The Week in Markets

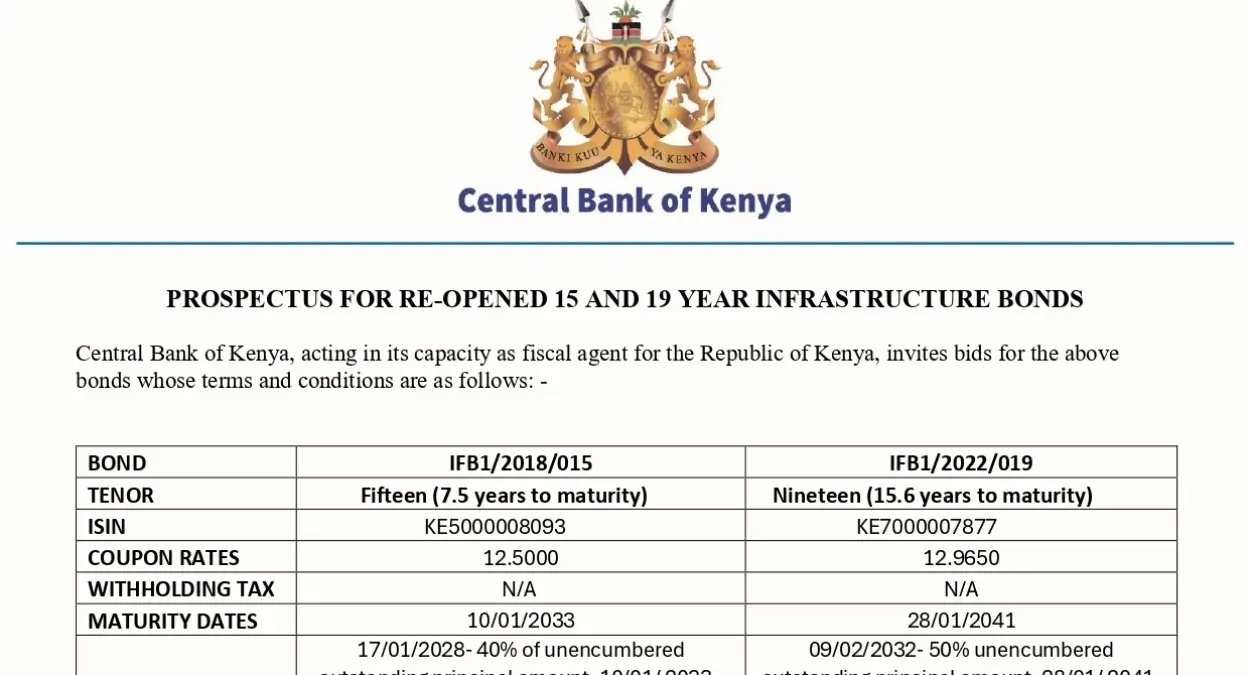

- The Central Bank of Kenya announced the reopening of two infrastructure bonds with a fundraising target of KSh 90 billion.

These tax-exempt bonds, aimed at financing specific infrastructure projects, have a bid deadline of August 13 and settlement date on August 18.

