The Week In Markets

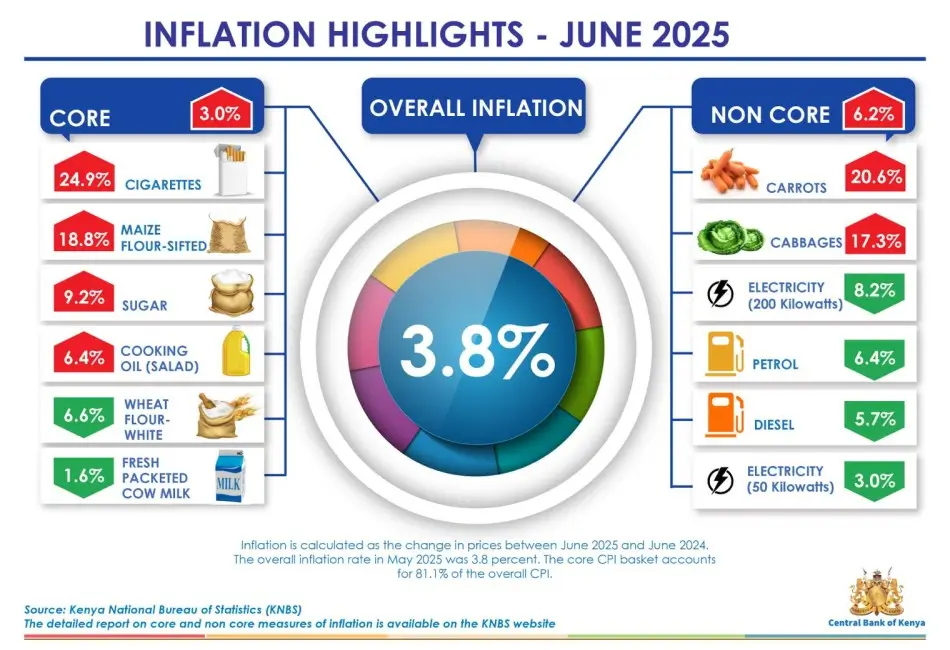

Kenya’s annual inflation rate remained unchanged at 3.8% in June 2025, according to data from the Kenya National Bureau of Statistics. Month-on-month inflation stood at 0.5%, driven by modest increases in food, transport, and housing costs. The stability keeps inflation well within the Central Bank of Kenya’s target range of 2.5%–7.5%, offering some relief to households.

Safaricom Ethiopia has surpassed 10 million active customers, just four years after launching operations. With 4G network coverage now reaching over 50% of the population across more than 150 towns, the telco is adding 31,000 new users daily. This marks a significant milestone in the company’s efforts to transform Ethiopia’s digital landscape.

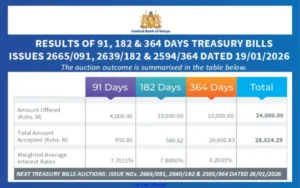

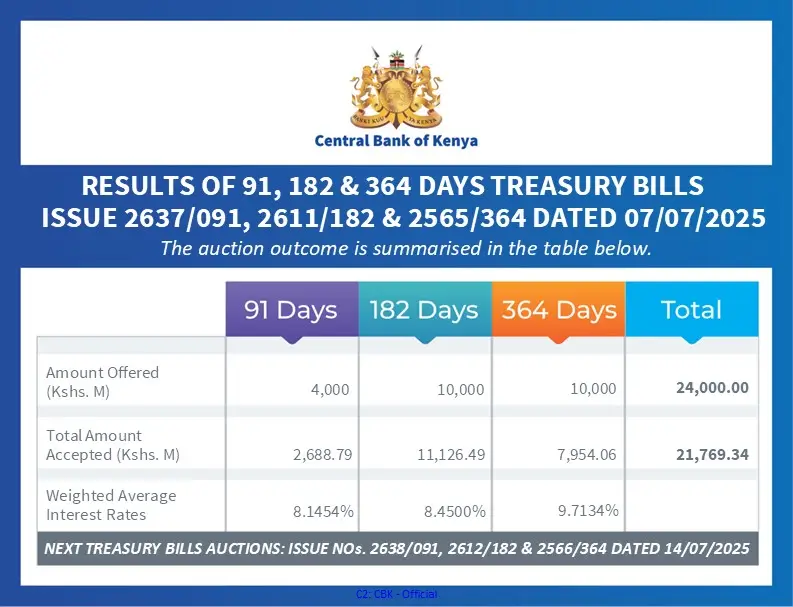

In this week’s Treasury bills auction, the government raised Ksh 21.8 billion out of a total offer of Ksh 24.0 billion. Investor demand remained strong, even as interest rates continued to ease below the 10% mark, an indicator of improved liquidity in the market.

