KCB Bank Named African Bank of the Year in Landmark Recognition

Week’s highlight: KCB Bank, Kenya’s most profitable listed lender, has been named 2025 African Bank of the Year at the 15th Africa Business Leadership Awards

Insights from your search query…

Week’s highlight: KCB Bank, Kenya’s most profitable listed lender, has been named 2025 African Bank of the Year at the 15th Africa Business Leadership Awards

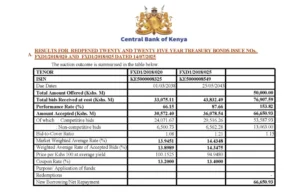

1. Investors showed strong interest in the reopened 20- and 25- year leading to Treasury bonds being oversubscribed by 153.82%. CBK aimed to raise Ksh

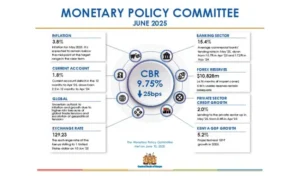

The Week In Markets Kenya’s annual inflation rate remained unchanged at 3.8% in June 2025, according to data from the Kenya National Bureau of Statistics.

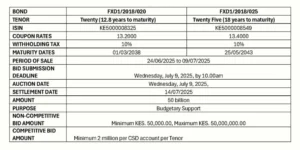

The Central Bank of Kenya (CBK) reopened two fixed coupon Treasury bonds this week: FXD1/2018/020 and FXD1/2018/025. FXD1/2018/020 has a remaining term of 12.8 years

Investors’ demand for government paper has shifted decisively toward longer‑dated maturities. In the most recent Treasury bond auction, bidders submitted Ksh 101.36 Bn, to lock in comparatively

In its sixth consecutive policy easing, the Central Bank of Kenya (CBK) has cut the Central Bank Rate (CBR) by 25 basis points to 9.75%,

Sanlam Unit Trust has overtaken CIC to become Kenya’s largest unit trust manager. Assets under management (AUM) rose 44% in Q1 2025, from Ksh 62.7B

Banking Sector: Q1 2025 Performance Round-up The banking sector was abuzz with results these past few weeks: Equity & KCB’s Regional Muscle The two giants posted

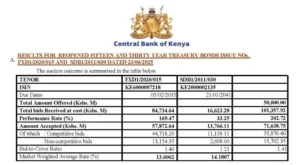

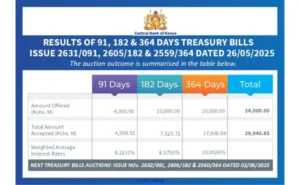

This week’s T-Bill auction was oversubscribed, raising Ksh 29.9B against a Ksh 24B offer. Q1 Results Round-Up NCBA Group reported a Ksh 5.5B profit after

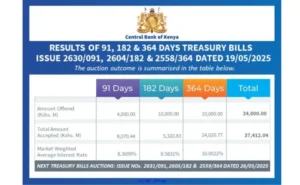

This week’s T-Bill auction saw an overwhelming demand, with investors submitting bids worth Ksh 43.13 billion against a Ksh 24 billion offer. The 91-day Treasury