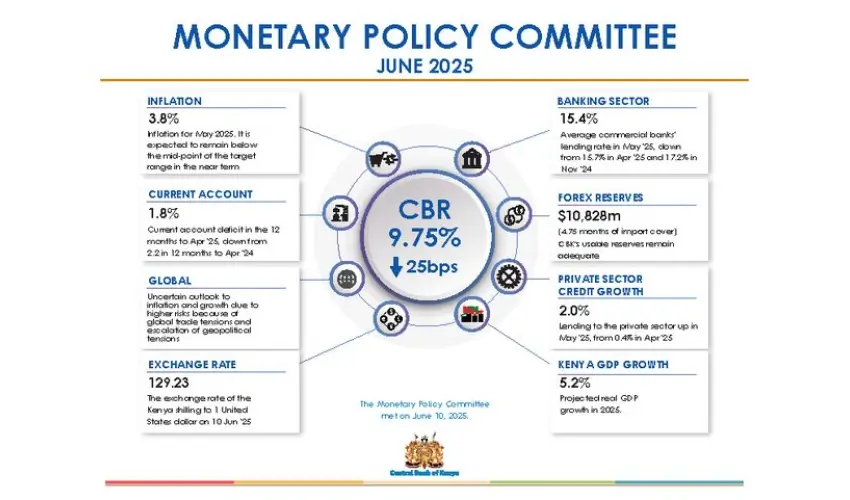

In its sixth consecutive policy easing, the Central Bank of Kenya (CBK) has cut the Central Bank Rate (CBR) by 25 basis points to 9.75%, following the Monetary Policy Committee (MPC) meeting held on June 10, 2025. This move signals the regulator’s continued push to stimulate lending and economic activity in the face of moderating inflation and softening global growth.

