Here’s Your Dose of Weekly Highlights and Economic Outlook 2026

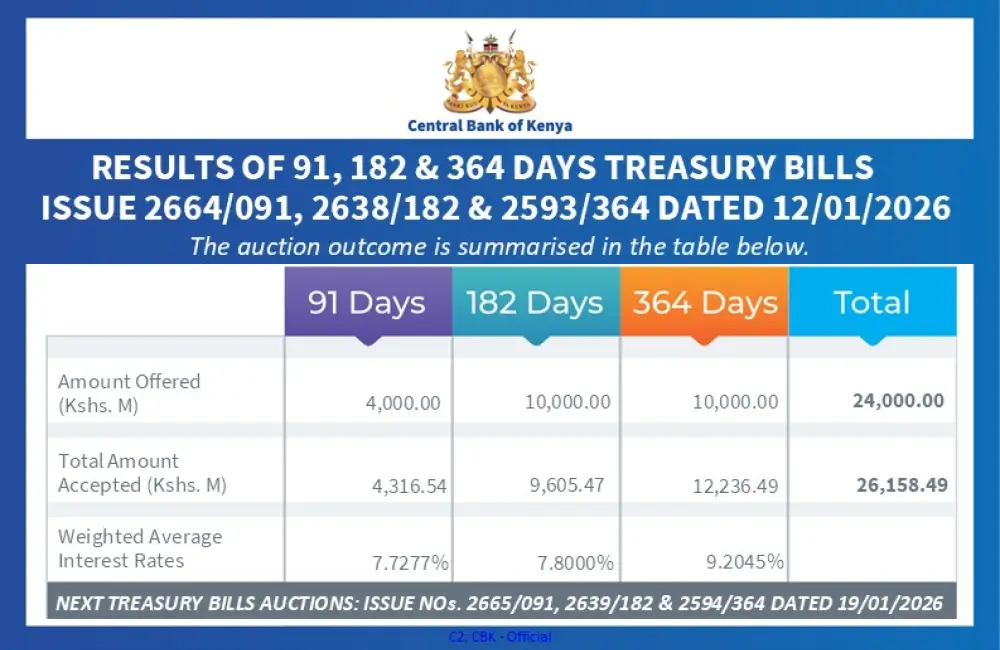

Treasury Bills and Bonds Oversubscription

Treasury bills were oversubscribed this week at 130.28%, with the government raising KSh 26.15 billion out of the offered KSh 24 billion. The 91-day weighted average interest rate stood at 7.7277%.

