This week’s financial landscape in Kenya was buzzing with activity, headlined by the impressive H1 2025 Banking Report earnings from the sector. The numbers tell a story of strong growth and shifting leadership, with key players like Equity and KCB leading the charge, and others like HF Group posting significant gains.

At a glance this week

What were the key highlights from the H1 2025 Banking Report?

Equity Group is back on top as the most profitable bank in East & Central Africa, while KCB remains Kenya’s largest by assets. Absa’s Bancassurance leads in profitability, and NCBA Group announced a record interim dividend.

How did the insurance and fund management sectors perform?

Jubilee Holdings emerged as the most profitable insurance company, while Standard Chartered remained the most profitable fund manager.

What other major financial news impacted the market this week?

The 91-day T-Bill yield fell below 8%, and the CBK introduced a new Risk-Based Credit Pricing Model to enhance lending transparency.

Beyond the banking results, we saw important developments in the bond market, new regulations from the CBK, and valuable insights on building wealth from the latest Abojani Wisdom Series session.

The Highlights in Details

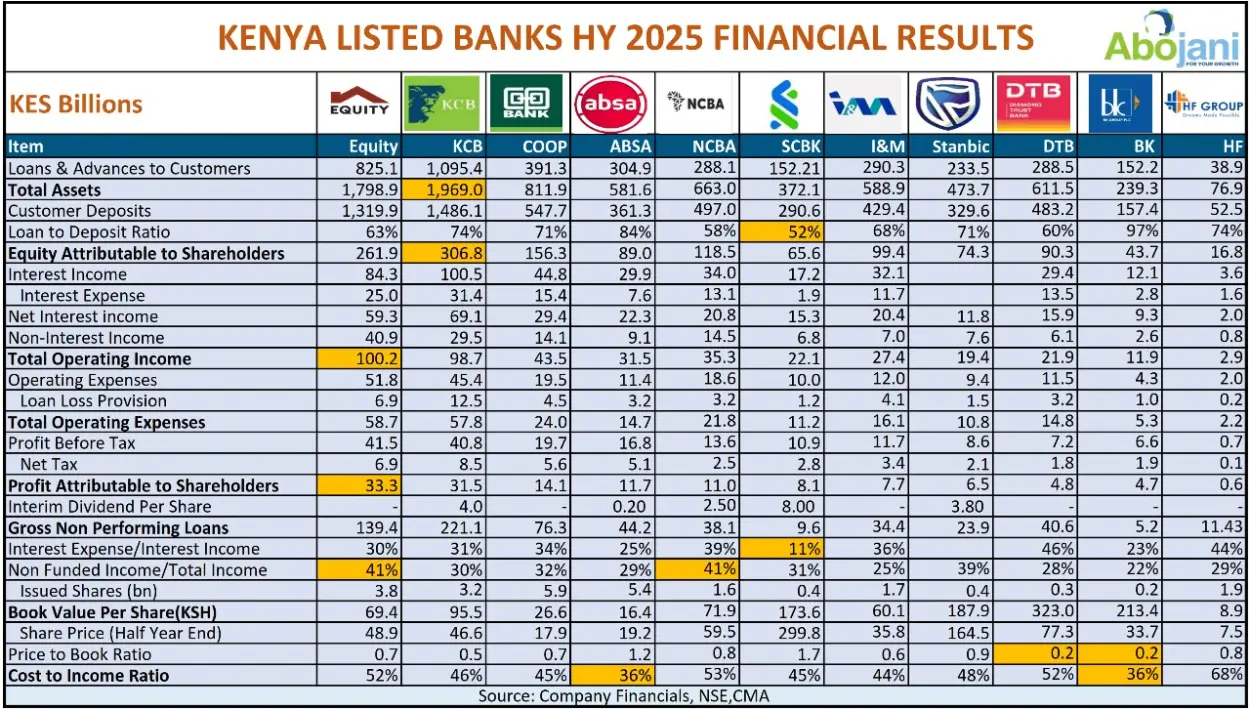

1. The H1 2025 banking sector earnings season has ended, and several highlights stand out:

Equity Group is back on top as the most profitable bank in East & Central Africa, while KCB remains Kenya’s largest bank by assets.

NCBA and Equity remain the most diversified, while BK Group and DTB are the cheapest in terms of book value.

Absa and BK Group are the most efficient.

HF Group records the fastest profitability growth.

