The financial week was defined by a monumental event: the landmark pension settlement from Standard Chartered. This KES 7 billion settlement isn’t just a win for the appellants; it’s a powerful statement on financial litigation and a new benchmark for corporate accountability in Kenya. As this story unfolded, we saw other significant movements, from a surge in investor demand for Treasury Bills to strategic, inclusive innovations by banks like Absa and NCBA. Here’s a concise look at the highlights that are shaping the market right now.

Here are the highlights of the week:

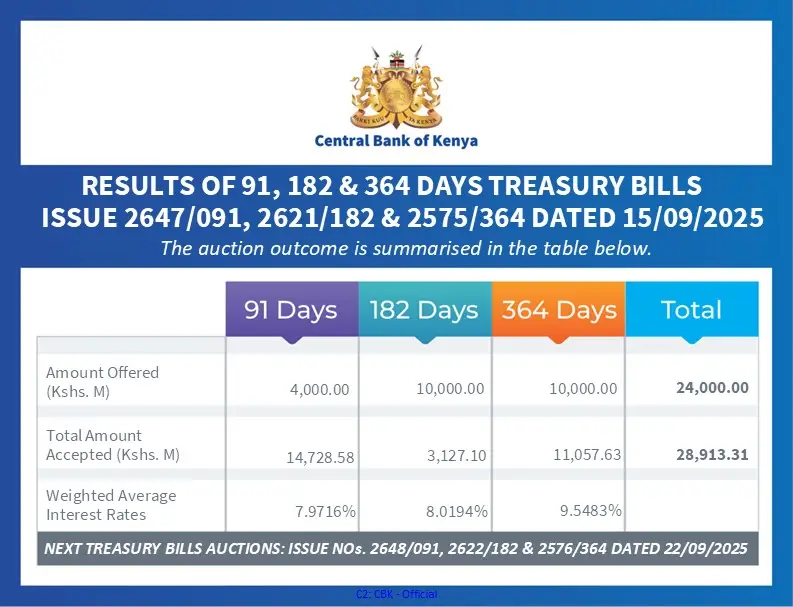

Treasury Bills Oversubscribed

CBK offered KSh 24 billion in treasury bills and received KSh 38.8 billion in bids. Ultimately, KSh 28.9 billion was accepted, showing continued strong investor appetite.

