Here is your Dose of Weekly Highlights.

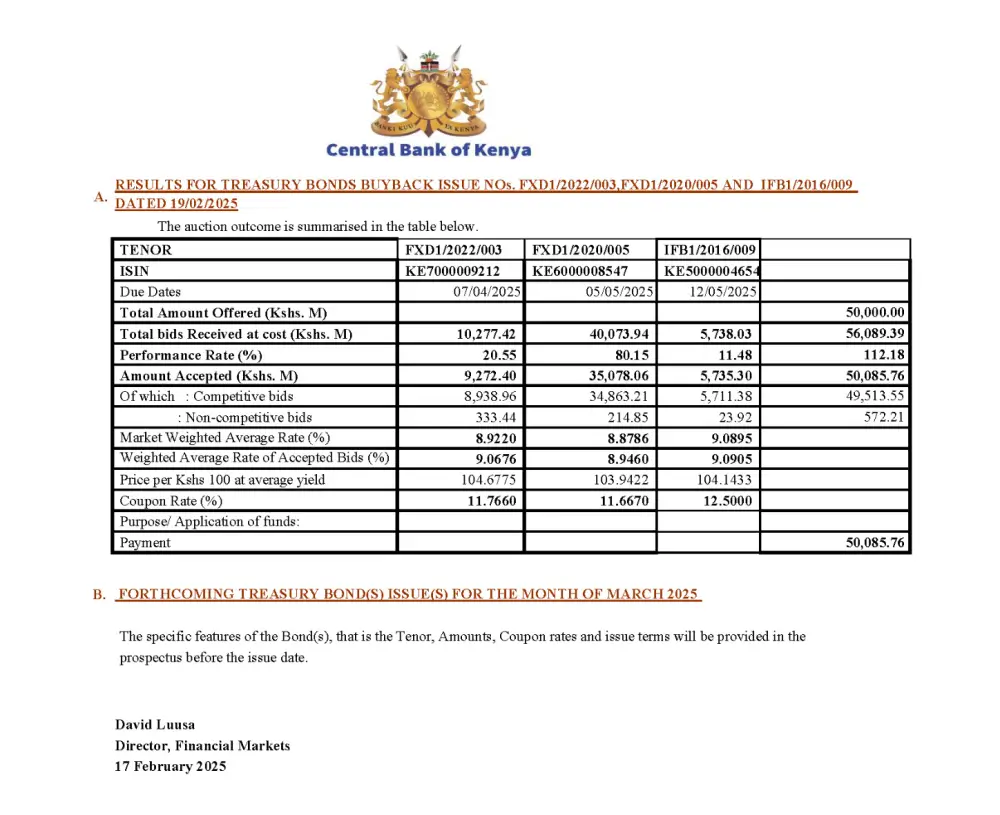

1. Central Bank of Kenya raises Ksh 130.8 Billion in reopened infrastructure bonds auction. The 14-year and 17-year bonds attracted total bids worth Ksh 193.9 billion against the offered Ksh 70 billion, representing an oversubscription of 277%.