2. All listed banks post a combined profit after tax of Ksh 134.06 billion in H1 2025

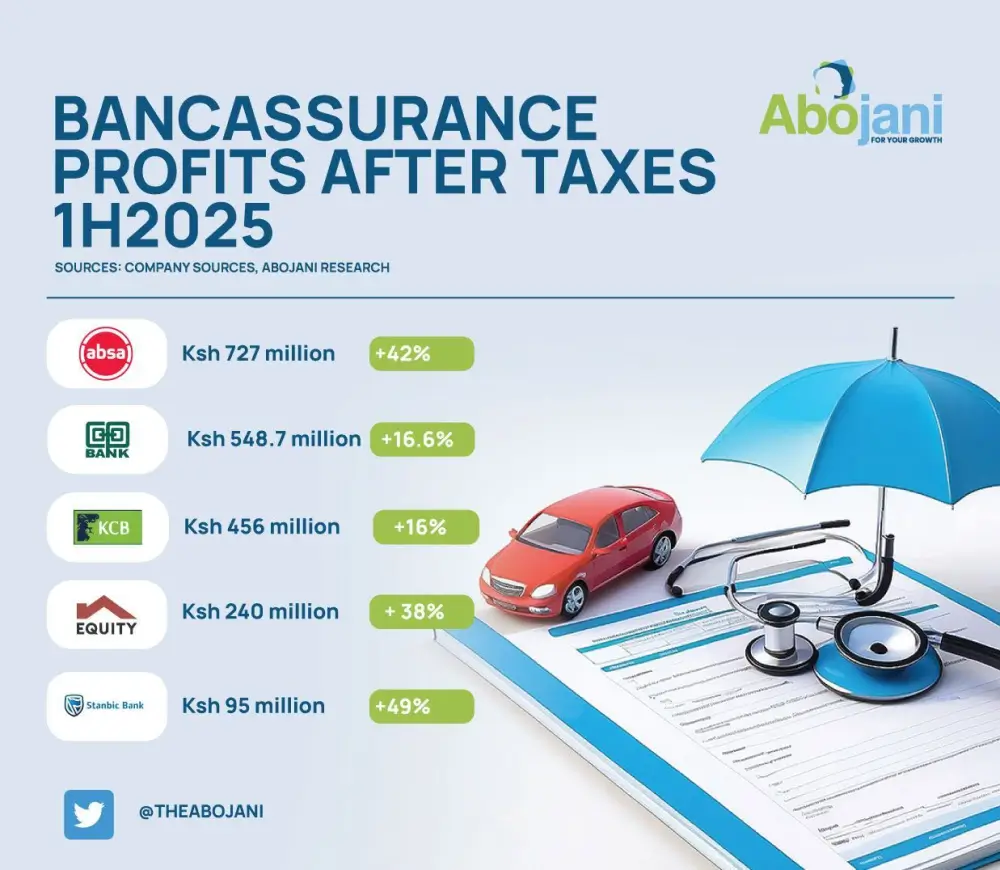

3. Absa Bank Kenya’s Bancassurance maintains its crown, leading in profitability for the fourth consecutive year, and becomes the first to cross the Ksh 1 billion mark in pre-tax profits in H1 2025..

Stanbic Bancassurance Intermediary emerges as the fastest-growing player in profitability.