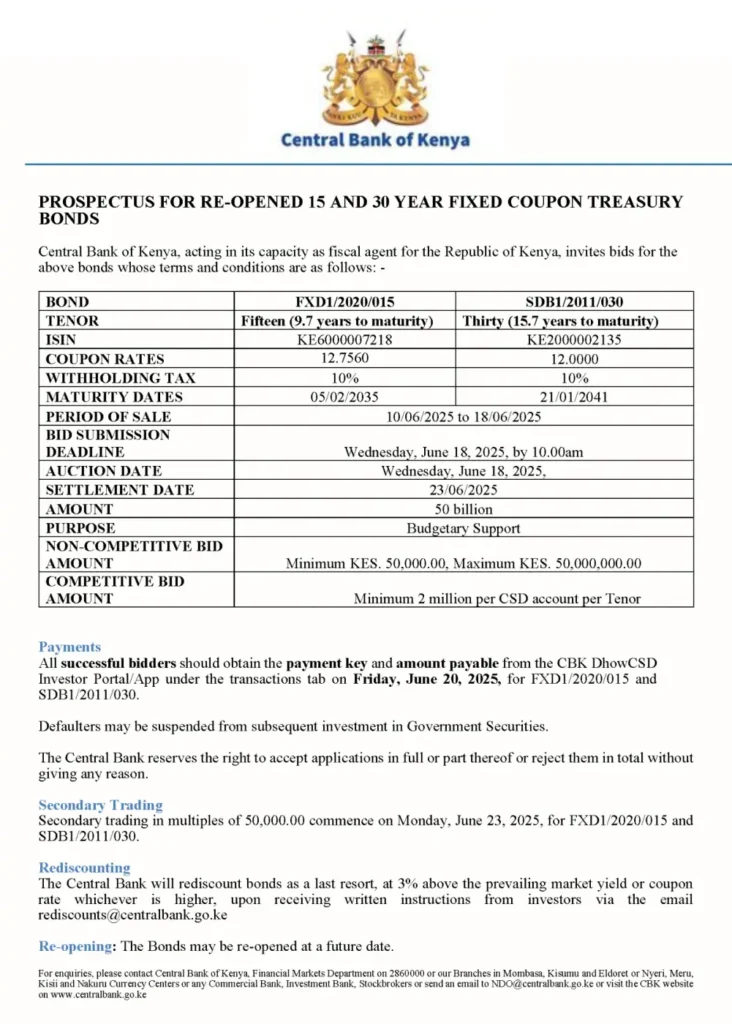

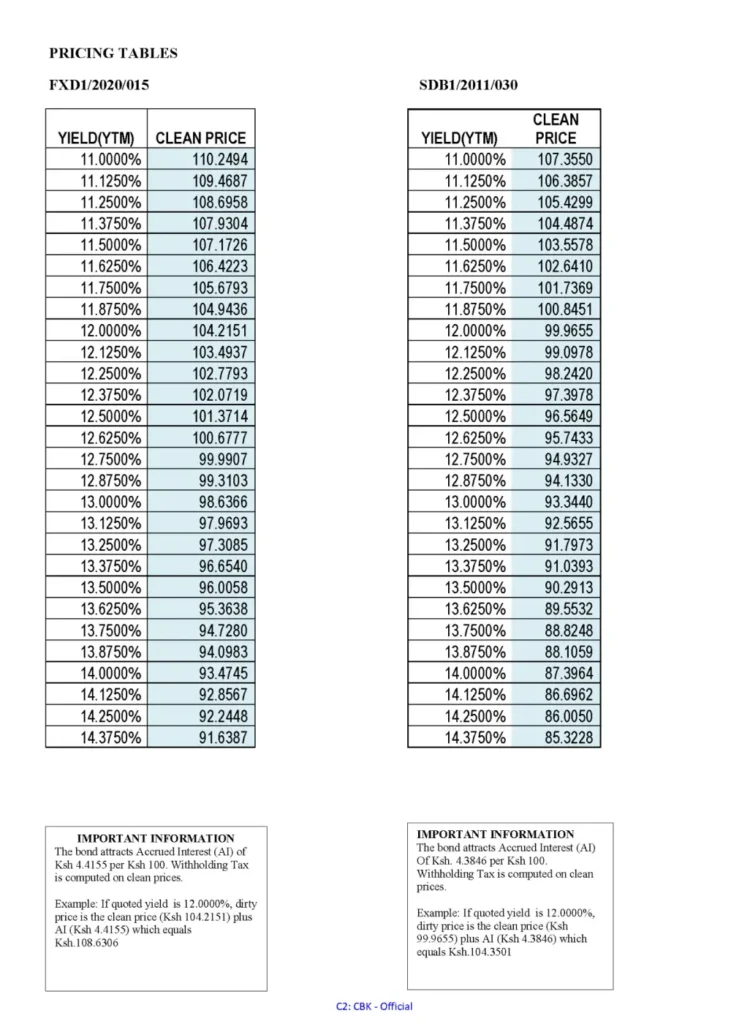

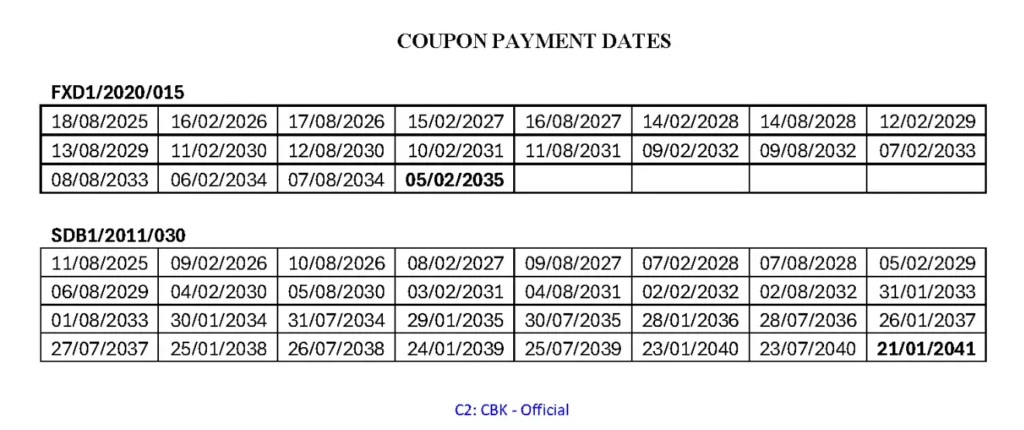

The Central Bank also released the June 2025 Treasury Bond prospectus, detailing the reopening of the FXD1‑2020‑015 (five‑year fixed‑coupon) and SDB1‑2011‑30 (30‑year savings development bond) issues dated June 23, 2025. The auction of the two papers started on Tuesday and is expected to run until Wednesday next week.

