It’s been a dynamic and eventful week for Kenya’s financial pulse. Amid a surge in stock market performance driven by easing inflation and strong corporate earnings, the country’s financial landscape is also being reshaped by key strategic partnerships and regulatory actions. This weekly roundup dives into the major highlights, from the licensing of new digital credit providers and record-breaking treasury bill sales to new corporate initiatives aimed at customer empowerment and expanded access to financial services across the country.

Exciting Week as Kenyan Stocks Hit New Highs

It’s been a thrilling week for stock investors, with several counters hitting 52-week highs. The rally is being fueled by easing inflation, strong H1 earnings, and renewed foreign investor inflows, signs of growing confidence in Kenya’s market this year.

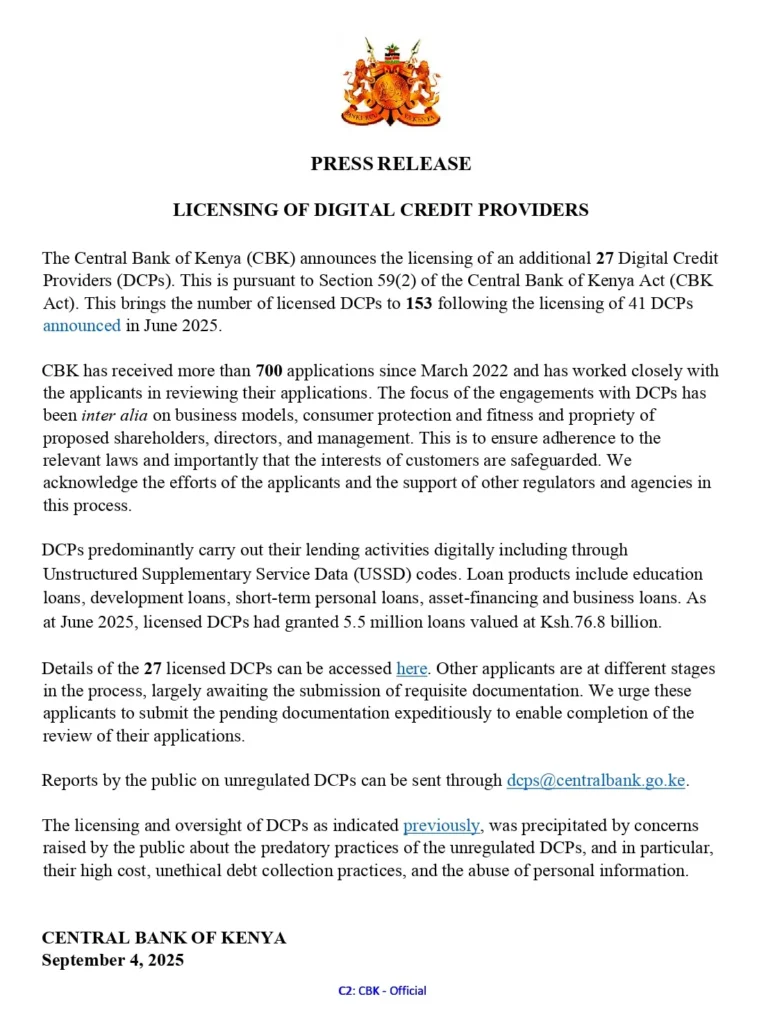

In an interesting development, the Central Bank of Kenya has announced the licensing of an additional 27 Digital Credit Providers, bringing the number of digital credit providers in the country to a whopping 153.

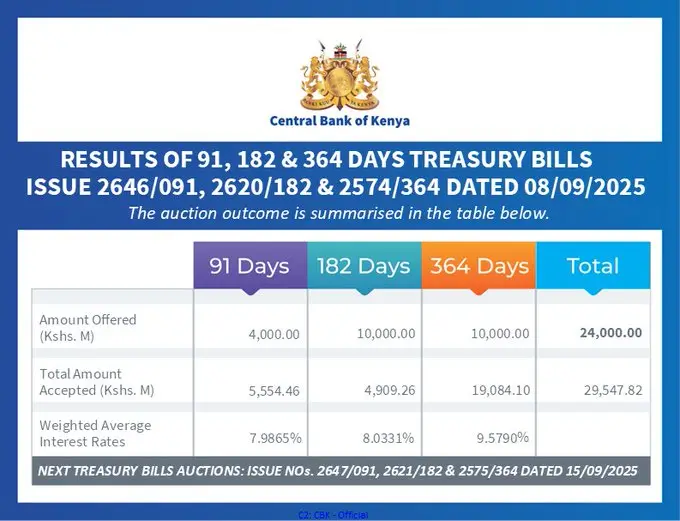

During the week, the government has raised Ksh 29 Bn through treasury bills, out of the Ksh 24 Bn that was on offer. The short-term government papers were oversubscribed as investors rushed to lock in returns.