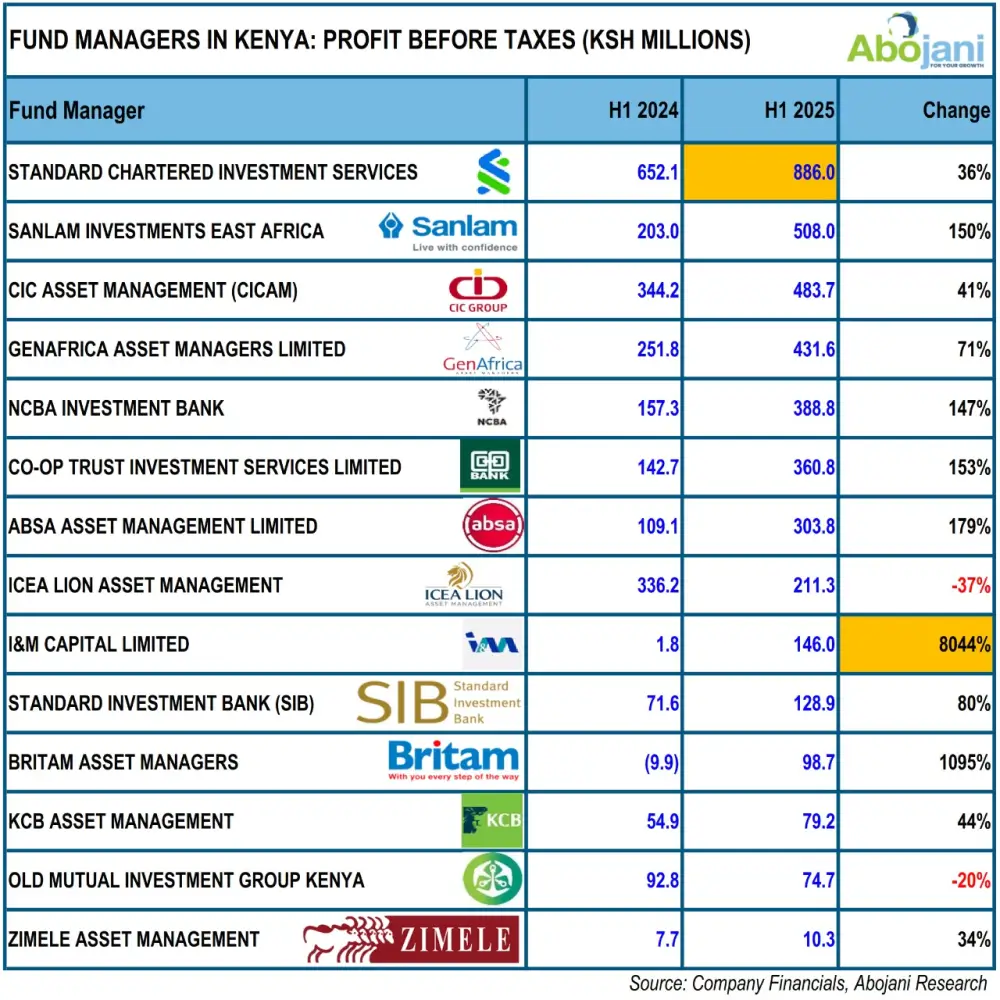

4. On the fund management side, Standard Chartered remains the most profitable, while I&M Capital leads in profitability growth

