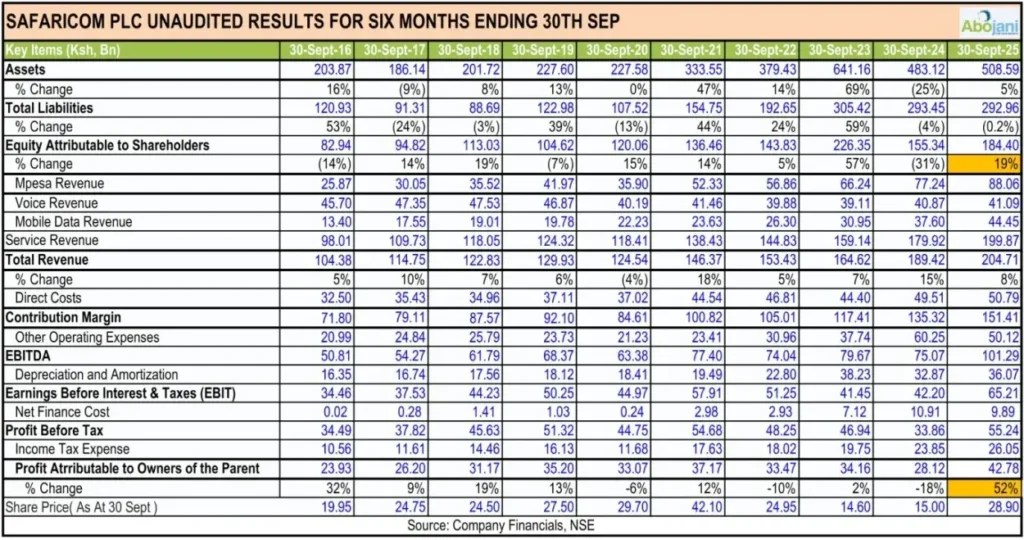

Safaricom’s half-year results for the period ended September 2025 tell the story of a company standing firmly on familiar ground while stretching confidently into new territory. The group reported total revenue at KSh 204.7 billion, with service revenue of KSh 199.9 billion (up 11.1% YoY), and a 52.1% surge in net income to KSh 42.8 billion.

In its home market, Safaricom’s story continues to be one of steady, disciplined expansion. Service revenue in Kenya rose 9.3% to KSh 194 billion, supported by a double-digit rebound in profitability. Net income climbed 22.6%, while EBIT grew 13.1%, reaching KSh 89.5 billion. Operating costs were tightly managed, helping to lift margins across the board.

Also read: Running a Business in Kenya: Challenges, Resilience, and Smarter Solutions

What’s clear is that Kenya remains the stabilizing base of Safaricom’s regional ambitions. Connectivity, still accounting for nearly half of total service revenue, expanded by 5.3%. Data, now contributing more than voice for the first time, grew 13.4% as 4G and 5G adoption deepened. The company’s push for affordable devices and local assembly seems to be paying off, expanding its 4G+ user base to over 25 million.

Beyond the core telecom operations, Safaricom’s fixed and enterprise businesses also showed solid momentum. Fixed service revenue grew 9.5% to KSh 9.8 billion, carried by increased fiber and wireless access, particularly among SMEs. Together, these figures underscore that Safaricom’s domestic business is anchoring digital life in every Kenyan household and enterprise.

Even after nearly two decades, M-PESA continues to be Safaricom’s defining force. The platform generated KSh 88.1 billion in the first half of FY26, a 14% YoY rise, and now accounts for 45% of total service revenue.

The growth is broad-based. Business payments rose 18.8%, consumer payments 19.4%, and global payments 17.3%. Merchant numbers climbed to 2.4 million, while transaction volumes grew sharply across both Lipa na M-PESA and Pochi channels. M-PESA’s total value moved up 5.0%, to KSh 20.2 trillion, showing how central it remains to Kenya’s payment ecosystem.

Crucially, the new credit and savings verticals are beginning to add meaningful layers to M-PESA’s value proposition. The Fuliza overdraft product grew 39.8% in value to KSh 629.2 billion, while overall digital credit customers increased to 9.5 million. Assets under management in Safaricom’s wealth products rose to KSh 15.1 billion, revealing a deliberate shift toward becoming a full-scale financial ecosystem rather than a payments-only platform.