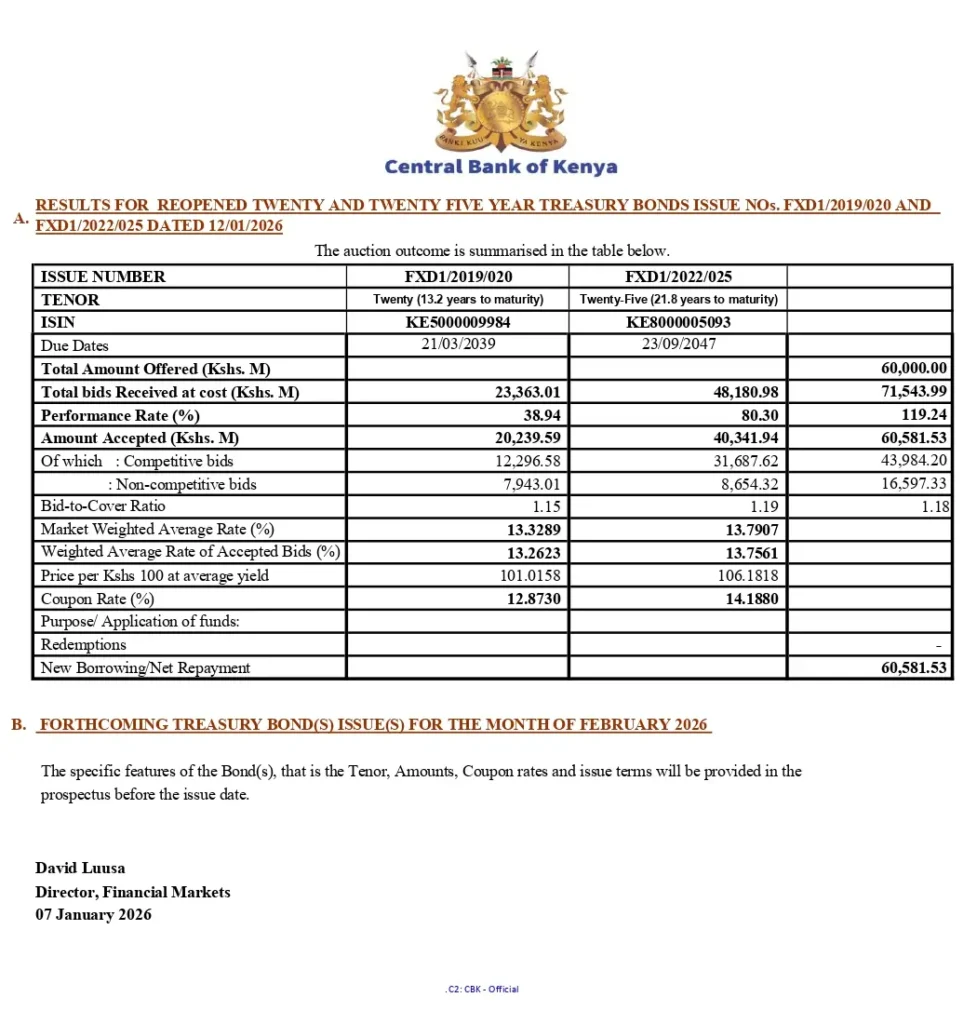

The reopened 20-year and 25-year Treasury Bonds were also oversubscribed, with a subscription rate of 119.24%. CBK offered KSh 60 billion, received KSh 71.54 billion in bids, and accepted KSh 60.58 billion. The 25-year bond received the majority of bids. Coupon rates are 14.1880% for the 25-year bond and 12.8730% for the 20-year bond.

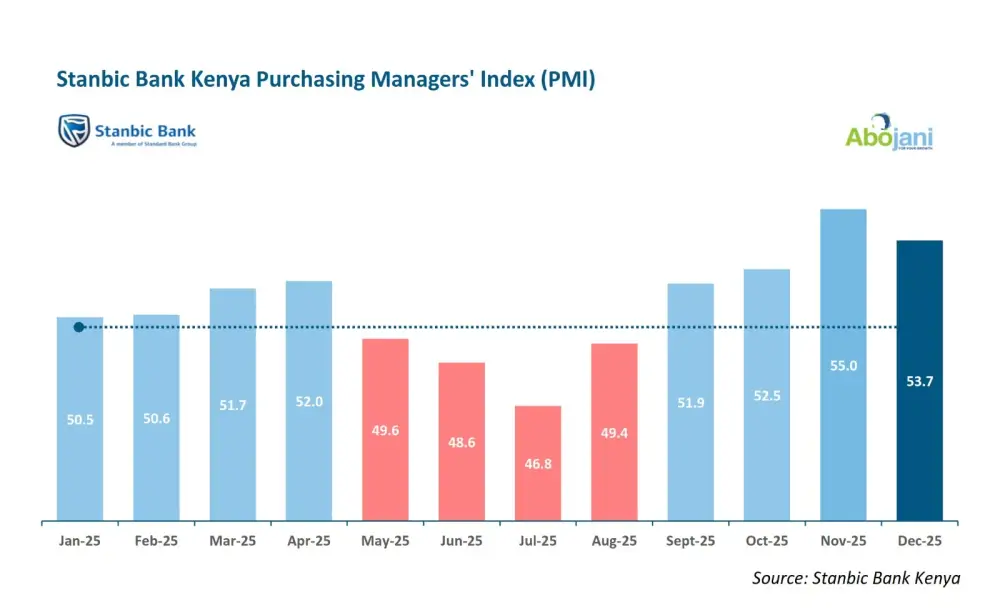

Private Sector Performance

Kenya’s private sector ended 2025 on a strong note. The Stanbic Bank Kenya Purchasing Managers’ Index (PMI) for December stood at 53.7, signaling robust growth in business activity. Companies reported rising customer demand, stronger sales, and the fastest employment growth since November 2019.

NCBA Go-Getter Internship Programme

Forty-five young professionals completed the third NCBA Go-Getter Internship Programme. Interns collaborated across teams, combining skills and perspectives to solve real business challenges with a strong focus on the customer. Since the programme began, 150 interns have participated, with nearly 40% securing permanent roles.

#NCBATwendeMbele #NCBAGoGetterInternship

Board Appointment

Mr. Peter Gitau has been appointed as an Independent Non-Executive Director of Unga Group Plc, following the retirement of Ms. Shilpa Haria.