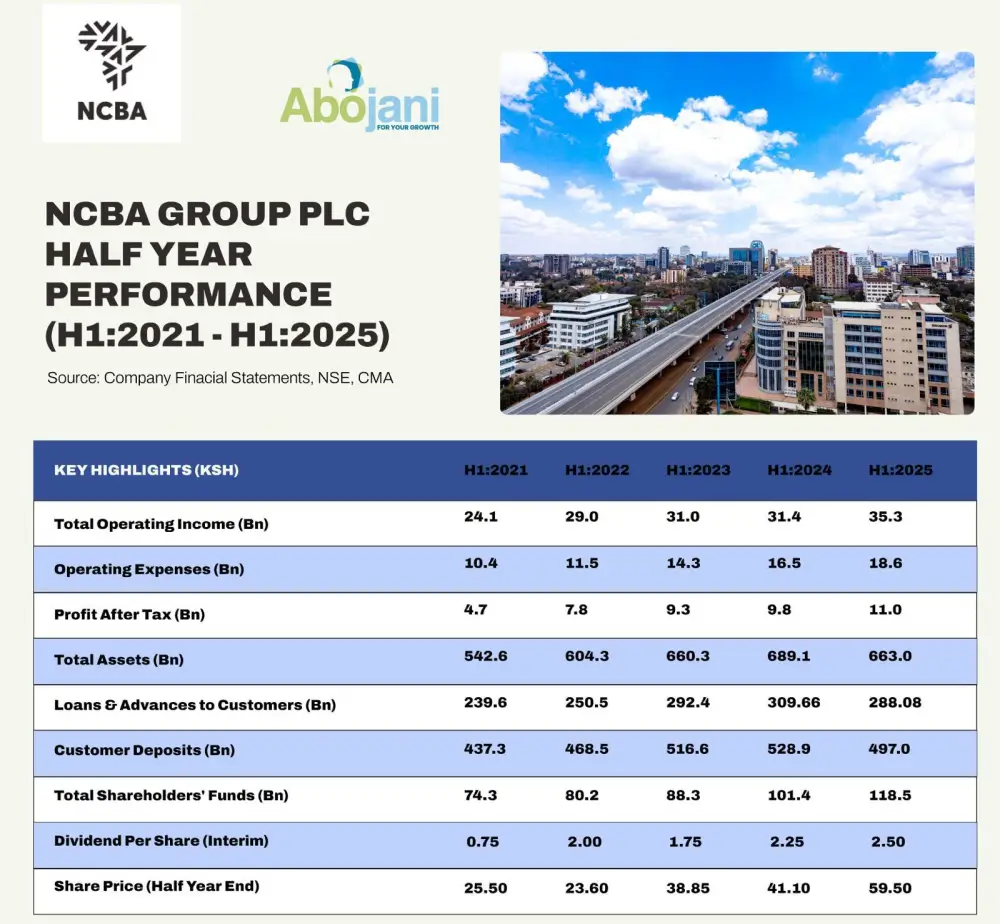

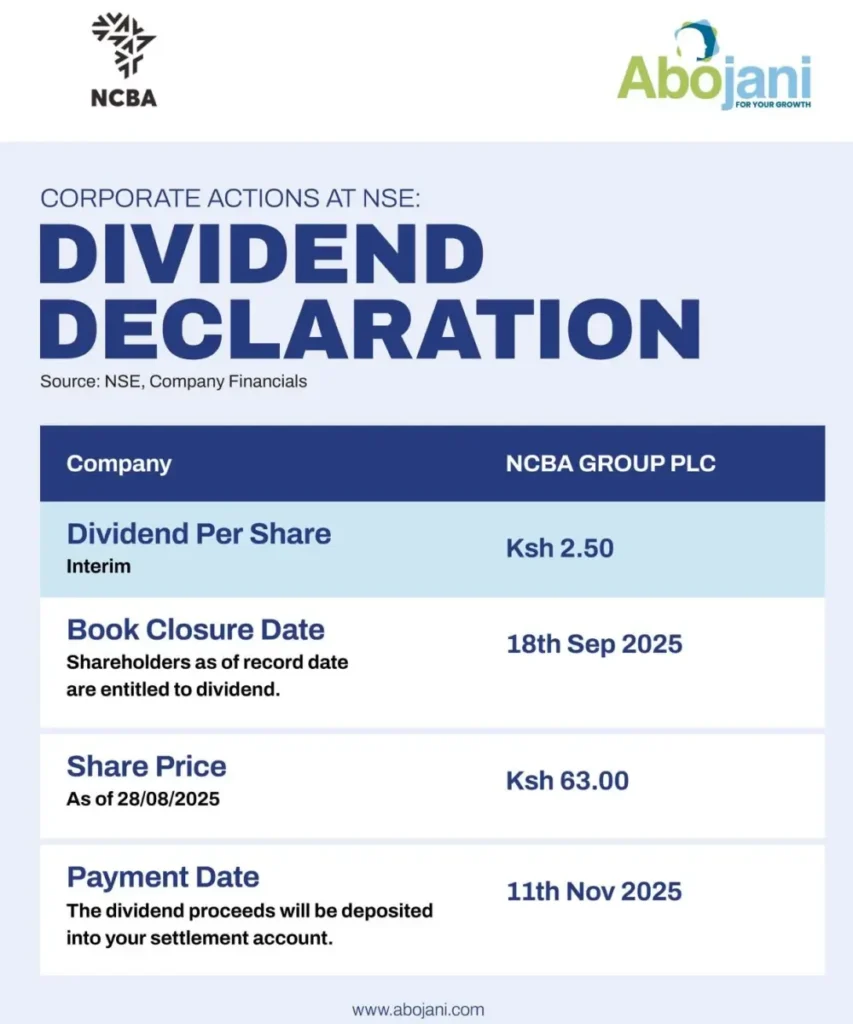

5. NCBA Group profit rose 12.6% to Ksh 11.1 billion in H1 2025.

The bank announced a record interim dividend of Ksh 2.50 per share, payable on or about 11th November 2025.

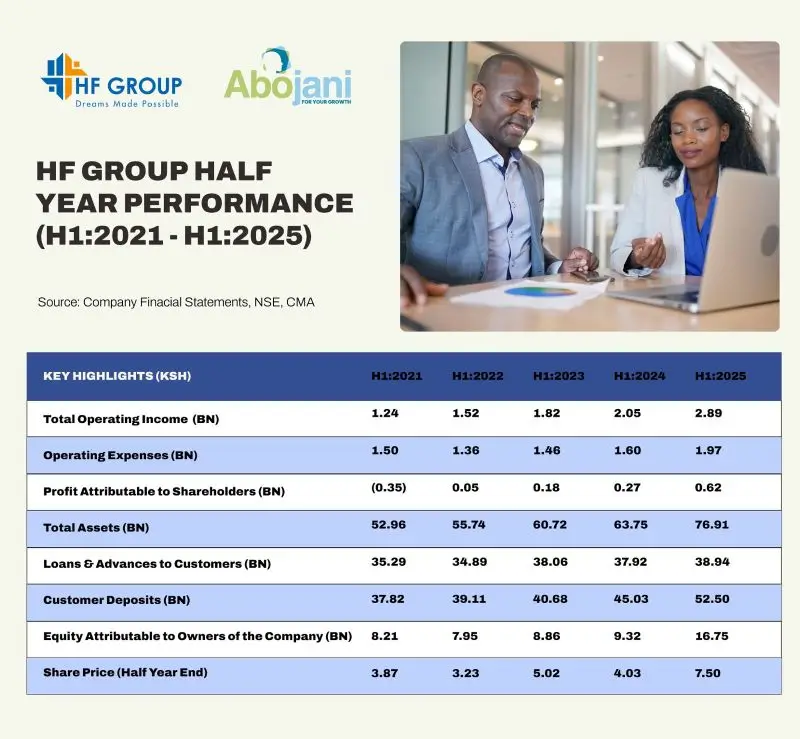

6. HF Group reports a 134.5% increase in profit after tax to Ksh 0.62 bn, fueled by strong net interest income and non-interest income.