This evolution, what Safaricom now brands as “Fintech 2.0”, is about moving beyond transactions to financial enablement. M-PESA is positioning itself less as a telco service and more as a financial institution in its own right.

If Kenya anchors Safaricom’s stability, Ethiopia represents its growth frontier. The numbers here are smaller but more dynamic, and tellingly, they are beginning to move in the right direction.

Service revenue in Ethiopia hit KSh 6.2 billion, representing a 49.4% increase year-on-year. Customer numbers surged 83.7% to 11.1 million, while data usage per subscriber grew steadily.

Safaricom Ethiopia’s progress is not merely about customer growth. The company has managed to build a network covering 55% of the population, activated 3,306 sites, and onboarded over 30,000 merchants for M-PESA within its first months of operation. Transactions worth ETB 12.3 billion (KSh 11.7 billion) were processed during the period, reflecting an encouraging early adoption curve in a market historically underbanked and dominated by cash.

The challenge, of course, remains macroeconomic. Currency depreciation; nearly 17% against the dollar and 33% against the euro during the review period, continues to cloud reported results. Yet even with these headwinds, Safaricom Ethiopia’s trajectory reinforces why the expansion matters: it’s a long-term play on a 120-million-person economy where digital financial inclusion is only just beginning.

The dual-market performance paints a clear picture of Safaricom’s direction. Kenya provides cash flow and profitability; Ethiopia offers scale and future potential. Together, they reflect a group deliberately balancing short-term returns with long-term transformation.

Capital expenditure stood at KSh 43.7 billion, largely focused on network expansion in both markets. The group maintained a healthy Net Debt-to-EBITDA ratio of 0.69, signaling financial flexibility even amid aggressive investment. Margins improved across all key metrics; EBITDA up 34.9% for the group and EBIT up 54.5%, confirming that Safaricom’s profitability is recovering after the heavy initial costs of entering Ethiopia.

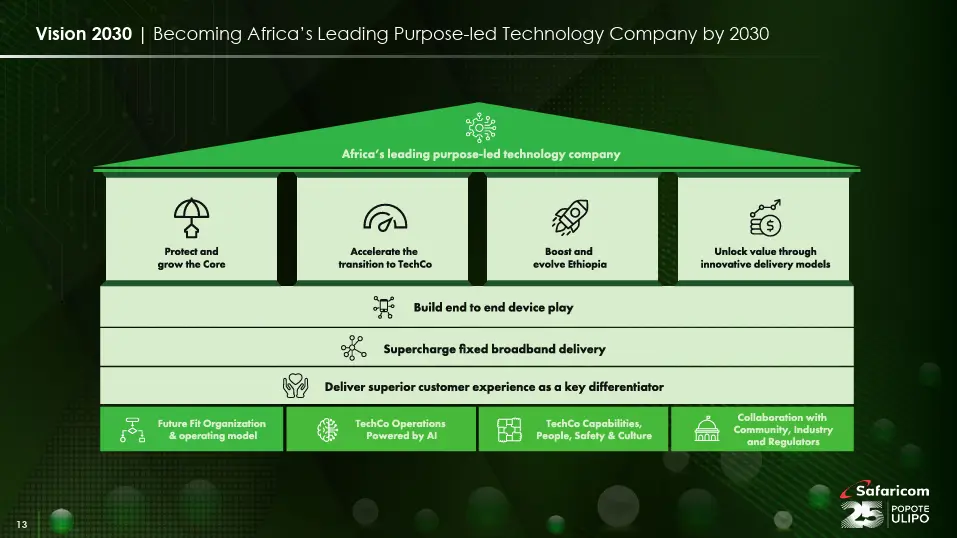

Beyond the numbers, Safaricom’s 25-year milestone adds a layer of perspective. Its Vision 2030 strategy to become Africa’s leading purpose-led technology company is already evident in its operating model. Artificial intelligence now underpins customer experience, network maintenance, and fraud prevention. The company continues to frame growth not merely in profit terms, but in inclusion, sustainability, and societal value.

For investors, regulators, and customers alike, the HY26 results show that Safaricom is no longer just a telecom operator with a mobile money arm. It’s evolving into a cross-border digital platform with the infrastructure, customer base, and technological ambition to redefine what a Kenyan multinational can be.

If the first 25 years were about connecting people, the next 25 may well be about connecting entire economies.