected.

For many in the diaspora, hesitation around investing isn’t always about lack of funds, it’s about fear. Fear of losing money, fear of making the wrong move, or simply not knowing where to start. Jesse Masiga tackled this emotional barrier head-on.

“People wait too long to start,” he said. “The best time to invest was yesterday. The next best time is now.” His advice: start with what you have. What matters more than size is consistency, clarity, and a plan.

Jesse introduced a simple but powerful framework: capacity vs. tolerance. “You might have the capacity to invest $200,000, but can you tolerate seeing that drop to $100,000 due to market swings? Knowing both helps you invest wisely.”

Beyond building wealth, Jesse emphasized the importance of protecting it through insurance, structured planning, and even estate planning. “NCBA’s approach is holistic. We look at your life stage and match your needs to investment vehicles that make sense for your goals and appetite for risk.”

Throughout the webinar, a common thread ran through all their insights: successful diaspora investing isn’t about doing everything yourself. It’s about building the right systems, surrounding yourself with professionals, and working with institutions that understand both the global and local landscape.

Whether it’s owning a dream home, managing a project back in Kenya, or just ensuring bills and responsibilities are handled smoothly from abroad, the formula remains the same:

✅ Structure over sentiment – trust your instincts, but back them up with documentation and professionals

✅ Start small, but start smart – let your financial plan evolve with your capacity and comfort

✅ Use the right tools – a bank account, a verified partner, and a regulated institution go a long way

✅ Plan for the return – financially, emotionally, and logistically

Investing back home doesn’t have to be a leap of faith. With the right partners, the right mindset, and the right tools, Kenyans in the diaspora can build wealth securely and transition home smoothly, when the time comes.

As the conversation from this webinar made clear, the opportunity is there. The next step is yours.