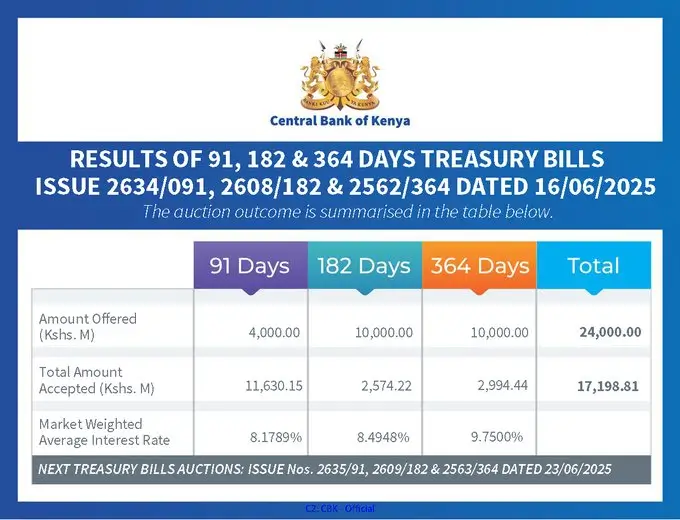

T-Bill rates have dropped by nearly 50% compared to the same time last year, now settling in single digits, a clear sign of falling inflation and the government’s reduced appetite for domestic borrowing, which continues to shape the current investment landscape.

And in a significant development, the Nairobi Securities Exchange (NSE) has appointed Sterling Capital as a market maker in its NEXT Derivatives Market, a key move aimed at boosting liquidity and deepening the uptake of derivatives trading in Kenya. As a market maker, Sterling Capital will provide continuous bid and ask quotes, enhancing market efficiency and investor confidence.

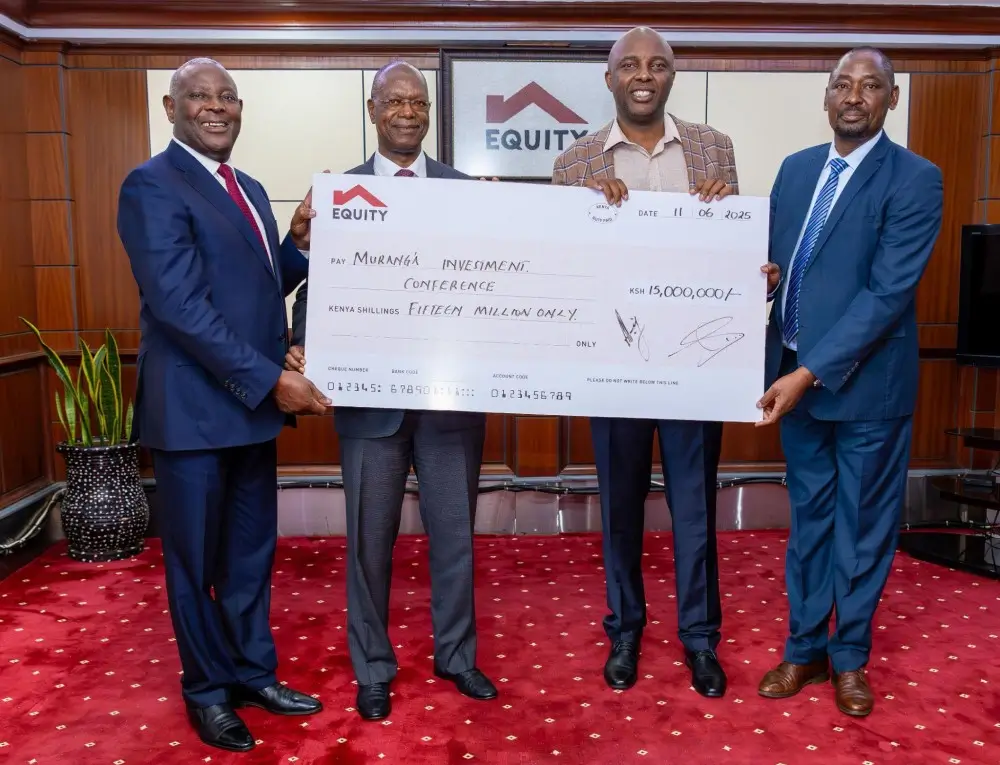

During the week, Equity Bank was unveiled as the title sponsor of the inaugural Murang’a Investment Conference 2025, following a KSh15 million deal signed by Equity Group CEO Dr. James Mwangi and Murang’a Governor Dr. Irungu Kang’ata. The event, which took place on 13th – 14th June at Thika Greens Golf Resort, highlights Equity’s deep-rooted and strategic ties to Murang’a County.

The bank also retained its title as Kenya’s most valuable brand for the second year running, according to Brand Finance Ranking.