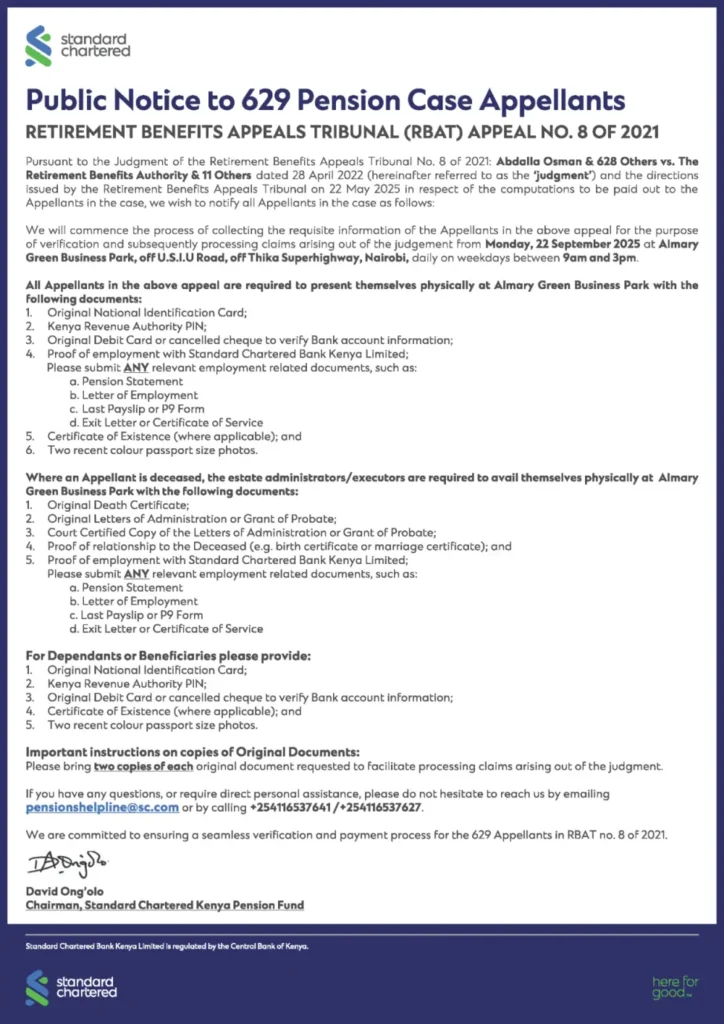

Standard Chartered Pension Payout

Following a ruling by the Retirement Benefits Appeals Tribunal, Standard Chartered has begun a verification exercise for 629 pension appellants to facilitate a KSh 7 billion payout.

Strengthening Africa’s VC Ecosystem

Over 40 of Africa’s top venture capital fund managers officially joined the Africa Venture Finance Programme. Organized by the European Investment Bank’s EIB Global and supported by AfricaGrow, the programme is designed to boost Africa’s VC ecosystem and accelerate tech-driven growth.

NCBA x Water.org: Supporting Schools

NCBA, in partnership with Water.org, has empowered 100 private school owners in Naivasha with tools on green financing, asset finance, digital cash management, and bancassurance. The initiative reinforces NCBA’s commitment to innovation and sustainability in Kenya’s education sector.

Still on NCBA, the lender unveiled new PSV Asset Finance solutions.

> SACCOs: Up to 90% financing, repayment terms up to 60 months.

> Individual SACCO members: Up to 80% financing, repayment terms up to 48 months.

Alongside this, NCBA also introduced Komiut, a digital fare collection platform that could be a game-changer for PSV operations.

CBK Achieves Global Certification

The Central Bank of Kenya attained ISO/IEC 20000-1:2018 certification for its Information Technology Service Management (ITSM).

Absa Kenya Launches Sultanah

Absa Bank Kenya introduced Sultanah; the first women-only Sharia’h-compliant proposition in the country, setting a new milestone in inclusive banking.