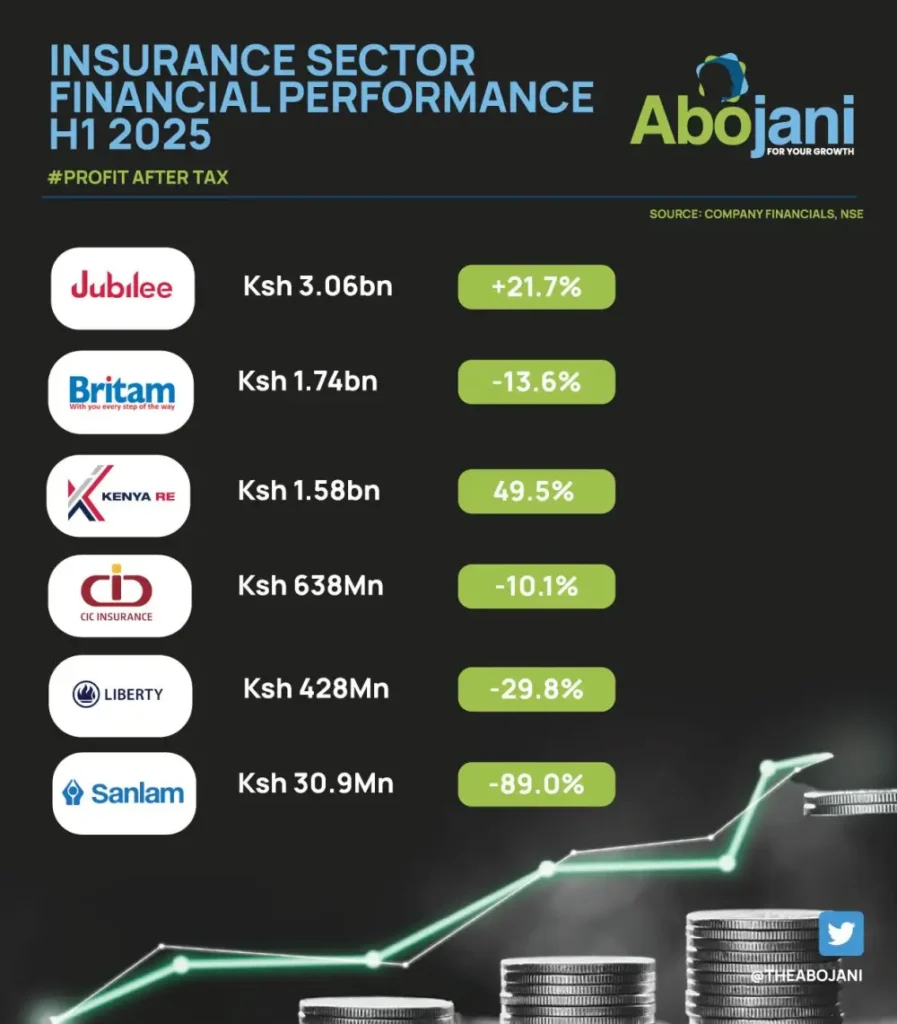

7. Jubilee Holdings emerges as the most profitable company in the insurance sector, while Kenya Re leads in profit growth.