NCBA joined leaders at a High-Level Breakfast Meeting on Championing Women’s Empowerment: Partnership for a Bold and Inclusive Future. The dialogue reaffirmed our commitment to empowering women for a bold and sustainable future. #NCBAChangeTheStory

Absa Bank Kenya PLC unveiled a dynamic new initiative aimed at accelerating card usage and deepening customer engagement through digital payments. The three-month campaign, dubbed “Play Your Cards Right,” is designed to encourage both existing and new customers to embrace cashless transactions using the Absa Debit and Credit cards in their day-to-day purchases while standing a chance to win exciting prizes.

KCB Foundation has rolled out a fresh intake of 96 young people in Taita Taveta County under its flagship 2Jiajiri programme, setting them on a path to technical and vocational skills training. The new cohort will receive practical, industry-driven training through partner institutions in the region, equipping them with competencies needed to secure jobs or venture into self-employment.

PesaLink, NALA, and Equity Bank have teamed up to streamline cross-border payments into Kenya, enabling near-instant, low-cost remittances directly to bank accounts and mobile wallets. With diaspora inflows hitting a record US$4.94B in 2024, the partnership boosts reliability and access for Kenyans abroad sending money home.

I&M Bank has officially opened its Kapsabet branch, expanding its presence in the North Rift region. The new branch aims to serve the town’s vibrant agriculture, athletics, and trade sectors by providing tailored financial solutions for individuals, MSMEs, and businesses.

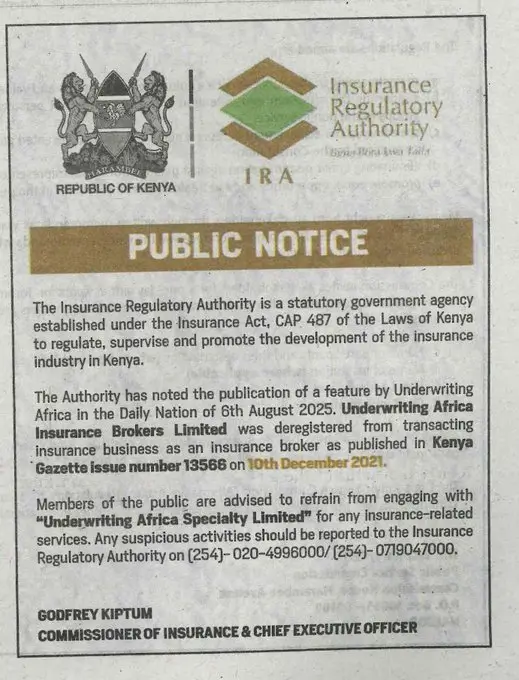

The Insurance Regulatory Authority (IRA) has warned the public that Underwriting Africa Insurance Brokers Ltd. is not licensed to conduct insurance business in Kenya. The regulator has urged Kenyans to avoid engaging with Underwriting Africa Specialty Ltd. for insurance services, stressing the importance of dealing only with licensed providers.

During the week, we wrapped up H1’2025 earnings season with our much anticipated #AbojaniBankingSectorAnalysis X-Space where we analyzed the results and shared what the numbers mean to investors.

To catch the recording, click Play Recording below

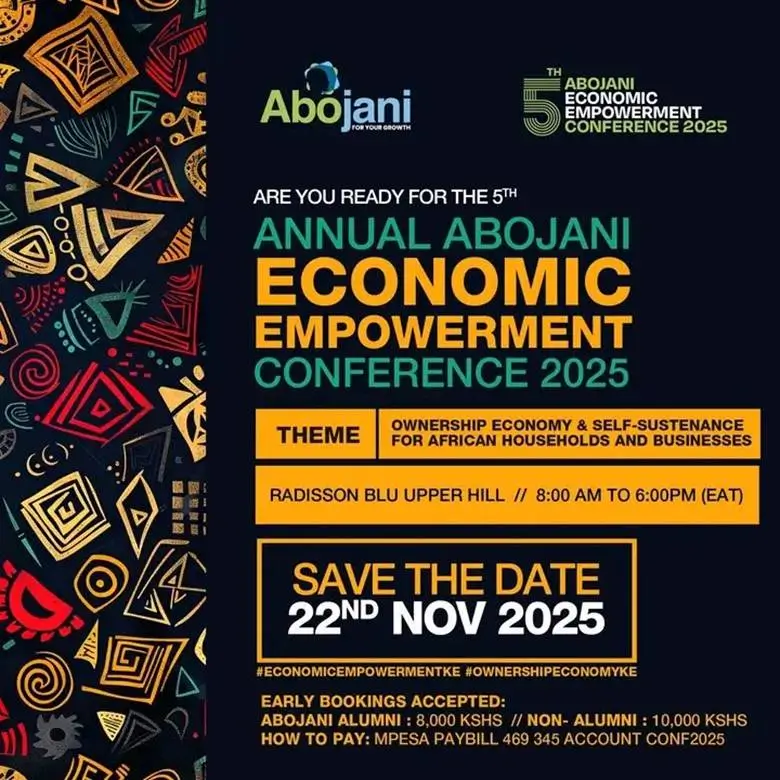

Preparations for the 5th Abojani Economic Empowerment Conference are still ongoing. We have already secured an anchor sponsor and will be making the official announcement very soon. If you are looking to network with investors and experts, then Radisson Blu is the place to be on 22nd November 2025.

