CBK Reopens Long-Term Treasury Bonds as Investors Shift to Higher Yields

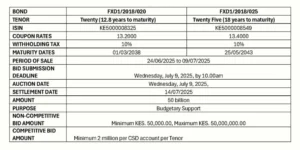

The Central Bank of Kenya (CBK) reopened two fixed coupon Treasury bonds this week: FXD1/2018/020 and FXD1/2018/025. FXD1/2018/020 has a remaining term of 12.8 years

Insights from your search query…

The Central Bank of Kenya (CBK) reopened two fixed coupon Treasury bonds this week: FXD1/2018/020 and FXD1/2018/025. FXD1/2018/020 has a remaining term of 12.8 years

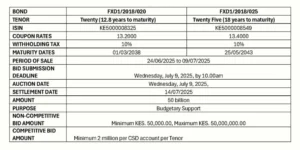

Investors’ demand for government paper has shifted decisively toward longer‑dated maturities. In the most recent Treasury bond auction, bidders submitted Ksh 101.36 Bn, to lock in comparatively

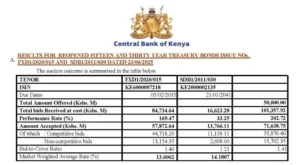

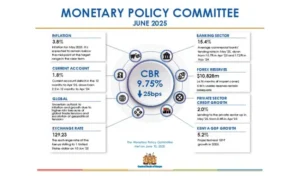

In its sixth consecutive policy easing, the Central Bank of Kenya (CBK) has cut the Central Bank Rate (CBR) by 25 basis points to 9.75%,

Sanlam Unit Trust has overtaken CIC to become Kenya’s largest unit trust manager. Assets under management (AUM) rose 44% in Q1 2025, from Ksh 62.7B

Banking Sector: Q1 2025 Performance Round-up The banking sector was abuzz with results these past few weeks: Equity & KCB’s Regional Muscle The two giants posted

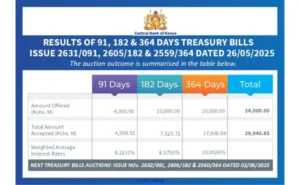

This week’s T-Bill auction was oversubscribed, raising Ksh 29.9B against a Ksh 24B offer. Q1 Results Round-Up NCBA Group reported a Ksh 5.5B profit after

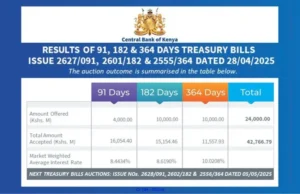

This week’s T-Bill auction saw an overwhelming demand, with investors submitting bids worth Ksh 43.13 billion against a Ksh 24 billion offer. The 91-day Treasury

Kenya’s largest telco, Safaricom PLC, has announced a stellar performance for the year ending March 2025. The total revenue surged 11.2% to Ksh 388.7 billion

The Central Bank of Kenya reopened the 15-year and 25-year Treasury bonds which attracted Ksh 57.09 billion in bids against the Ksh 50 billion offer.

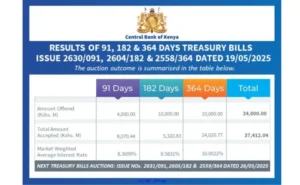

Treasury bills (T-Bills) were oversubscribed this week, with the government raising Ksh 42.8 Bn out of the Ksh 24.0 Bn that was on offer. Rates

Manga House

Kiambere Road - Nairobi, Kenya

Call: +254 763 682 116

Email: learning@abojani.com

Copyright © 2025 Abojani Investment. All Rights Reserved. Designed by Asher Group Ltd