CBK CEO and Credit Outlook

According to the CBK Chief Executive Officers’ Survey, CEOs expect sustained growth over the next 12 months, supported by favorable weather, a stable macroeconomic environment, easing lending rates, and technology adoption. Risks remain from high business costs, weak consumer demand, and global uncertainties.

Private sector credit growth is expected to rise in 2026, driven by stronger credit demand, improved business activity, and lower interest rates, although high business costs, reduced disposable incomes, and pending government bills may limit growth.

Wisdom Series Webinar: Diversification

We kicked off the year with our first Wisdom Series webinar on “Diversification: Building Strong Portfolios for 2026.” Key takeaways included:

- Asset classes feed on each other.

- Follow people with results, not the loudest.

- Take time to understand the backstage story if you’re serious about achieving goals.

- People are the real assets, success in business or career requires strong interpersonal skills.

Click HERE for the Webinar Recording

Passcode: Wisdom@2026

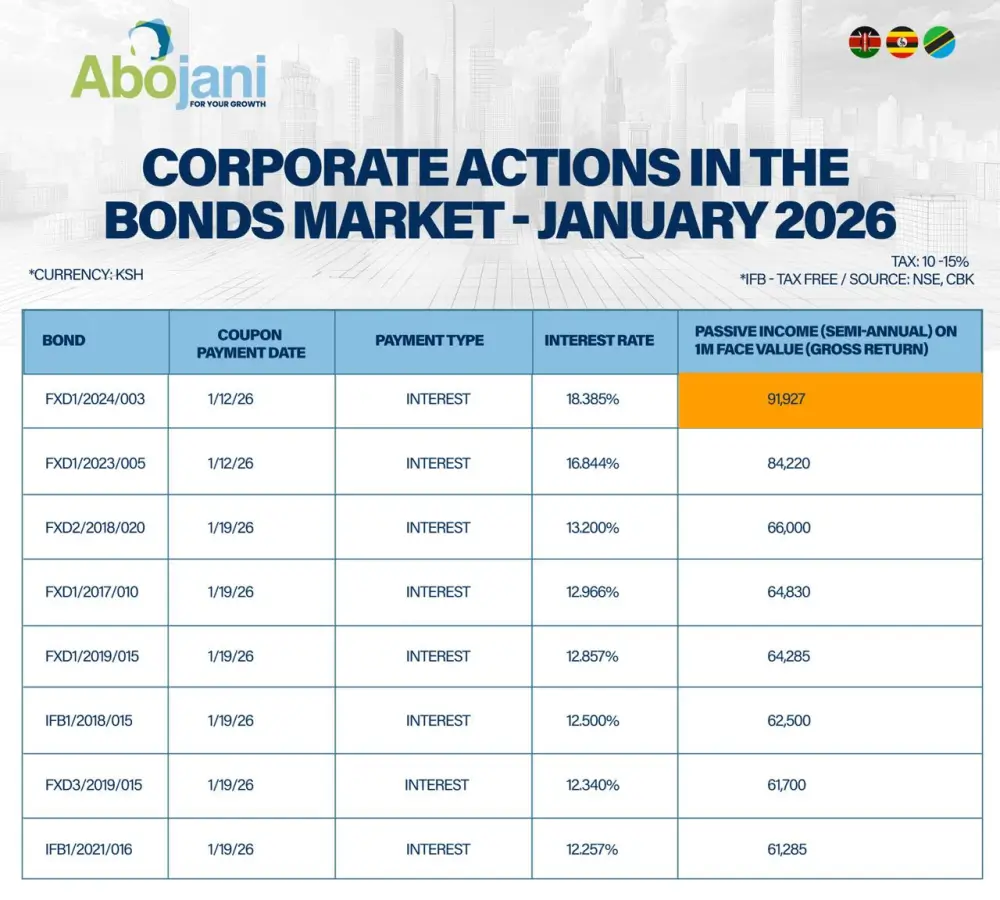

Upcoming Actions

- Bondholders of FXD1/2024/003 and FXD1/2023/005 will receive coupon payments on January 12, 2026.

- BK Group shareholders will receive interim dividends on January 12, 2026. I&M Group investors will receive theirs on January 14, 2026.

The 73rd Abojani Masterclass

Our 73rd Masterclass starts on Monday, 12th January 2026.

If growing your financial literacy and investment skills is on your 2026 plan, this is the perfect place to start. Over the course of the class, you’ll learn practical strategies to manage your money, make smarter investment decisions, and build a strong financial foundation for the year ahead.