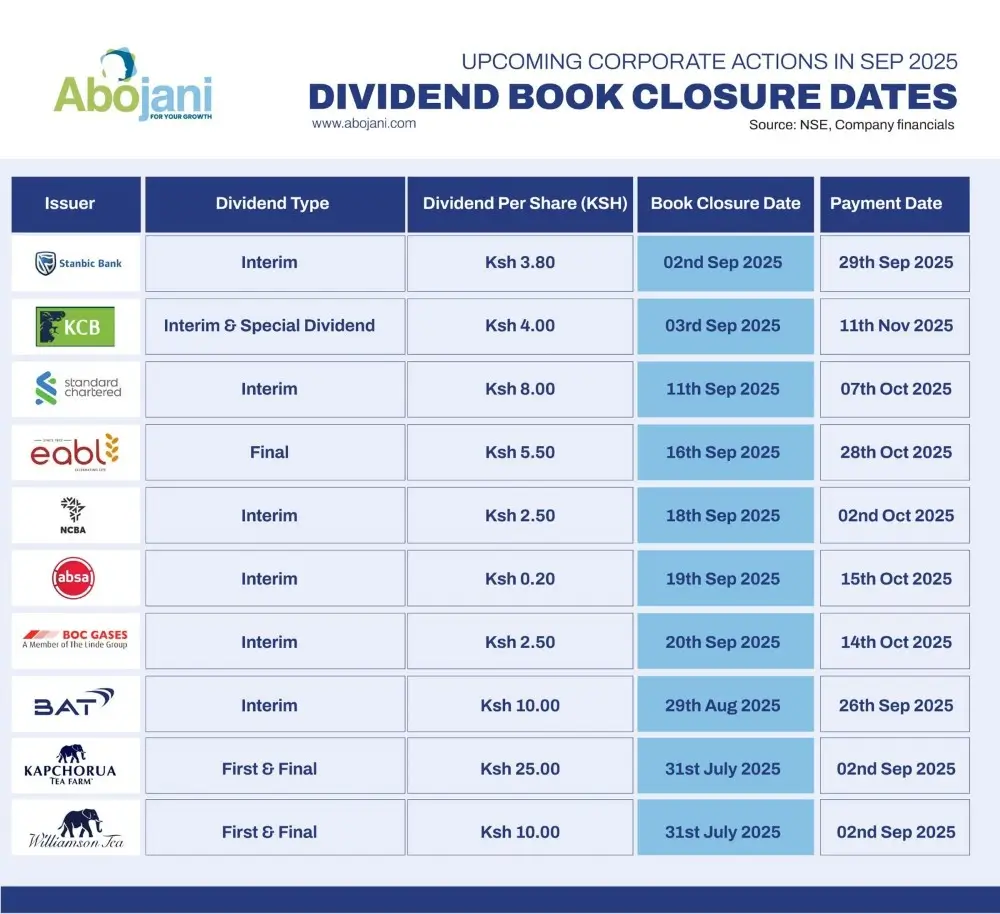

Corporate Actions on the NSE

Key dividend book closure dates this week:

- EABL – Sept 16

- NCBA Group – Sept 18

- Absa Bank Kenya – Sept 19

- BOC Gases – Sept 20

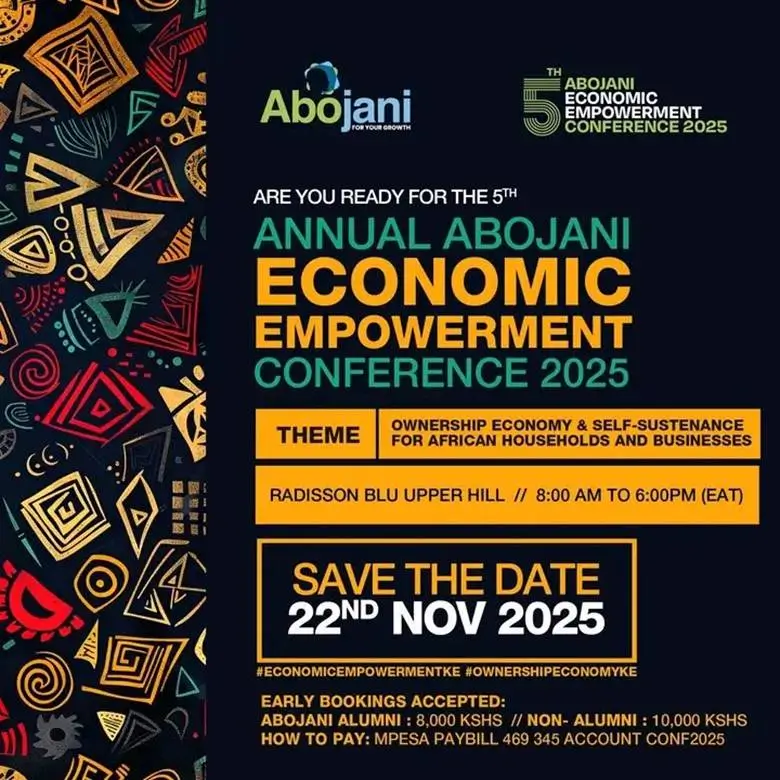

5th Abojani Economic Empowerment Conference

We’re thrilled to have secured an anchor sponsor for this year’s conference. Expect insightful sessions, valuable learning opportunities, and networking that will reshape your financial and business journey.

October Masterclass

Our 72nd Masterclass on Personal Finance & Investing (6th–24th Oct, 7:00–8:00 pm EAT) is now open for registration. Topics include personal finance, unit trusts, treasury bills & bonds, and the stock market.

Book before 30th September and enjoy a 10% discount!