Regulatory Updates

The Central Bank of Kenya revoked Bank Al-Habib’s license to operate a representative office in Kenya, effective May 15, 2025. The exit is part of the Pakistani bank’s global restructuring and does not pose any risk to Kenya’s financial stability.

Corporate Updates

NCBA Bank hosted its annual SACCO Empowerment Forum this week, bringing together leaders from Kenya’s cooperative sector to discuss governance, sustainability, and innovation. With the SACCO sector managing over Ksh 1 trillion in assets and serving more than 6 million members, the forum addressed key challenges such as fraud and governance gaps. NCBA reaffirmed its commitment to supporting SACCOs through strategic partnerships, technology, and training.

Equity Bank was named Kenya’s Most Admired Financial Services Brand by Brand Africa, following its recent recognition as the Most Valuable Brand by Brand Finance. These accolades highlight the bank’s broad impact, especially through initiatives like the #AfricaRecoveryandResiliencePlan.

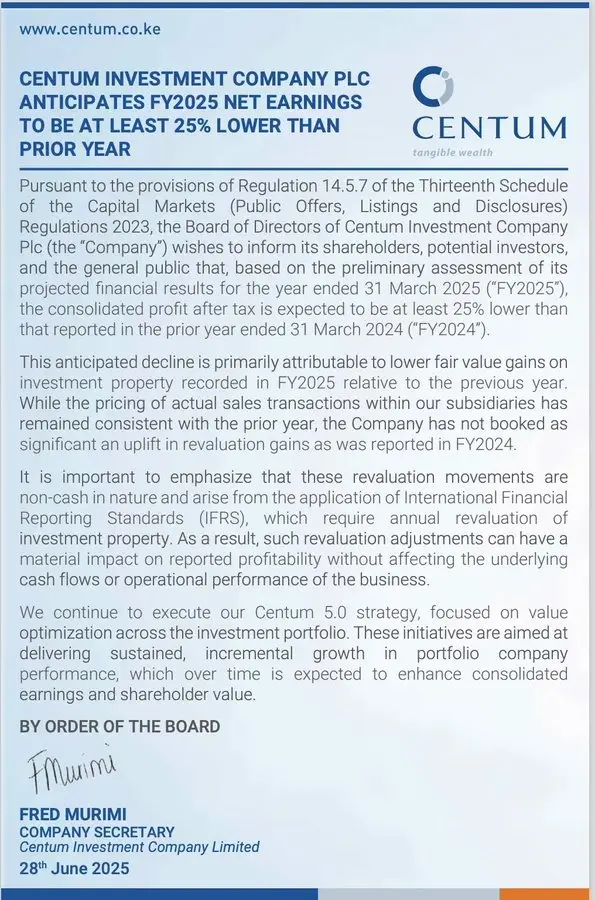

Centum Investment Company has issued a profit warning, anticipating at least a 25% decline in net earnings for the financial year ending March 31, 2025. The reduction is attributed to lower fair value gains on investment property, a non-cash adjustment under IFRS, and does not reflect core business performance. The company continues to pursue long-term growth through its Centum 5.0 strategy.