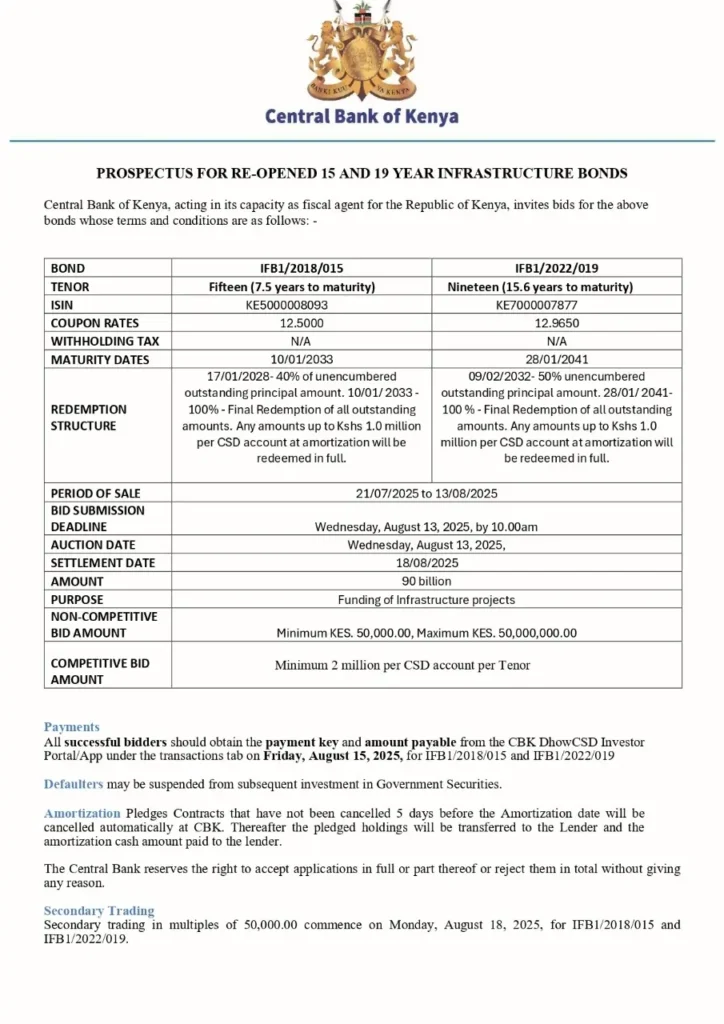

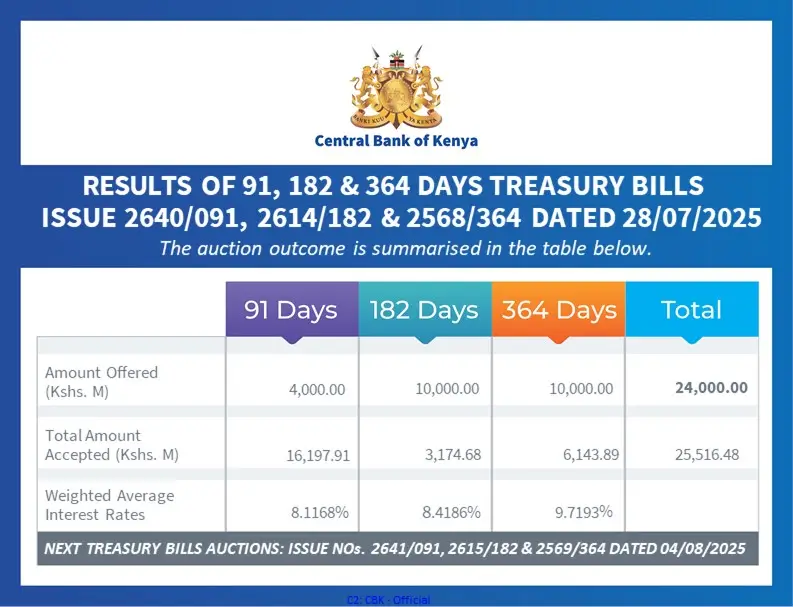

- Meanwhile, Treasury Bills were oversubscribed at 166.74%, with the government raising KSh 25.5 billion against an offer of KSh 24 billion.

The 91-day paper remained the most attractive, recording a subscription rate of 265.9%.

- Shri Krishana Overseas Ltd (SKL) was officially listed on the Nairobi Securities Exchange via introduction.

The company floated 50.5 million shares at KSh 5.90, valuing the listing at KSh 298 million, with 8.7 million shares made available to public investors.

- Linzi Finco LLP, a subsidiary of Liaison Group, successfully listed the Linzi 003 Infrastructure Asset-Backed Security on the Nairobi Securities Exchange.

Valued at KES 44.9 billion, this marks one of the region’s most significant securitization transactions to date.

Corporate Updates

- Safaricom has crossed the 50 million customer mark in Kenya, attributing its growth to continued investment in connectivity, innovation, and community engagement.

- NCBA Group announced a partnership with MoneyGram, expanding cross-border remittance capabilities to over 200 countries and territories for NCBA customers in Kenya.

- Absa Group renewed its long-standing partnership with Visa to advance secure and inclusive digital financial systems across its Regional Operations outside South Africa.