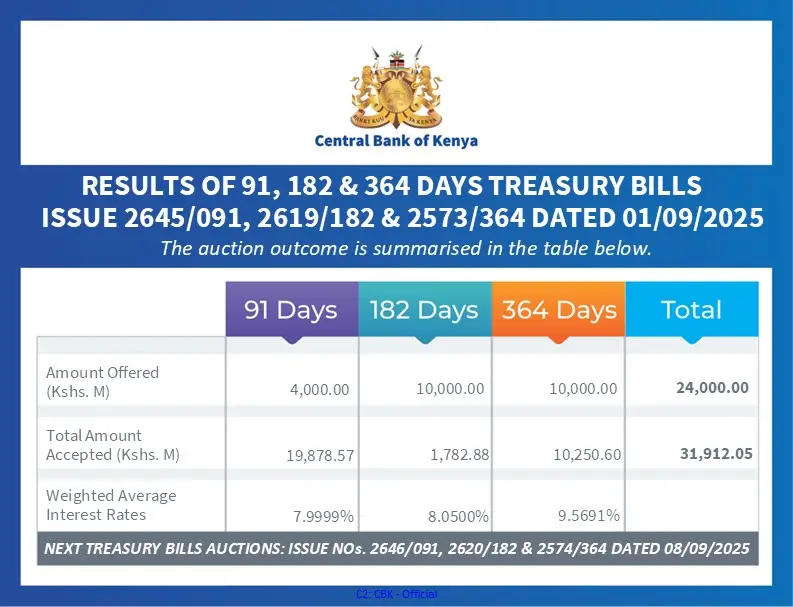

8. The 91 Days T Bills yield has fallen below 8%.

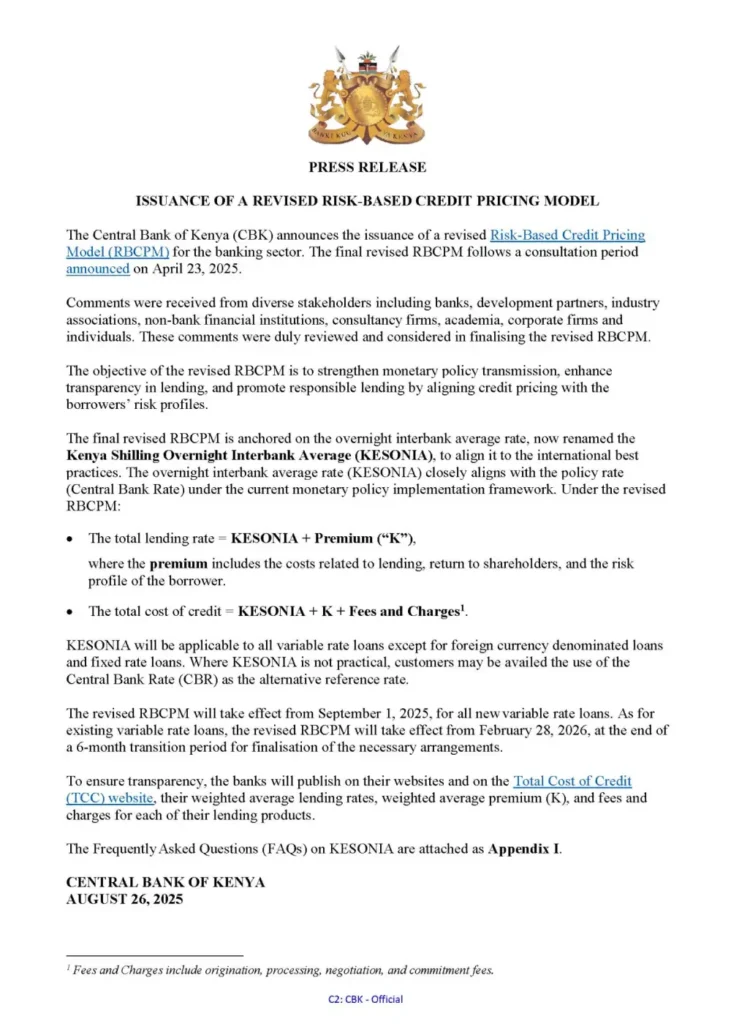

9. CBK has issued a revised Risk-Based Credit Pricing Model for the banking sector. The new model, which will take effect on September 1, 2025, for all new variable-rate loans, aims to enhance transparency in lending and ensure that credit pricing is more aligned with a borrower’s risk profile.