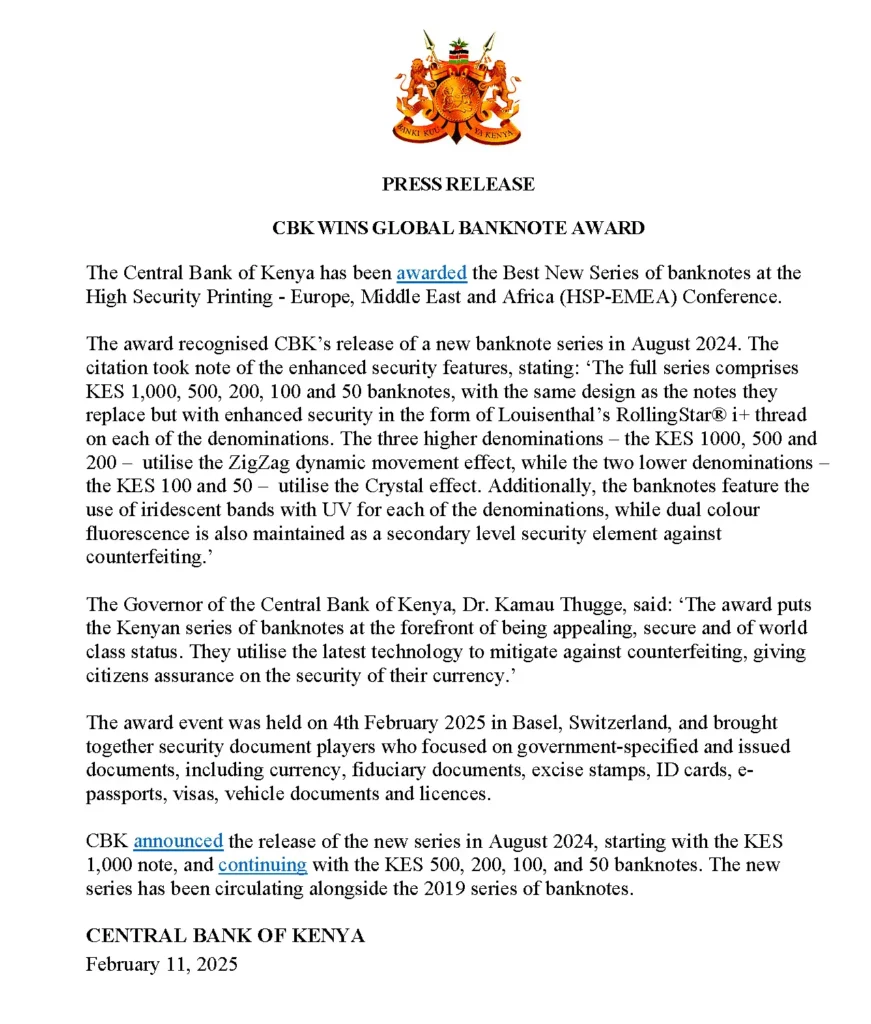

2. CBK won the Best New Series of Banknotes award at the High Security Printing EMEA Conference in Basel, Switzerland.

3. Kenyan CEOs are more optimistic about economic growth in the next 12 months, citing favorable weather and macroeconomic stability, according to a January 2025 survey. However, the rising cost of doing business remains a key concern for firms.

4. NCBA, KCB, Absa, and Equity Bank announced cuts to their lending rates, creating a more favorable borrowing environment for businesses and individuals.

5. KMRC announced closure of the register for bondholders ahead of February interest payment.

Bondholders must be registered by February 14, 2025, to receive the 12.5% interest payment on February 28, 2025.

6. NCBA Group has been ranked the second-best overall bank in customer experience in the 2024 Kenya Bankers Association Customer Satisfaction Survey.

7. At an event at Nairobi Serena Hotel, Old Mutual Kenya launched the Old Mutual Financial Services Monitor (OMFSM) 2024, offering insights into the financial behaviors of working Kenyans.

Key takeaways:

● 64% haven’t started saving for retirement.

● 28% worry about debt.

● The top financial priority is income/job security.

● Saving for children’s education is the top goal.

Only 1 in 10 are confident about the Kenyan economy.

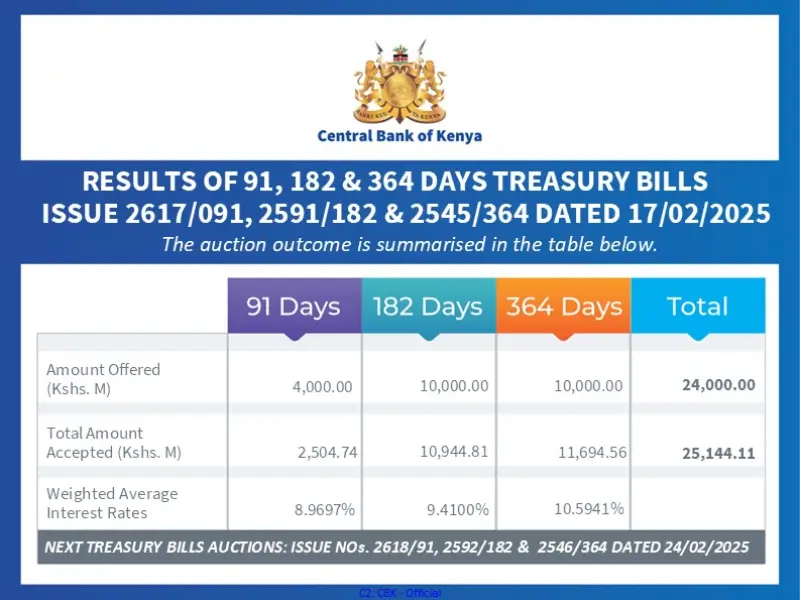

8. Central Bank of Kenya received bids worth Ksh44.255 billion at this weekly treasury bills auction against an advertised amount of Ksh24.0 billion, a performance rate of 184.40% and accepted Treasury Bills worth Ksh25.144 billion. The 91-day T-bill interest rate stood at 9.0483%.

9. Standard Chartered Bank Kenya Limited joins the MSCI Frontier Markets Index, increasing Kenyan representation to six, while HF Group PLC’s addition to the MSCI Frontier Markets Small Cap Index brings the total number of NSE-listed companies there to eight.

10. This week, we held a webinar in partnership with Britam Asset Managers on “New Year, New Opportunities: Investing Strategies for 2025.”

Key highlights included:

● Money has power; give it authority and purpose.

● Investing is for growth, while insurance is for protection.

● There’s no such thing as “enough” money for investing.

● Investing is not a goal; it’s a journey.

● The equity valuation outlook is positive for 2025.

● The tech sector is expanding rapidly, presenting numerous opportunities and with positive momentum expected in 2025.

11. Jubilee Health Insurance launches J-Force, a digital platform aimed at streamlining insurance intermediation. The platform enables agents, brokers, and bancassurers to manage client onboarding, generate instant quotes, issue policies, and track commissions in real time. #JubileeHealth

12. And lastly, join our March 2025 Investment masterclass and learn from a community of like minded, informed and courageous investors.