NCBA also reinforced its green financing goals, pledging to:

- Plant 10 million trees by 2030

- Invest KSh 30 billion in green projects

- Allocate KSh 100 million annually to community initiatives

Events

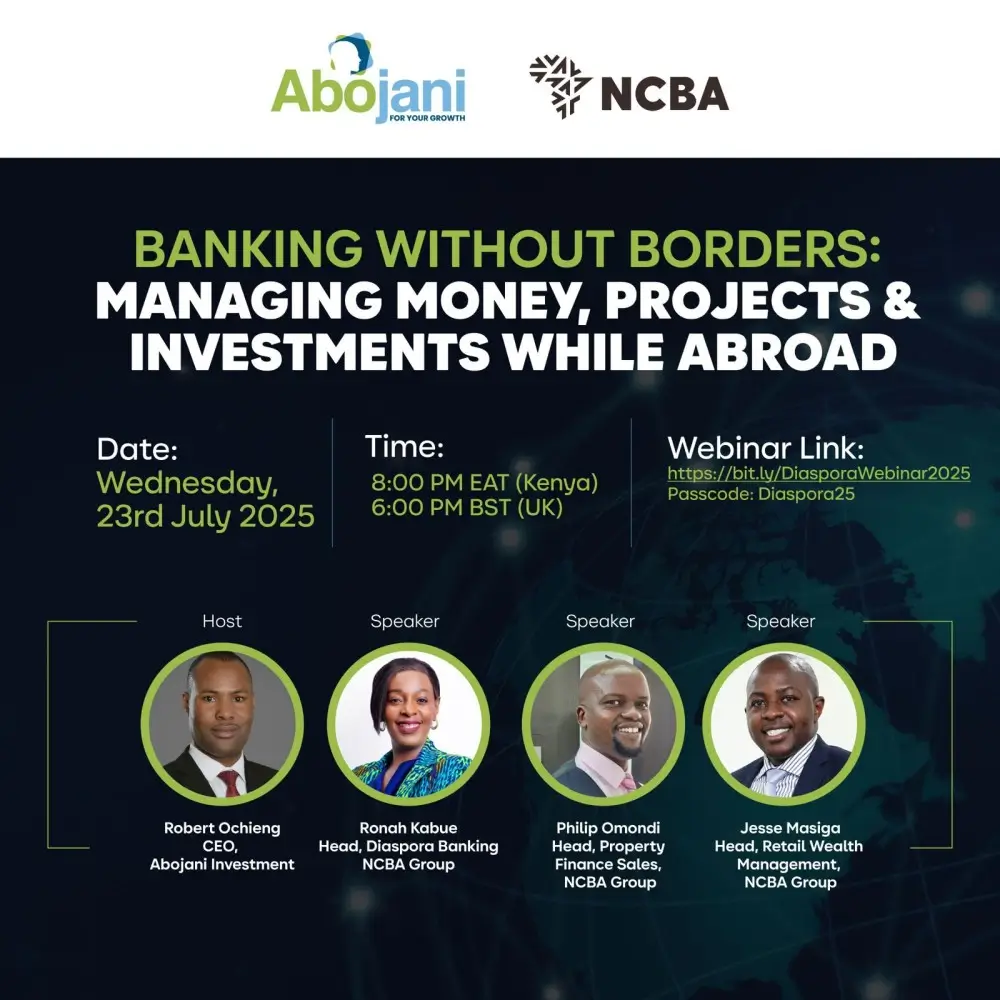

- Diaspora Investment Webinar: Held in partnership with NCBA, this virtual session emphasized the importance of early investment, building wealth back home through formal channels, and planning for future local expenses, not just current foreign income.

Banking Without Borders: Managing Money, Projects & Investments While Abroad Webinar Recording:

Passcode: Diaspora@25

- Abojani SME Networking Event – “10X is Easier than 2X”: In collaboration with I&M Bank and E&M Technology, this in-person event featured top industry speakers including Eva Muraya, Franklin Masinde, and Eunice Kinyanjui, offering tangible strategies on branding, sales, and SME growth.

Coming Up

Dividend Payments and Book Closures scheduled for the coming week:

- TPS Eastern Africa – KSh 0.35 on 30 July 2025

- Total Energies Marketing Kenya – KSh 1.92 on 31 July 2025

- Umeme Ltd – UShs 222.00 on 31 July 2025

- Williamson Tea, Kapchorua Tea, and Safaricom’s book closures on 31 July 2025

The 5th Annual Abojani Economic Empowerment Conference

It will be held on Saturday, 22nd November 2025 at Radisson Blu, Upper Hill, Nairobi. Themed “Ownership Economy & Self-Sustenance”, the conference aims to be the largest of its kind in the region.

August Personal Finance Masterclass

Abojani’s 70th masterclass is around the corner! For KSh 6,000, attendees will receive:

- Three expert-led sessions in finance

- Three free eBooks on personal finance

- Access to the 2025 #IMilliChallenge