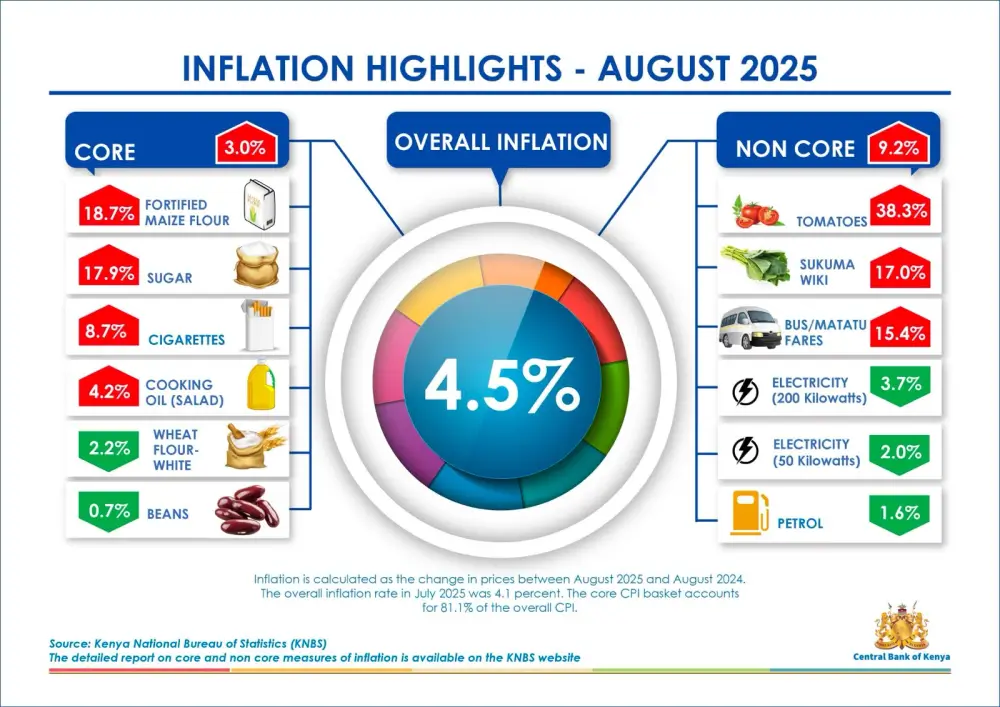

10. Inflation rose to 4.5% in August 2025.

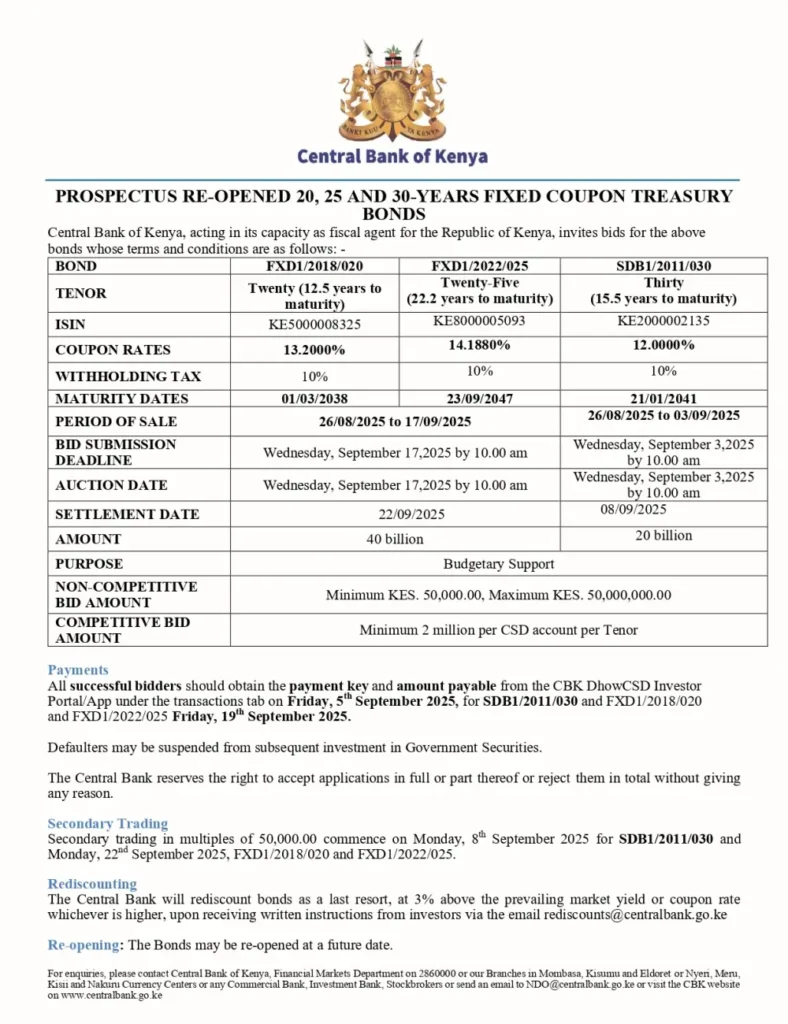

11. CBK has re-opened bids for three fixed coupon treasury bonds, including a 20-year bond (with 12.5 years remaining), a 25-year bond (with 22.2 years remaining), and a 30-year bond (with 15.5 years remaining). The coupon rates are 13.2000% for the 20-year bond, 14.1880% for the 25-year bond, and 12.0000% for the 30-year bond.

12. NCBA Group has entered into a distributor partnership with Zetu Innovations, the creators of the Nyumba Zetu property management platform. This collaboration enables NCBA’s real estate clients to access next-generation, scalable property management tools tailored for today’s Kenyan market.

13. Hounen, the multinational developer and solar manufacturer, is rolling out over 63,000 square metres of developments at Tatu City.

14. This week, we had an insightful Wisdom Series session with Samuel Kariuki, CEO of Mi Vida Homes.

Here are some key lessons from the session:

- You must start with your first payslip. You start building your passive income portfolio from your first income

- Always have a personal balance sheet that shows you your net worth. Characterise your income generating assets and liabilities as well. And constantly review your personal balance sheet.

- As you build more knowledge and skills, do not forget to skill

#WisdomSeries @mividahomes @skmakii

15. We also hosted an X-Space, in partnership with Equity Bank, to discuss how to protect life, health, and wealth.

Here are some of key takeaways:

- Insurance is there to protect what you value – your life, health, and wealth.

- Wealth comes with liabilities.

- Buy life insurance when you are young, because that’s when you have more dreams to protect.

- You must ensure you buy cover from a credible insurance provider regulated by IRA.

- The last expense cover is very important, as it helps ease the burden of WhatsApp contributions.

Upcoming Event

16. This Wednesday at 7:00 pm, join us on X-Space for a discussion on how banks performed in the first half of 2025.

Save the date and set a reminder!