Notably, the banking sector continues to dominate the branding landscape, contributing over half of the ranking’s total brand value

Absa Bank Kenya together with Visa, a global leader in digital payments, launched the Absa Business Credit Card, aimed at empowering Micro, Small, and Medium Enterprises (MSMEs) by improving transactional efficiency and expense tracking across Kenya and beyond. #YourStoryMatters

NCBA Bank has teamed up with Crown Motors to make owning the rugged Nissan Navara Double Cab more attainable for Kenyan motorists. Buyers can now enjoy financing options of up to 72 months, a 60-day repayment grace period, and access to one of the most durable and high-performing pickups on the market. The deal is designed to offer both convenience and value for those seeking reliability, power, and flexibility in their next vehicle purchase.

Superior Homes Kenya signed a deal with HF Group to offer mortgages at a low 9.5% interest rate, with up to 20 years repayment and fast approvals—making it easier for more Kenyans to own homes.

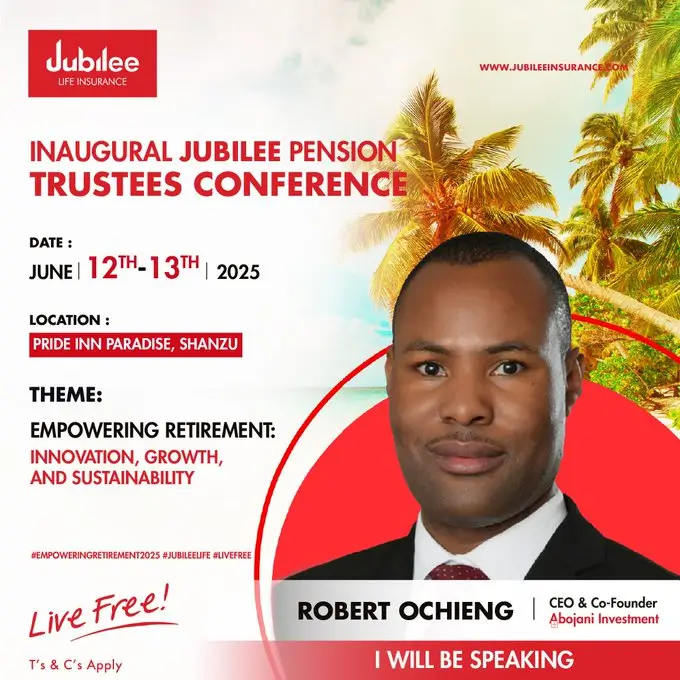

Our CEO, Robert Ochieng, participated by speaking at the Inaugural Jubilee Pension Trustees Conference. The theme for this year was Empowering Retirement: Innovation, Growth, and Sustainability.

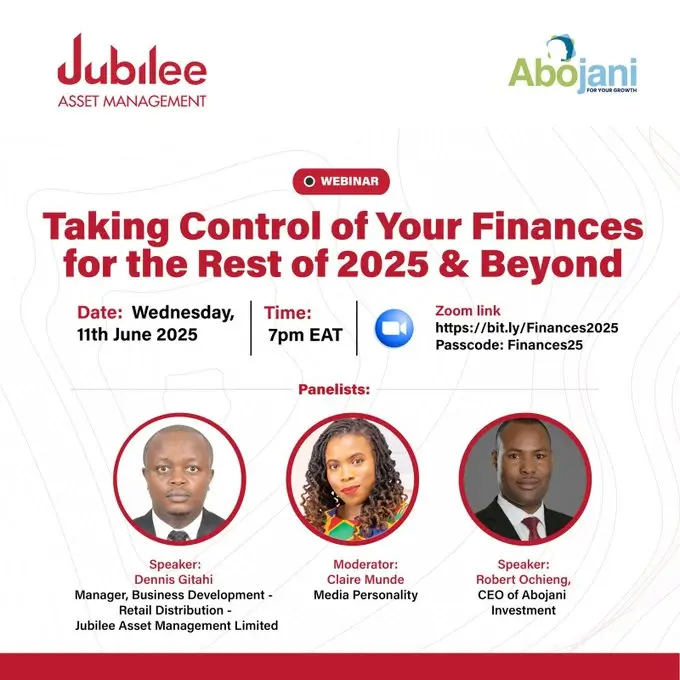

We also held a relevant and timely webinar in partnership with Jubilee Asset Management Limited during the week. Here’s the recording if you missed the #FreeWebinar.

Passcode: Finances@2025

Coming up in November, the 5th Abojani Economic Empowerment Conference. Preparations are already underway to ensure we go bigger and better this year. See details on the flier below

Registration for the 69th Masterclass is also ongoing. Use the details below to register:

- Amount : Ksh 6000

- Mpesa Paybill: 469345

- A/C Number: Your Name

We will add you to our WhatsApp Group once you register.