There are fundamentally two ways to invest in equities.

The first is direct. You open a CDSC account, select individual stocks, follow earnings announcements, monitor macroeconomic data, track foreign flows, and make buy or sell decisions as market conditions change. The rewards can be significant, but so is the responsibility. You carry the full burden of timing, diversification, discipline and emotional control.

The second is indirect. You entrust that responsibility to a regulated fund manager through an equity fund, gaining exposure to the stock market without having to manage the daily complexity yourself.

For many Kenyan investors, the distinction between these two approaches only became truly clear in 2025.

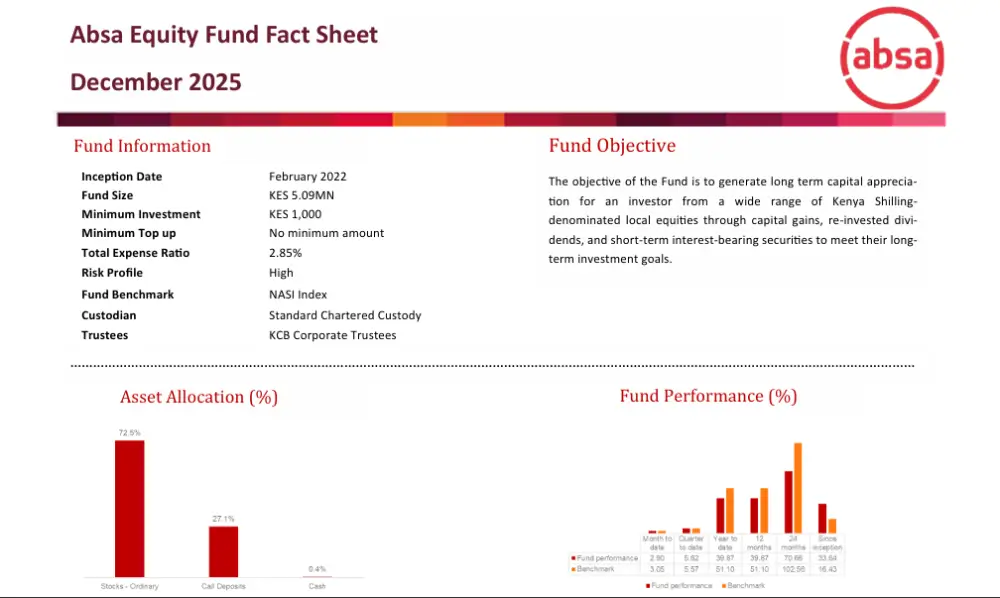

An equity fund is a unit trust structured to generate long-term capital appreciation by investing across a diversified portfolio of equities. Returns are driven by capital gains, reinvested dividends and, where necessary, short-term interest-bearing instruments that support liquidity. The objective is not to trade headlines, but to compound value over time through professional allocation and disciplined portfolio management.

In theory, both approaches participate in the same market. In practice, they experience it very differently.

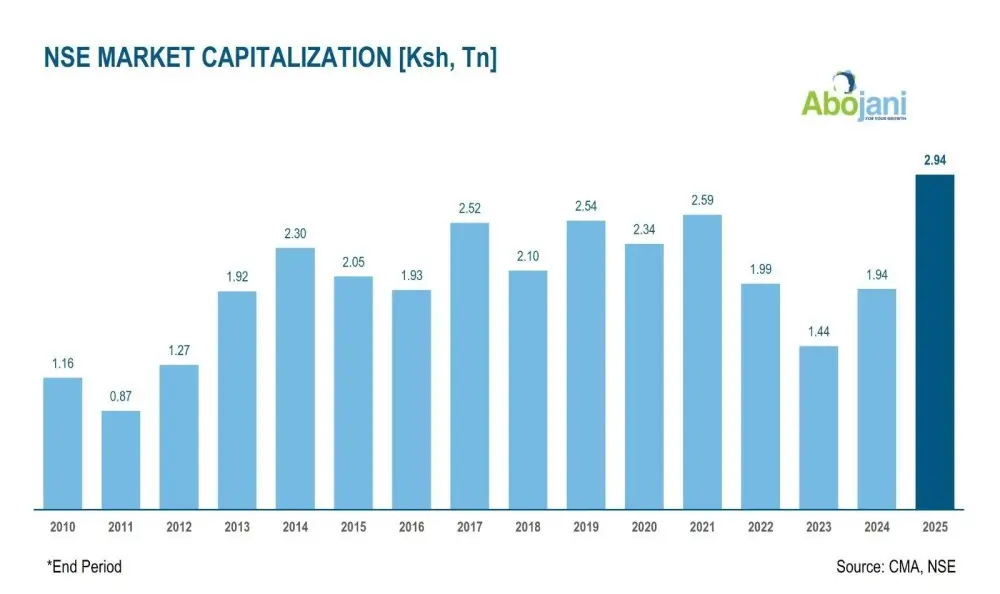

After several years of suppressed valuations, cautious sentiment and persistent macroeconomic headwinds, 2025 marked a turning point for Kenyan equities. Inflation moderated, interest rates stabilised, the shilling remained relatively stable against the dollar, and foreign investors began returning as net buyers on the Nairobi Securities Exchange. This was not a euphoric bull market, but a repricing driven by improving fundamentals and restored confidence.

In such environments, equity investing rewards preparation more than reaction. The Absa Asset Management Limited Equity Fund provides a useful illustration of this difference. Managed within a regulated institutional framework and benchmarked against the NASI Index, the fund recorded a 40% return for the full 2025 financial year, with 4% delivered in the fourth quarter. The Q4 performance reflected consolidation following an earlier rally rather than a loss of momentum, underscoring the importance of staying invested through different phases of the market cycle.

What makes this outcome particularly instructive is the conditions under which it was achieved. The fund navigated a year in which inflation remained within the Central Bank of Kenya’s target range, interest rates eased as government reliance on domestic borrowing declined, and foreign participation in blue-chip stocks gradually rebuilt. These shifts were incremental, not dramatic, yet they created a powerful backdrop for equity revaluation.

For individual investors attempting to time these inflection points on their own, the challenge was behavioural as much as analytical. Equity markets rarely move when confidence feels comfortable. They move ahead of consensus. Many investors who waited for certainty entered later, after prices had already adjusted.

An equity fund structure mitigates this challenge by enforcing discipline. Asset allocation decisions are guided by mandate rather than emotion. Portfolio exposure is adjusted gradually rather than abruptly. Dividends are systematically reinvested, and diversification reduces the impact of single-stock misjudgments. The result is participation without the constant pressure of decision-making.

The Absa Equity Fund’s performance in 2025 was driven by sustained exposure to a recovering market, supported by macro stability and renewed investor participation. It demonstrates how long-term positioning often delivers results not when markets are loud, but when they are quietly healing.

This distinction matters because equity investing is as much about temperament as it is about analysis. Direct stock investing can be rewarding, but it demands time, expertise and emotional resilience. Equity funds, by contrast, are designed for investors who believe in equities as a long-term wealth-building asset class but prefer professional stewardship over personal execution.

Ultimately, the choice is not about which approach is superior. It is about alignment. Investors who understand the demands of direct investing and are equipped to meet them may thrive independently. Those who value structure, diversification and disciplined exposure may find equity funds better suited to their long-term goals.

What 2025 made clear is that when markets turn, preparation matters. And in equity investing, preparation is often less about predicting the next move, and more about choosing the right vehicle before the move happens.