Register for #EconomicEmpowermentKE

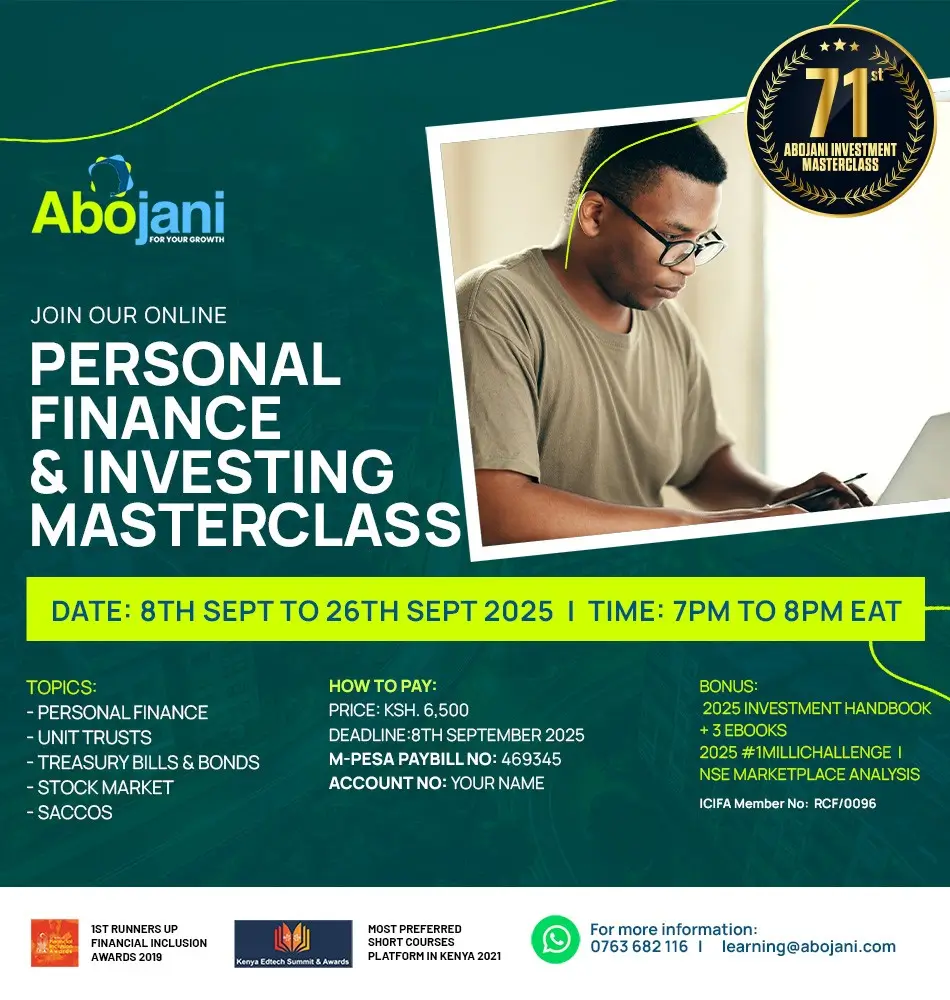

And finally, we are excited to announce the start of the 71st Personal Finance, Saving & Investing masterclass. If you are ready to take charge of your finances and start investing in Unit Trusts, stocks, bonds and even treasury bills, then you can register using the details on the flier below.

Quick Summaries in Q&A

- What is fueling the recent stock market rally in Kenya?

- The rally in Kenyan stocks is being fueled by easing inflation, strong half-year (H1) earnings reports from companies, and renewed inflows of foreign investment.

- How many new digital credit providers has the Central Bank of Kenya licensed?

- The Central Bank of Kenya (CBK) recently licensed an additional 27 Digital Credit Providers, bringing the total number of licensed providers in the country to 153.

- How are companies streamlining cross-border payments in Kenya?

- A new partnership between PesaLink, NALA, and Equity Bank is streamlining cross-border payments into Kenya, enabling near-instant, low-cost remittances directly to bank accounts and mobile wallets.

- Why did the Insurance Regulatory Authority (IRA) issue a public warning?

- The Insurance Regulatory Authority (IRA) warned the public that Underwriting Africa Insurance Brokers Ltd. is not licensed to conduct insurance business in Kenya, urging citizens to only engage with licensed providers to protect their interests.