X-Space link: https://x.com/i/spaces/1vOGwdnoVpDJB

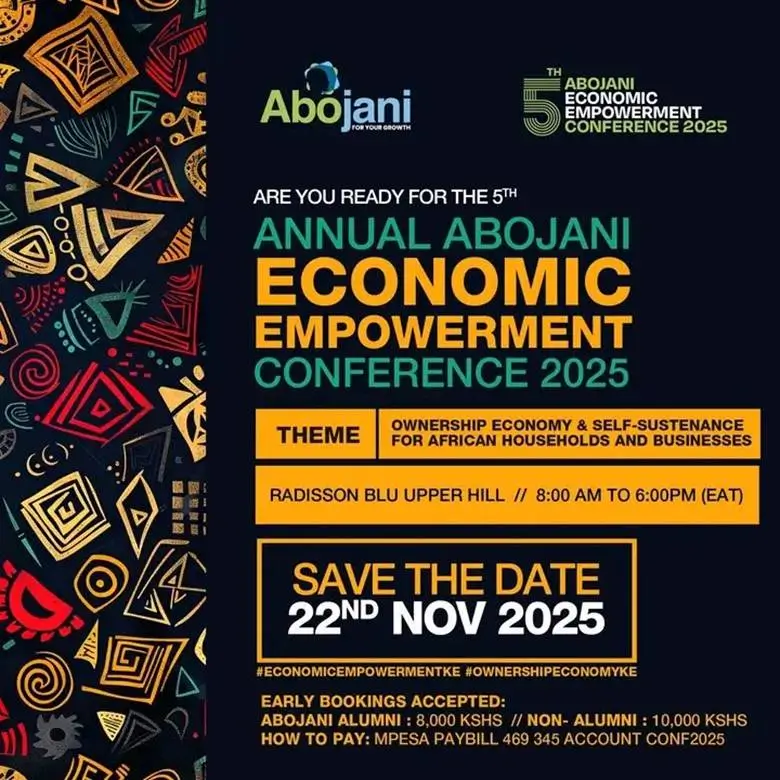

17. The 5th Annual Abojani Economic Empowerment Conference is happening on Saturday, November 22, 2025, at the Radisson Blu Hotel in Upper Hill, Nairobi.

The event will bring together investors, entrepreneurs, and financial enthusiasts from across Africa.

You’ll have the opportunity to make valuable connections and gain tools to build lasting wealth.

Secure your seat today and become a part of this impactful event.

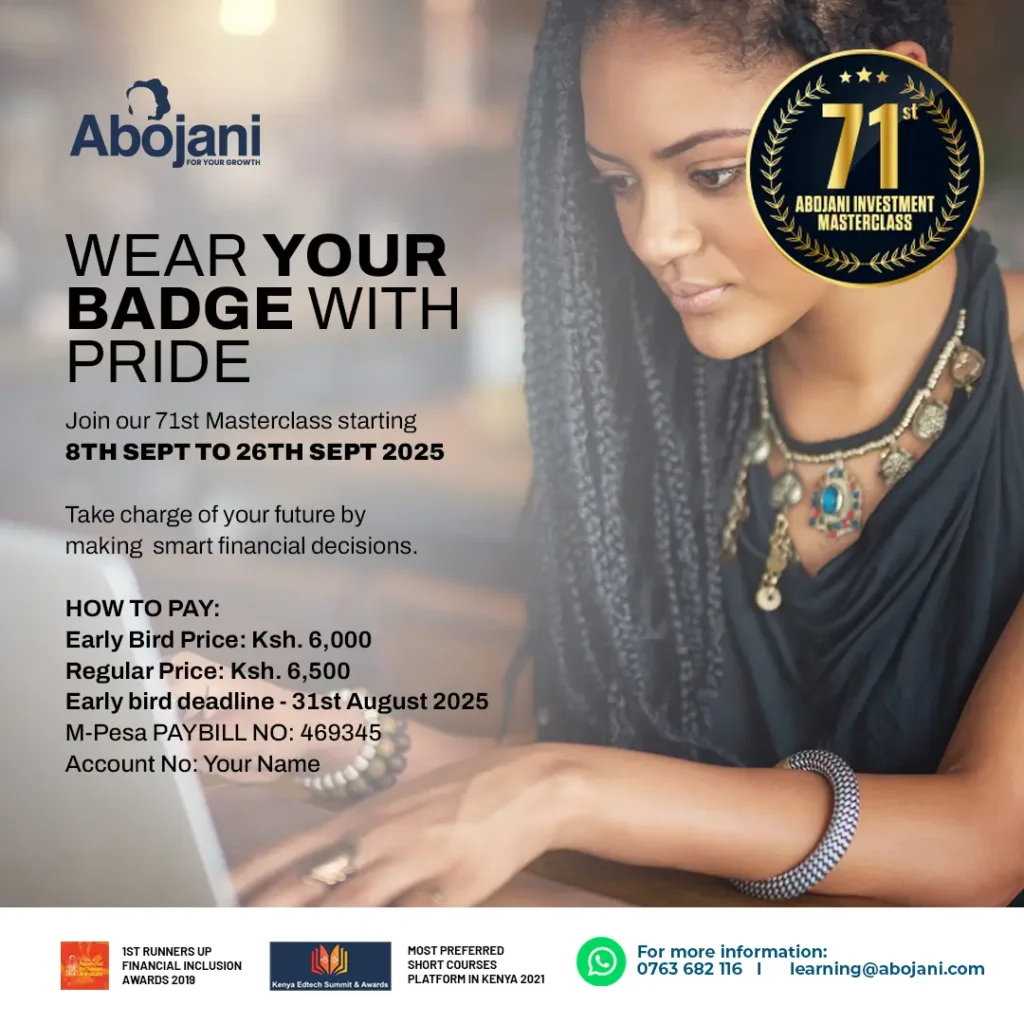

18. And lastly, if you missed our August Masterclass, join @TheAbojani’s 71st masterclass to learn about personal finance, the stock market, Saccos, MMF, bonds, and much more from 8th to 26th Sep 2025.

Book your ticket early for only Ksh 6,000 and get an investment handbook plus 3 e-books.