Events

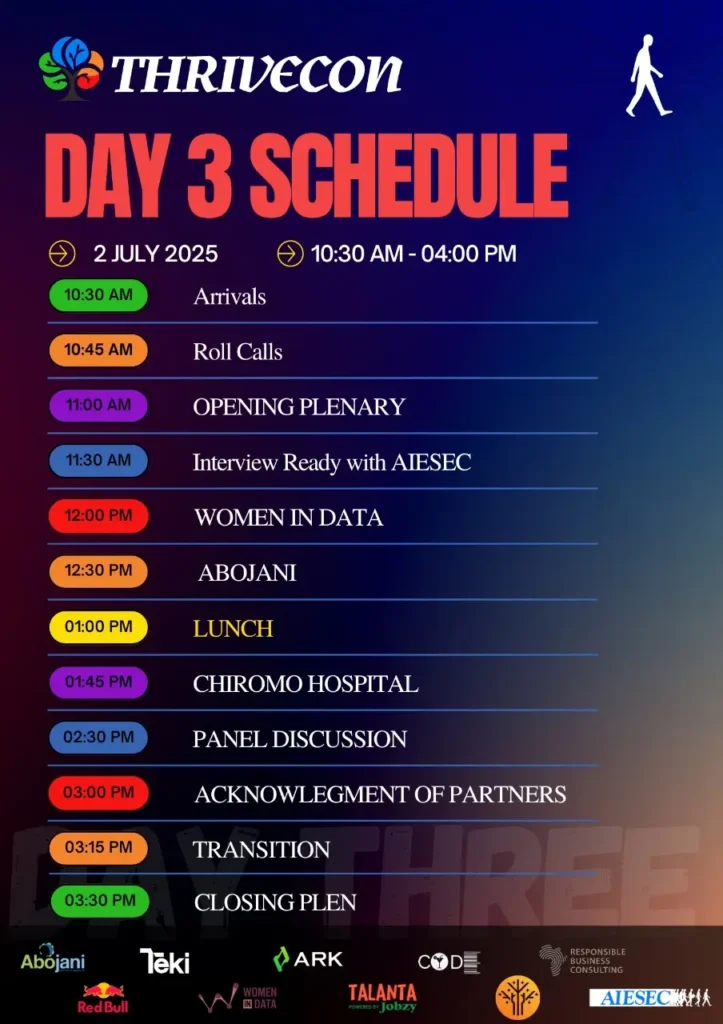

In the lead-up to World Youth Skills Day, we partnered with AIESEC for #THRIVECONKE2025; a high-energy forum focused on equipping young people with real-world life and career skills. As part of our ongoing Youth Skills Month campaign, we delivered a session on “Strategic Money Moves,” empowering university students and early career professionals to make informed financial decisions from the outset.

Coming Up

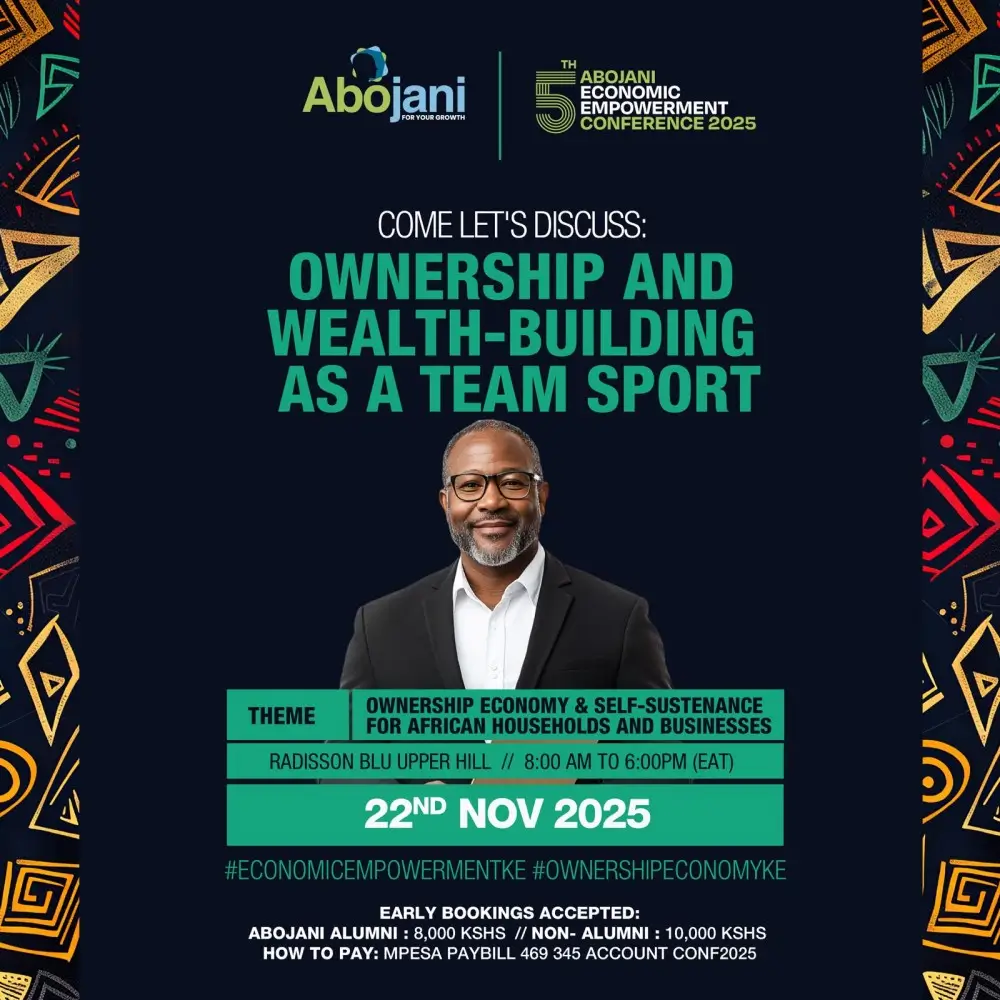

Preparations are underway for the 5th Abojani Economic Empowerment Conference, scheduled for 22nd November 2025. This year’s theme is “Ownership Economy & Self Sustenance for African Households and Businesses.”

And finally, the 69th Abojani Personal Finance, Saving & Investing Masterclass begins tomorrow at 7:00 PM sharp. Last-minute registrations are still open; we look forward to a transformative and insightful learning experience.