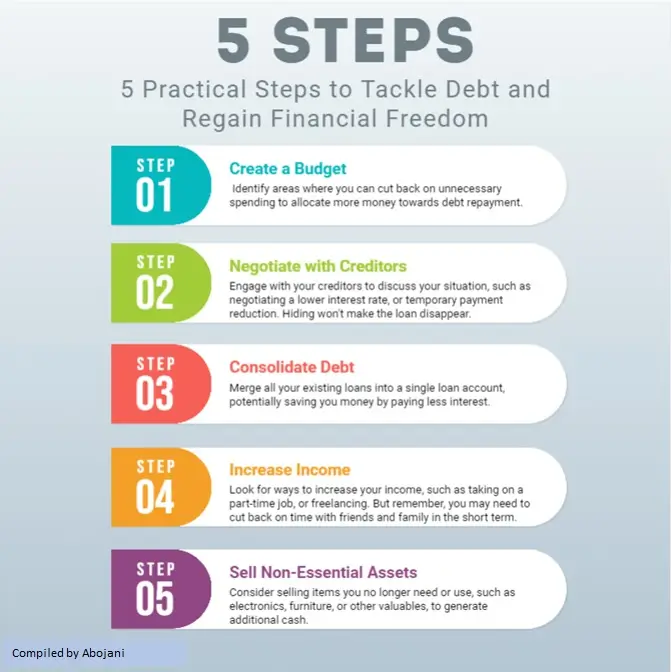

It won’t happen overnight, but reclaiming your financial freedom is entirely possible. We’ve outlined 5 steps on Digging yourself out of debt and undoing years of lifestyle inflation takes patience, honesty, and a shift in priorities, how to start the climb back, from facing the truth about your finances to making small, intentional changes that create significant breathing room.

This is about more than just numbers; it’s about shifting your mindset and choosing a sustainable path over a debt-fueled façade. Get ready to take control of your money and build a solid foundation for your future.

Here’s how to start the climb back.

- First, stop pretending it’s fine.

Many people keep spending to maintain an image, even when overwhelmed by debt.

Start by acknowledging the real state of your finances. There’s no shame in pausing, regrouping, and choosing a quieter, more sustainable path.

Also read: Debt Management for SMEs, Entrepreneurs and Individuals

- List all your debts. All of them.

Credit cards, mobile loans, sacco loans, overdrafts, personal loans, digital loans… everything.

This is your starting point. Knowing what you owe helps you make a clear plan.

Next, ask yourself:

‘How much of my spending is a habit, not a need?’ Lifestyle inflation creeps in when your income rises and your expenses rise faster.

You deserve comfort. But you don’t have to prove your success with purchases.

- Start cutting back gently but firmly.

This doesn’t mean becoming miserly. It means being intentional.

Say no to the third streaming service. Choose home-cooked meals more often. Pause that trip. Small changes create breathing room.

- Automate a minimum debt repayment plan.

Even if you’re only paying a little extra each month, consistency chips away at the problem.

Snowball (smallest to largest) or avalanche (highest interest first), choose a method and stick to it.

If your income has plateaued, consider:

– A side gig (within reason)

– Selling items you no longer need

– Asking for better terms from lenders

The goal here is to help you increase cash flow.

And if you’ve been living above your means, ask:

What version of myself was I trying to impress?

Who was I trying to be?

Rebuilding your finances is an act of self-respect. You’re not going backwards, you’re choosing freedom over facade.

Once you’re making progress:

– Track your net worth quarterly

– Set mini financial wins (e.g., “Ksh 10K paid off!”)

– Use every raise to boost your repayment or savings

Celebrate quiet wins. They add up.

You may not be able to undo all your past choices. But you can make different ones from today.

Digging yourself out of bad financial decisions should not make you feel guilty, but help you regain control.

You’re allowed to rebuild.

Frequenly Ask Questions

Prompting Search Engine Snippets

How do I start getting out of debt in Kenya?

- Start by listing all your debts, from mobile loans to personal loans, and honestly assess your spending habits to identify areas for reduction.

What is lifestyle inflation and how can I avoid it?

- Lifestyle inflation is when your expenses increase along with your income. You can avoid it by being intentional with your spending and prioritizing needs over wants.

What are the best methods to pay off multiple loans?

- You can choose between the snowball method, where you pay off the smallest loan first, or the avalanche method, where you tackle the loan with the highest interest rate first.

How can I increase my cash flow to pay off debt?

- Consider taking on a side gig, selling items you no longer need, or asking your lenders for better repayment terms to free up more money for debt repayment.

Why is it important to face your debt instead of ignoring it?

- Facing your debt is an act of self-respect that allows you to regain control of your finances, make better decisions, and choose financial freedom over a façade.

Key Take Aways

- Honesty is the First Step: The journey begins with a candid acknowledgment of your financial reality. Stop pretending everything is fine and face your debts head-on.

- Know Your Debts: List out every single loan—from mobile loans to sacco loans—to create a clear starting point for your repayment plan.

- Curb Lifestyle Inflation: Distinguish between needs and habits. Start making intentional, firm cuts to your spending to create cash flow without becoming miserly.

- Automate & Accelerate Repayment: Implement a consistent debt repayment plan. Whether you choose the snowball or avalanche method, consistency is key to chipping away at your debt.

- Boost Your Income: Explore practical ways to increase your cash flow, such as a side gig, selling unused items, or renegotiating loan terms with your lenders.

- Mindset Shift: Rebuilding your finances is an act of self-respect, not a punishment. It’s about choosing freedom over living up to a false image you created.